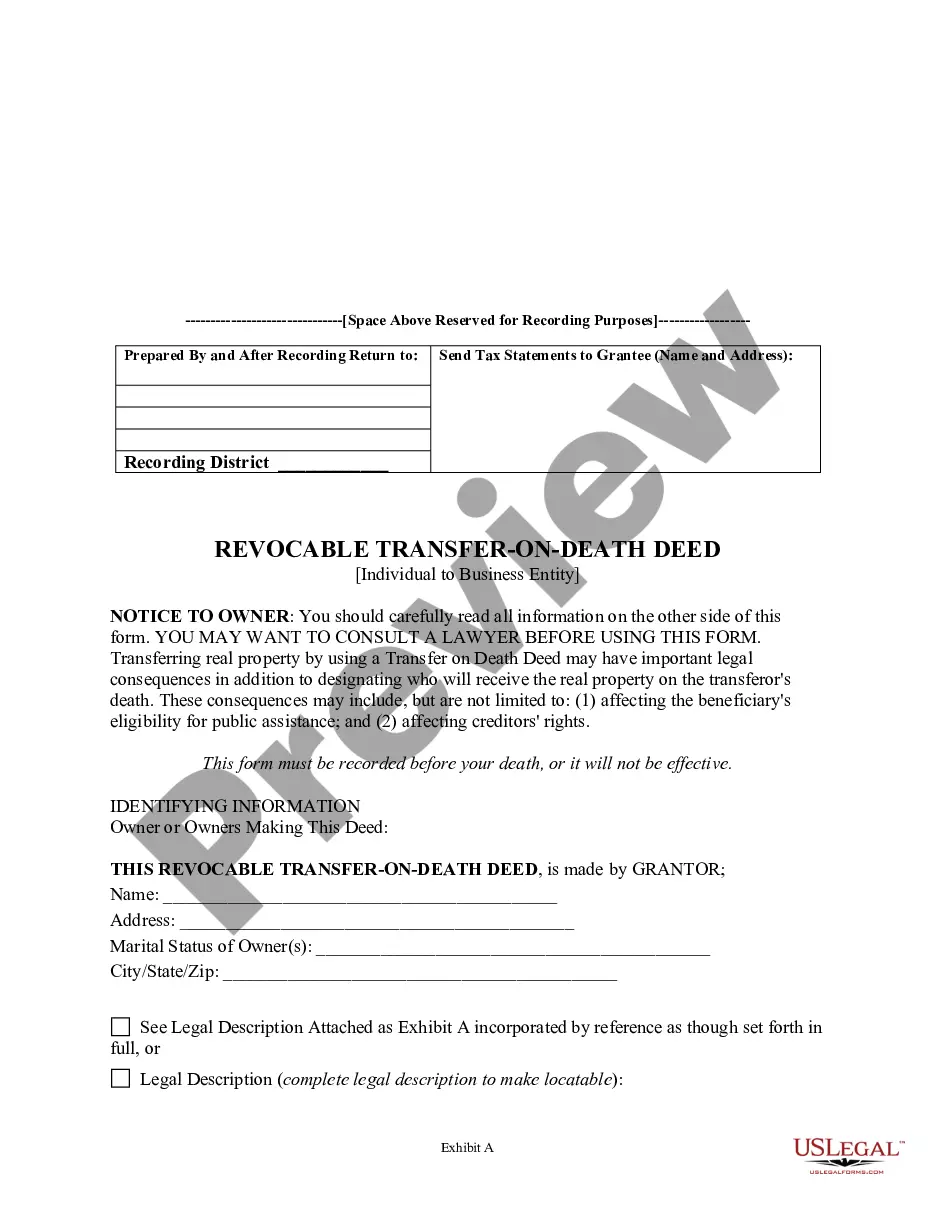

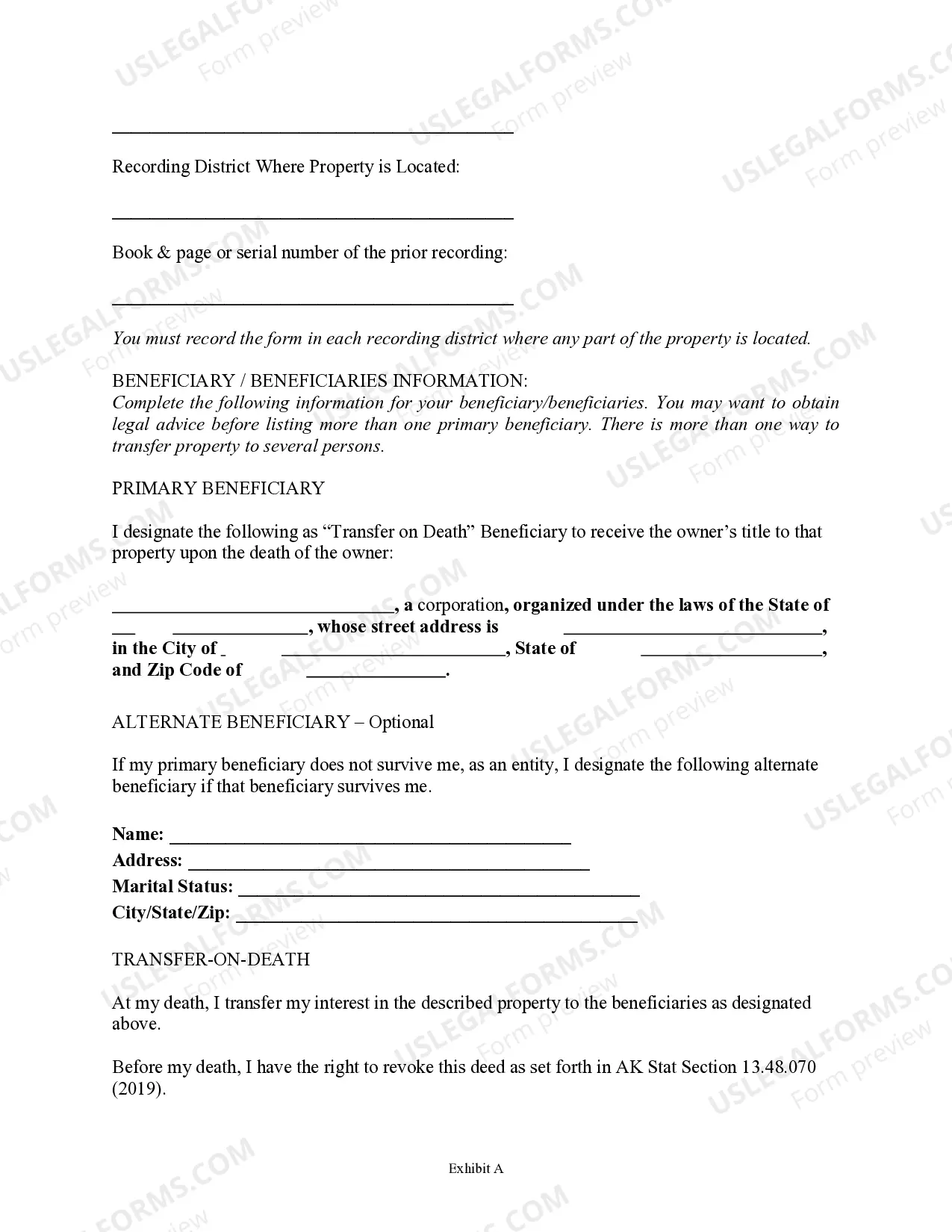

An Anchorage Alaska Transfer on Death Deed (TOD) or Beneficiary Deed for Individual to a Business Entity is a legal document that allows an individual to transfer their property to a business entity upon their death, without the need for probate. There are several types of Transfer on Death Deeds or Beneficiary Deeds available in Anchorage, Alaska, each serving different purposes. These include: 1. Traditional Transfer on Death Deed: This type of deed allows an individual property owner to designate a specific business entity as the beneficiary of their property upon their death. The property owner retains full ownership and control of the property during their lifetime, but at the time of their death, the property is automatically transferred to the designated business entity. 2. Joint Transfer on Death Deed: This deed is used when multiple property owners wish to transfer their property to a business entity upon the death of either owner. In this case, the property is automatically transferred to the designated business entity upon the death of the last surviving owner. 3. Alternate Beneficiary Deed: This type of deed allows the property owner to designate an alternate beneficiary, in addition to the primary business entity beneficiary. If the primary beneficiary cannot accept the property or is no longer in existence at the time of the property owner's death, the alternate beneficiary will receive the property. 4. Revocable/Amendable Transfer on Death Deed: This type of deed allows the property owner to revoke or amend the beneficiary designation during their lifetime. It offers flexibility in case the property owner changes their mind about the designated business entity. It is important to consult with an experienced attorney in Anchorage, Alaska, to determine the most suitable type of TOD or Beneficiary Deed for a transfer from an Individual to a Business Entity. The attorney can guide you through the legal requirements and ensure the proper execution of the deed to avoid any future complications or disputes.

Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity

Description

How to fill out Alaska Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To A Business Entity?

If you have previously used our service, Log In to your account and download the Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity onto your device by clicking the Download button. Ensure that your subscription is active. If not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have continual access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to reuse it. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Ensure you’ve located an appropriate document. Read the description and utilize the Preview option, if available, to verify if it fulfills your requirements. If it doesn’t meet your needs, utilize the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Set up an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity. Select the file format for your document and save it to your device.

