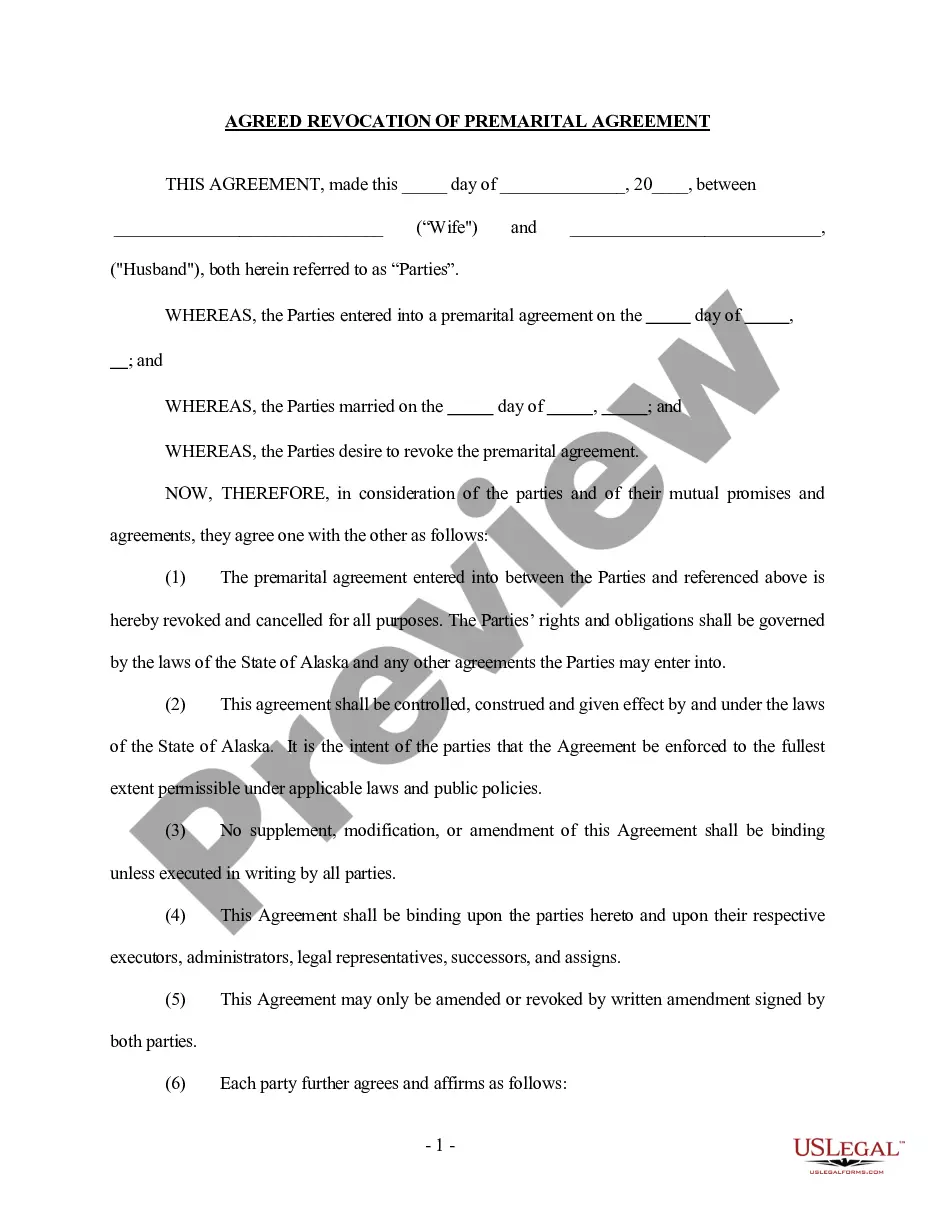

Anchorage Alaska Financial Statements play a crucial role in the context of prenuptial and premarital agreements. These statements provide a comprehensive overview of a couple's financial situation and assets before entering into a legal marriage contract. They help establish a clear and accurate picture of each individual's financial standing, ensuring transparency and fairness in the event of a divorce or separation. Here, we will delve into the different types of Anchorage Alaska Financial Statements that are commonly used in connection with prenuptial or premarital agreements: 1. Personal Balance Sheets: Personal balance sheets outline an individual's assets, liabilities, and net worth. This document includes details such as real estate properties, investments, bank accounts, retirement accounts, loans, credit card debts, and other financial obligations. A balance sheet is an essential component of financial statements as it provides a consolidated view of the individual's current financial position. 2. Income Statements: Income statements, also known as profit and loss statements, provide a summary of an individual's income, expenses, and overall financial performance over a specific period. This statement gives a clear understanding of the individual's earning potential, sources of income, and spending habits. 3. Tax Returns: Tax returns are a fundamental component of financial statements. Anchorage Alaska Financial Statements often include copies of recent tax returns, which offer a comprehensive overview of income, deductions, exemptions, and other relevant financial information mandated by the Internal Revenue Service (IRS). 4. Bank Statements: Anchorage Alaska Financial Statements typically include recent bank statements from all financial institutions where the individual holds accounts. These statements reveal the individual's cash flow, savings, investments, and any outstanding debts or loans. 5. Investment Portfolio Statements: For individuals who possess investments, financial statements may include investment portfolio statements. These documents provide details on stocks, bonds, mutual funds, real estate investments, retirement accounts, and other investment holdings. 6. Retirement Account Statements: If an individual has retirement accounts such as IRAs, 401(k)s, or pension plans, financial statements should include recent statements from these accounts. These statements outline the value and growth of the retirement investments, their contribution history, and any accompanying terms and conditions. 7. Debt Statements: Anchorage Alaska Financial Statements may also include debt statements, which provide an overview of any outstanding debts, mortgage payments, car loans, student loans, or credit card debts. This information is crucial as it helps both parties to understand the existing financial obligations that may impact future financial decisions. Prenuptial and premarital agreements are legally binding contracts that require complete and accurate financial disclosure. Anchorage Alaska Financial Statements are essential components of these agreements, helping couples draft fair and equitable arrangements. By providing unprecedented transparency, these documents play a vital role in ensuring financial protection and stability for both parties involved.

