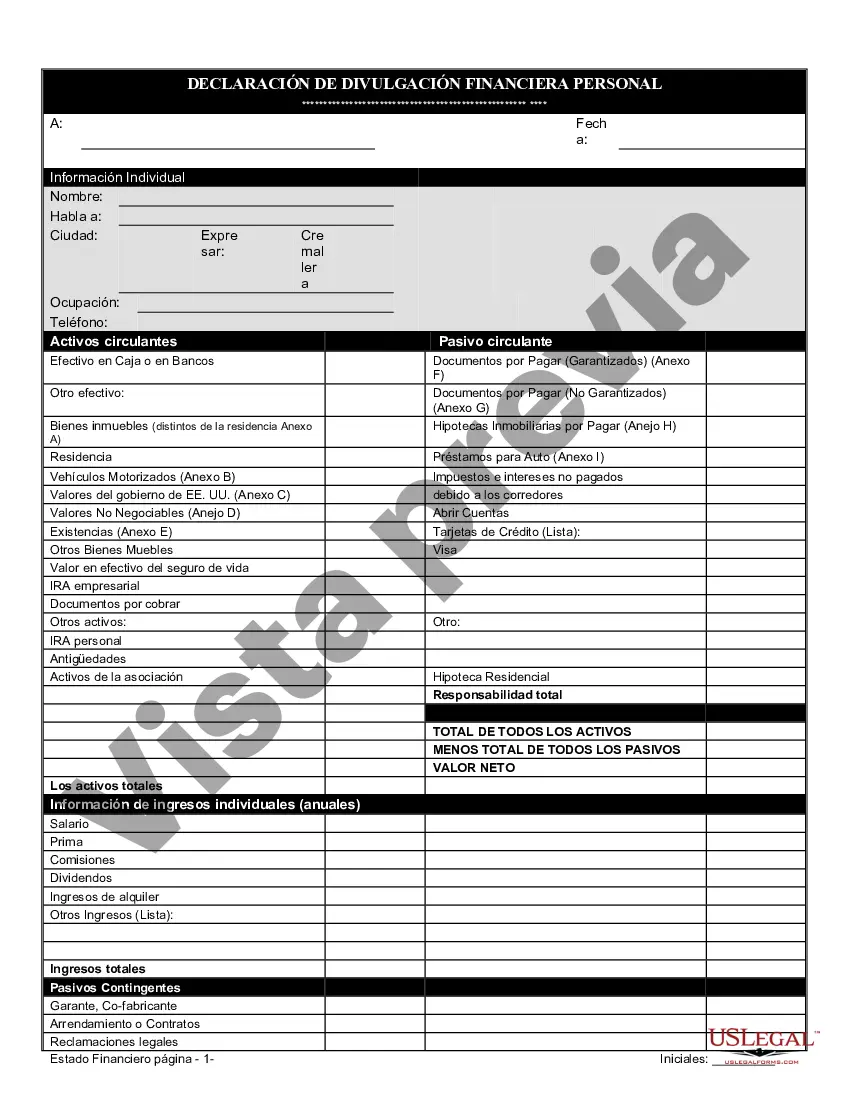

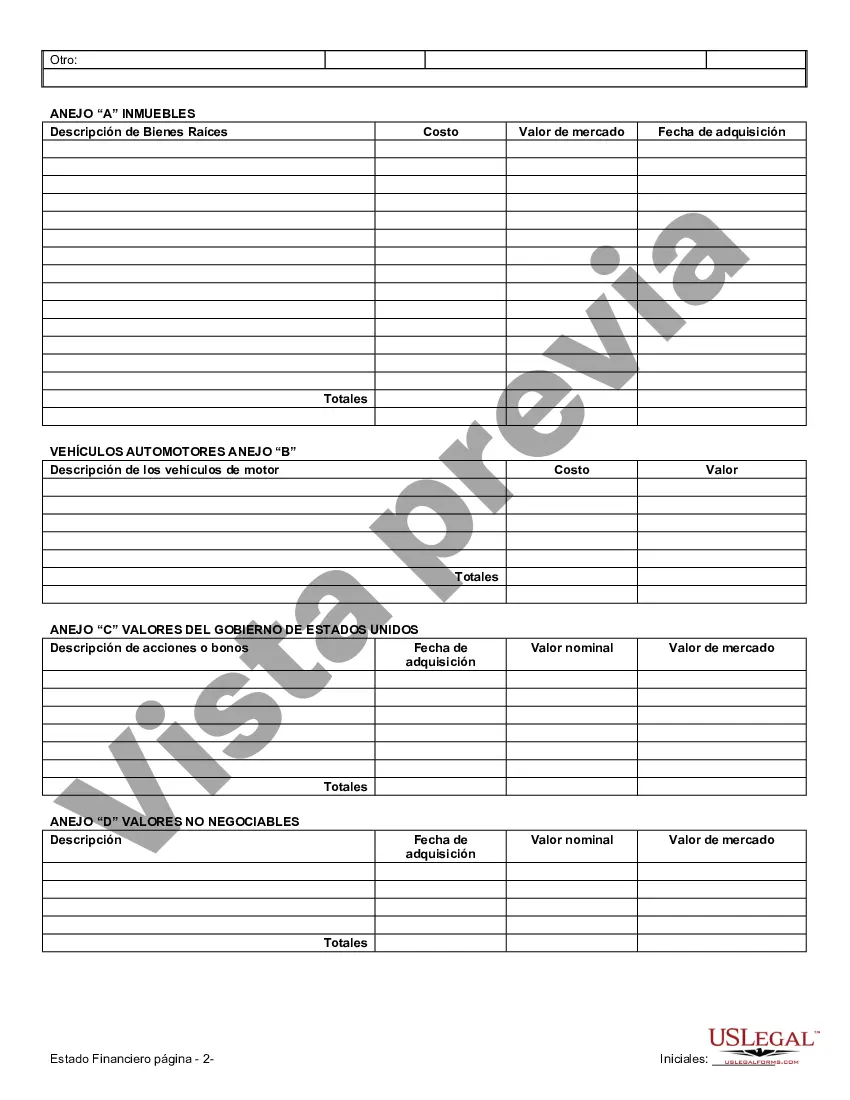

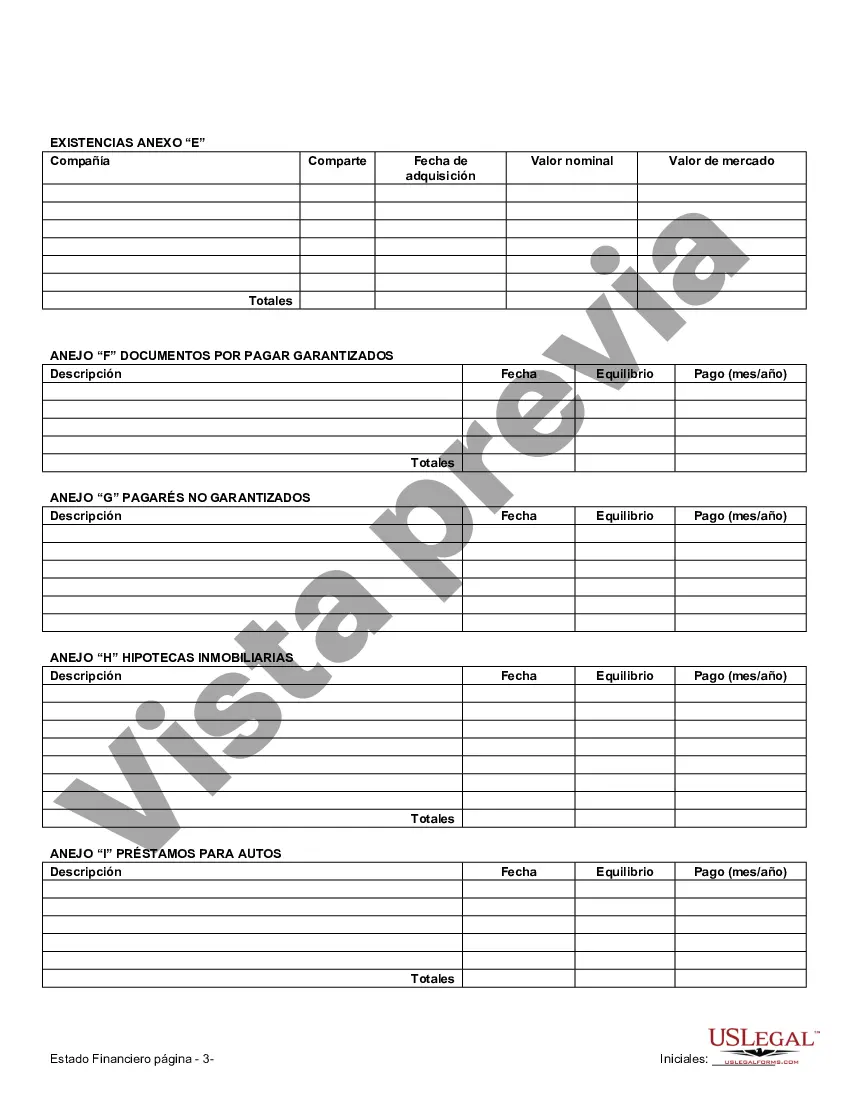

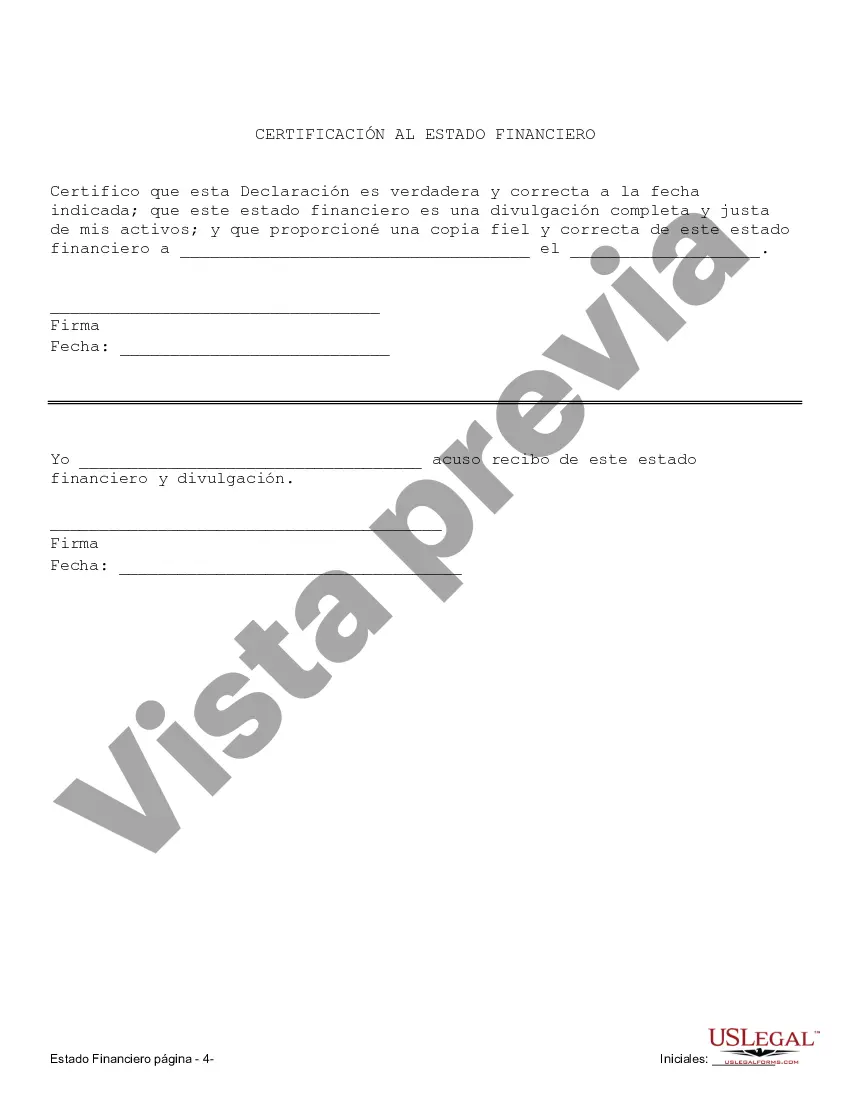

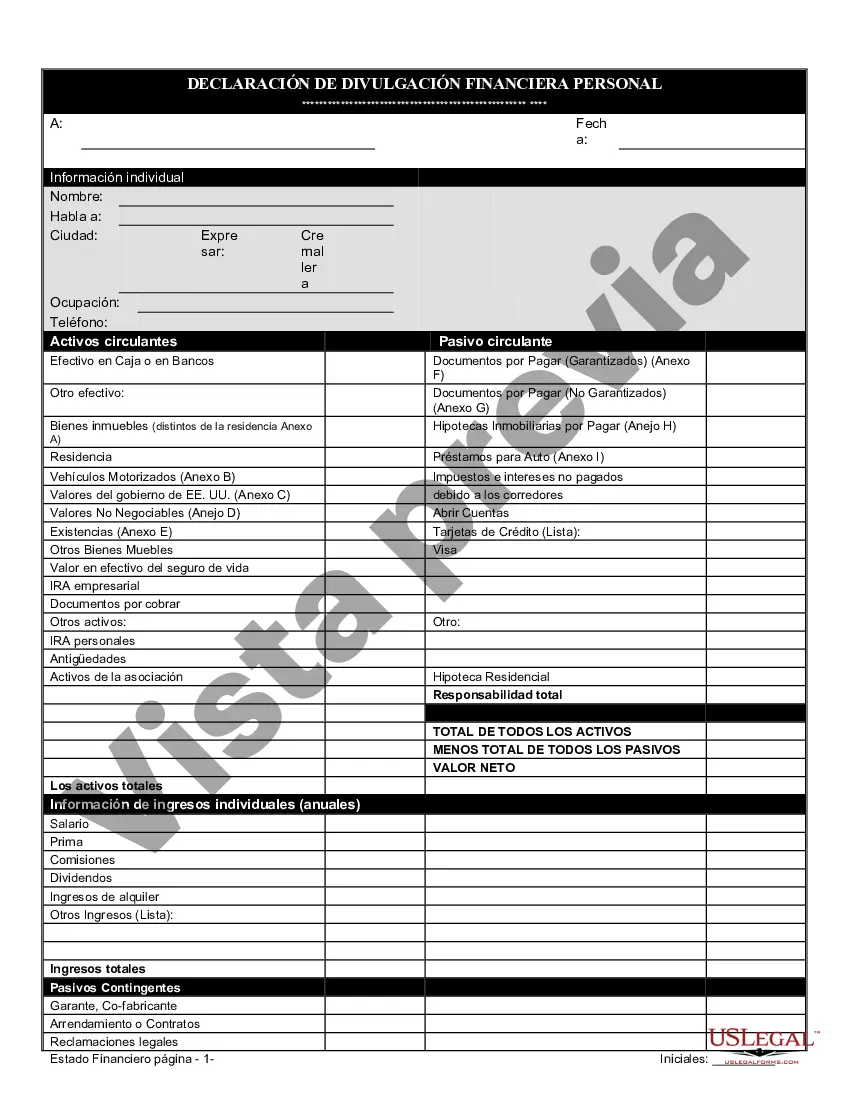

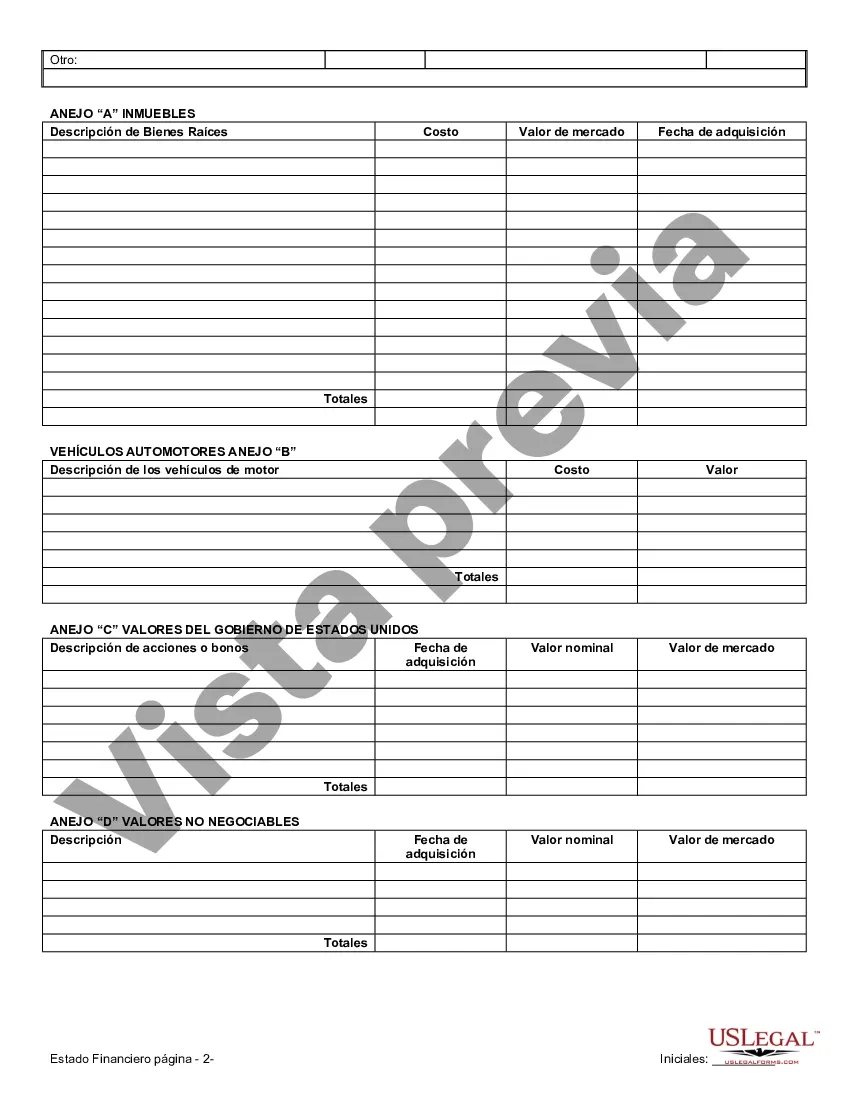

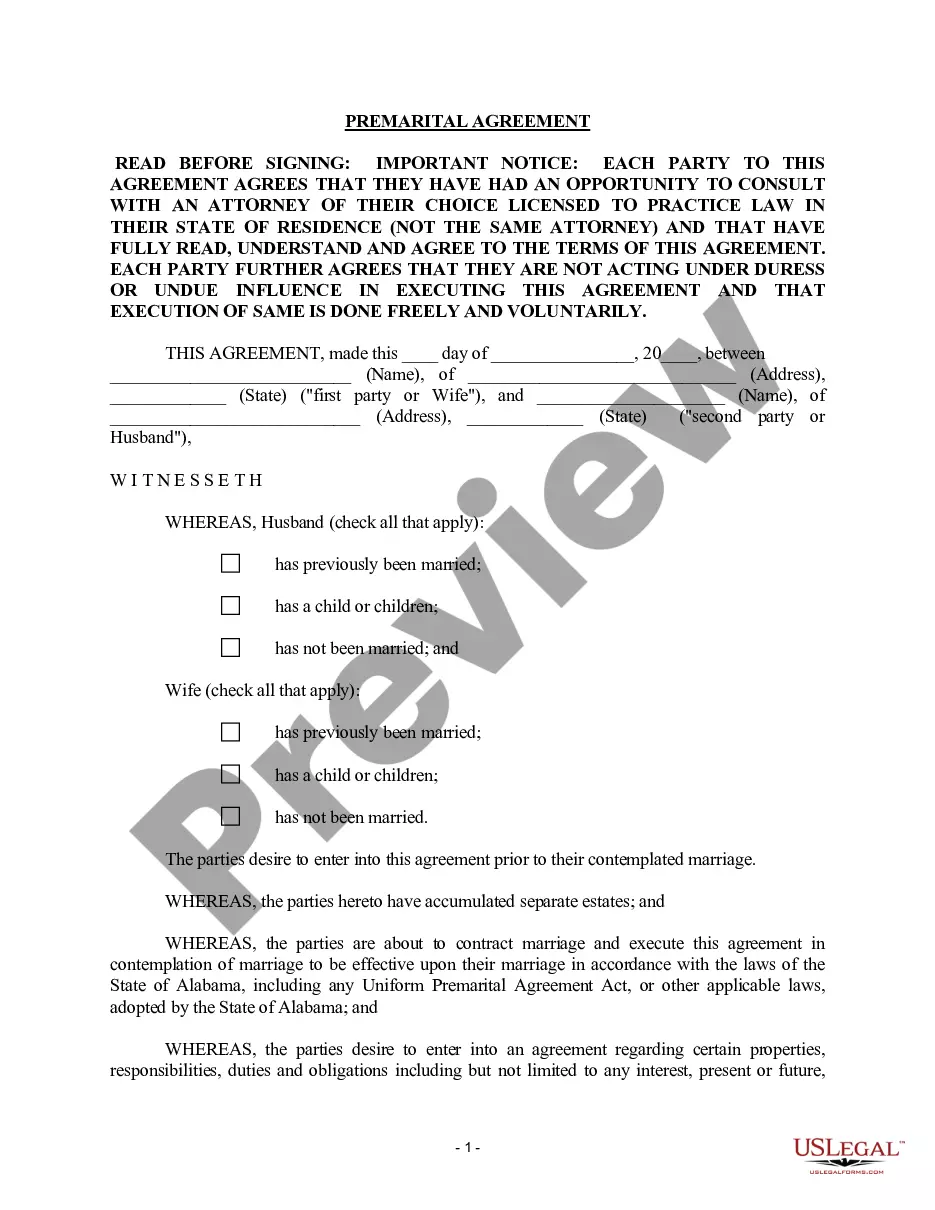

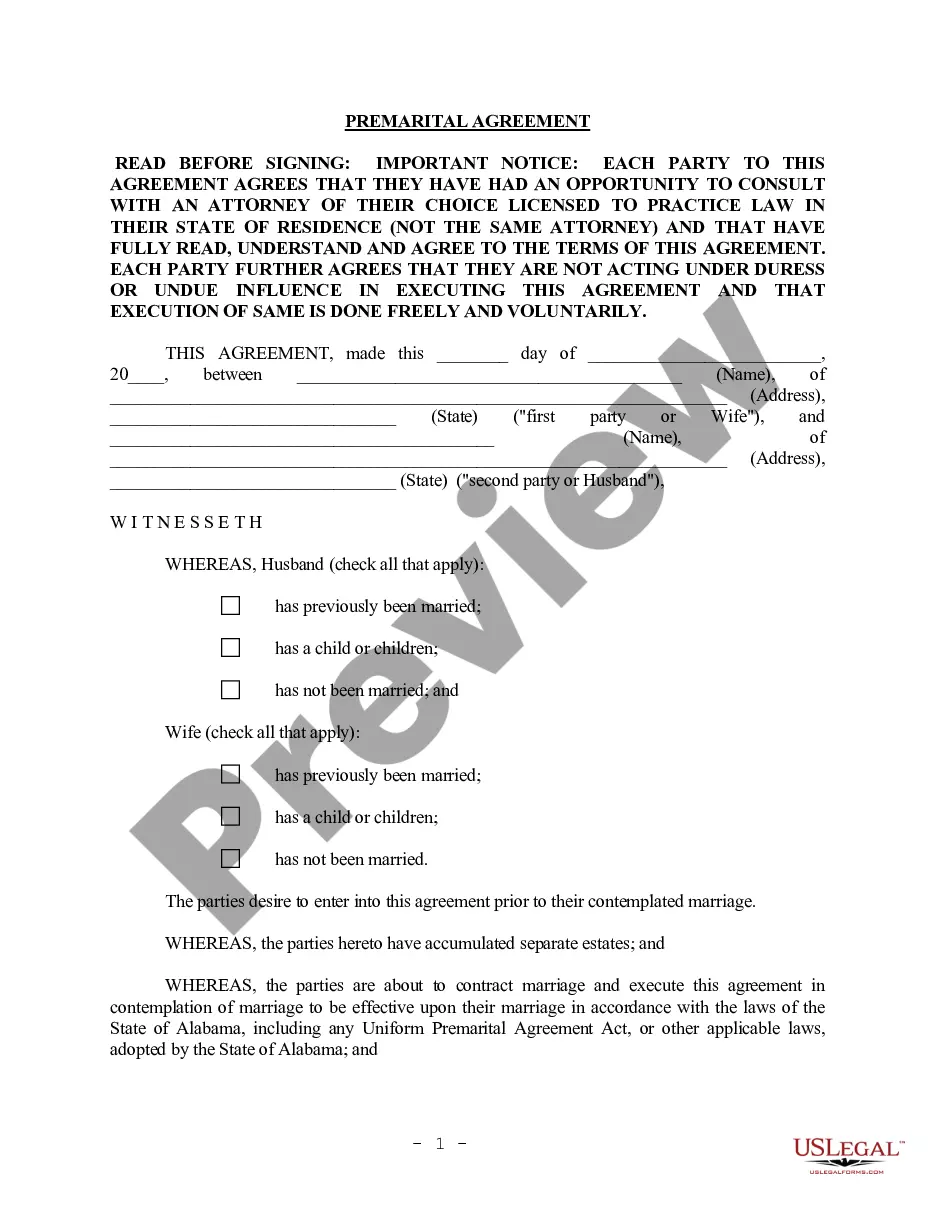

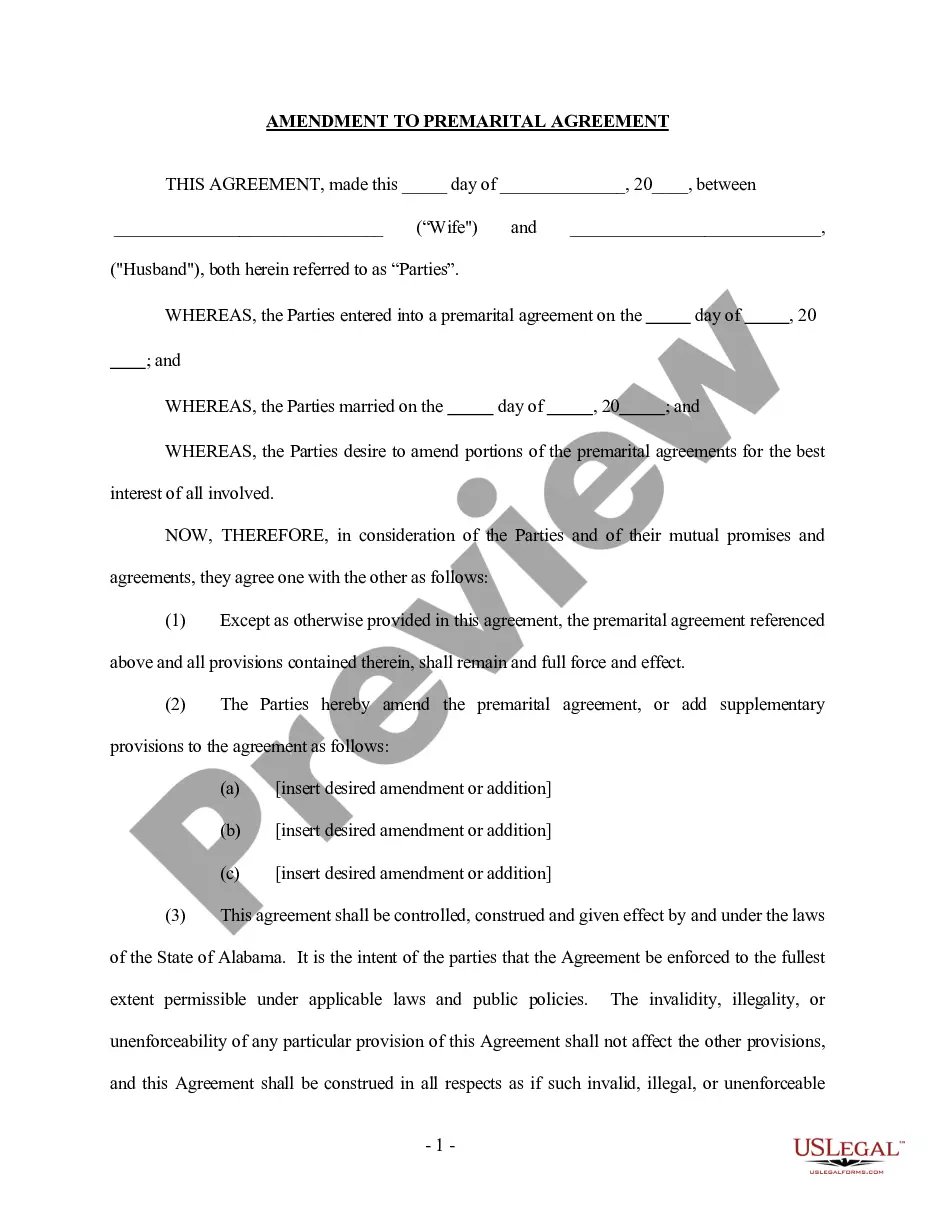

Birmingham Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement Financial statements play a crucial role in the process of creating a prenuptial or premarital agreement. In Birmingham, Alabama, these