Wyoming Partnership Agreement Re Land

Description

How to fill out Partnership Agreement Re Land?

Have you ever found yourself in a scenario where you need documents for occasional business or personal purposes regularly.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

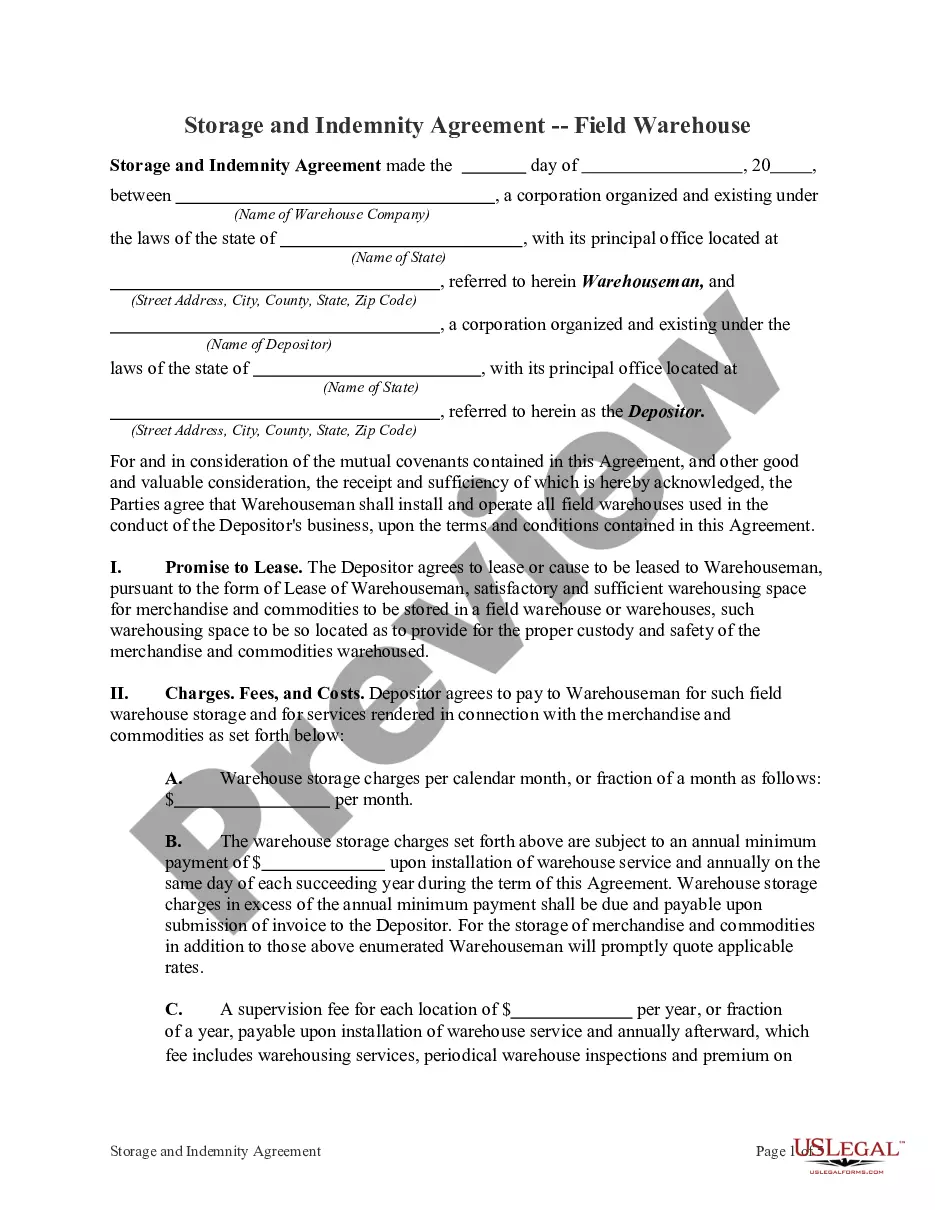

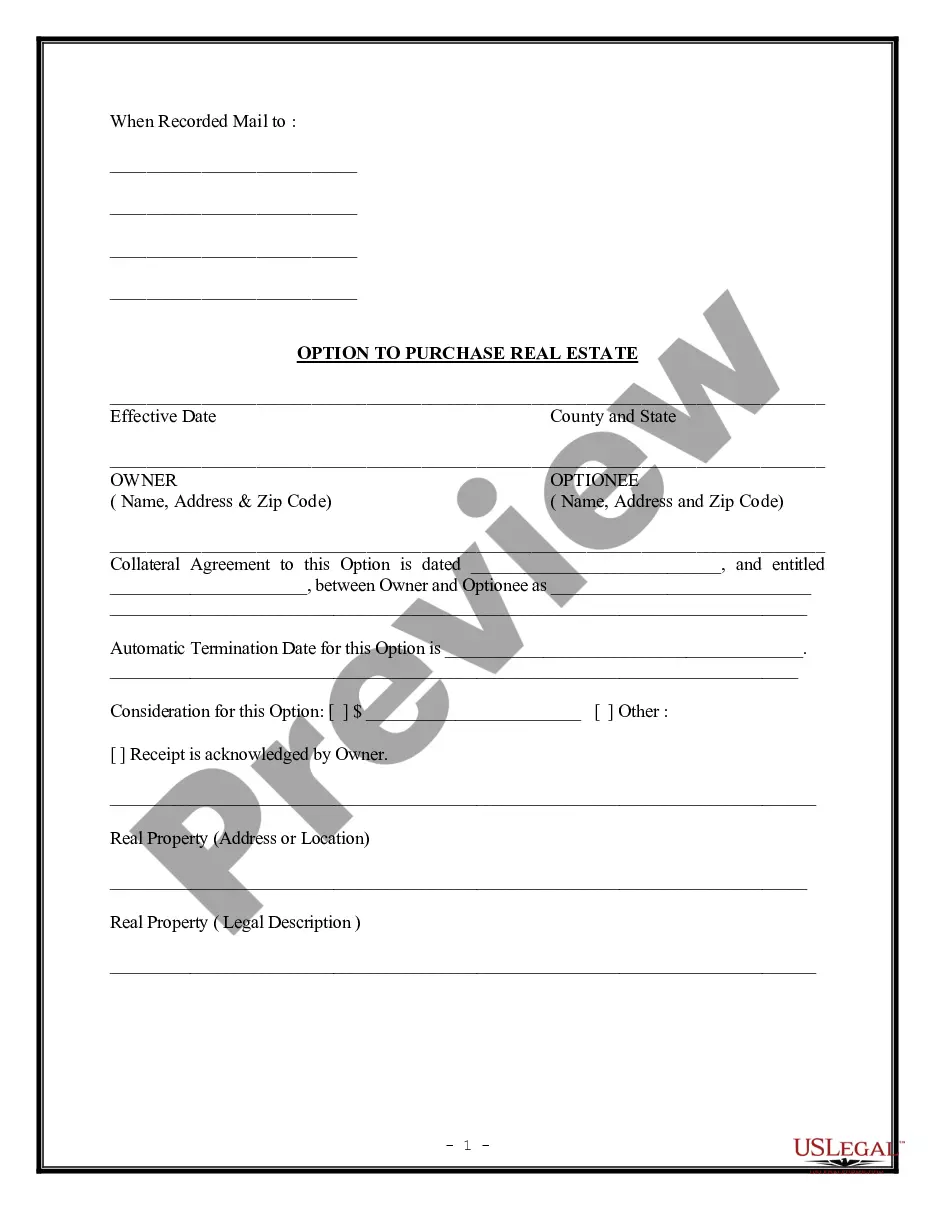

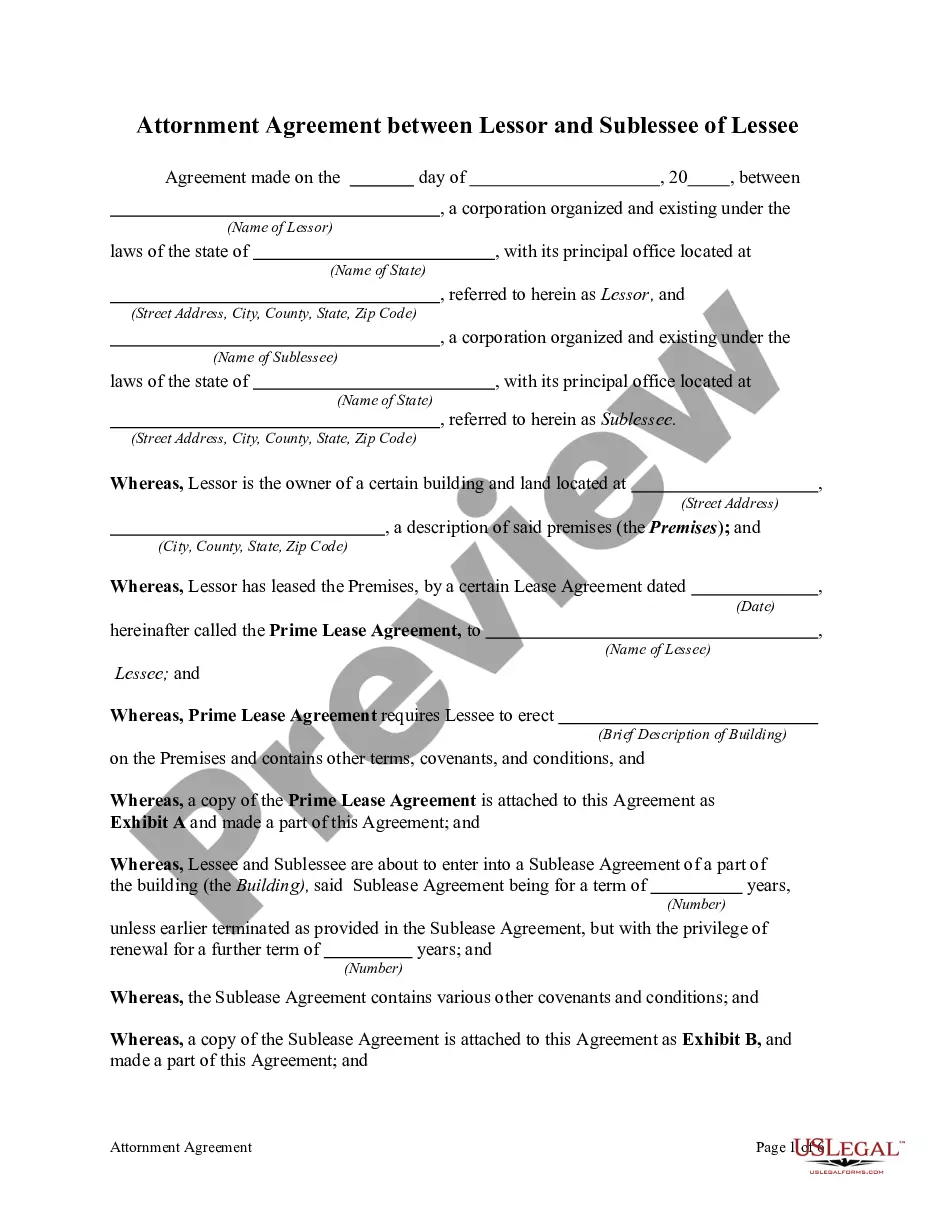

US Legal Forms offers a vast array of form templates, including the Wyoming Partnership Agreement Re Land, which can be completed to comply with federal and state regulations.

Once you find the appropriate form, click Buy now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Wyoming Partnership Agreement Re Land template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/state.

