Wyoming Subscription Agreement - A Section 3C1 Fund

Description

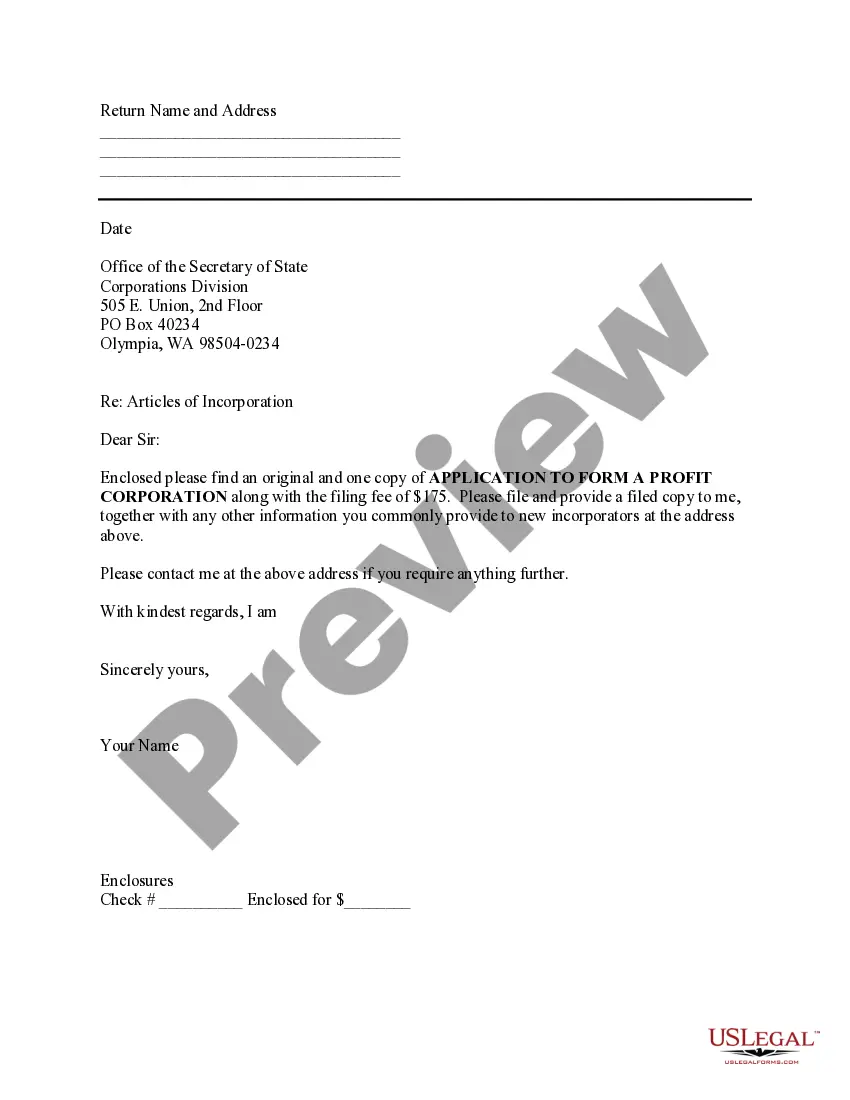

How to fill out Subscription Agreement - A Section 3C1 Fund?

Choosing the right legal papers design can be a battle. Naturally, there are a variety of themes available on the Internet, but how can you find the legal kind you require? Use the US Legal Forms internet site. The assistance gives a huge number of themes, for example the Wyoming Subscription Agreement - A Section 3C1 Fund, that you can use for organization and private requirements. All the kinds are examined by professionals and fulfill state and federal requirements.

If you are presently signed up, log in to the bank account and then click the Download option to obtain the Wyoming Subscription Agreement - A Section 3C1 Fund. Make use of your bank account to check through the legal kinds you possess purchased formerly. Visit the My Forms tab of your respective bank account and have yet another duplicate from the papers you require.

If you are a fresh user of US Legal Forms, listed below are simple recommendations that you should follow:

- Initial, ensure you have selected the right kind to your area/region. You can examine the form while using Preview option and study the form outline to make certain this is the best for you.

- In the event the kind will not fulfill your needs, utilize the Seach area to obtain the appropriate kind.

- When you are certain that the form would work, click on the Buy now option to obtain the kind.

- Opt for the pricing plan you would like and type in the required info. Design your bank account and buy an order using your PayPal bank account or credit card.

- Opt for the submit format and acquire the legal papers design to the product.

- Total, edit and print and indicator the received Wyoming Subscription Agreement - A Section 3C1 Fund.

US Legal Forms is definitely the largest local library of legal kinds where you can see a variety of papers themes. Use the company to acquire appropriately-manufactured papers that follow express requirements.

Form popularity

FAQ

A 3(c)(1) fund is a pooled investment vehicle that is excluded from the definition of investment company in the Investment Company Act because it has no more than 100 beneficial owners (or, in the case of a qualifying venture capital fund, 250 beneficial owners) and otherwise meets criteria outlined in Section 3(c)(1) ...

3(c)(1) In other words, 3C1 allows private funds with 100 or fewer investors (and venture capital funds with fewer than 250 investors) and no plans for an initial public offering to sidestep SEC registration and other requirements, including ongoing disclosure and restrictions on derivatives trading.

A 3(c)(1) fund is a pooled investment vehicle that is excluded from the definition of investment company in the Investment Company Act because it has no more than 100 beneficial owners (or, in the case of a qualifying venture capital fund, 250 beneficial owners) and otherwise meets criteria outlined in Section 3(c)(1) ...

Private funds must not plan to issue an IPO and their investors must be qualified purchases to qualify for the 3C7 exemption. There is no maximum limit for the number of purchasers of 3C7 funds. In contrast to 3C7, 3C1 funds deal with no more than 100 accredited investors.

Knowledgeable employees This includes directors and certain executive officers of the private fund, or of an affiliated person of the private fund that manages the investment activities of the private fund (?affiliated management person?).

3(c)(1) In other words, 3C1 allows private funds with 100 or fewer investors (and venture capital funds with fewer than 250 investors) and no plans for an initial public offering to sidestep SEC registration and other requirements, including ongoing disclosure and restrictions on derivatives trading.

Investor signs the subscription agreement; Investor pays for the shares; Company counter-signs the subscription agreement; Company issues the shares.

An individual with gross income exceeding $200,000 in each of the two most recent years or joint income with a spouse or partner exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.