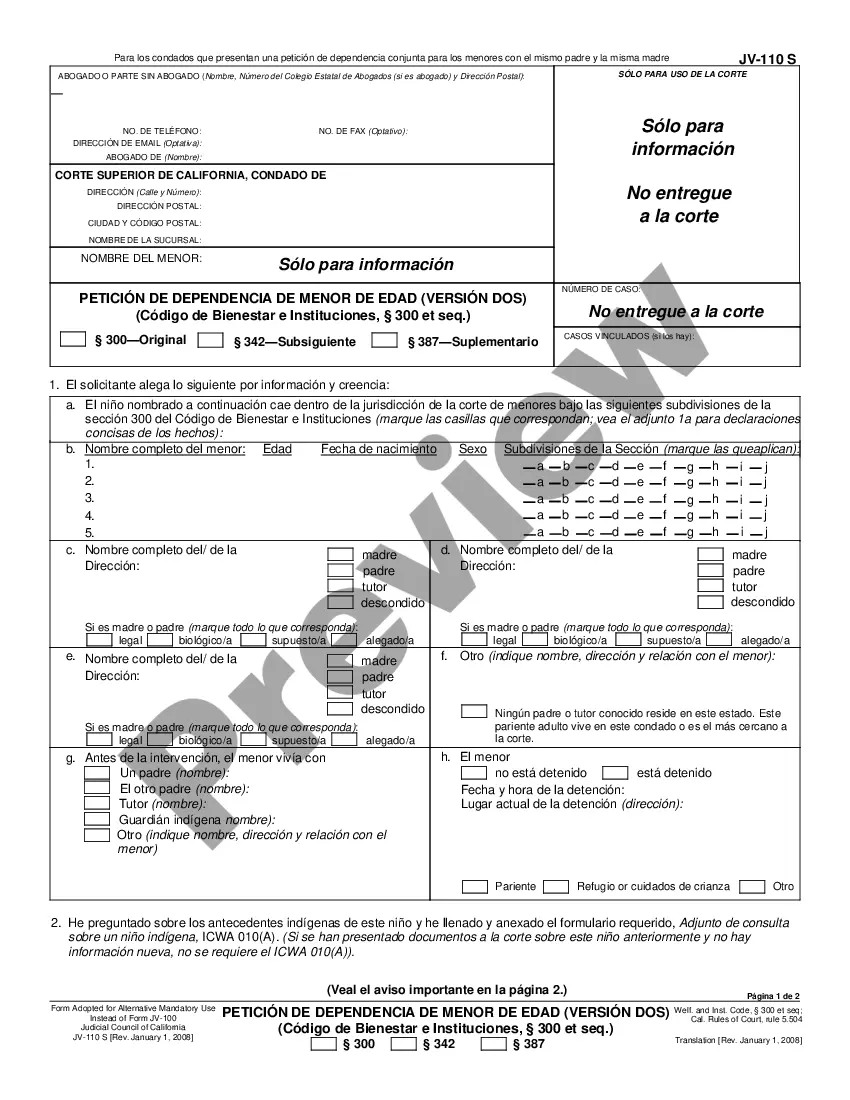

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Anchorage Alaska Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Alaska Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Anchorage Alaska Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

If you are looking for a relevant form template, it’s difficult to choose a more convenient service than the US Legal Forms website – probably the most comprehensive libraries on the web. Here you can get a large number of form samples for business and individual purposes by categories and regions, or key phrases. With our advanced search function, finding the newest Anchorage Alaska Financial Statements only in Connection with Prenuptial Premarital Agreement is as easy as 1-2-3. Additionally, the relevance of every document is verified by a group of expert attorneys that on a regular basis review the templates on our website and revise them based on the latest state and county requirements.

If you already know about our platform and have a registered account, all you should do to get the Anchorage Alaska Financial Statements only in Connection with Prenuptial Premarital Agreement is to log in to your account and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have opened the form you need. Read its description and utilize the Preview feature (if available) to check its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to find the appropriate document.

- Affirm your selection. Click the Buy now option. Next, pick your preferred subscription plan and provide credentials to register an account.

- Make the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Get the form. Indicate the format and save it to your system.

- Make changes. Fill out, revise, print, and sign the received Anchorage Alaska Financial Statements only in Connection with Prenuptial Premarital Agreement.

Each and every form you add to your account has no expiry date and is yours permanently. It is possible to access them using the My Forms menu, so if you want to receive an extra version for enhancing or printing, you may come back and save it again at any moment.

Take advantage of the US Legal Forms professional library to get access to the Anchorage Alaska Financial Statements only in Connection with Prenuptial Premarital Agreement you were seeking and a large number of other professional and state-specific samples in one place!