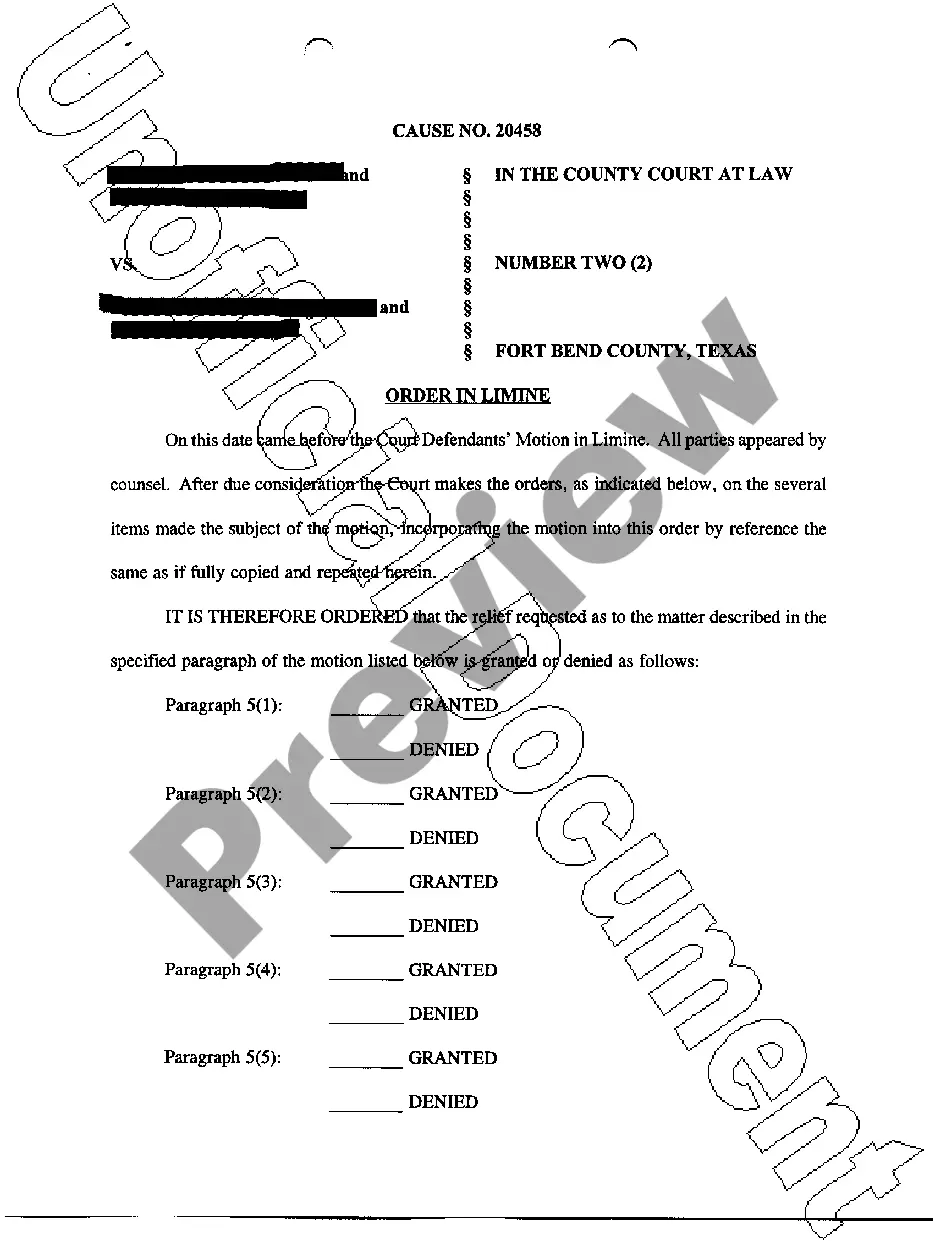

- Utilize the Review button to examine the form.

- Check the summary to confirm that you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

To finalize a partnership, ensure that all partners review and sign the finalized partnership agreement. It’s essential to communicate clearly about all terms and obtain consent from each partner. Using a platform like USLegalForms can facilitate the process of creating and formalizing your Wyoming Partnership Agreement Re Land, making it straightforward and official.

An LLC can own multiple LLCs, this is no problem. It is commonly referred to as a parent-child setup, or a holding company with subsidiaries. Generally a unique subsidiary is formed for each revenue stream or asset. Yes, an LLC can own 50% of another LLC - it can also own 100% or 1%.

Wyoming is one of only a very few states that does not have a personal income tax or a corporation income tax. Consequently, for most LLCs, including those that may have elected to be taxed as corporations, no state income taxes are due.

Is an LLC Operating Agreement required in Wyoming? No. An Operating Agreement is not required in Wyoming. Although it is not required, the SBA recommends that all LLCs in every state have a clear and detailed Operating Agreement.

How to form a partnership: 10 steps to successChoose your partners.Determine your type of partnership.Come up with a name for your partnership.Register the partnership.Determine tax obligations.Apply for an EIN and tax ID numbers.Establish a partnership agreement.Obtain licenses and permits, if applicable.More items...?

Can an LLC Own Another LLC? Yes. There are two ways in which an LLC may own another LLC: An LLC may own multiple, single-member LLCsthis is called a holding company structure; or.

A partnership (also known as a general partnership) is an informal business structure consisting of two or more people. You don't have to file paperwork to establish a partnership -- you create a partnership simply by agreeing to go into business with another person.

These are the steps you can follow to write a partnership agreement:Step 1 : Give your partnership agreement a title.Step 2 : Outline the goals of the partnership agreement.Step 3 : Mention the duration of the partnership.Step 4 : Define the contribution amounts of each partner (cash, property, services, etc.).More items...?

Take the partnership agreement and the partnership form to your secretary of state's office. You can usually submit the form in person or via mail or fax, but be sure to confirm delivery.

5 Steps to Filing Partnership TaxesPrepare Form 1065, U.S. Return of Partnership Income. Every partnership must prepare a federal partnership tax return on Internal Revenue Servicer Form 1065.Prepare Schedule K-1.File Form 1065 and Copies of the K-1 Forms.File State Tax Returns.File Personal Tax Returns.