Wyoming Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift is an essential legal document that acknowledges the receipt of a gift by a nonprofit church corporation in the state of Wyoming. This document is crucial for both the donor and the recipient organization as it serves as proof of the gift and helps ensure compliance with state laws and regulations regarding charitable contributions. The Wyoming Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift includes several key elements to make it legally binding and valid. These elements typically consist of: 1. Nonprofit Church Corporation Information: The document begins with the complete and accurate identification of the nonprofit church corporation, including its official name, address, and contact details. This information helps establish the identity and legitimacy of the recipient organization. 2. Donor Information: The acknowledgment also includes the essential details of the donor, such as their full name, address, and any other relevant contact information. This information is necessary for purposes of identification and contact. 3. Description of Gift: The document specifies the nature and description of the gift received by the nonprofit church corporation. It may include details like the type of donation (cash, check, property, stocks, etc.) and its estimated monetary value. This information is vital for accounting purposes and to ensure transparency in the organization's financial records. 4. Statement of Acknowledgment: The Wyoming Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift includes a statement indicating that the nonprofit church corporation has received the gift and expresses gratitude towards the donor for their generosity. This statement affirms the validity of the acknowledgment and solidifies the agreement between the donor and the organization. 5. Tax-Exempt Status: If the nonprofit church corporation has obtained tax-exempt status under section 501(c)(3) of the Internal Revenue Code, this document may also include a declaration acknowledging the tax-exempt status of the organization. It clarifies that the donation may be tax-deductible for the donor, subject to the specific tax laws and regulations. The Wyoming Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift may not have different types per se, but it can be tailored based on the unique circumstances of the donation or any specific requirements imposed by the nonprofit church corporation or Wyoming state law. To ensure compliance with Wyoming state regulations and enhance the legal efficacy of the acknowledgment, it is recommended to consult an attorney or legal professional experienced in nonprofit law and compliance. They can review and customize the document to meet the specific needs and requirements of the nonprofit church corporation, as well as provide guidance on how to properly execute and distribute the acknowledgment to all relevant parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wyoming Acuse de recibo de una donación por parte de una corporación eclesiástica sin fines de lucro - Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift

Description

How to fill out Wyoming Acuse De Recibo De Una Donación Por Parte De Una Corporación Eclesiástica Sin Fines De Lucro?

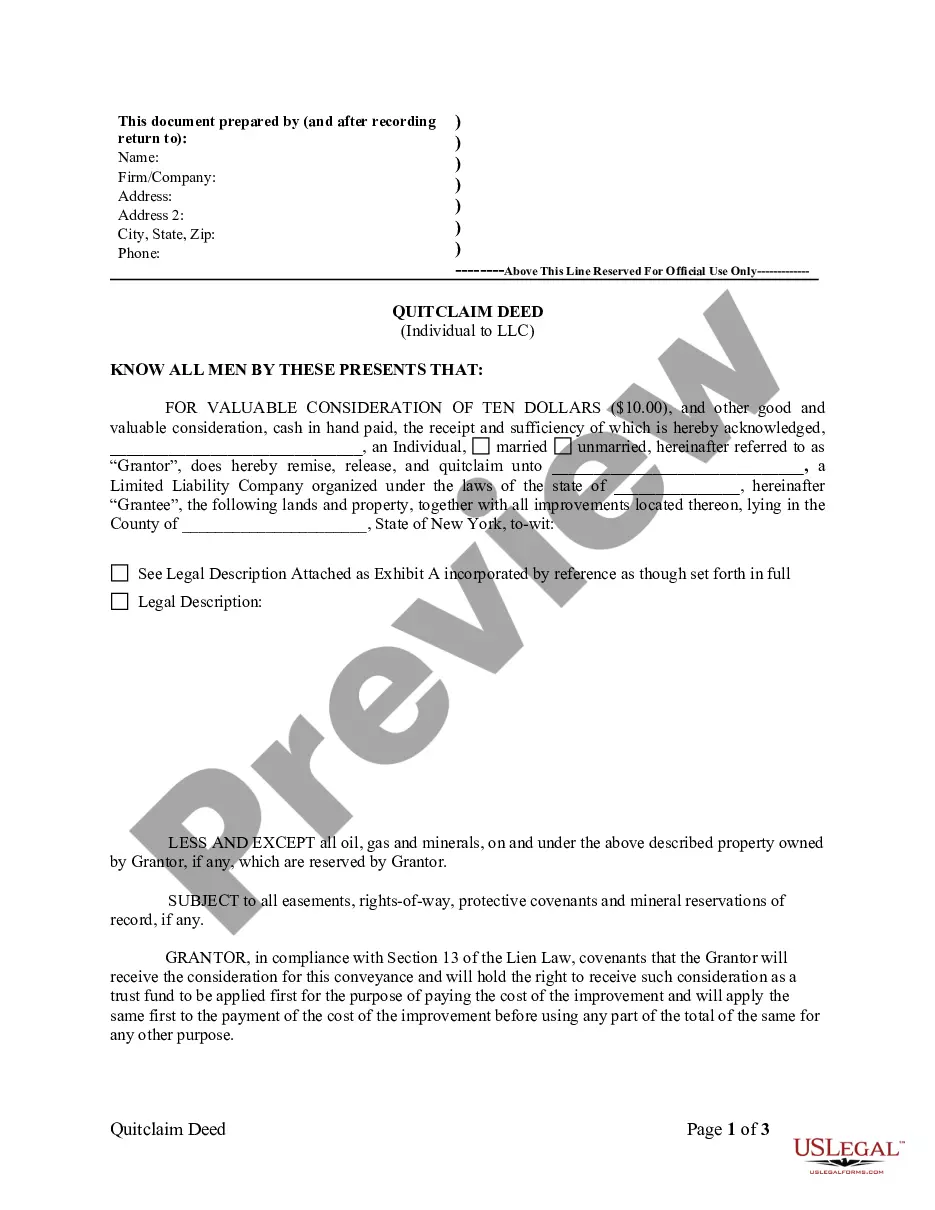

You may invest several hours on the web trying to find the legitimate papers web template which fits the federal and state specifications you require. US Legal Forms supplies a large number of legitimate kinds which can be analyzed by pros. It is possible to obtain or print out the Wyoming Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift from my assistance.

If you have a US Legal Forms profile, it is possible to log in and click the Down load option. Afterward, it is possible to full, change, print out, or indication the Wyoming Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift. Each and every legitimate papers web template you acquire is your own permanently. To get yet another version of any purchased type, proceed to the My Forms tab and click the related option.

If you use the US Legal Forms site for the first time, adhere to the simple instructions listed below:

- Initially, ensure that you have chosen the right papers web template to the region/metropolis of your choosing. Browse the type description to ensure you have selected the appropriate type. If available, utilize the Review option to check from the papers web template too.

- If you would like discover yet another version of your type, utilize the Research industry to find the web template that meets your needs and specifications.

- When you have identified the web template you need, simply click Buy now to proceed.

- Pick the pricing program you need, type your accreditations, and sign up for an account on US Legal Forms.

- Total the deal. You can use your Visa or Mastercard or PayPal profile to cover the legitimate type.

- Pick the file format of your papers and obtain it to the product.

- Make modifications to the papers if needed. You may full, change and indication and print out Wyoming Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift.

Down load and print out a large number of papers templates making use of the US Legal Forms site, that provides the largest assortment of legitimate kinds. Use specialist and express-particular templates to tackle your small business or individual needs.