A financial hardship resulting in a need for such an affidavit such as this form can be defined as a material change in the financial situation of a person that is or will affect their ability to pay their debts. Many things can cause a hardship such as a payment Increase on your mortgage note, loss of your job, business failure, damage to property, death of a spouse or other family member, severe illness, divorce, medical bills, or just accruing too much debt.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

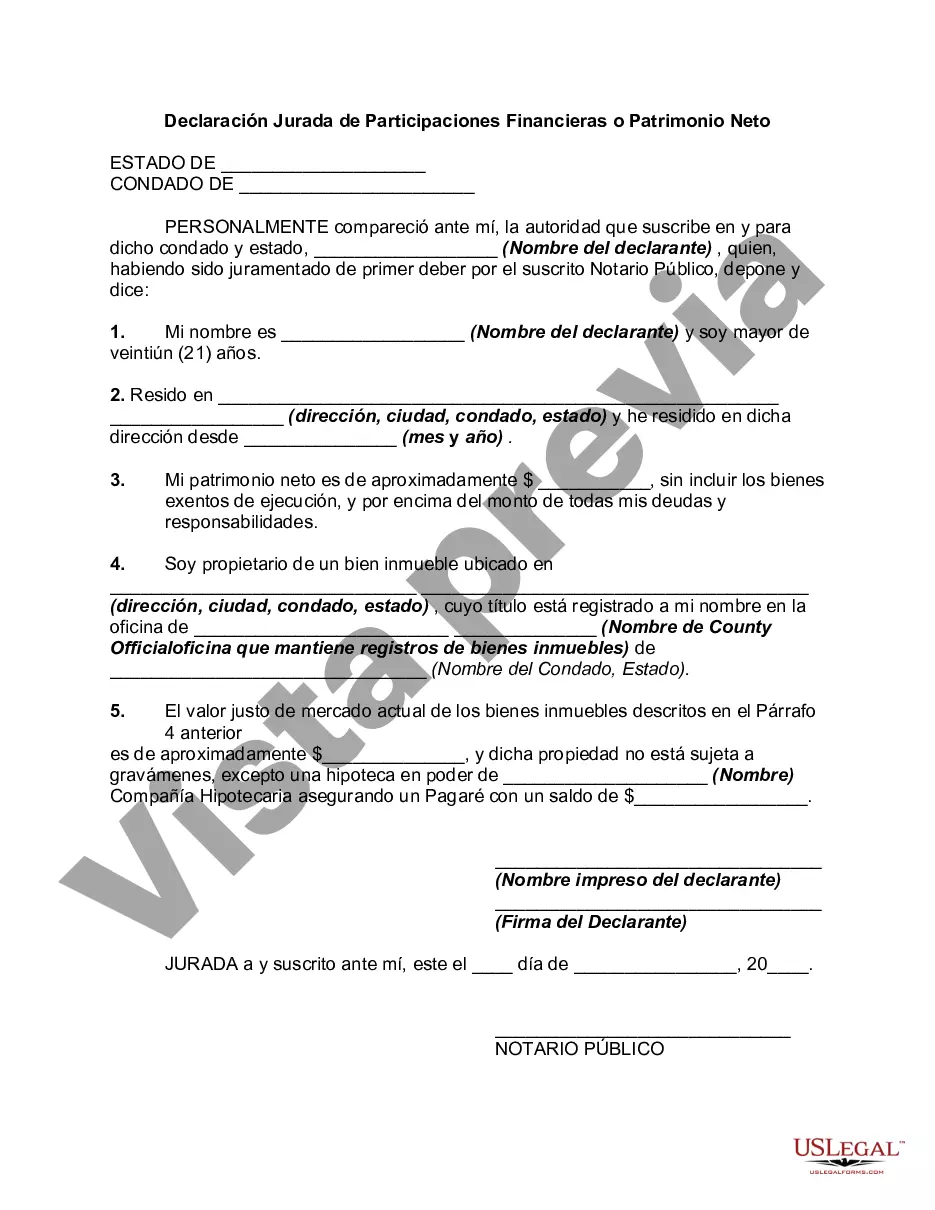

Keywords: Wyoming, affidavit of financial holdings, net worth, assets, liabilities, types. Wyoming Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a legal document used to disclose an individual's or a business entity's financial standing. This affidavit provides a comprehensive summary of one's assets, liabilities, and net worth, serving as a crucial tool in various legal proceedings, such as divorce cases, litigation, or business transactions. The Wyoming Affidavit of Financial Holdings captures pertinent information regarding an individual's or entity's financial situation. It includes both tangible and intangible assets, debts, and liabilities. This affidavit ensures transparency and fairness in legal negotiations, ensuring that parties involved can make informed decisions based on accurate financial information. There are different types of Wyoming Affidavit of Financial Holdings or Net Worth — Assets and Liabilities, each tailored to specific scenarios: 1. Personal Affidavit of Financial Holdings: This type of affidavit is used by individuals during divorce proceedings or legal disputes requiring disclosure of personal financial information. It outlines personal assets, such as real estate, vehicles, investments, bank accounts, retirement funds, valuable possessions, and other financial holdings. It also includes liabilities like mortgage debts, credit card debts, loans, and outstanding obligations, providing a detailed picture of an individual's net worth. 2. Business Affidavit of Financial Holdings: This type of affidavit is designed for businesses and provides a comprehensive overview of their financial status. It outlines the company's assets, such as property, equipment, inventory, accounts receivable, investments, and intellectual property. Liabilities, including loans, debts, accounts payable, and outstanding legal obligations, are also detailed. This affidavit is often used in legal proceedings, such as mergers and acquisitions, partnerships, or shareholder disputes, where transparency and accurate financial information are essential. 3. Joint Affidavit of Financial Holdings: This type of affidavit is used during divorce or separation cases where both parties make a combined disclosure of their financial holdings. It combines the financial information of both individuals, including assets, liabilities, income, and expenses. The joint affidavit ensures that each party provides a transparent and complete picture of their financial situation, facilitating the division of property and determining alimony or child support. In conclusion, the Wyoming Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a crucial legal document that discloses an individual's or business entity's financial standing. It provides a comprehensive summary of assets, liabilities, and