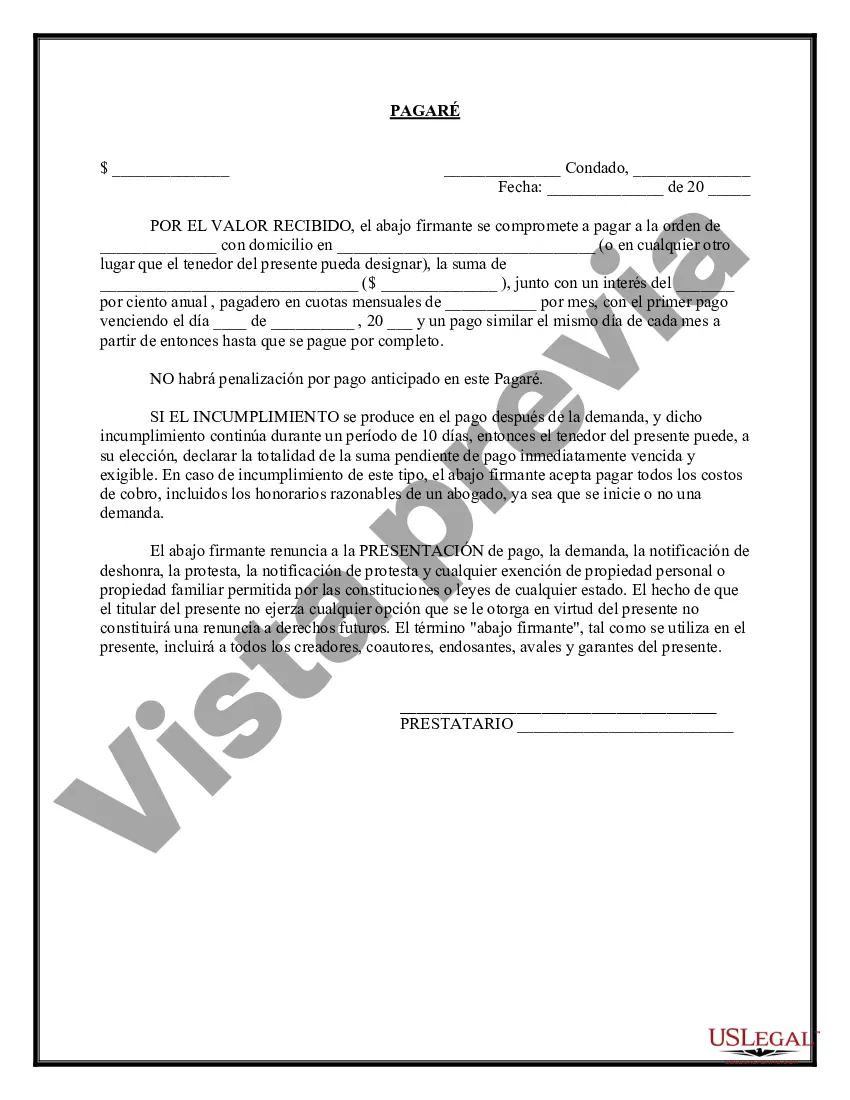

A Wyoming Promissory Note with Installment Payments is a legal document that outlines the terms and conditions between a borrower and a lender for a loan transaction in the state of Wyoming. This note serves as a written promise by the borrower to repay a certain amount of money borrowed, along with interest, in scheduled installments over a specified period of time. The main purpose of a Wyoming Promissory Note with Installment Payments is to provide a formal and binding agreement that protects both parties involved in the loan. It establishes the repayment plan, interest rate, late fees, and any collateral held against the loan. It also details the consequences of defaulting on the loan and the rights and obligations of each party. There are different types of Wyoming Promissory Notes with Installment Payments, depending on the specific requirements and circumstances of the loan: 1. Secured Promissory Note: This type of note requires the borrower to provide collateral, such as real estate or a vehicle, to secure the loan amount. In the event of default, the lender can claim ownership of the designated collateral. 2. Unsecured Promissory Note: Unlike a secured note, an unsecured note does not require collateral. This type of note is usually based on the borrower's creditworthiness and the lender's trust in their ability to repay the loan. 3. Balloon Promissory Note: A balloon note is structured so that the borrower makes regular smaller payments over a predetermined period, with a larger final payment (the "balloon payment") due at the end of the loan term. This type of note is useful when the borrower anticipates having a significant sum of money in the future to make the final payment. 4. Demand Promissory Note: A demand note allows the lender to call in the loan at any time, requesting the immediate repayment of the loan balance. This type of note is useful in situations where the borrower and lender have a long-term relationship and trust, or when the borrower's financial situation becomes uncertain. 5. Installment Promissory Note: The installment note is the most common type, where the borrower repays the loan amount in equal installments over an agreed-upon period, along with accrued interest. When drafting a Wyoming Promissory Note with Installment Payments, it is crucial to include key information such as the loan amount, interest rate, installment schedule, repayment dates, late fees, and any specific terms agreed upon by both parties. It is recommended to consult with a legal professional to ensure compliance with Wyoming state laws and to tailor the note to the specific loan arrangement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wyoming Pagaré con pagos a plazos - Promissory Note with Installment Payments

Description

How to fill out Wyoming Pagaré Con Pagos A Plazos?

If you need to total, down load, or print out lawful papers web templates, use US Legal Forms, the most important assortment of lawful kinds, which can be found online. Utilize the site`s simple and convenient look for to find the files you want. Various web templates for organization and person functions are categorized by types and states, or search phrases. Use US Legal Forms to find the Wyoming Promissory Note with Installment Payments within a few click throughs.

In case you are previously a US Legal Forms consumer, log in to the bank account and click on the Down load option to get the Wyoming Promissory Note with Installment Payments. You can even entry kinds you earlier downloaded inside the My Forms tab of your own bank account.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the form for your proper city/nation.

- Step 2. Take advantage of the Review solution to look through the form`s content. Never overlook to read the description.

- Step 3. In case you are not happy with all the type, utilize the Search industry near the top of the monitor to get other versions of your lawful type format.

- Step 4. Once you have found the form you want, go through the Get now option. Pick the rates plan you favor and include your qualifications to sign up to have an bank account.

- Step 5. Process the deal. You can utilize your charge card or PayPal bank account to complete the deal.

- Step 6. Select the structure of your lawful type and down load it on the gadget.

- Step 7. Comprehensive, edit and print out or indication the Wyoming Promissory Note with Installment Payments.

Each and every lawful papers format you buy is your own property eternally. You have acces to every single type you downloaded in your acccount. Click the My Forms portion and select a type to print out or down load once more.

Compete and down load, and print out the Wyoming Promissory Note with Installment Payments with US Legal Forms. There are thousands of professional and condition-distinct kinds you may use to your organization or person needs.