statements are prepared to ensure transparent financial disclosure between both parties involved. They serve as a means to protect the rights and interests of each partner, laying a foundation of trust and understanding from the very start of the marital journey. Let's explore the different types of Birmingham Alabama Financial Statements used in connection with a prenuptial or premarital agreement: 1. Personal Balance Sheet: A personal balance sheet provides a comprehensive snapshot of an individual's financial position. It includes assets, such as cash, real estate, investments, and personal property, as well as liabilities, such as loans, mortgages, and credit card debts. This statement helps determine each partner's net worth before entering into a prenuptial or premarital agreement. 2. Income Statements: Income statements outline an individual's income, including wages, salaries, self-employment earnings, rental income, and any other sources of revenue. It also includes details of the individual's expenses, such as rent or mortgage payments, utilities, insurance, and personal expenditures. This statement demonstrates the financial stability and earning potential of each partner. 3. Bank Statements: Bank statements are essential to provide evidence of cash flow, deposits, withdrawals, and transactions made by each party. They offer transparency when evaluating an individual's financial handling and validate the data presented in the balance sheet and income statements. 4. Investment Account Statements: Investment account statements disclose information about any stocks, bonds, mutual funds, or other investment holdings. These statements show the value of these assets, any associated income, and potential growth. Including investment account statements ensures that both parties are aware of the existing investments and can consider their effects on the prenuptial or premarital agreement. 5. Retirement Account Statements: Retirement account statements, such as 401(k) or IRA statements, are important for assessing long-term financial planning. They outline the value of the account, contributions made, and any investment gains. These statements help determine the division of retirement assets should the marriage dissolve. 6. Tax Returns: Tax returns provide a record of an individual's income, deductions, and tax liabilities. They give insight into the person's financial responsibilities and allow an in-depth review of their financial situation. This information is crucial when deciding on any financial arrangements within the prenuptial or premarital agreement. 7. Debts and Liabilities: Documenting debts and liabilities, such as mortgages, loans, or credit card debts, is also an integral part of financial statements in relation to prenuptial or premarital agreements. Full disclosure of outstanding debts helps both parties understand and plan for potential financial obligations during the marriage. By utilizing these different types of Birmingham Alabama Financial Statements within the context of prenuptial or premarital agreements, couples can ensure open communication about their financial standing and expectations. It is always advisable to consult with experienced attorneys specializing in family or matrimonial law to guide through the preparation and execution of such agreements, ensuring the protection and well-being of all involved parties.

