West Virginia Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506© Offerings In West Virginia, the Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506© Offerings follow the guidelines set by the Securities and Exchange Commission (SEC). Rule 506(c) allows issuers to offer and sell securities to accredited investors through general solicitation and advertising. Accredited Investor Qualification: 1. Income-based Qualification: An individual is considered an accredited investor if their annual income has exceeded $200,000 ($300,000 for joint income) for the past two years, with a reasonable expectation of reaching the same income level in the current year. 2. Net Worth-based Qualification: An individual is considered an accredited investor if their net worth, or joint net worth with their spouse, exceeds $1 million, excluding the value of their primary residence. It's important to note that the individual cannot include the value of the primary residence when determining their net worth. 3. Entity-based Qualification: Certain types of entities are also eligible to be classified as accredited investors. These include banks, registered investment companies, business development companies, trusts, partnerships, corporations, and other entities that meet specific requirements outlined by the SEC. Accredited Investor Verification Requirements: To ensure compliance with SEC regulations, issuers must utilize reasonable steps to verify that investors are indeed accredited. While Rule 506(c) does not provide specific verification methods, it requires issuers to consider the following factors when determining the reasonableness of the steps taken: 1. Nature of Investor: The issuer should consider the type of investor and their background, such as their profession or prior experience in financial or investment matters. 2. Income Verification: For income-based qualification, issuers may request written representations from the investor, such as tax returns, W-2s, or similar forms. Alternatively, issuers can rely on a third-party verification service to verify income. 3. Net Worth Verification: For net worth-based qualification, issuers may require the investor to provide financial statements, bank statements, appraisal reports, or other documents that substantiate their net worth. Issuers can also rely on a third-party CPA, attorney, or investment adviser to verify net worth. 4. Prior Verification: If an investor has been previously verified as an accredited investor in the past, issuers may consider it as a reasonable step for verification in subsequent offerings. Different Types of West Virginia Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506© Offerings: The Accredited investor qualification and verification requirements for Rule 506(c) offerings in West Virginia do not differ from the federal requirements established by the SEC. The same rules and guidelines apply to ensure consistency throughout the United States. However, additional state-specific regulations may exist that could impact the offering process, such as notice filings or other filing requirements. It is important for issuers to consult with legal counsel experienced in West Virginia securities laws to ensure compliance with any state-specific obligations.

West Virginia Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings

Description

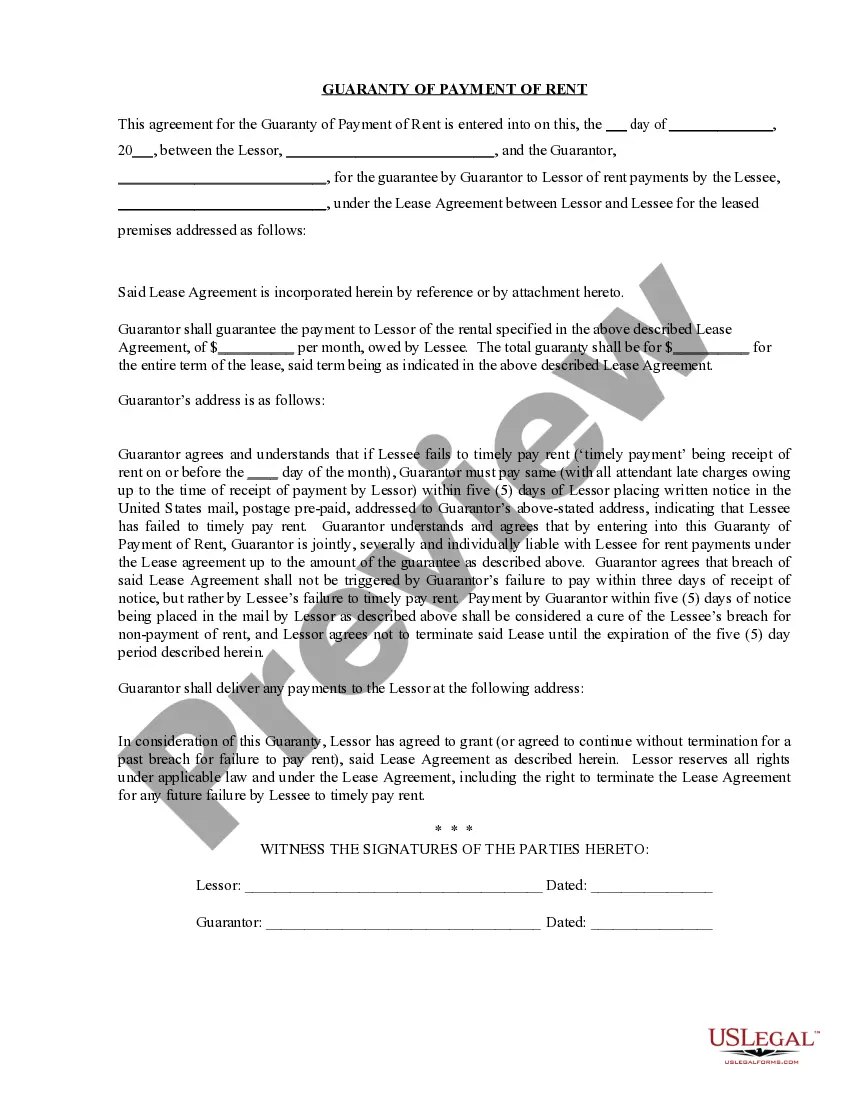

How to fill out West Virginia Accredited Investor Qualification And Verification Requirements For Reg D, Rule 506(c) Offerings?

You are able to spend time online trying to find the legitimate document template that suits the state and federal requirements you require. US Legal Forms supplies a large number of legitimate kinds which can be analyzed by experts. It is simple to download or printing the West Virginia Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings from the assistance.

If you have a US Legal Forms profile, you can log in and then click the Down load option. Next, you can total, change, printing, or indication the West Virginia Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings. Every legitimate document template you acquire is the one you have for a long time. To have an additional duplicate for any bought develop, check out the My Forms tab and then click the related option.

If you are using the US Legal Forms site the very first time, follow the easy instructions listed below:

- Very first, ensure that you have chosen the best document template for your state/town of your choosing. Read the develop information to ensure you have chosen the proper develop. If accessible, make use of the Preview option to search from the document template also.

- In order to locate an additional version from the develop, make use of the Lookup area to discover the template that meets your needs and requirements.

- Upon having found the template you want, click on Buy now to carry on.

- Choose the pricing strategy you want, enter your credentials, and sign up for a merchant account on US Legal Forms.

- Complete the deal. You can utilize your Visa or Mastercard or PayPal profile to cover the legitimate develop.

- Choose the file format from the document and download it in your product.

- Make modifications in your document if needed. You are able to total, change and indication and printing West Virginia Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings.

Down load and printing a large number of document themes making use of the US Legal Forms site, which provides the most important variety of legitimate kinds. Use skilled and state-distinct themes to deal with your small business or person requires.