West Virginia Exempt Survey is a comprehensive analysis conducted to identify various exemptions available to West Virginia residents, businesses, or properties. This survey is a vital tool for understanding the exemptions and their eligibility criteria in the state. By examining the West Virginia Exempt Survey, individuals and organizations can gain valuable insights into the exemptions that may apply to them, ensuring they comply with the state's regulations while maximizing their benefits. Here are different types of West Virginia Exempt Surveys available: 1. Personal Exemptions: This category includes exemptions related to individuals such as personal property exemptions, homestead exemptions, and exemptions for disabled or elderly persons. 2. Business Exemptions: West Virginia Exempt Survey also covers exemptions relevant to businesses. These can include exemptions for specific industries or sectors, machinery and equipment exemptions, and exemptions related to research and development activities. 3. Property Exemptions: This type of West Virginia Exempt Survey focuses on exemptions associated with various types of properties. It includes exemptions for agricultural properties, conservation lands, historic properties, and properties used for religious, charitable, or educational purposes. 4. Tax Exemptions: West Virginia Exempt Survey delves into tax exemptions that individuals and businesses may qualify for. This encompasses exemptions on sales and use taxes, income taxes, property taxes, and other applicable taxes in the state. 5. Energy Exemptions: This category of West Virginia Exempt Survey addresses exemptions related to energy production, including renewable energy sources. It may cover exemptions for solar, wind, hydroelectric, or biomass energy projects, fostering green and sustainable initiatives. 6. Nonprofit Organization Exemptions: West Virginia Exempt Survey highlights exemptions available to nonprofit organizations, including those related to property taxes, sales taxes, and income taxes, enabling these organizations to further their philanthropic activities. By performing a West Virginia Exempt Survey, individuals, businesses, and organizations can gain a thorough understanding of the exemptions they may qualify for. This knowledge helps them in financial planning, regulatory compliance, and taking advantage of the incentives provided by the state. Keeping up-to-date with any changes or additions to the exemptions through regular surveys ensures that individuals and organizations are fully aware of the benefits they can enjoy, while adhering to West Virginia's legal requirements.

