Wyoming Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment is a legal document designed to outline the process of terminating a partnership in the state of Wyoming. In this agreement, the partners agree to dissolve the partnership and settle any remaining financial obligations by making a one-time lump-sum payment. The primary purpose of this agreement is to establish a clear and formal understanding between the partners regarding the dissolution and winding up of the partnership. It aims to provide a structured framework for the distribution of assets, settlement of debts, and the allocation of remaining partnership profits or losses. By entering into this agreement, the partners acknowledge their intent to dissolve the partnership cooperatively, ensuring a smooth and efficient process. This agreement serves as a legal safeguard, protecting the interests of all partners involved and minimizing the potential for future disputes or disagreements. This type of agreement can be further categorized into different types based on the specific circumstances of the partnership dissolution. Some noteworthy examples include: 1. Wyoming Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment in the Case of Retirement: This type of agreement is tailored to partnerships where one or more partners decide to retire, prompting the dissolution of the partnership. The agreement outlines how the remaining partners will settle any financial obligations with the retiring partner(s) and allocate assets and profits accordingly. 2. Wyoming Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment in the Case of Bankruptcy: In situations where the partnership is facing financial distress and is compelled to declare bankruptcy, this agreement defines the process of winding up the partnership and settling outstanding debts through a lump-sum payment. 3. Wyoming Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment in the Case of Mutual Agreement: If all partners unanimously agree to dissolve the partnership, this type of agreement provides a structured framework for the distribution of assets, settlement of debts, and the allocation of profits or losses through a one-time lump-sum payment. It is essential for partners to consult with legal professionals while drafting and executing a Wyoming Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment. This ensures compliance with Wyoming state laws and guarantees that all partners' rights and obligations are adequately addressed and protected.

Wyoming Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump-sum Payment?

If you wish to total, obtain, or printing authorized file templates, use US Legal Forms, the greatest assortment of authorized varieties, which can be found on-line. Make use of the site`s easy and hassle-free research to obtain the papers you need. Different templates for company and individual functions are sorted by groups and says, or keywords and phrases. Use US Legal Forms to obtain the Wyoming Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment in just a few click throughs.

Should you be already a US Legal Forms client, log in to the account and click on the Acquire button to have the Wyoming Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment. You can also accessibility varieties you formerly downloaded inside the My Forms tab of the account.

If you work with US Legal Forms for the first time, follow the instructions listed below:

