This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

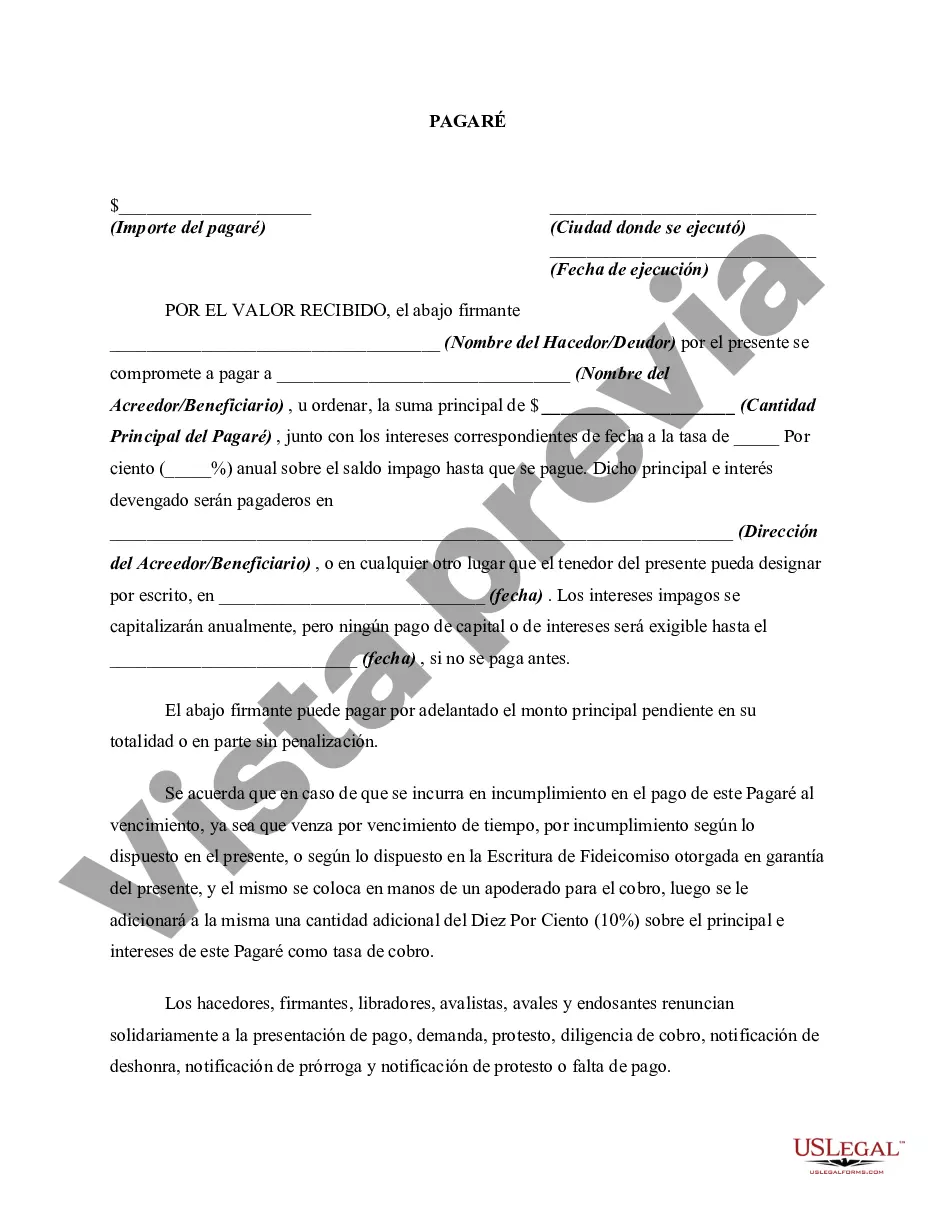

A Wyoming Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding agreement between a borrower and a lender in Wyoming, outlining the terms and conditions of a loan. This type of promissory note is unique in that it does not require any periodic payments from the borrower until the maturity date, at which point the borrower must repay the entire principal amount borrowed, along with any accumulated interest. The interest on this promissory note is compounded annually, meaning that the interest earned on the principal amount is added to the loan balance at the end of each year, thus increasing the total amount owed by the borrower. This compound interest arrangement can be advantageous for lenders as it allows them to earn more interest over the duration of the loan. There are several variations of Wyoming Promissory Notes with no Payment Due Until Maturity and Interest to Compound Annually, depending on the specific terms negotiated by the parties involved. Some possible variations include: 1. Fixed-Rate Wyoming Promissory Note: This type of promissory note establishes a fixed interest rate at the time of borrowing, which remains constant throughout the loan's term. Borrowers will know exactly how much interest they will have to repay at the end of the maturity period. 2. Adjustable-Rate Wyoming Promissory Note: This promissory note offers an interest rate that may fluctuate over time, typically based on current market conditions or an agreed-upon index. The interest rate may adjust periodically, which can affect the total amount owed by the borrower at maturity. 3. Secured Wyoming Promissory Note: This type of promissory note includes collateral, such as real estate or personal property, that the lender can seize and sell in case of default. Having collateral provides additional security for lenders, often leading to more favorable loan terms. 4. Unsecured Wyoming Promissory Note: In contrast to a secured promissory note, this type of note does not require any collateral. Borrowers are therefore not required to pledge any assets if they default on the loan, although lenders may charge higher interest rates to compensate for the increased risk. 5. Convertible Wyoming Promissory Note: This note allows the lender or borrower to convert the debt into equity in the borrower's company or business. This option is commonly utilized in start-up financing or venture capital deals. It is essential to consult legal professionals or financial advisors when drafting or entering into any promissory note to ensure compliance with Wyoming state laws and accurate understanding