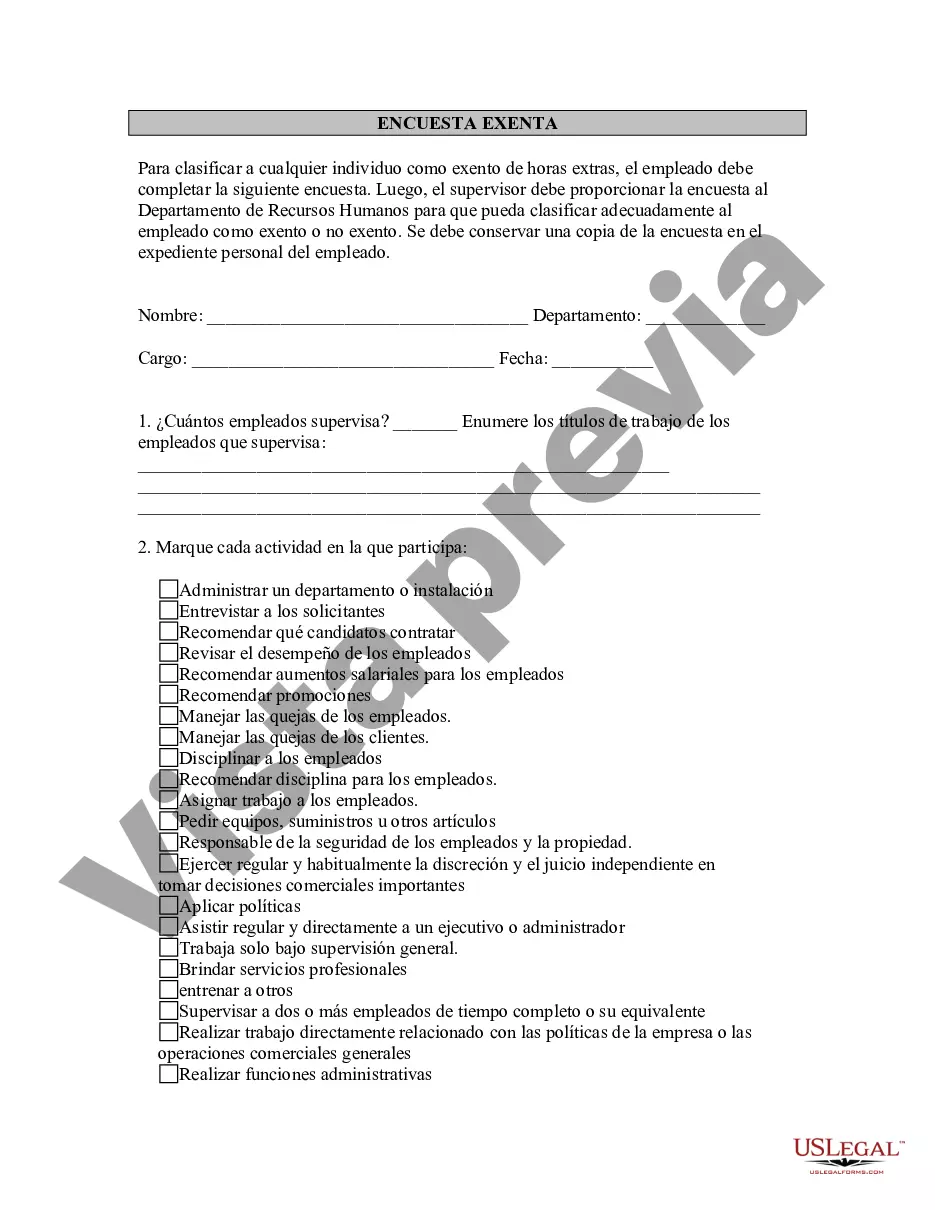

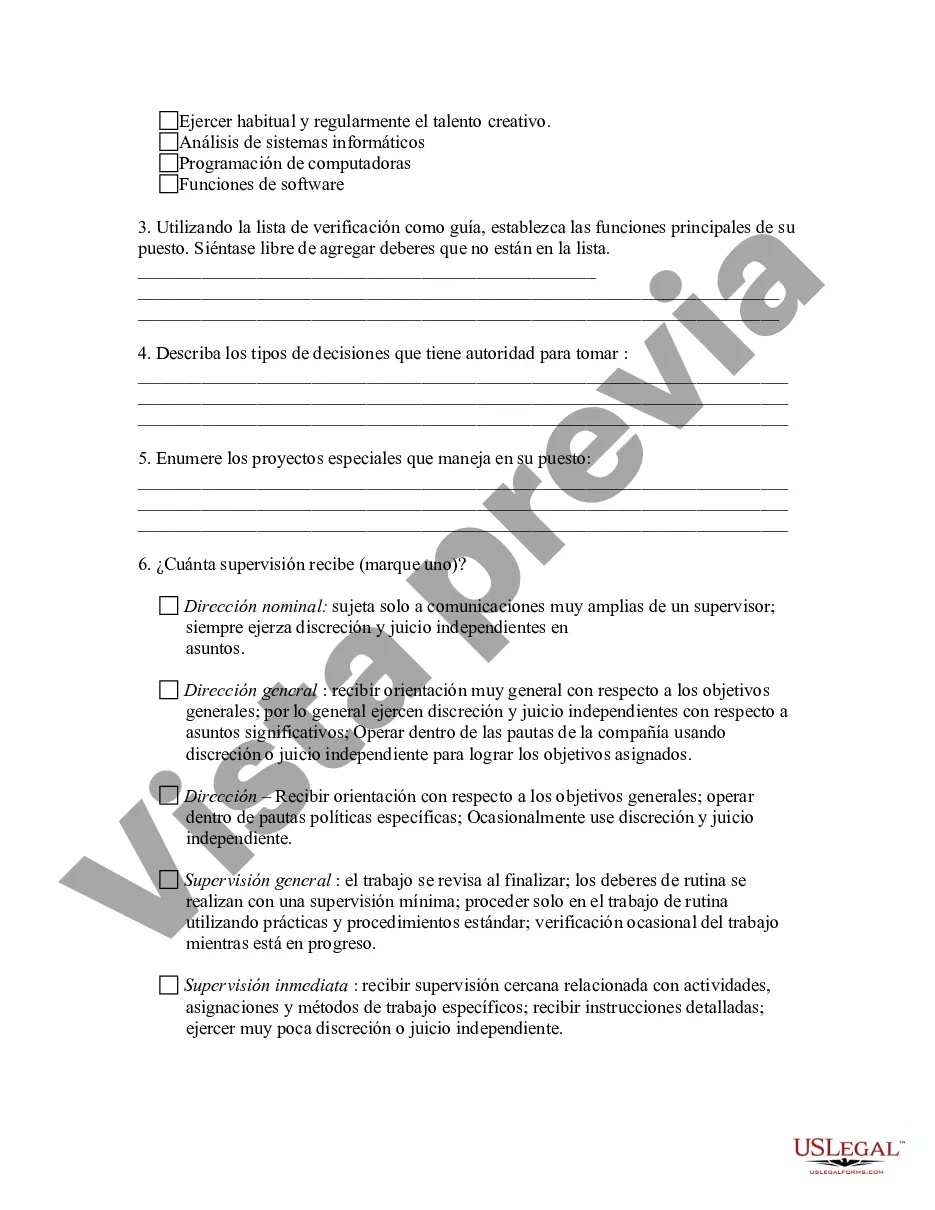

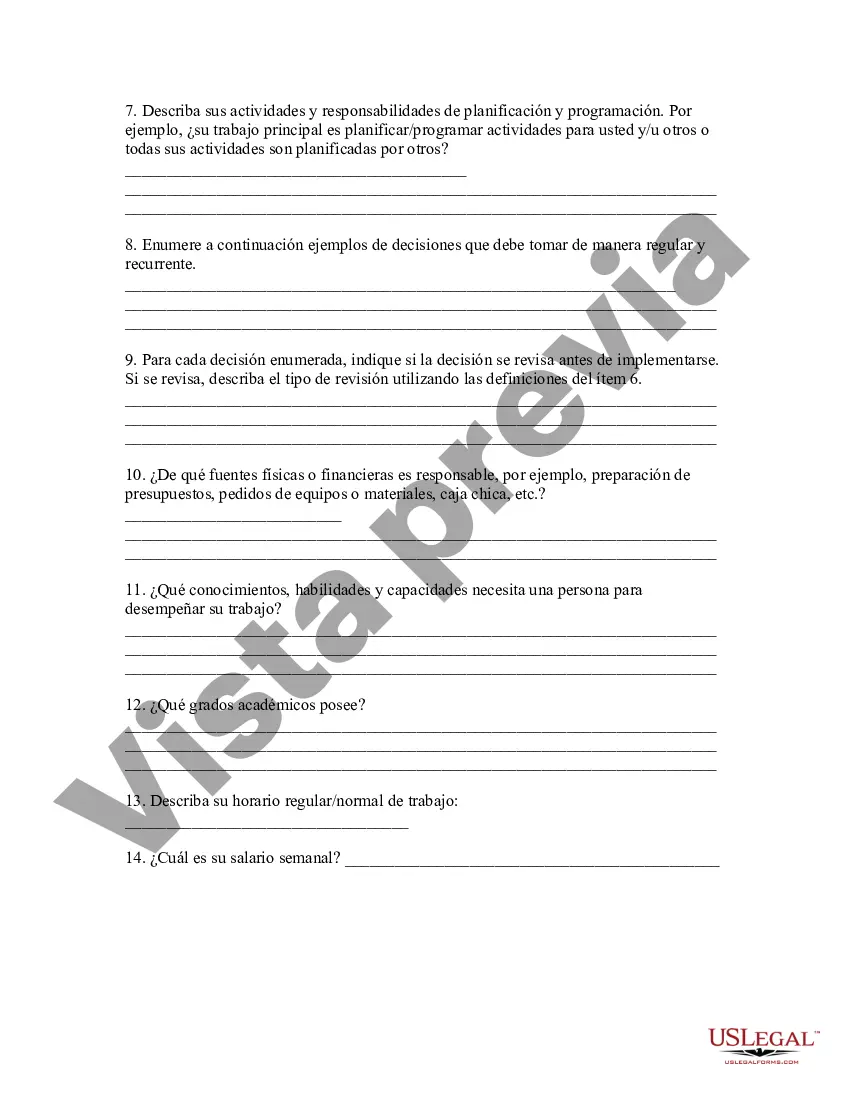

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Encuesta exenta - Exempt Survey

Description

How to fill out West Virginia Encuesta Exenta?

Finding the right authorized papers template can be a have difficulties. Needless to say, there are plenty of templates available on the Internet, but how will you get the authorized type you want? Make use of the US Legal Forms internet site. The services gives a huge number of templates, like the West Virginia Exempt Survey, that can be used for business and personal requirements. Each of the types are inspected by pros and satisfy federal and state specifications.

When you are currently signed up, log in to the accounts and then click the Download button to find the West Virginia Exempt Survey. Use your accounts to search throughout the authorized types you may have purchased formerly. Go to the My Forms tab of your own accounts and have yet another backup of the papers you want.

When you are a whole new user of US Legal Forms, listed here are basic directions so that you can stick to:

- Initial, make certain you have selected the right type for the city/region. You can look through the form using the Review button and look at the form explanation to make certain this is basically the right one for you.

- If the type does not satisfy your needs, take advantage of the Seach discipline to get the correct type.

- Once you are certain that the form would work, select the Acquire now button to find the type.

- Opt for the prices plan you want and type in the necessary details. Make your accounts and pay money for your order utilizing your PayPal accounts or credit card.

- Select the file format and obtain the authorized papers template to the product.

- Complete, change and print out and signal the acquired West Virginia Exempt Survey.

US Legal Forms may be the biggest collection of authorized types where you can see numerous papers templates. Make use of the service to obtain skillfully-produced documents that stick to condition specifications.