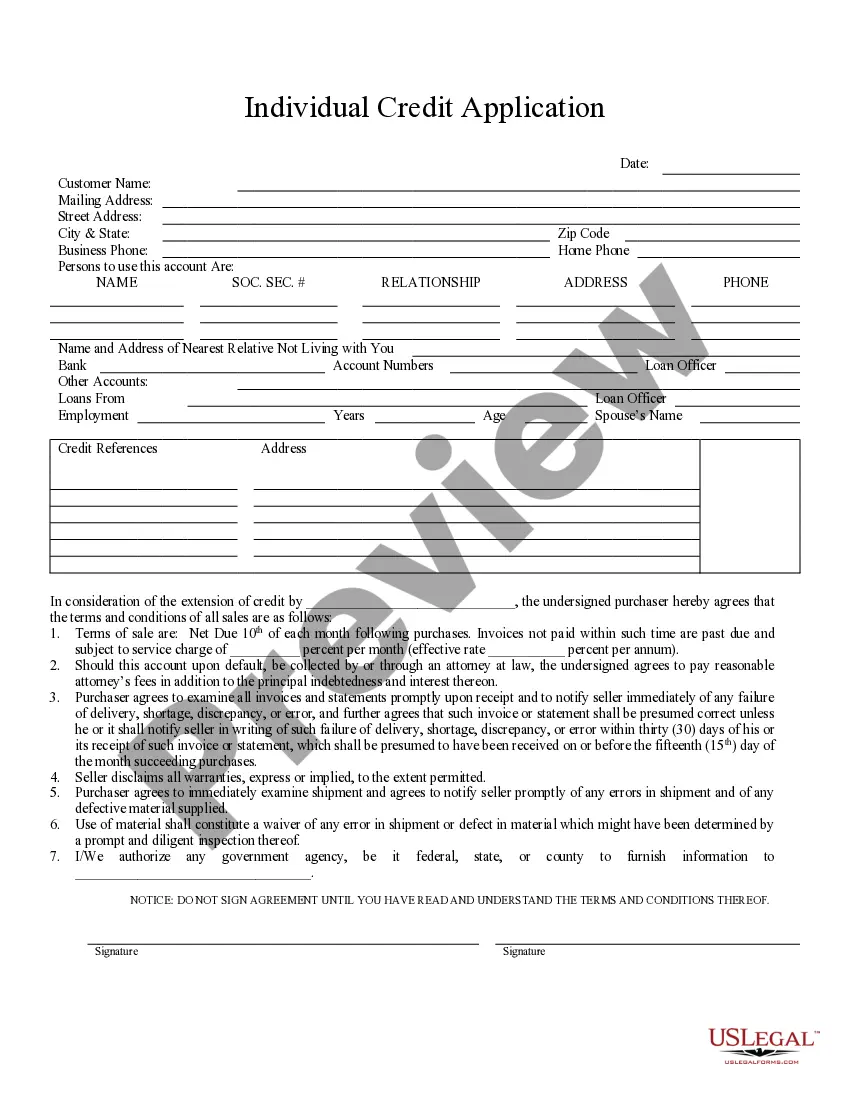

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Anchorage Alaska Individual Credit Application is a formal document used by individuals living in Anchorage, Alaska, to apply for credit from financial institutions, such as banks or credit unions. This application is necessary for those seeking various types of loans, credit cards or other forms of credit to meet their financial needs. Anchorage, being the largest city in Alaska, offers several types of Individual Credit Application forms, tailored to different financial requirements. These can include the following: 1. Personal Loan Application: Anchorage residents can apply for personal loans through Individual Credit Application forms. These loans can be used for various purposes, such as debt consolidation, home improvements, medical expenses, or vacation funding. 2. Auto Loan Application: Individuals looking to purchase a car in Anchorage can utilize an Individual Credit Application specifically designed for auto loans. This type of application gathers information needed by financial institutions to evaluate creditworthiness and determine loan terms for buying a vehicle. 3. Mortgage Loan Application: Anchorage residents interested in buying a home or refinancing existing mortgages can fill out an Individual Credit Application for a mortgage loan. It includes detailed information about the borrower’s financial status, employment history, and property information. 4. Credit Card Application: To obtain a credit card from a financial institution in Anchorage, individuals are required to complete an Individual Credit Application specifically designed for credit cards. This form collects information about personal details, income, and credit history. When completing an Anchorage Alaska Individual Credit Application, applicants are typically asked to provide their full legal name, contact information, social security number, employment details, income information, and details about their assets and liabilities. Additionally, applicants often need to disclose their credit history, including any outstanding debts or repayment issues. It is essential for applicants to complete all sections of the application accurately and thoroughly, ensuring that they provide the necessary supporting documentation, such as income statements, tax returns, and identification proof. Lenders in Anchorage use the information gathered through these applications to assess an applicant's creditworthiness and make informed decisions regarding loan approvals, interest rates, and credit limits. While specific requirements and processes may vary among financial institutions, Anchorage Alaska Individual Credit Applications serve as the primary means for individuals to request credit and facilitate smooth financial transactions.Anchorage Alaska Individual Credit Application is a formal document used by individuals living in Anchorage, Alaska, to apply for credit from financial institutions, such as banks or credit unions. This application is necessary for those seeking various types of loans, credit cards or other forms of credit to meet their financial needs. Anchorage, being the largest city in Alaska, offers several types of Individual Credit Application forms, tailored to different financial requirements. These can include the following: 1. Personal Loan Application: Anchorage residents can apply for personal loans through Individual Credit Application forms. These loans can be used for various purposes, such as debt consolidation, home improvements, medical expenses, or vacation funding. 2. Auto Loan Application: Individuals looking to purchase a car in Anchorage can utilize an Individual Credit Application specifically designed for auto loans. This type of application gathers information needed by financial institutions to evaluate creditworthiness and determine loan terms for buying a vehicle. 3. Mortgage Loan Application: Anchorage residents interested in buying a home or refinancing existing mortgages can fill out an Individual Credit Application for a mortgage loan. It includes detailed information about the borrower’s financial status, employment history, and property information. 4. Credit Card Application: To obtain a credit card from a financial institution in Anchorage, individuals are required to complete an Individual Credit Application specifically designed for credit cards. This form collects information about personal details, income, and credit history. When completing an Anchorage Alaska Individual Credit Application, applicants are typically asked to provide their full legal name, contact information, social security number, employment details, income information, and details about their assets and liabilities. Additionally, applicants often need to disclose their credit history, including any outstanding debts or repayment issues. It is essential for applicants to complete all sections of the application accurately and thoroughly, ensuring that they provide the necessary supporting documentation, such as income statements, tax returns, and identification proof. Lenders in Anchorage use the information gathered through these applications to assess an applicant's creditworthiness and make informed decisions regarding loan approvals, interest rates, and credit limits. While specific requirements and processes may vary among financial institutions, Anchorage Alaska Individual Credit Applications serve as the primary means for individuals to request credit and facilitate smooth financial transactions.