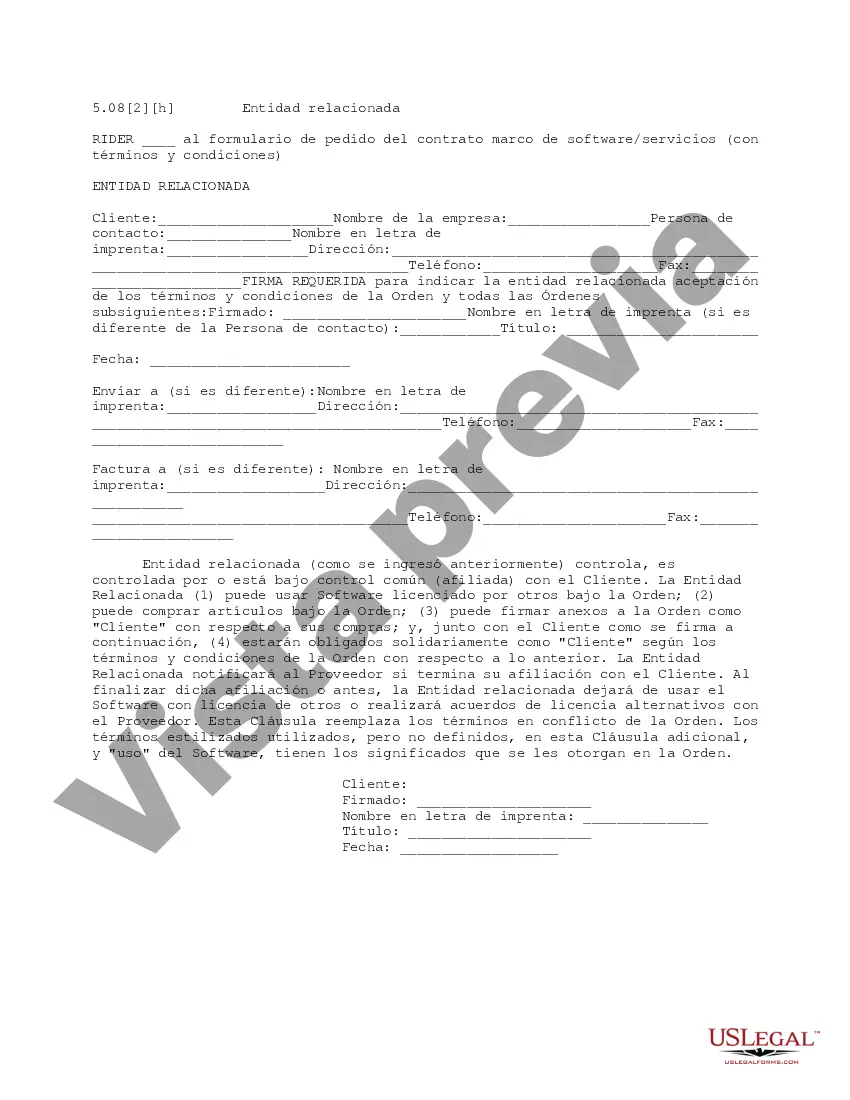

This is a rider to the software/services master agreement order form. It provides that a related entity of the customer may use the software purchased from the vendor.

Wyoming Related Entity refers to a legal entity that is formed or operating within the state of Wyoming, USA. As an ideal destination for businesses and entrepreneurs due to its business-friendly laws and tax advantages, Wyoming is known as a hub for various types of Related Entities. Limited Liability Company (LLC): A Wyoming LLC is the most common type of entity formed in Wyoming. It provides the owners, also known as members, with limited liability protection, similar to a corporation, while enjoying flexible management and tax benefits of a partnership. Corporation: Wyoming also allows the formation of corporations, whether C corporations or S corporations. A Wyoming corporation provides limited liability protection to its shareholders, directors, and officers. Additionally, Wyoming corporations benefit from the state's favorable tax laws, including no corporate income tax and no tax on corporate shares. Limited Partnership (LP): A Wyoming LP consists of at least one general partner and one limited partner. The general partner assumes liability for the partnership's debts and obligations, while the limited partner has limited liability based on their investment amount. LPs are commonly used for investment funds, real estate projects, and similar ventures. Limited Liability Partnership (LLP): Designed mainly for professional service providers, such as accountants and lawyers, a Wyoming LLP allows partners to limit their personal liability. Each partner is not held responsible for the negligence, malpractice, or wrongful acts of other partners. Series LLC: Wyoming was the first state to authorize the creation of Series LCS. This type of entity provides liability protection and segregation of assets between different series or divisions within the LLC. Each series can have its own members, assets, and liabilities, making it an attractive option for businesses with multiple subsidiaries or properties. Nonprofit Corporation: Wyoming allows the formation of nonprofit corporations that operate for charitable, educational, religious, or scientific purposes. These entities enjoy tax-exempt status and have specific regulations and reporting requirements to maintain their nonprofit status. Benefit Corporation: Wyoming recognizes the formation of benefit corporations, which have the dual purpose of generating profits and fulfilling a specific social or environmental mission. Benefit corporations must adhere to specific standards and report on their social and environmental performance. Overall, Wyoming provides a myriad of entity options, each catering to different needs and objectives. Choosing the right Wyoming Related Entity depends on factors such as liability protection, tax considerations, management structure, and the nature of the business or organization.Wyoming Related Entity refers to a legal entity that is formed or operating within the state of Wyoming, USA. As an ideal destination for businesses and entrepreneurs due to its business-friendly laws and tax advantages, Wyoming is known as a hub for various types of Related Entities. Limited Liability Company (LLC): A Wyoming LLC is the most common type of entity formed in Wyoming. It provides the owners, also known as members, with limited liability protection, similar to a corporation, while enjoying flexible management and tax benefits of a partnership. Corporation: Wyoming also allows the formation of corporations, whether C corporations or S corporations. A Wyoming corporation provides limited liability protection to its shareholders, directors, and officers. Additionally, Wyoming corporations benefit from the state's favorable tax laws, including no corporate income tax and no tax on corporate shares. Limited Partnership (LP): A Wyoming LP consists of at least one general partner and one limited partner. The general partner assumes liability for the partnership's debts and obligations, while the limited partner has limited liability based on their investment amount. LPs are commonly used for investment funds, real estate projects, and similar ventures. Limited Liability Partnership (LLP): Designed mainly for professional service providers, such as accountants and lawyers, a Wyoming LLP allows partners to limit their personal liability. Each partner is not held responsible for the negligence, malpractice, or wrongful acts of other partners. Series LLC: Wyoming was the first state to authorize the creation of Series LCS. This type of entity provides liability protection and segregation of assets between different series or divisions within the LLC. Each series can have its own members, assets, and liabilities, making it an attractive option for businesses with multiple subsidiaries or properties. Nonprofit Corporation: Wyoming allows the formation of nonprofit corporations that operate for charitable, educational, religious, or scientific purposes. These entities enjoy tax-exempt status and have specific regulations and reporting requirements to maintain their nonprofit status. Benefit Corporation: Wyoming recognizes the formation of benefit corporations, which have the dual purpose of generating profits and fulfilling a specific social or environmental mission. Benefit corporations must adhere to specific standards and report on their social and environmental performance. Overall, Wyoming provides a myriad of entity options, each catering to different needs and objectives. Choosing the right Wyoming Related Entity depends on factors such as liability protection, tax considerations, management structure, and the nature of the business or organization.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.