of the terms and obligations.A Wyoming Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding agreement between a borrower and a lender in Wyoming, outlining the terms and conditions of a loan. This type of promissory note is unique in that it does not require any periodic payments from the borrower until the maturity date, at which point the borrower must repay the entire principal amount borrowed, along with any accumulated interest. The interest on this promissory note is compounded annually, meaning that the interest earned on the principal amount is added to the loan balance at the end of each year, thus increasing the total amount owed by the borrower. This compound interest arrangement can be advantageous for lenders as it allows them to earn more interest over the duration of the loan. There are several variations of Wyoming Promissory Notes with no Payment Due Until Maturity and Interest to Compound Annually, depending on the specific terms negotiated by the parties involved. Some possible variations include: 1. Fixed-Rate Wyoming Promissory Note: This type of promissory note establishes a fixed interest rate at the time of borrowing, which remains constant throughout the loan's term. Borrowers will know exactly how much interest they will have to repay at the end of the maturity period. 2. Adjustable-Rate Wyoming Promissory Note: This promissory note offers an interest rate that may fluctuate over time, typically based on current market conditions or an agreed-upon index. The interest rate may adjust periodically, which can affect the total amount owed by the borrower at maturity. 3. Secured Wyoming Promissory Note: This type of promissory note includes collateral, such as real estate or personal property, that the lender can seize and sell in case of default. Having collateral provides additional security for lenders, often leading to more favorable loan terms. 4. Unsecured Wyoming Promissory Note: In contrast to a secured promissory note, this type of note does not require any collateral. Borrowers are therefore not required to pledge any assets if they default on the loan, although lenders may charge higher interest rates to compensate for the increased risk. 5. Convertible Wyoming Promissory Note: This note allows the lender or borrower to convert the debt into equity in the borrower's company or business. This option is commonly utilized in start-up financing or venture capital deals. It is essential to consult legal professionals or financial advisors when drafting or entering into any promissory note to ensure compliance with Wyoming state laws and accurate understanding of the terms and obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.