A Wyoming Commercial Lease Agreement for Tenant is a legally binding contract between a landlord and a tenant for the rental of a commercial property in the state of Wyoming. This agreement outlines the terms and conditions under which the tenant can use and occupy the leased premises for commercial purposes. The Wyoming Commercial Lease Agreement for Tenant consists of several essential components, including: 1. Parties: It identifies the names and addresses of the landlord (lessor) and tenant (lessee) involved in the lease agreement. This ensures clarity regarding the responsible parties. 2. Property Description: The agreement includes a detailed description of the commercial property being leased, including its address, square footage, and any specific features or amenities. 3. Lease Term: It specifies the duration of the lease agreement, indicating the start and end dates of the tenancy. Additionally, it may outline any provisions for renewal or termination options. 4. Rent and Payment Terms: This section outlines the monthly rent amount that the tenant is obligated to pay and the acceptable payment methods. It may also cover details on security deposits, late payment penalties, and any additional fees or expenses. 5. Use of Premises: It clearly defines the permitted use of the commercial property, ensuring that the tenant adheres to the designated purpose and any applicable zoning regulations or restrictions. 6. Maintenance and Repairs: The lease agreement addresses the responsibilities of both the landlord and tenant regarding property maintenance and repairs. It typically stipulates that the tenant is responsible for routine maintenance, while the landlord takes care of major structural repairs. 7. Alterations and Improvements: This section addresses whether the tenant is allowed to make any alterations or improvements to the leased premises. It may specify that any modifications must receive the landlord's prior written consent. 8. Insurance and Liability: The tenant is often required to obtain liability insurance to protect against any damage or injuries caused on the property. This section may also outline the landlord's insurance responsibilities. 9. Default and Remedies: This section details the actions that may be taken by either party in the event of non-compliance or default under the lease agreement. It includes information about eviction, late fees, or legal actions. 10. Governing Law: The agreement identifies that it is governed by the laws of the state of Wyoming, ensuring that any disputes or legal matters are handled according to Wyoming's legal system. Some specific types of Wyoming Commercial Lease Agreements for Tenants include: 1. Triple Net Lease Agreement: This type of lease places financial responsibilities on the tenant for property taxes, insurance, and maintenance costs, in addition to rent. The lease amount is typically lower than in other lease types but can vary based on the property. 2. Gross Lease Agreement: In this type of lease, the rent charged to the tenant includes the cost of all property expenses, such as taxes, insurance, and maintenance. The landlord covers these expenses, simplifying the tenant's responsibilities. 3. Percentage Lease Agreement: This lease includes a base rent along with a percentage of the tenant's monthly sales revenue. It is commonly used in retail or commercial spaces where the tenant's success is closely tied to their sales performance. By understanding the elements of a Wyoming Commercial Lease Agreement for Tenant and different lease types, both landlords and tenants can ensure they have a comprehensive and legally protective agreement in place that suits their specific needs.

