Wyoming Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company

Description

How to fill out Pooling And Servicing Agreement Contemplating The Sale Of Mortgage Loans To Trustee For Inclusion In The Trust Fund By The Company?

It is possible to commit time online looking for the lawful file template which fits the state and federal needs you will need. US Legal Forms offers a large number of lawful kinds which are reviewed by specialists. You can easily download or produce the Wyoming Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company from our service.

If you already have a US Legal Forms account, you may log in and click on the Acquire option. Next, you may complete, edit, produce, or sign the Wyoming Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company. Each lawful file template you get is the one you have eternally. To have yet another backup for any bought form, visit the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms site initially, follow the simple guidelines below:

- Very first, make sure that you have chosen the right file template for the state/city of your liking. Browse the form outline to make sure you have picked the proper form. If offered, use the Preview option to appear throughout the file template as well.

- If you would like get yet another edition of your form, use the Research field to obtain the template that meets your needs and needs.

- When you have located the template you desire, click Buy now to move forward.

- Pick the pricing strategy you desire, type in your accreditations, and register for a free account on US Legal Forms.

- Full the deal. You can utilize your charge card or PayPal account to purchase the lawful form.

- Pick the format of your file and download it to the gadget.

- Make alterations to the file if required. It is possible to complete, edit and sign and produce Wyoming Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company.

Acquire and produce a large number of file templates while using US Legal Forms website, which provides the biggest assortment of lawful kinds. Use specialist and condition-specific templates to deal with your organization or specific requires.

Form popularity

FAQ

Following these eight steps can help you speed up the process to getting your keys: Step 1: Finalize your homeowners insurance. ... Step 2: Decide on your title vesting. ... Step 3: Review your loan closing documents. ... Step 4: Avoid any major life changes. ... Step 5: Get your closing cost dollars ready. ... Step 6: Plan for your walkthrough.

Securitization. Act of pooling mortgages and then selling them as mortgage-backed securities. - Mortgage loans purchased from the primary mortgage market are assembled into pools by a government/quasi-governmental entity or a private investor who operates in the secondary mortgage market.

For those loans, you will receive two forms?a Good Faith Estimate (GFE) and an initial Truth-in-Lending disclosure?instead of a Loan Estimate. Instead of a Closing Disclosure, you will receive a final Truth in Lending disclosure and a HUD-1 Settlement Statement.

In a mortgage loan, the borrower always creates two documents: a note and a mortgage.

First, your lender will want to see verification of your income and assets, such as pay stubs and recent bank statements. Then you'll need to present your current debt and monthly expenses, which can help your lender determine your debt-to-income ratio.

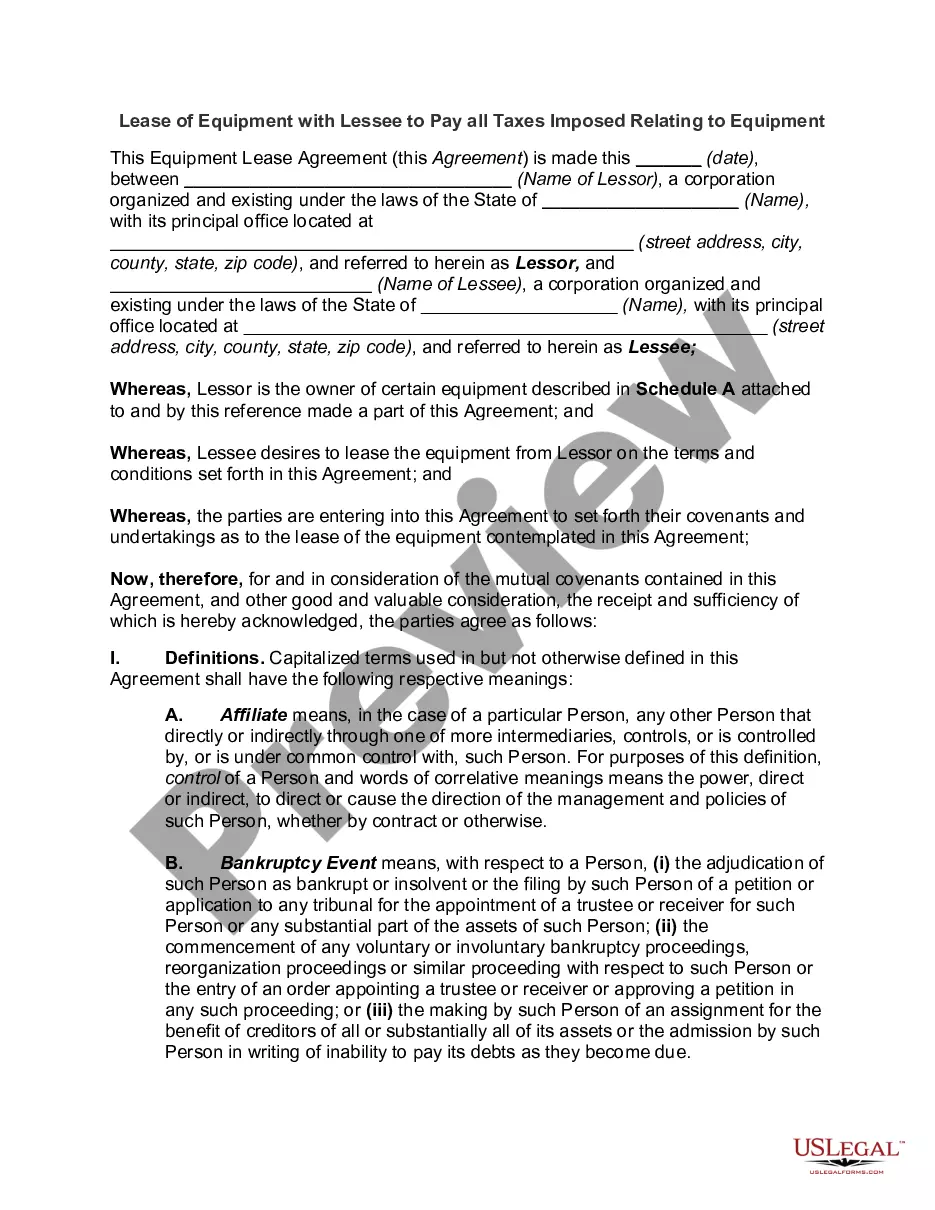

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

List at least 2 things you would be sure to tell a borrower in preparation for closing. There is no right or wrong answer, but the date/time/location of closing is important. The borrower should also be clear on the amount of money he/she needs to bring to the closing table.