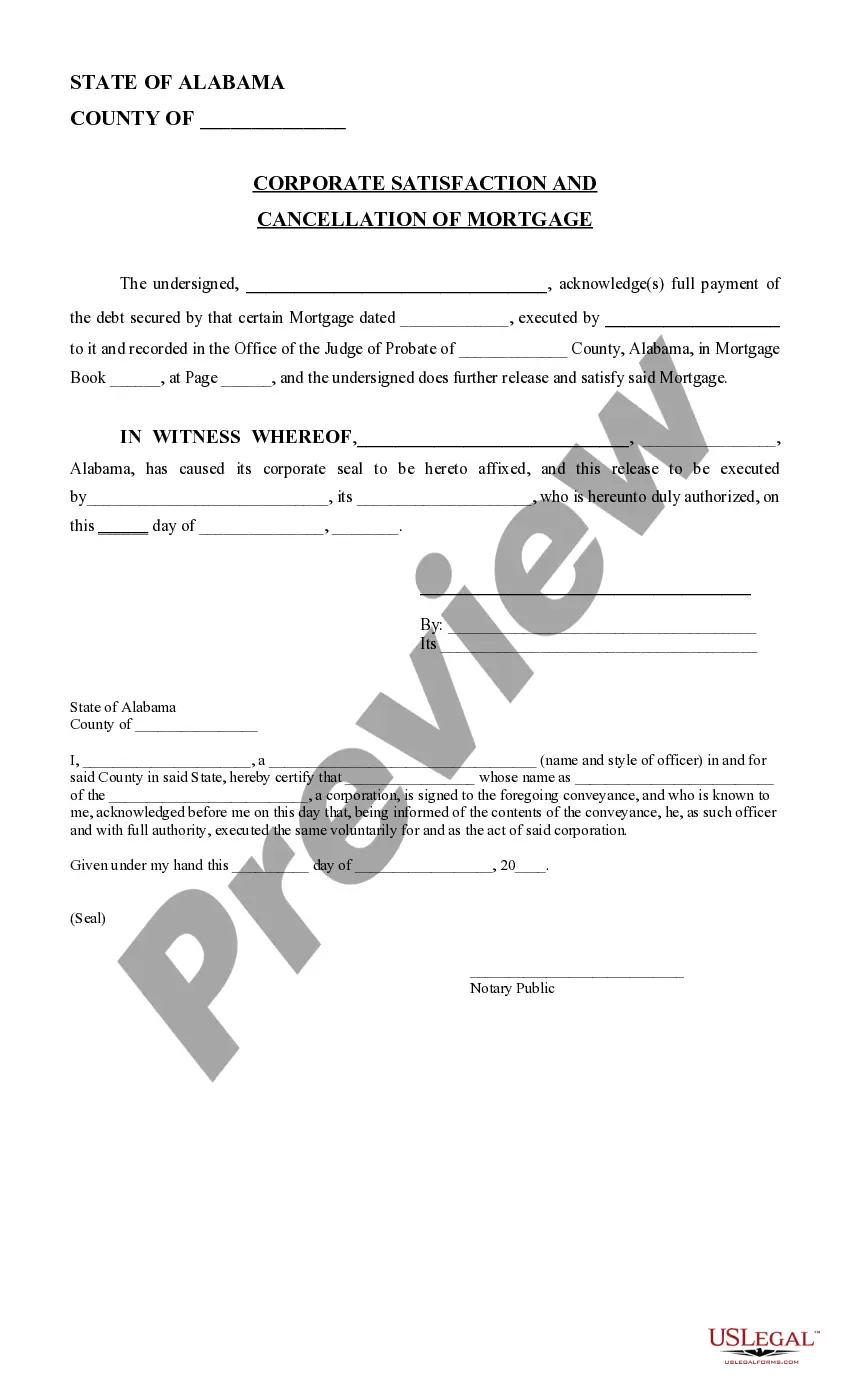

This form is used to release a corporation from a mortgage once full payment of the debt secured by the mortgage has bee paid. This form is available in Word and Wordperfect formats.