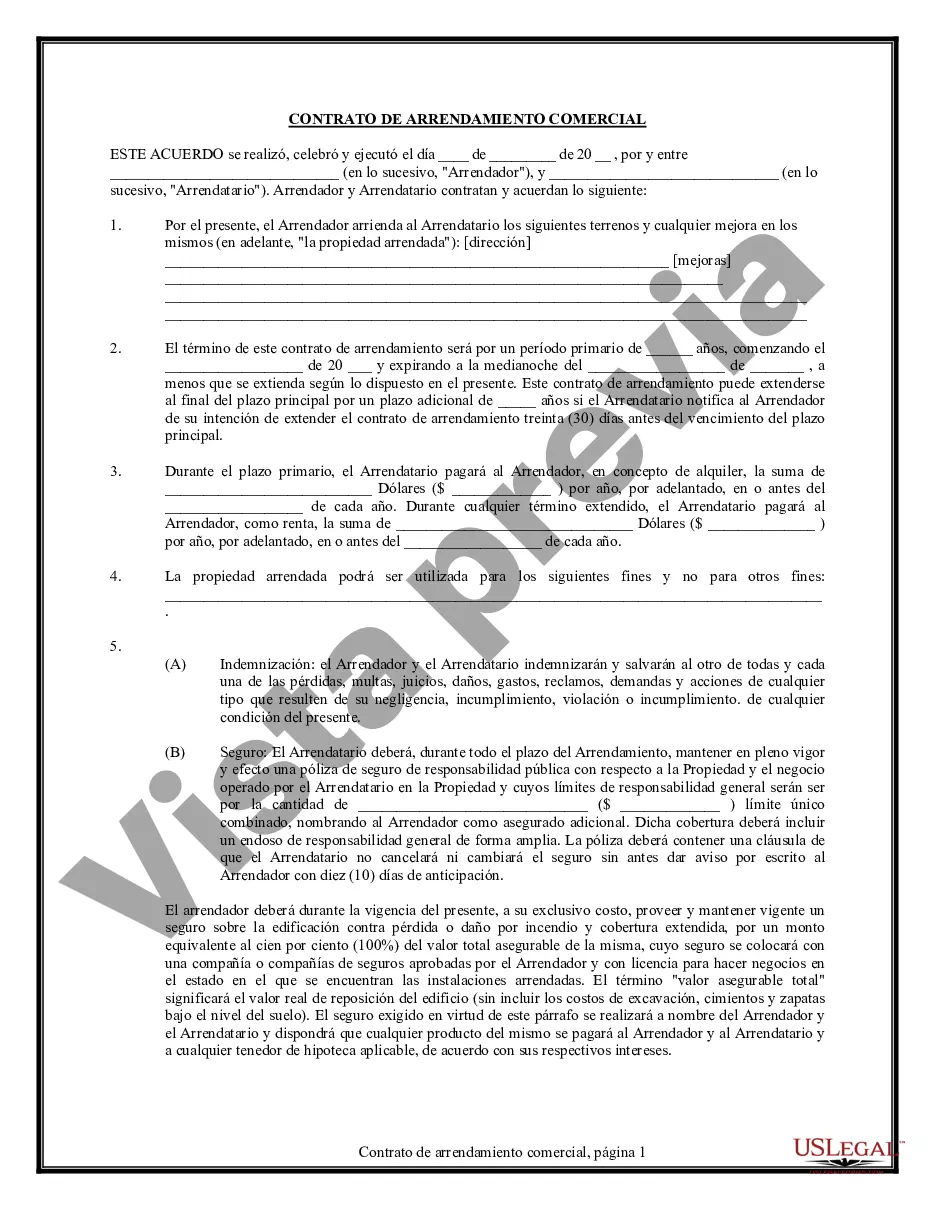

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wyoming Contrato de Arrendamiento Comercial para Inquilino - Commercial Lease Agreement for Tenant

Description

How to fill out Wyoming Contrato De Arrendamiento Comercial Para Inquilino?

If you wish to full, obtain, or print out legitimate document layouts, use US Legal Forms, the greatest collection of legitimate types, that can be found on-line. Use the site`s easy and convenient look for to discover the files you need. Various layouts for company and person reasons are sorted by groups and states, or keywords and phrases. Use US Legal Forms to discover the Wyoming Commercial Lease Agreement for Tenant with a number of click throughs.

Should you be previously a US Legal Forms consumer, log in to the profile and click the Acquire switch to get the Wyoming Commercial Lease Agreement for Tenant. You can even entry types you previously downloaded within the My Forms tab of your profile.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have selected the form for that appropriate city/nation.

- Step 2. Use the Review option to look through the form`s content material. Never neglect to learn the outline.

- Step 3. Should you be unsatisfied with all the type, utilize the Look for field towards the top of the display to discover other types in the legitimate type web template.

- Step 4. After you have identified the form you need, go through the Acquire now switch. Select the pricing program you favor and include your credentials to register for an profile.

- Step 5. Approach the deal. You can utilize your charge card or PayPal profile to accomplish the deal.

- Step 6. Pick the file format in the legitimate type and obtain it in your product.

- Step 7. Total, change and print out or indicator the Wyoming Commercial Lease Agreement for Tenant.

Each and every legitimate document web template you acquire is the one you have for a long time. You might have acces to every type you downloaded inside your acccount. Select the My Forms segment and choose a type to print out or obtain once more.

Compete and obtain, and print out the Wyoming Commercial Lease Agreement for Tenant with US Legal Forms. There are many specialist and condition-particular types you can utilize to your company or person requirements.