West Virginia Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

Are you currently within a position in which you will need files for either business or person reasons just about every day? There are a variety of lawful document themes available on the Internet, but finding kinds you can trust isn`t simple. US Legal Forms delivers a large number of form themes, much like the West Virginia Liquidation of Partnership with Sale and Proportional Distribution of Assets, which are published to fulfill federal and state requirements.

In case you are previously knowledgeable about US Legal Forms website and possess your account, just log in. After that, you can download the West Virginia Liquidation of Partnership with Sale and Proportional Distribution of Assets template.

If you do not come with an bank account and wish to begin to use US Legal Forms, abide by these steps:

- Get the form you will need and ensure it is for the proper town/area.

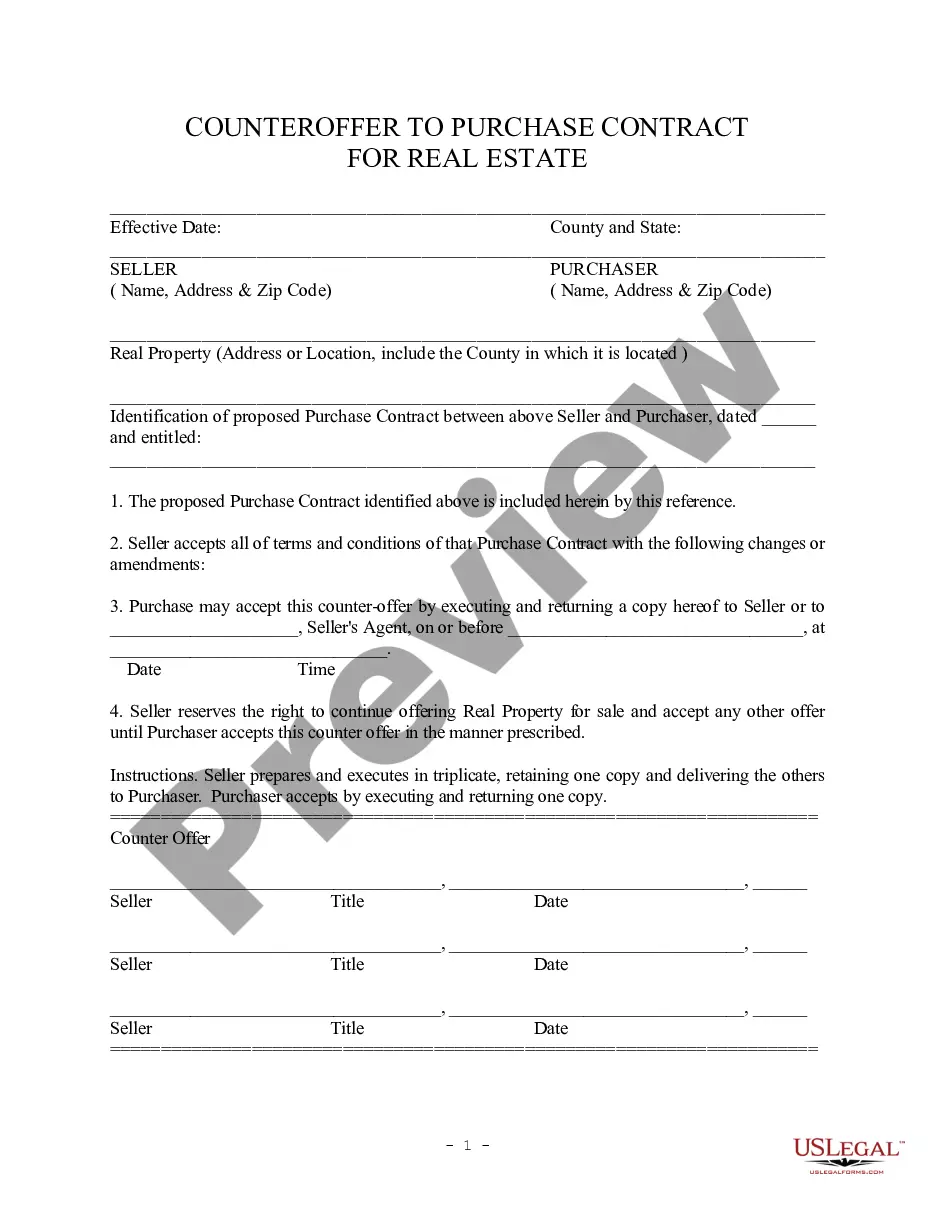

- Take advantage of the Preview button to analyze the form.

- See the description to actually have selected the right form.

- In case the form isn`t what you`re looking for, take advantage of the Research industry to discover the form that meets your needs and requirements.

- Whenever you get the proper form, click Buy now.

- Choose the prices strategy you desire, submit the desired information and facts to produce your money, and purchase the transaction with your PayPal or bank card.

- Choose a handy file format and download your copy.

Discover all the document themes you might have purchased in the My Forms menus. You may get a additional copy of West Virginia Liquidation of Partnership with Sale and Proportional Distribution of Assets whenever, if needed. Just click on the necessary form to download or print out the document template.

Use US Legal Forms, one of the most extensive selection of lawful types, to conserve some time and prevent mistakes. The services delivers appropriately made lawful document themes which can be used for an array of reasons. Make your account on US Legal Forms and begin producing your life a little easier.

Form popularity

FAQ

In the general partnership, the limited liability partnership, the limited liability limited partnership and the limited partnership, profits and losses are passed through to the partners as specified in the partnership agreement. If left unspecified, profits and losses are shared equally among the partners.

For a loss, credit and zero out income summary and debit each partner's capital account. Finally, debit each partner's capital account by the balance in the corresponding drawing account, which records cash withdrawals by partners and credit and zero out the drawing accounts.

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

In the general partnership, the limited liability partnership, the limited liability limited partnership and the limited partnership, profits and losses are passed through to the partners as specified in the partnership agreement. If left unspecified, profits and losses are shared equally among the partners.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

After the dissolution of the partnership, the partner is liable to pay his debt and to wind up the affairs regarding the partnership. After the dissolution, partners are liable to share the profit which they have decided in agreement or accordingly.

Losses are allocated first to the extent of positive capital account balances and second 50% to A and 50% to B. Cash is first disbursed to pay the preferred return, second to pay any unreturned capital, and last 50% to A and 50% to B.

Winding up is the process of collecting, liquidating, and distributing the partnership assets. Dissolution can be brought about by acts of the partners, operation of law, or by judicial decree.