Title: Wyoming Inquiry of Credit Cardholder Concerning Billing Error — A Comprehensive Guide Introduction: In Wyoming, credit cardholders have important rights when it comes to disputing billing errors on their credit card statements. This article aims to provide an in-depth understanding of the Wyoming Inquiry of Credit Cardholder Concerning Billing Error process, helping cardholders navigate through different scenarios. We will explore various types of billing errors that can occur, shed light on the actions cardholders can take, and provide relevant keywords to enhance search engine optimization (SEO). 1. Types of Wyoming Inquiry of Credit Cardholder Concerning Billing Errors: a) Unauthorized Charges: This occurs when a cardholder notices transactions on their credit card statement that they did not authorize or make. b) Duplicate Charges: This type of error happens when the same transaction appears multiple times on the cardholder's billing statement. c) Incorrect Amounts: Cardholders may encounter discrepancies in the amount charged for a particular purchase, either overcharged or undercharged. d) Failed Refunds: This involves situations where a cardholder fails to receive a refund for a returned item or a canceled service. 2. Initiating a Wyoming Inquiry of Credit Cardholder Concerning Billing Error: To resolve billing errors, Wyoming credit cardholders can take the following steps: a) Prompt Reporting: Cardholders should notify their credit card issuer immediately after identifying a billing error. b) Written Notice: Prepare a written notice to the credit card issuer, detailing the nature of the billing error, transaction date, and any supporting evidence to strengthen the claim. c) Specific Reasoning: Cardholders must clearly state the reason they believe a billing error has occurred (e.g., unauthorized charge, incorrect amount). d) Time Limit: Emphasize the importance of adhering to the federal requirement of reporting the error within 60 days of the statement's mailing date. 3. Resolving Wyoming Inquiry of Credit Cardholder Concerning Billing Errors: a) Investigation Process: Upon receiving the written notice, the credit card issuer is obligated to investigate the dispute promptly, typically within 30 days. b) Provisional Credit: During the investigation, credit card issuers may provide a provisional credit while the dispute is being resolved, ensuring minimal inconvenience and financial strain for the cardholder. c) Written Response: The credit card issuer is required to respond to the cardholder's notice within a specific timeframe and provide an explanation of their findings and any adjustments made to the account. Conclusion: Understanding the Wyoming Inquiry of Credit Cardholder Concerning Billing Error process is essential for cardholders to protect their rights and financial interests. By promptly reporting billing errors, providing supporting evidence, and adhering to federal regulations, Wyoming credit cardholders can effectively resolve disputes and ensure accurate billing. Keywords: Wyoming, credit cardholder, billing error, unauthorized charges, duplicate charges, incorrect amounts, failed refunds, written notice, investigation process, provisional credit.

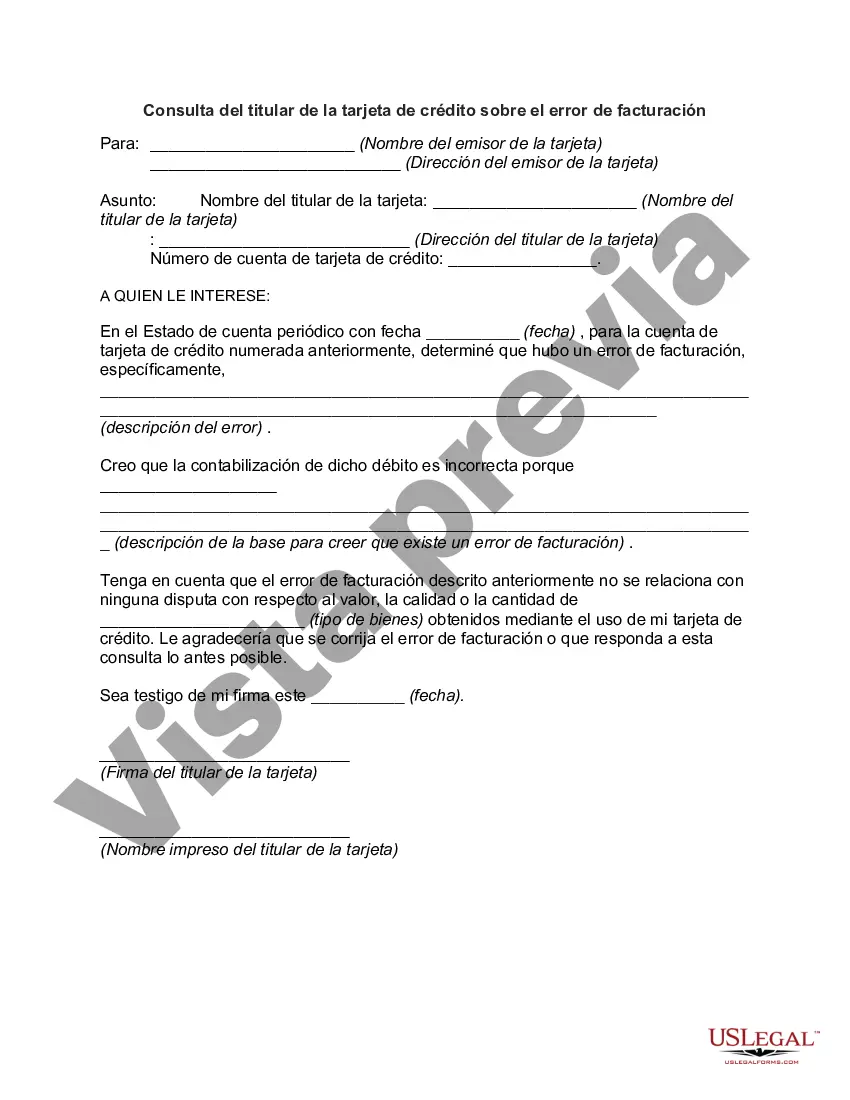

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wyoming Consulta del titular de la tarjeta de crédito sobre un error de facturación - Inquiry of Credit Cardholder Concerning Billing Error

Description

How to fill out Wyoming Consulta Del Titular De La Tarjeta De Crédito Sobre Un Error De Facturación?

Discovering the right authorized record template can be a have a problem. Of course, there are plenty of themes available on the net, but how do you discover the authorized kind you will need? Take advantage of the US Legal Forms web site. The assistance provides a huge number of themes, like the Wyoming Inquiry of Credit Cardholder Concerning Billing Error, which can be used for organization and private needs. All the varieties are inspected by professionals and satisfy state and federal specifications.

In case you are currently authorized, log in to your bank account and click the Download option to find the Wyoming Inquiry of Credit Cardholder Concerning Billing Error. Utilize your bank account to appear throughout the authorized varieties you may have bought formerly. Check out the My Forms tab of your bank account and have an additional duplicate of your record you will need.

In case you are a new user of US Legal Forms, here are simple directions that you can adhere to:

- First, make certain you have selected the appropriate kind to your metropolis/area. It is possible to examine the form utilizing the Preview option and browse the form information to guarantee this is basically the right one for you.

- When the kind does not satisfy your needs, utilize the Seach discipline to discover the appropriate kind.

- Once you are certain that the form is proper, click the Get now option to find the kind.

- Pick the pricing plan you would like and type in the necessary details. Make your bank account and pay for your order making use of your PayPal bank account or bank card.

- Select the submit format and obtain the authorized record template to your system.

- Complete, edit and print out and sign the obtained Wyoming Inquiry of Credit Cardholder Concerning Billing Error.

US Legal Forms will be the biggest collection of authorized varieties in which you can see a variety of record themes. Take advantage of the company to obtain expertly-created documents that adhere to status specifications.