Wyoming Stop Annuity Request is a legal process that individuals can use to halt or terminate an existing annuity contract in the state of Wyoming. An annuity is a financial product typically offered by insurance companies, where an individual invests a lump sum or makes regular contributions in exchange for a guaranteed income stream in the future. The Wyoming Stop Annuity Request allows annuity holders to initiate a process wherein they can discontinue the annuity contract before its scheduled payout period. This request can be made for various reasons, such as a change in financial circumstances, unsatisfactory returns, or a need for immediate access to funds. There are different types of Wyoming Stop Annuity Requests, depending on the specific situation, needs, and contractual terms of the annuity: 1. Full Surrender Request: This type of stop annuity request involves terminating the annuity contract in its entirety, where the contract and any associated benefits are forfeited. In such cases, the annuity holder receives a lump sum payout equal to the cash value of the annuity, minus any surrender charges or penalties outlined in the contract. 2. Partial Surrender Request: This type of stop annuity request allows the annuity holder to withdraw a portion of the annuity's accumulated value while keeping the contract and its remaining benefits intact. However, partial surrenders may also be subject to surrender charges and can impact the future growth potential and benefits of the annuity. 3. Annuity Exchange Request: Sometimes, rather than terminating an annuity, individuals may opt for an annuity exchange by using the Wyoming Stop Annuity Request. An annuity exchange involves transferring the value of an existing annuity to a new annuity contract with potentially more favorable terms, such as better interest rates or added features. It's important to note that the specific procedures and requirements for initiating a Wyoming Stop Annuity Request may vary depending on the annuity contract, insurance company, and relevant state laws. Therefore, individuals seeking to stop or terminate an annuity in Wyoming should consult with a licensed financial advisor or legal professional to ensure they comply with all applicable regulations and understand the potential implications of their decision.

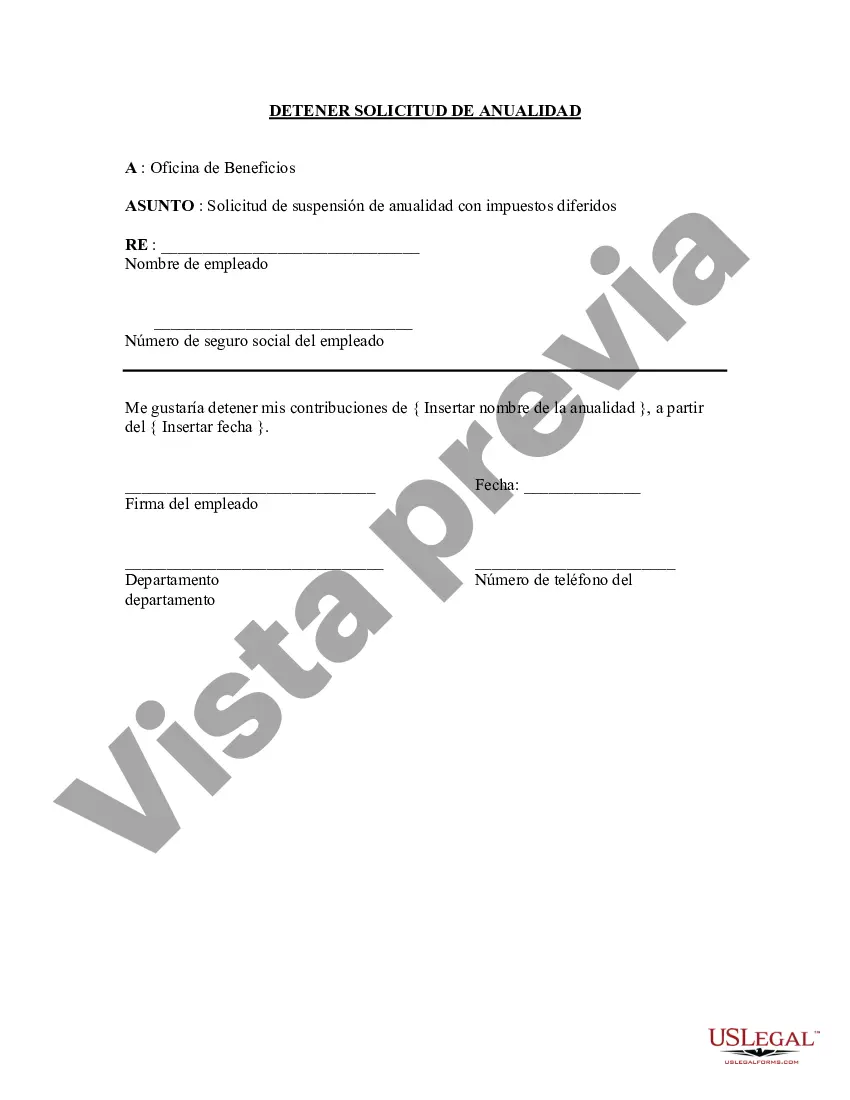

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wyoming Detener solicitud de anualidad - Stop Annuity Request

Description

How to fill out Wyoming Detener Solicitud De Anualidad?

Are you presently in the position in which you will need files for either company or individual purposes almost every time? There are tons of legal record themes available on the net, but locating ones you can depend on isn`t simple. US Legal Forms provides 1000s of develop themes, much like the Wyoming Stop Annuity Request, that happen to be published to meet federal and state specifications.

If you are currently informed about US Legal Forms web site and have a merchant account, just log in. Following that, you are able to download the Wyoming Stop Annuity Request design.

If you do not offer an accounts and wish to begin to use US Legal Forms, abide by these steps:

- Get the develop you want and make sure it is for the correct town/area.

- Take advantage of the Review button to check the shape.

- See the information to actually have selected the correct develop.

- In the event the develop isn`t what you are searching for, make use of the Research discipline to discover the develop that suits you and specifications.

- Once you obtain the correct develop, just click Acquire now.

- Opt for the prices plan you desire, submit the required information and facts to generate your money, and pay money for an order utilizing your PayPal or Visa or Mastercard.

- Choose a hassle-free data file format and download your backup.

Locate every one of the record themes you might have purchased in the My Forms food selection. You may get a more backup of Wyoming Stop Annuity Request any time, if required. Just select the necessary develop to download or print the record design.

Use US Legal Forms, by far the most extensive variety of legal varieties, to save some time and steer clear of mistakes. The services provides skillfully created legal record themes that can be used for an array of purposes. Create a merchant account on US Legal Forms and initiate making your daily life a little easier.