Wyoming Form - Large Quantity Sales Distribution Agreement

Description

How to fill out Form - Large Quantity Sales Distribution Agreement?

It is possible to invest hours on the Internet attempting to find the legal record template that fits the federal and state needs you require. US Legal Forms gives a huge number of legal varieties that are evaluated by specialists. You can easily download or printing the Wyoming Form - Large Quantity Sales Distribution Agreement from the services.

If you already have a US Legal Forms profile, you may log in and click on the Download key. Following that, you may full, edit, printing, or signal the Wyoming Form - Large Quantity Sales Distribution Agreement. Each and every legal record template you get is yours eternally. To have yet another backup of the purchased kind, go to the My Forms tab and click on the corresponding key.

If you use the US Legal Forms website the first time, keep to the easy directions under:

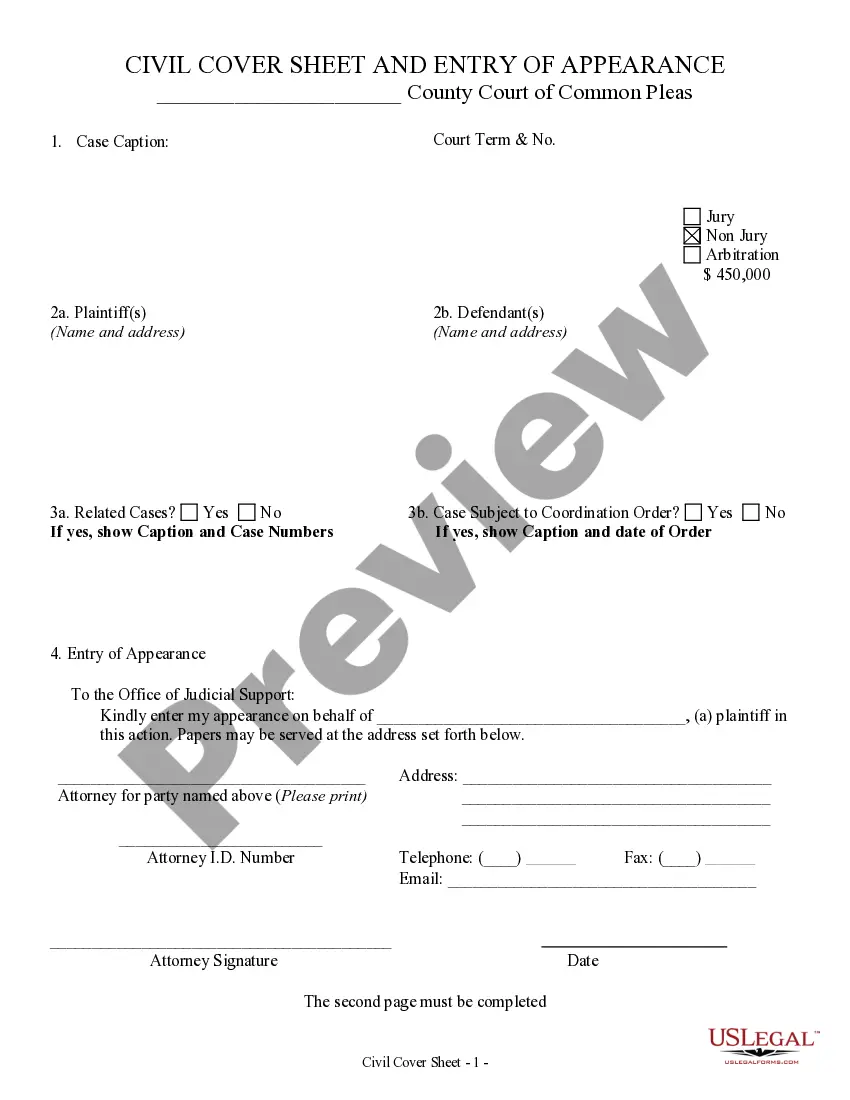

- Very first, be sure that you have selected the correct record template for the state/metropolis that you pick. See the kind information to ensure you have picked the correct kind. If offered, use the Review key to search from the record template also.

- If you would like find yet another model in the kind, use the Look for field to find the template that fits your needs and needs.

- Upon having identified the template you desire, click Purchase now to carry on.

- Choose the pricing prepare you desire, key in your accreditations, and register for an account on US Legal Forms.

- Comprehensive the transaction. You can use your credit card or PayPal profile to purchase the legal kind.

- Choose the formatting in the record and download it to your gadget.

- Make modifications to your record if needed. It is possible to full, edit and signal and printing Wyoming Form - Large Quantity Sales Distribution Agreement.

Download and printing a huge number of record themes using the US Legal Forms site, which offers the largest assortment of legal varieties. Use skilled and express-distinct themes to deal with your business or specific demands.

Form popularity

FAQ

In general, Wyoming sales tax does not apply to separately stated charges for shipping, handling, delivery, freight, and postage. However, if the charges are included in the sales price of a taxable item, the charges are taxable as well.

Wyoming's Department of Revenue only requires a seller's permit, or resale certificate, when sales are made to Wyoming residents and thus sales tax needs collected. Resale Certificates in Wyoming are issued by the Department of Revenue, as such this is the only department which can verify a certificate's authenticity.

In general, delivery-related charges for taxable products are not taxable when you ship directly to the purchaser via common carrier, contract carrier, or USPS; delivery, shipping, freight, or postage charges are separately stated; and the charge isn't greater than the actual cost of delivery.

Five states (Alaska, Delaware, Montana, New Hampshire and Oregon) do not implement any sales tax, so shipping and handling will likewise not be taxable. Additionally, Hawaii utilizes a general excise tax or GET which is a tax on business income from retail sales rather than a sales tax to the consumer.

(iv) The tax imposed by this article upon the sale of a transportable home shall be collected upon the first sale of the transportable home. The tax shall be collected on seventy percent (70%) of the sales price of the transportable home. No tax shall be collected upon any subsequent sale of the home.

The state of Wyoming has a 4% sales tax that applies to each purchase made, except for some services, groceries and prescription drugs, in all 23 counties.

Sourcing sales tax: understanding which rate to apply California is a modified origin-based state: State, county, and city taxes are based on the ship-from address, but district taxes are based on the ship-to address.