Huntsville Alabama Corporate Satisfaction Mortgage is a type of mortgage specifically designed to cater to the needs of corporate borrowers in Huntsville, Alabama. This mortgage option offers corporate entities the opportunity to secure financing for various real estate or business-related purposes, enabling them to achieve their financial goals effectively. With Huntsville being a thriving business hub in Alabama, this specialized mortgage solution aims to address the unique requirements of corporate borrowers. By providing tailored financial assistance, companies can take advantage of favorable interest rates, flexible repayment terms, and convenient application processes. There are several types of Huntsville Alabama Corporate Satisfaction Mortgages available, including: 1. Commercial Property Mortgage: This mortgage option is suitable for corporations seeking financing for the purchase, construction, or improvement of commercial real estate properties such as office buildings, warehouses, retail spaces, or industrial facilities. 2. Business Acquisition Mortgage: This type of corporate mortgage allows businesses to secure funds for acquiring another company or expanding their existing operations. It provides the necessary capital to facilitate mergers, acquisitions, or strategic partnerships. 3. Equipment Financing Mortgage: Corporate entities requiring funds to purchase equipment or machinery can avail of this mortgage. It enables businesses to upgrade or add essential assets to improve their operational efficiency and productivity. 4. Construction Mortgage: Ideal for corporations undertaking new construction projects, this mortgage offers financial support throughout the construction process. From land acquisition to the completion of the project, this type of mortgage provides the necessary capital to cover expenses and ensure seamless execution. 5. Working Capital Mortgage: This mortgage option caters to the short-term financial needs of businesses, assisting in managing cash flow fluctuations, inventory management, or covering operational expenses. It provides companies with liquidity to support day-to-day operations and fund growth opportunities. Huntsville Alabama Corporate Satisfaction Mortgage is tailored to meet the specific requirements of corporate borrowers, ensuring their financial satisfaction and empowering them with the necessary resources to thrive in the Huntsville business landscape. Whether your corporation needs financing for real estate projects, business expansion, equipment purchase, or working capital needs, these mortgage options aim to provide comprehensive solutions for sustained growth and success.Huntsville Alabama Corporate Satisfaction Mortgage is a type of mortgage specifically designed to cater to the needs of corporate borrowers in Huntsville, Alabama. This mortgage option offers corporate entities the opportunity to secure financing for various real estate or business-related purposes, enabling them to achieve their financial goals effectively. With Huntsville being a thriving business hub in Alabama, this specialized mortgage solution aims to address the unique requirements of corporate borrowers. By providing tailored financial assistance, companies can take advantage of favorable interest rates, flexible repayment terms, and convenient application processes. There are several types of Huntsville Alabama Corporate Satisfaction Mortgages available, including: 1. Commercial Property Mortgage: This mortgage option is suitable for corporations seeking financing for the purchase, construction, or improvement of commercial real estate properties such as office buildings, warehouses, retail spaces, or industrial facilities. 2. Business Acquisition Mortgage: This type of corporate mortgage allows businesses to secure funds for acquiring another company or expanding their existing operations. It provides the necessary capital to facilitate mergers, acquisitions, or strategic partnerships. 3. Equipment Financing Mortgage: Corporate entities requiring funds to purchase equipment or machinery can avail of this mortgage. It enables businesses to upgrade or add essential assets to improve their operational efficiency and productivity. 4. Construction Mortgage: Ideal for corporations undertaking new construction projects, this mortgage offers financial support throughout the construction process. From land acquisition to the completion of the project, this type of mortgage provides the necessary capital to cover expenses and ensure seamless execution. 5. Working Capital Mortgage: This mortgage option caters to the short-term financial needs of businesses, assisting in managing cash flow fluctuations, inventory management, or covering operational expenses. It provides companies with liquidity to support day-to-day operations and fund growth opportunities. Huntsville Alabama Corporate Satisfaction Mortgage is tailored to meet the specific requirements of corporate borrowers, ensuring their financial satisfaction and empowering them with the necessary resources to thrive in the Huntsville business landscape. Whether your corporation needs financing for real estate projects, business expansion, equipment purchase, or working capital needs, these mortgage options aim to provide comprehensive solutions for sustained growth and success.