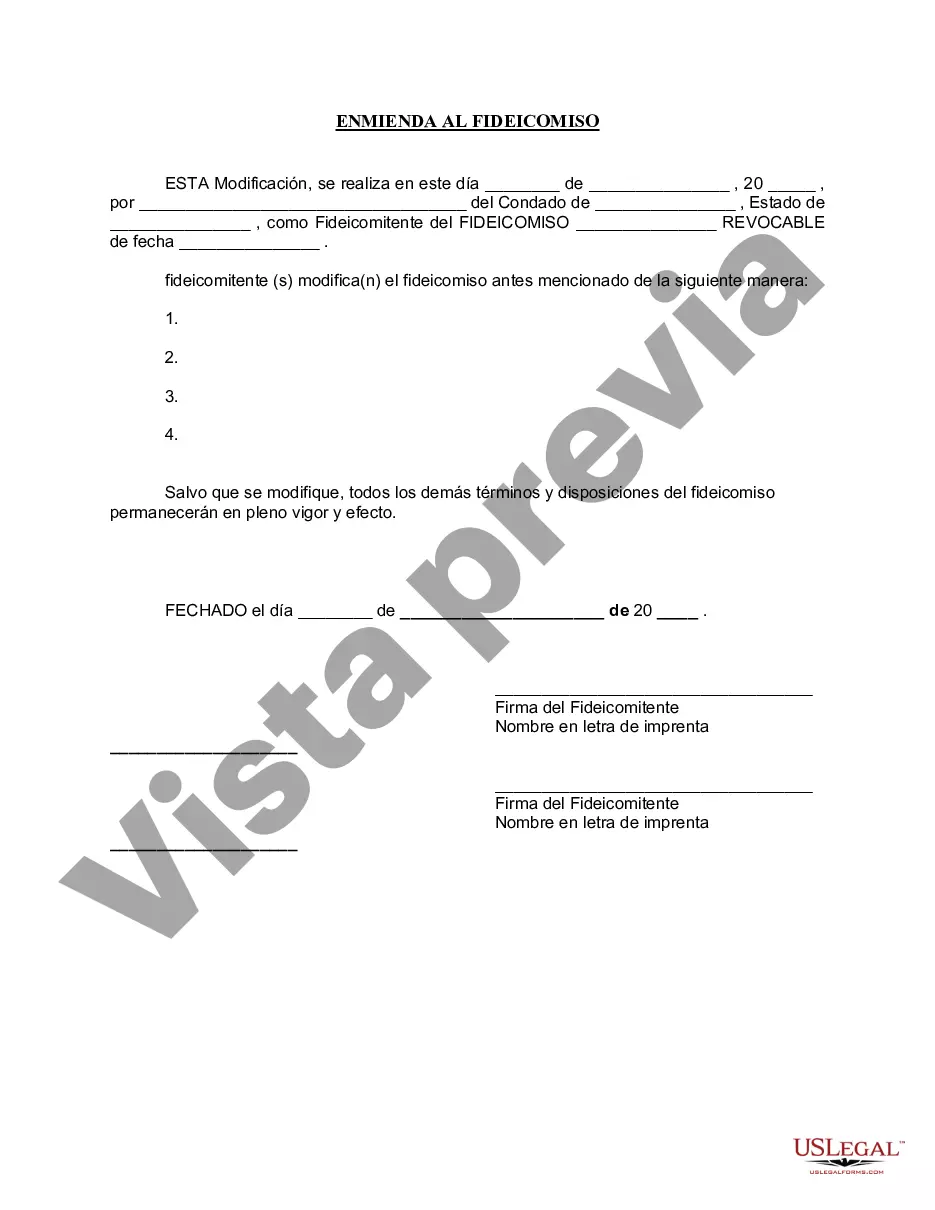

Birmingham Alabama Amendment to Living Trust: A Comprehensive Guide to Modifying Your Trust When it comes to estate planning in Birmingham, Alabama, a living trust is considered a valuable tool to manage and distribute your assets effectively. However, life is constantly changing, and your trust may need to be updated to reflect your current circumstances. That's where the Birmingham Alabama Amendment to Living Trust comes into play, allowing you to make necessary changes and adjustments. An amendment to a living trust is a legal document that alters specific terms, provisions, or beneficiaries within an existing trust. It enables you to modify the trust without needing to create an entirely new one, saving time and money. Understanding the different types of amendments available is crucial to ensure your trust accurately represents your wishes and protects your beneficiaries. 1. Beneficiary Amendment: If you wish to change the beneficiaries listed in your trust or add new ones, a beneficiary amendment is required. This amendment allows for the addition, removal, or alteration of beneficiaries according to your evolving preferences and family dynamics. 2. Property Amendment: A property amendment to a living trust allows for the modification of assets held within the trust. It lets you add or remove properties, change their ownership, or adjust their distribution methods. This amendment is particularly useful when acquiring new properties or selling existing ones. 3. Distribution Amendment: The distribution amendment is commonly used to revise how assets are distributed among beneficiaries. It enables you to modify the frequency, timing, or percentages at which beneficiaries receive their share of the trust's assets. This amendment is beneficial when circumstances change, such as the birth of a grandchild or the death of a beneficiary. 4. Successor Trustee Amendment: In case the initially appointed successor trustee becomes unavailable or unwilling to fulfill their duties, a successor trustee amendment allows you to designate an alternate trustee. This ensures your trust administration remains efficient and avoids potential complications. By utilizing the Birmingham Alabama Amendment to Living Trust, you can address your changing needs while maintaining the integrity of your estate plan. It is essential to engage an experienced estate planning attorney to draft and execute the amendment accurately, ensuring compliance with Alabama state laws and tax requirements. Remember, a poorly drafted or improperly executed amendment may lead to legal complications or unintended consequences. Thus, seeking professional guidance during the amendment process is crucial to safeguard your interests and protect your loved ones. In conclusion, the Birmingham Alabama Amendment to Living Trust is a powerful tool that empowers you to adapt your trust to evolving circumstances. Whether you need to modify beneficiaries, properties, distributions, or successor trustees, this amendment ensures your estate plan reflects your current wishes. Consult with a trusted estate planning attorney to navigate the amendment process effectively and continue to secure your legacy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Birmingham Alabama Enmienda al fideicomiso en vida - Alabama Amendment to Living Trust