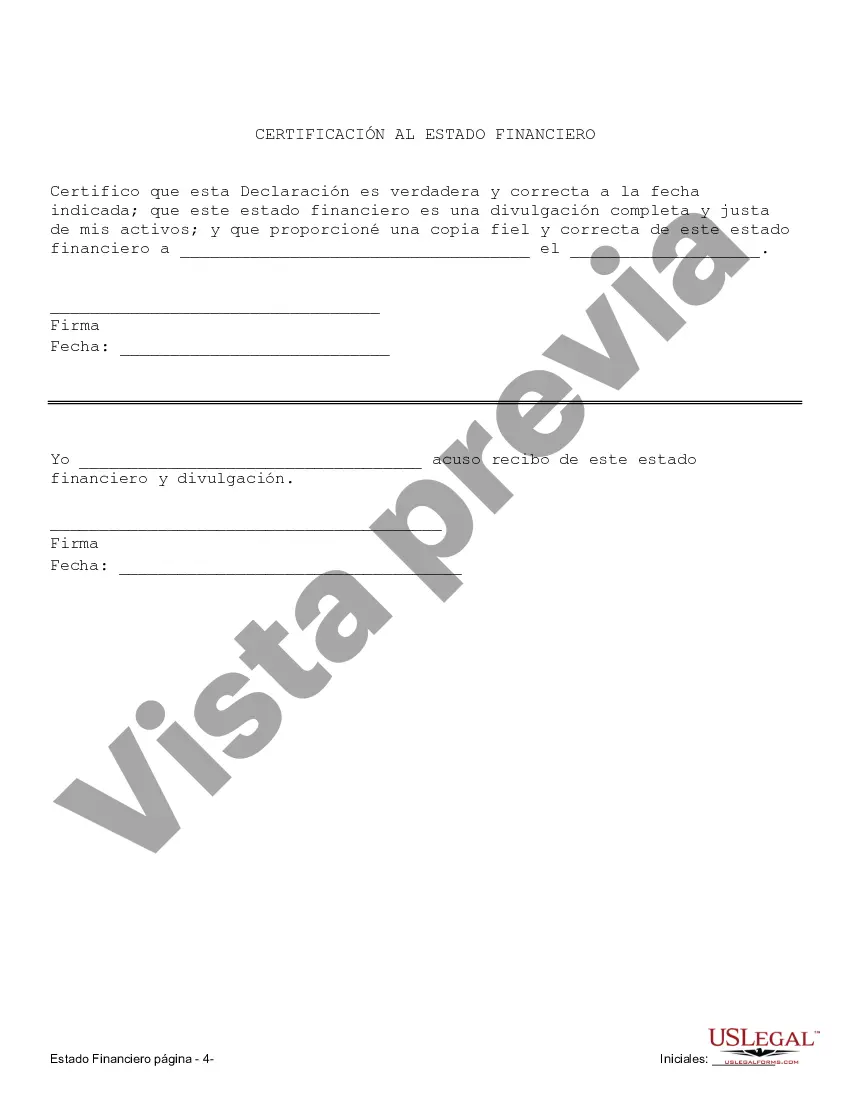

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Birmingham Alabama Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Birmingham Alabama Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

We consistently endeavor to minimize or evade legal repercussions when handling intricate legal or financial matters.

To achieve this, we seek legal services that are typically very expensive.

However, not all legal issues are that complicated.

Many of them can be managed by ourselves.

Utilize US Legal Forms whenever you need to obtain and download the Birmingham Alabama Financial Statements exclusively related to Prenuptial Premarital Agreements or any other form swiftly and securely. Just Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always re-download it from the My documents tab. The procedure is just as simple if you’re not familiar with the website! You can create your account in just a few minutes. Ensure to verify if the Birmingham Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement complies with the laws and regulations of your state and area. Furthermore, it’s crucial that you read through the form’s description (if available), and if you see any inconsistencies with what you were initially seeking, look for a different form. Once you’ve confirmed that the Birmingham Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement suits your needs, you can select the subscription option and proceed to payment. After that, you can download the document in any preferred file format. With over 24 years in the industry, we’ve assisted millions of individuals by offering readily customizable and updated legal forms. Make the most of US Legal Forms today to conserve time and resources!

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and motions for dissolution.

- Our collection allows you to take charge of your affairs without resorting to legal counsel.

- We provide access to legal form templates that are not always publicly available.

- Our templates are specific to states and regions, which significantly simplifies the search process.

Form popularity

FAQ

Signing a prenuptial agreement is not inherently a red flag; rather, it demonstrates responsibility and foresight. Couples can establish clear expectations regarding their financial responsibilities and assets, which can ultimately strengthen their relationship. Incorporating Birmingham Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement can enhance the clarity and understanding between partners. If you’re contemplating a prenup, consider utilizing the UsLegalForms platform for comprehensive support.

A prenuptial agreement is a legal contract made before marriage, outlining how assets will be divided in the event of a divorce. In contrast, a postnuptial agreement is created after the couple is already married. Both types of agreements can benefit from the inclusion of Birmingham Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement, as these statements help clarify each party's financial status. For tailored guidance, you may want to explore resources on the UsLegalForms platform.

To tell your fiancé that you want a prenup, choose a moment when both of you can talk without distractions. Frame the conversation around the idea of shared financial goals and mutual assurance during your marriage. Highlight that by discussing Birmingham Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement, you're taking a proactive step towards a secure future together.

Initiating a prenup starts with open, honest dialogue. Clearly express your desire for a prenuptial agreement and its advantages for both partners. Use Birmingham Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement as a framework to ensure that both parties can see the value in discussing financial matters openly.

To ask your partner for a prenuptial agreement, choose a private, comfortable setting for your discussion. Explain the benefits of having such an agreement, including financial clarity and planning for the future. You can reference Birmingham Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement as a useful tool for maintaining financial harmony.

When asking your wife for a prenup, approach the topic with empathy and respect. Share your reasons clearly, focusing on financial protection and mutual respect. Mention how discussing Birmingham Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement can facilitate honest communication about your financial goals.

Couples often seek a prenup to safeguard their assets and define their financial responsibilities before marriage. A prenuptial agreement addresses potential financial disputes and establishes clear expectations. By incorporating Birmingham Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement, both parties can enjoy peace of mind regarding their financial future.

Bringing up a prenuptial agreement with your fiancé requires sensitivity and thoughtfulness. Start by highlighting the importance of financial transparency in your relationship. Focus on how Birmingham Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement can create security for both parties, ensuring a fair arrangement.

Respectfully asking for a prenup begins with a calm and open conversation. Choose a suitable time to discuss your future together and introduce the idea as a way to protect both of your interests. Emphasize that discussing Birmingham Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement can help clarify financial responsibilities and foster trust.

Yes, you can choose not to have a prenuptial agreement, but it is important to understand the implications. Without a prenuptial agreement, you may not have control over how your assets are divided in the event of a divorce. Protecting your financial interests through Birmingham Alabama Financial Statements only in Connection with Prenuptial Premarital Agreement can provide clarity and security for both partners. uslegalforms offers guidance and resources to create the agreement that suits your needs, ensuring that your financial future is safeguarded.