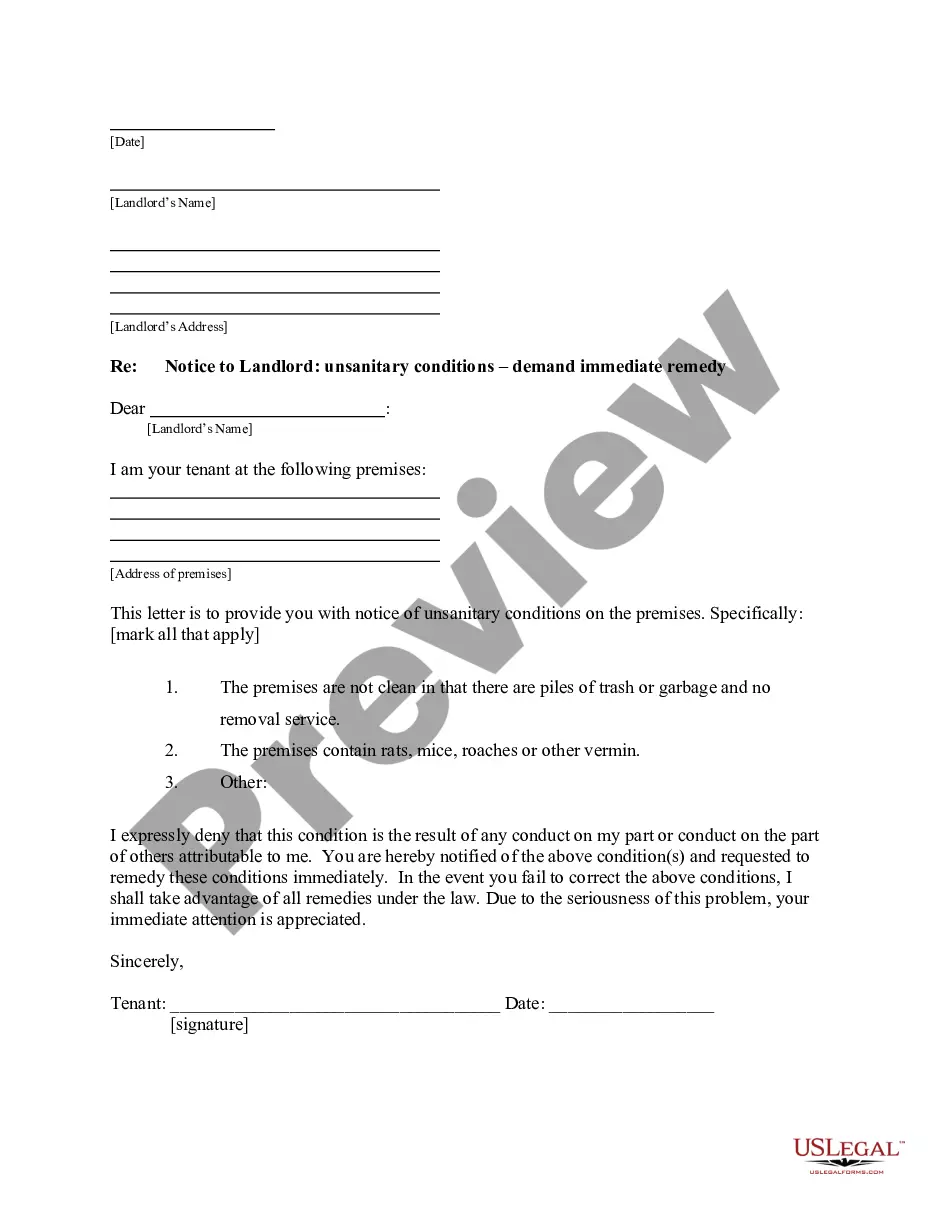

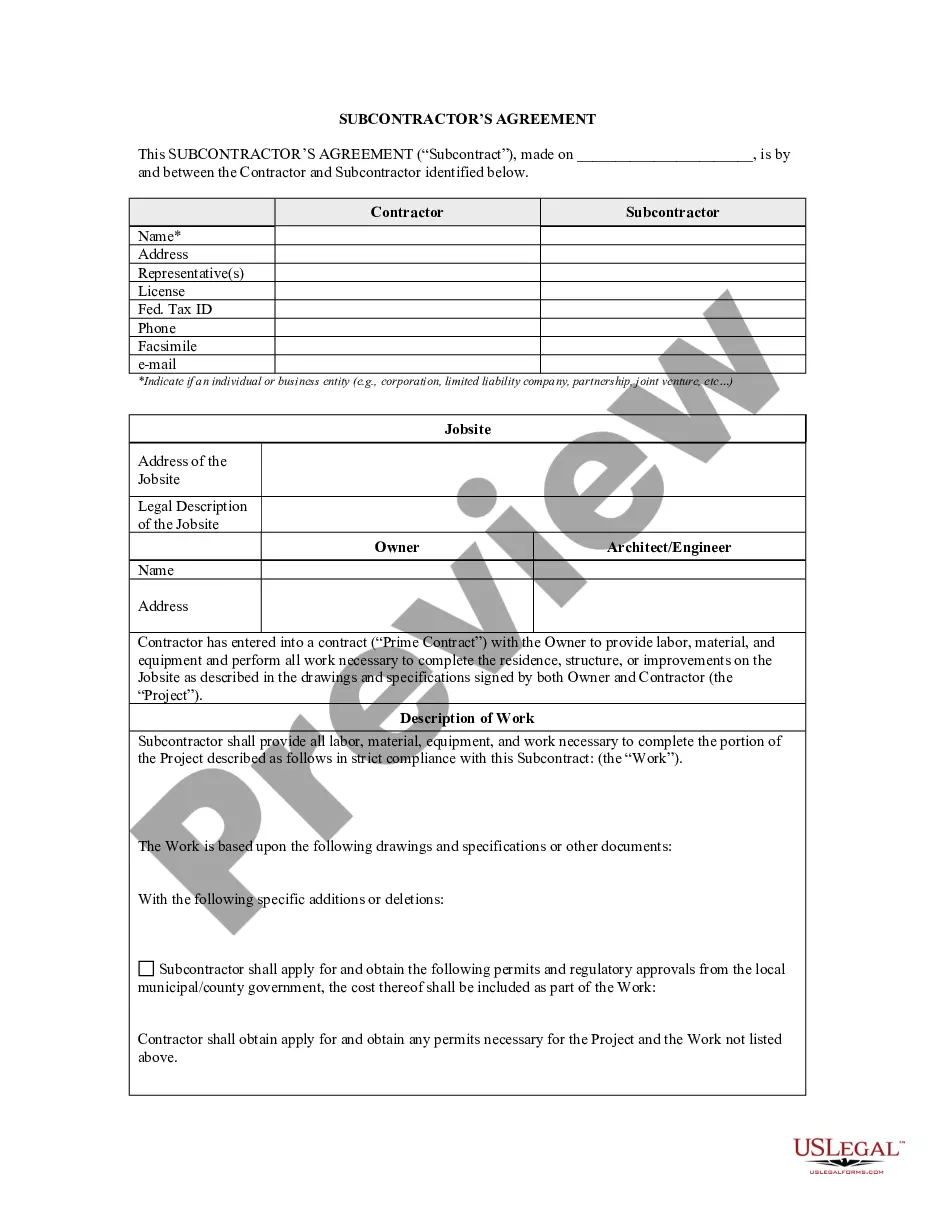

- Step 1. Be sure you have chosen the form for that appropriate area/region.

- Step 2. Utilize the Review choice to look through the form`s content. Never overlook to learn the outline.

- Step 3. Should you be not satisfied using the kind, take advantage of the Look for discipline near the top of the screen to discover other models of the authorized kind design.

- Step 4. When you have discovered the form you need, click on the Purchase now button. Select the pricing program you favor and add your qualifications to register on an account.

- Step 5. Approach the deal. You should use your charge card or PayPal account to finish the deal.

- Step 6. Pick the formatting of the authorized kind and obtain it on the product.

- Step 7. Full, edit and printing or sign the Wyoming Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment.

Each and every authorized file design you purchase is your own eternally. You possess acces to every kind you downloaded with your acccount. Go through the My Forms section and pick a kind to printing or obtain again.

Compete and obtain, and printing the Wyoming Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment with US Legal Forms. There are many skilled and status-particular varieties you can utilize for your personal company or individual needs.

Form popularity

FAQ

First of all the external liabilities and expenses are to be paid. Then, all loans and advances forwarded by the partners should be paid. Then, the capital of each partner should be paid off.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

In the dissolution process, any partner may dissolve the partnership at any time by providing a notice of dissolution. The partnership is then required to wind up its business activities and distribute its assets.

Settlement of accounts on dissolutionPayment of the debts of the firm to the third parties.Payment of advances and loans given by the partners.Payment of capital contributed by the partners.The surplus, if any, will be divided among the partners in their profit-sharing ratio.

Settlement of accounts on dissolution Losses including deficiencies of capital shall be first paid out from the profits, next from the capital, and if necessary, by the personal contribution of partners in their profit-sharing ratio.

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

The distribution of payments of the Company in the process of winding-up shall be made in the following order: (i) All known debts and liabilities of the Company, excluding debts and liabilities to Members who are creditors of the Company; (ii) All known debts and liabilities of the Company owed to Members who are

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

The firm shall apply its assets including any contribution to make up the deficiency firstly, for paying the third party debts, secondly for paying any loan or advance by any partner and lastly for paying back their capitals. Any surplus left after all the above payments is shared by partners in profit sharing ratio.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.