Description

How to fill out Birmingham Alabama Enmienda Al Fideicomiso En Vida?

We constantly aim to reduce or avert legal harm when managing intricate law-related or financial issues.

To achieve this, we enlist legal services that are typically quite expensive.

Nevertheless, not all legal concerns are of equal difficulty.

Many of them can be handled independently.

Leverage US Legal Forms whenever you need to obtain and download the Birmingham Alabama Amendment to Living Trust or any other document efficiently and securely.

- US Legal Forms is an online repository of current do-it-yourself legal documents covering everything from wills and powers of attorney to company formation articles and dissolution petitions.

- Our collection empowers you to manage your issues without needing to consult a lawyer.

- We offer access to legal document models that are not always available to the public.

- Our templates are tailored to specific states and regions, which significantly eases the searching process.

Form popularity

FAQ

Trust funds can present various dangers, especially if not managed properly. Funds may fall prey to mismanagement or excessive withdrawals by beneficiaries. Additionally, there is always the risk of fraudulent claims against the trust's assets. Engaging with a competent platform like uslegalforms can help create a secure Birmingham Alabama Amendment to Living Trust, minimizing these risks.

In Alabama, a trust does not necessarily have to be recorded to be valid. However, certain documents related to the trust, like property titles, may require recording for clarity and legal purposes. To ensure that your Birmingham Alabama Amendment to Living Trust complies with local laws, consulting a legal professional is advisable.

Another common mistake is failing to communicate with heirs about the trust's existence and purpose. This lack of communication can result in resentment or conflicts later. It is vital to engage in honest discussions about the trust to clarify its objectives. A clear Birmingham Alabama Amendment to Living Trust helps in this regard.

One disadvantage of a family trust is the complexity involved in its management. Family trusts require ongoing oversight, which may lead to misunderstandings among family members. Furthermore, these trusts can incur administrative costs. To alleviate some of these concerns, creating a well-structured Birmingham Alabama Amendment to Living Trust can be beneficial.

While trusts offer many benefits, they do come with drawbacks. For example, setting up and maintaining a trust can be expensive and time-consuming. Additionally, certain types of trusts may limit access to funds during a person's lifetime. Understanding these potential disadvantages can help you decide on a Birmingham Alabama Amendment to Living Trust.

The best approach to amend a trust is to draft a written amendment that meets legal standards. This document should specify the sections of the trust you wish to change and the exact adjustments. Consulting an attorney can ensure these changes comply with Alabama laws. For an efficient process, consider using uslegalforms for your Birmingham Alabama Amendment to Living Trust.

Amending a trust deed requires careful attention to detail. Generally, you must prepare a formal document that outlines the changes you wish to implement. In Alabama, this process may involve signing the amendment in front of witnesses. Using a reliable platform, like uslegalforms, can simplify creating a Birmingham Alabama Amendment to Living Trust effectively.

One significant error parents often make involves not clearly defining their wishes within the trust. Without detailed instructions, confusion may arise regarding asset distribution. This lack of clarity can lead to disputes among beneficiaries. Therefore, it is crucial to create a comprehensive Birmingham Alabama Amendment to Living Trust to avoid these complications.

A living trust in Alabama allows you to manage your assets during your lifetime and specify how they should be distributed after your death. This type of trust provides flexibility, as you can amend it whenever necessary, especially in light of the Birmingham Alabama Amendment to Living Trust. A living trust also helps avoid probate, making the transfer of assets smoother for your beneficiaries. To learn more about setting one up, visit uslegalforms for comprehensive guidance.

The Birmingham Alabama Amendment to Living Trust refers to recent changes in state laws that impact how living trusts operate. These amendments affect various aspects, such as how a trust can be changed or revoked. Understanding these updates is vital for ensuring your trust remains compliant and governs your assets as you intend. Further details can be explored through legal resources or platforms like uslegalforms.