The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

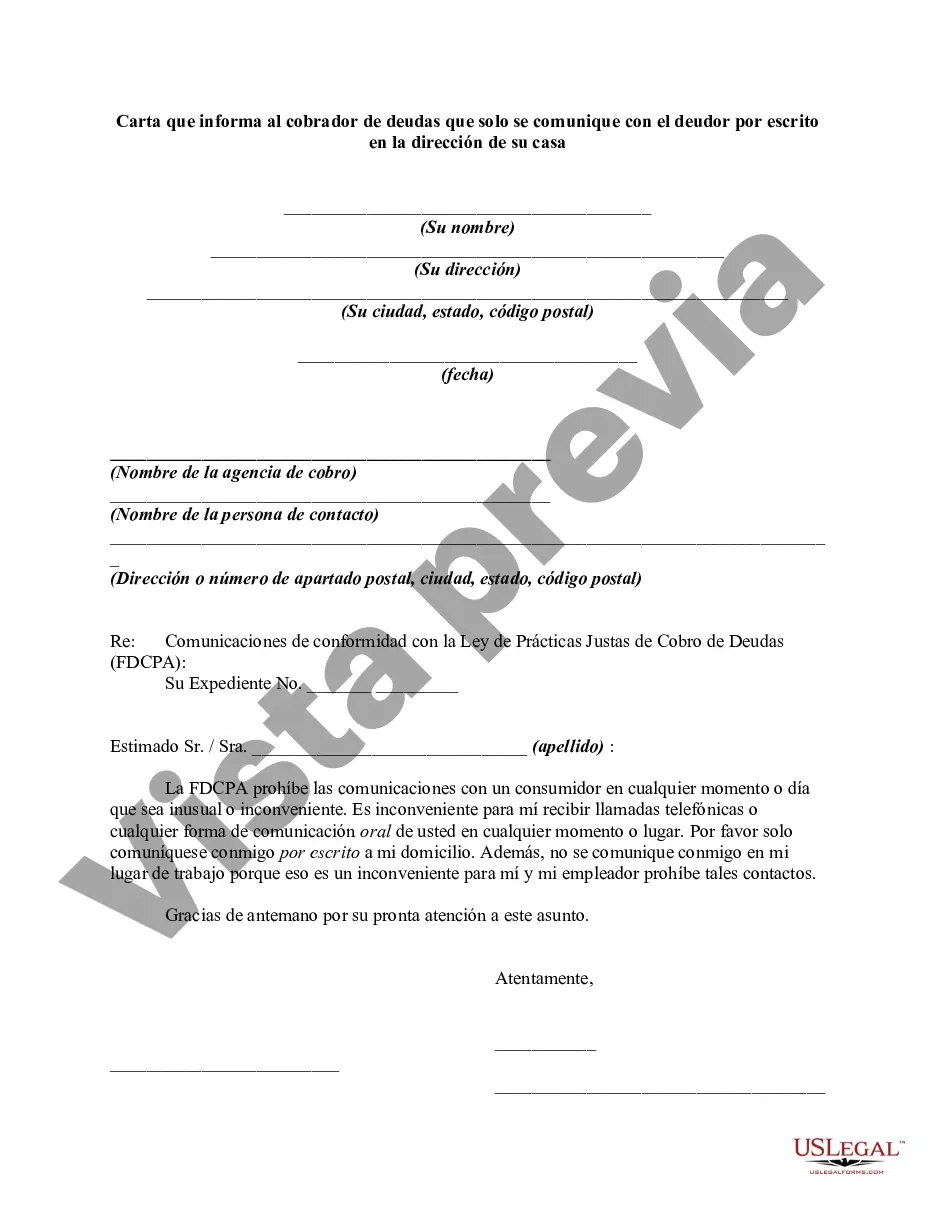

Wyoming Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address In the state of Wyoming, debtors have rights and protections against aggressive and harassing debt collection practices. One valuable tool available to debtors is the Wyoming Letter Informing Debt Collector to only Communicate with the Debtor in Writing at the Debtor's Home Address. This letter, also known as a "cease and desist" letter, is a formal request by the debtor to the debt collector, instructing them to only communicate with the debtor in writing at their home address. By sending this letter, the debtor can put an end to any unwelcome and harassing phone calls or in-person visits from debt collectors. It is important to note that there are different types of Wyoming Letters Informing Debt Collectors to only Communicate with Debtors in Writing at Debtors' Home Addresses. These variations may include: 1. General Wyoming Letter Informing Debt Collector: This type of letter is used when the debtor wants to stop all forms of communication from the debt collector, apart from written correspondence sent to their home address. It ensures that the debtor's personal space and privacy are respected. 2. Validation of Debt Wyoming Letter: Sometimes, debtors may receive collection notices or demands for payment from debt collectors that they do not recognize or believe to be inaccurate. In such cases, a Validation of Debt Wyoming Letter can be sent, requesting the debt collector to provide detailed documentation validating the debt's legitimacy. This type of letter helps protect the debtor from fraudulent or erroneous debt collection attempts. 3. Timely Response Wyoming Letter: If a debtor believes that they are being wrongly pursued for a debt that is beyond the statute of limitations or has already been resolved, a Timely Response Wyoming Letter can be sent. This letter emphasizes the debtor's rights and requests written acknowledgement from the debt collector that they will cease collection efforts. 4. Fair Debt Collection Practices Act (FD CPA) Compliance Wyoming Letter: This letter highlights the debtor's rights under the Fair Debt Collection Practices Act (FD CPA), a federal law that sets guidelines for debt collection practices. By sending this Wyoming Letter, the debtor requests that the debt collector strictly adheres to the FD CPA guidelines when communicating with them in writing. Each type of Wyoming Letter Informing Debt Collector to only Communicate with Debtors in Writing at Debtors' Home Addresses serves as a powerful tool for debtors to protect their rights, privacy, and well-being. It is advisable for debtors to consult legal professionals or certified credit counselors to understand the specific requirements and implications of these letters before sending them to debt