Wyoming Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner Assets Of A Building And Construction Business?

Have you ever been in a situation where you require documentation for either business or personal reasons on almost every occasion.

There is a wide assortment of legal document templates accessible online, but finding ones you can rely on is not straightforward.

US Legal Forms offers thousands of template documents, such as the Wyoming Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, designed to comply with state and federal regulations.

Once you find the correct document, click Get now.

Choose a convenient payment plan, fill in the necessary information to set up your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Wyoming Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the document you need and ensure it pertains to the correct area/region.

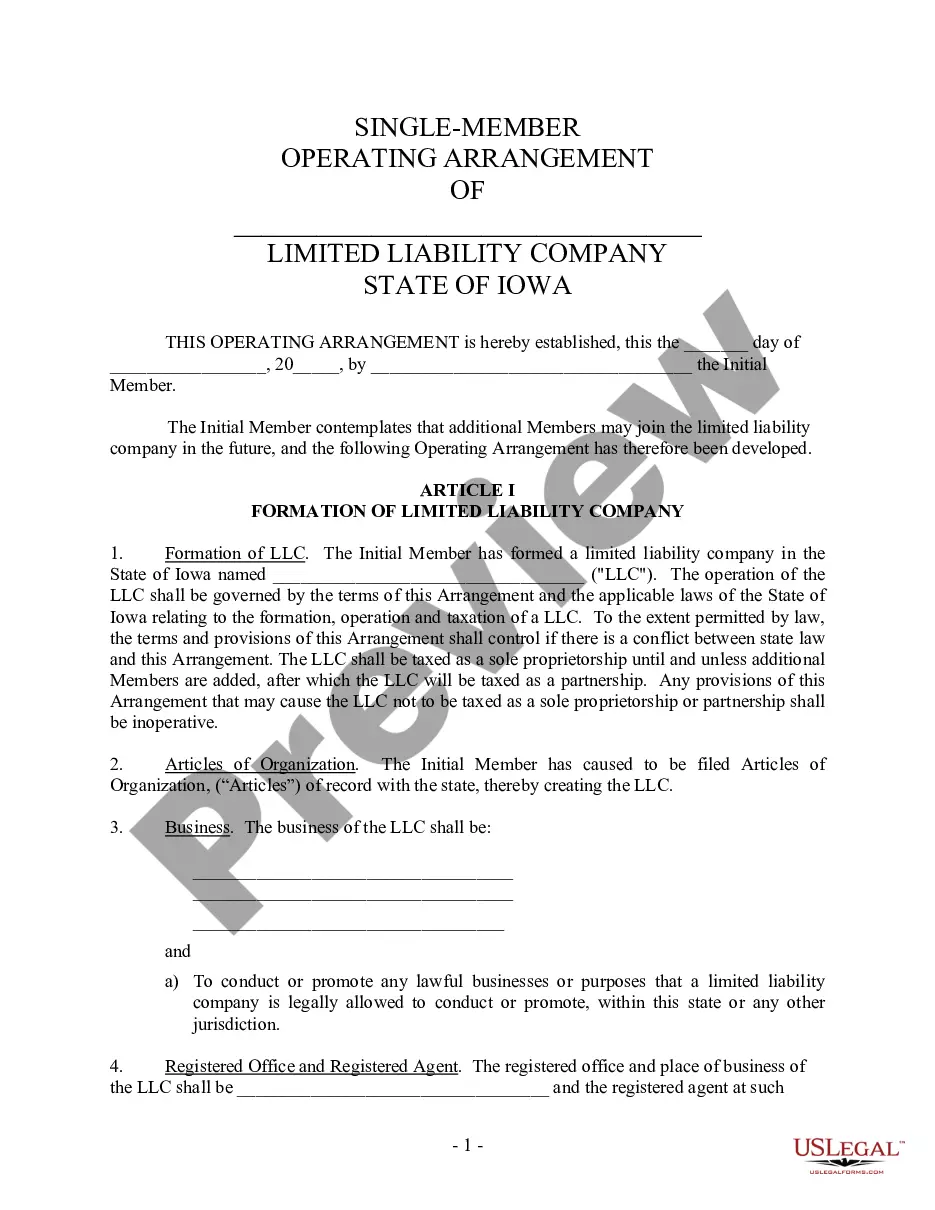

- Use the Preview button to view the document.

- Check the summary to confirm you have selected the correct document.

- If the document is not what you seek, utilize the Research field to find a document that meets your requirements.

Form popularity

FAQ

When a partnership is dissolved, the assets are typically distributed according to the partnership agreement. In the case of a Wyoming Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, the partnership must evaluate its assets, settle any debts, and then allocate the remaining assets to the partners based on their ownership stakes or any agreed-upon terms. It's vital to follow legal guidelines to ensure a fair distribution and to avoid disputes. For precise management of this process, you can rely on platforms like uslegalforms, which provide resources tailored to these transactions.

After dissolving a partnership, partners may still be liable for any debts or obligations incurred during the partnership’s existence. The Wyoming Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business emphasizes the importance of settling these liabilities before finalizing the dissolution. Understanding these ongoing responsibilities can aid in protecting personal assets in the long run.

Conditions for dissolving a partnership may vary but typically include mutual agreement, fulfilled partnership objectives, or significant conflicts. Utilizing the Wyoming Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business provides clarity on these conditions. This platform can guide partners through the necessary legal frameworks, ensuring compliance.

A partnership may be dissolved under circumstances including mutual consent, the expiration of a specified term, or one partner’s decision to leave. The Wyoming Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business effectively outlines these scenarios to avoid confusion. Recognizing these circumstances early can facilitate a more seamless transition.

When you dissolve a partnership, it triggers a series of steps to wind up business operations, settle debts, and distribute remaining assets among partners. The Wyoming Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business ensures that this process is logical and fair. Proper execution of these steps minimizes disputes and promotes collaboration.

The circumstances of dissolution of a partnership often include reaching the end of a business goal, mutual consent, or unforeseen issues like partner incapacity or bankruptcy. Each situation should be clearly addressed within the framework of the Wyoming Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business. Being aware of these circumstances can reduce complications during the dissolution process.

If one partner withdraws from a partnership, the remaining partners must initiate the process of dissolution or buyout, as outlined in the Wyoming Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business. This action may involve compensating the withdrawing partner for their share of the business assets. Clear communication during this stage can help maintain professional relationships.

A partnership may be dissolved for several reasons, including the completion of its intended business purpose, mutual agreement between partners, or external factors like legal disputes. The Wyoming Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business offers a structured solution to manage such situations efficiently. Understanding these reasons can prepare partners for smoother transitions.

To dissolve a business partnership agreement, partners must follow the specific terms outlined in their original partnership contract. Typically, the Wyoming Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business includes these steps. This formal process ensures that all partners agree on the dissolution and allows for an orderly wind-up of business operations.

When a partner dissolves a partnership, the remaining partners must manage the process according to the Wyoming Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business. This involves evaluating the partnership assets and liabilities, as well as determining the fair distribution of those assets. Proper procedures help avoid disputes and ensure a smooth transition.