net worth, enabling fair negotiations and informed decision-making. Different types of affidavits cater to specific scenarios, including personal, business, and joint affidavits, ensuring accurate financial disclosure in various legal proceedings.Keywords: Wyoming, affidavit of financial holdings, net worth, assets, liabilities, types. Wyoming Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a legal document used to disclose an individual's or a business entity's financial standing. This affidavit provides a comprehensive summary of one's assets, liabilities, and net worth, serving as a crucial tool in various legal proceedings, such as divorce cases, litigation, or business transactions. The Wyoming Affidavit of Financial Holdings captures pertinent information regarding an individual's or entity's financial situation. It includes both tangible and intangible assets, debts, and liabilities. This affidavit ensures transparency and fairness in legal negotiations, ensuring that parties involved can make informed decisions based on accurate financial information. There are different types of Wyoming Affidavit of Financial Holdings or Net Worth — Assets and Liabilities, each tailored to specific scenarios: 1. Personal Affidavit of Financial Holdings: This type of affidavit is used by individuals during divorce proceedings or legal disputes requiring disclosure of personal financial information. It outlines personal assets, such as real estate, vehicles, investments, bank accounts, retirement funds, valuable possessions, and other financial holdings. It also includes liabilities like mortgage debts, credit card debts, loans, and outstanding obligations, providing a detailed picture of an individual's net worth. 2. Business Affidavit of Financial Holdings: This type of affidavit is designed for businesses and provides a comprehensive overview of their financial status. It outlines the company's assets, such as property, equipment, inventory, accounts receivable, investments, and intellectual property. Liabilities, including loans, debts, accounts payable, and outstanding legal obligations, are also detailed. This affidavit is often used in legal proceedings, such as mergers and acquisitions, partnerships, or shareholder disputes, where transparency and accurate financial information are essential. 3. Joint Affidavit of Financial Holdings: This type of affidavit is used during divorce or separation cases where both parties make a combined disclosure of their financial holdings. It combines the financial information of both individuals, including assets, liabilities, income, and expenses. The joint affidavit ensures that each party provides a transparent and complete picture of their financial situation, facilitating the division of property and determining alimony or child support. In conclusion, the Wyoming Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a crucial legal document that discloses an individual's or business entity's financial standing. It provides a comprehensive summary of assets, liabilities, and net worth, enabling fair negotiations and informed decision-making. Different types of affidavits cater to specific scenarios, including personal, business, and joint affidavits, ensuring accurate financial disclosure in various legal proceedings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.