collectors.Wyoming Letter Informing Debt Collector to only Communicate with Debtor in Writing at Debtor's Home Address In the state of Wyoming, debtors have rights and protections against aggressive and harassing debt collection practices. One valuable tool available to debtors is the Wyoming Letter Informing Debt Collector to only Communicate with the Debtor in Writing at the Debtor's Home Address. This letter, also known as a "cease and desist" letter, is a formal request by the debtor to the debt collector, instructing them to only communicate with the debtor in writing at their home address. By sending this letter, the debtor can put an end to any unwelcome and harassing phone calls or in-person visits from debt collectors. It is important to note that there are different types of Wyoming Letters Informing Debt Collectors to only Communicate with Debtors in Writing at Debtors' Home Addresses. These variations may include: 1. General Wyoming Letter Informing Debt Collector: This type of letter is used when the debtor wants to stop all forms of communication from the debt collector, apart from written correspondence sent to their home address. It ensures that the debtor's personal space and privacy are respected. 2. Validation of Debt Wyoming Letter: Sometimes, debtors may receive collection notices or demands for payment from debt collectors that they do not recognize or believe to be inaccurate. In such cases, a Validation of Debt Wyoming Letter can be sent, requesting the debt collector to provide detailed documentation validating the debt's legitimacy. This type of letter helps protect the debtor from fraudulent or erroneous debt collection attempts. 3. Timely Response Wyoming Letter: If a debtor believes that they are being wrongly pursued for a debt that is beyond the statute of limitations or has already been resolved, a Timely Response Wyoming Letter can be sent. This letter emphasizes the debtor's rights and requests written acknowledgement from the debt collector that they will cease collection efforts. 4. Fair Debt Collection Practices Act (FD CPA) Compliance Wyoming Letter: This letter highlights the debtor's rights under the Fair Debt Collection Practices Act (FD CPA), a federal law that sets guidelines for debt collection practices. By sending this Wyoming Letter, the debtor requests that the debt collector strictly adheres to the FD CPA guidelines when communicating with them in writing. Each type of Wyoming Letter Informing Debt Collector to only Communicate with Debtors in Writing at Debtors' Home Addresses serves as a powerful tool for debtors to protect their rights, privacy, and well-being. It is advisable for debtors to consult legal professionals or certified credit counselors to understand the specific requirements and implications of these letters before sending them to debt collectors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.