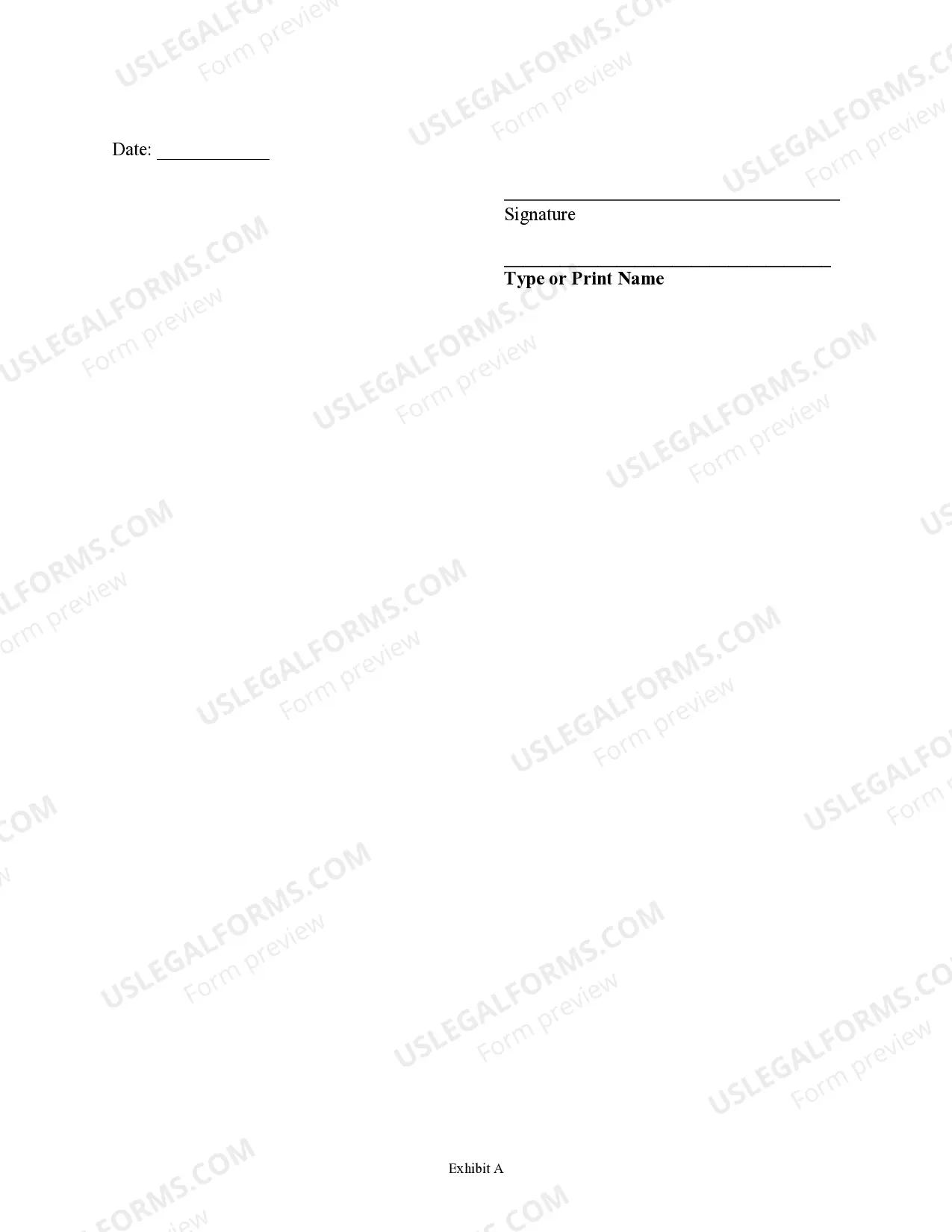

- Finalize your document. Print it out or use professional online editors to complete and sign it electronically.

Form popularity

FAQ

The Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity can be a beneficial tool for many property owners. It allows for a seamless transfer of property without the need for probate, simplifying the process for your beneficiaries. However, it is essential to consider your individual circumstances and consult with a legal professional to ensure it aligns with your estate planning goals.

One significant drawback of the Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity is that it may not address outstanding debts or liabilities. Additionally, if the property involves multiple owners, complications can arise during the transfer process. Lastly, if the named beneficiaries are not kept up to date, it may lead to unintended consequences upon the property owner's passing.

While it is not strictly necessary to hire an attorney to create a Transfer on Death deed in Alaska, consulting one can be beneficial. An attorney can provide legal advice and ensure that the Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity meets all legal requirements. However, many individuals successfully complete this process independently using templates from platforms like US Legal Forms, which offer user-friendly resources.

Currently, many states across the U.S. allow Transfer on Death (TOD) deeds, including Alaska. These deeds enable property owners to designate a beneficiary who will inherit the property without going through probate. Each state has its own rules regarding the execution and recording of these deeds, so it’s crucial to understand local laws. For comprehensive information and templates, consider using US Legal Forms for guidance on the process.

