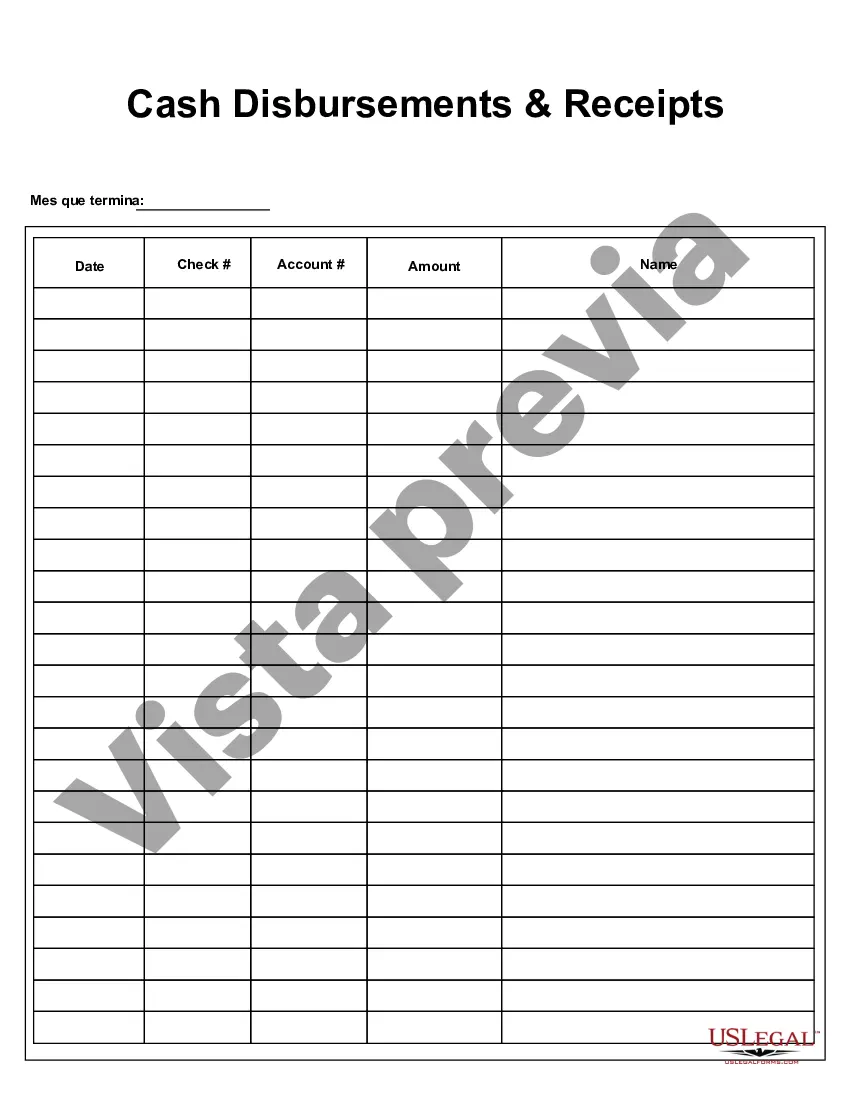

Wyoming Cash Disbursements and Receipts refer to the financial transactions related to the allocation and collection of funds within the state of Wyoming. These transactions involve the disbursement of cash from the state treasury to various entities and individuals, as well as the receipt of cash from various sources. Wyoming Cash Disbursements are the outflows of funds from the state treasury to fulfill various financial obligations. These disbursements encompass a wide range of expenditures, including but not limited to salaries and wages for state employees, grants and subsidies to other governmental bodies and organizations, payments for goods and services procured by the state, and debt repayments. The state of Wyoming employs a transparent and accountable system to track and manage cash disbursements. This includes maintaining comprehensive records and documentation of each payment made, including the amount, purpose, and recipient of the disbursement. The information on cash disbursements is essential for budget planning, financial reporting, and ensuring compliance with applicable laws and regulations. On the other hand, Wyoming Cash Receipts refer to the inflow of funds into the state treasury from various sources. These receipts include tax revenues generated from individuals, businesses, and industries, federal grants and reimbursements, fees and fines imposed by the state, returns on investments, and other miscellaneous sources of income. To effectively manage cash receipts, Wyoming employs robust financial systems and processes. These ensure accurate and timely recording and reconciliation of all incoming cash, helping to maintain financial stability and integrity within the state. While Wyoming Cash Disbursements and Receipts are broad categories, there may be specific types within each. These can be identified based on the purpose or source of funds. Some possible examples include: 1. Payroll Disbursements: These involve the disbursal of funds for salaries, wages, and benefits to state employees. 2. Vendor Disbursements: These are payments made to suppliers, contractors, and service providers for goods and services procured by the state. 3. Grant Disbursements: Funds provided to other governmental bodies, non-profit organizations, or individuals to support specific projects or initiatives. 4. Income Tax Receipts: Cash received from individual taxpayers based on their income and tax liability. 5. Sales and Use Tax Receipts: Revenue generated from the collection of taxes on retail sales and other taxable goods and services. 6. Fuel Tax Receipts: Funds collected from the taxes imposed on the sale and use of motor fuels within the state. 7. Investment Income Receipts: Returns on investments made by the state with surplus cash or reserves. By effectively managing both cash disbursements and receipts, Wyoming aims to ensure efficient financial operations, meet financial obligations, maintain adequate reserves, and contribute to the overall economic development of the state.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wyoming Desembolsos y recibos de efectivo - Cash Disbursements and Receipts

Description

How to fill out Wyoming Desembolsos Y Recibos De Efectivo?

It is possible to spend time on the Internet looking for the legitimate record format which fits the state and federal specifications you want. US Legal Forms gives thousands of legitimate forms that happen to be reviewed by pros. It is simple to download or produce the Wyoming Cash Disbursements and Receipts from my support.

If you currently have a US Legal Forms profile, you are able to log in and then click the Obtain button. Following that, you are able to comprehensive, modify, produce, or sign the Wyoming Cash Disbursements and Receipts. Each legitimate record format you buy is the one you have forever. To acquire yet another backup associated with a obtained develop, go to the My Forms tab and then click the related button.

If you use the US Legal Forms web site initially, adhere to the simple recommendations listed below:

- Initially, ensure that you have selected the best record format for your region/area of your choosing. See the develop description to make sure you have picked the right develop. If accessible, make use of the Preview button to search with the record format at the same time.

- If you want to locate yet another version in the develop, make use of the Search discipline to find the format that meets your requirements and specifications.

- When you have located the format you need, simply click Acquire now to proceed.

- Find the prices plan you need, type your references, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal profile to pay for the legitimate develop.

- Find the structure in the record and download it to your system.

- Make modifications to your record if necessary. It is possible to comprehensive, modify and sign and produce Wyoming Cash Disbursements and Receipts.

Obtain and produce thousands of record themes while using US Legal Forms Internet site, which provides the greatest selection of legitimate forms. Use professional and condition-specific themes to deal with your small business or individual demands.