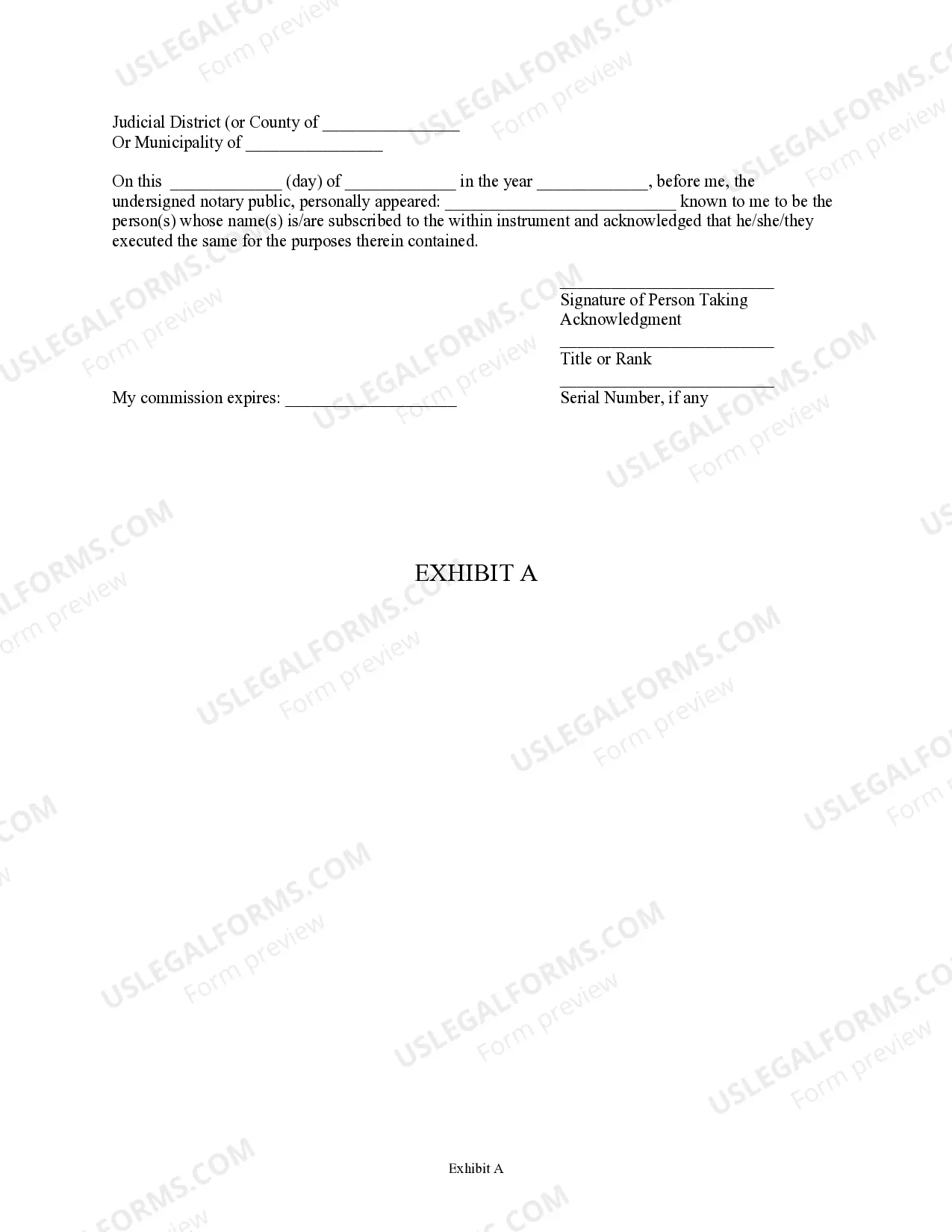

To transfer ownership of a property in Alaska, you typically need to execute a deed, such as the Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity. This deed allows you to name a beneficiary who will receive the property upon your death, avoiding probate. You must file this deed with the local recorder's office to make it legally effective. Using a reliable platform like US Legal Forms can simplify this process and ensure that your documentation is accurate.

While the Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity offers many benefits, it also has some disadvantages. For instance, it does not provide asset protection during your lifetime, which means creditors can still make claims against your assets. Additionally, if the beneficiary does not survive you, the deed may not fulfill your wishes. Understanding these drawbacks is vital, and if you need assistance, consider using tools from USLegalForms to navigate your options.

You do not necessarily need a lawyer to execute an Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity. However, consulting a legal professional can help ensure that you meet all procedural requirements and avoid potential pitfalls. If you're unsure about the process or your specific situation, legal advice can provide peace of mind. Additionally, platforms like USLegalForms offer easy-to-understand resources and templates that guide you through the process.

Writing a beneficiary deed, specifically an Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity, involves several important steps. First, ensure you clearly identify the property you wish to transfer and name the beneficiary accurately. Next, obtain the proper form that adheres to Alaska's legal requirements; using US Legal Forms can simplify this process. Finally, make sure to sign the deed and record it with the local recorder's office to ensure it is valid and enforceable.

Engaging a lawyer when preparing a TOD deed is highly recommended, although not a requirement. A lawyer can help navigate specific legal nuances and ensure compliance with Alaska laws. This professional support can enhance your understanding of the implications, especially if you are considering the Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity. Platforms like US Legal Forms can aid in drafting forms, but expert advice should not be overlooked.

While it is not legally mandatory to hire an attorney to complete a transfer on death deed in Alaska, doing so can provide clarity and security. An attorney can ensure that the deed is properly drafted, executed, and recorded, minimizing complications later on. This guidance is particularly valuable for individuals who wish to utilize the Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity effectively.