Birmingham Alabama Financial Account Transfer to Living Trust is a legal process in which an individual's financial accounts, such as bank accounts, investment accounts, or retirement funds, are transferred to a living trust. This transfer ensures that the assets held within these accounts seamlessly pass to the designated beneficiaries upon the account owner's death, bypassing the probate process. By transferring financial accounts to a living trust, Alabamians can enjoy several benefits, including privacy, cost-effectiveness, and efficient management of assets. When a person creates a living trust, they become the granter and can also serve as the initial trustee, maintaining control over their financial accounts during their lifetime. However, upon their passing, the successor trustee takes over and distributes the assets to the beneficiaries according to the granter's instructions. There are various types of financial accounts that can be transferred to a living trust in Birmingham, Alabama. These may include: 1. Bank Accounts: This encompasses savings accounts, checking accounts, and certificates of deposit (CDs). By transferring these accounts to a living trust, the successor trustee can easily manage these assets and distribute them to beneficiaries as per the granter's wishes. 2. Investment Accounts: These include brokerage accounts, mutual funds, stocks, bonds, and other securities. Transferring investment accounts to a living trust ensures consolidated management and facilitates the seamless transfer of these assets upon the account owner's death. 3. Retirement Accounts: Transferring retirement accounts like IRAs (Individual Retirement Accounts) or 401(k)s to a living trust allows for the continuation of tax-deferred growth on these assets while providing guidance on distribution to beneficiaries. It is important to consult with a financial advisor or estate planning attorney in Birmingham, Alabama, who specializes in living trusts to ensure a smooth transition of financial accounts. They can provide specific guidance on the appropriate steps to take, as well as the legal requirements, necessary documentation, and potential tax implications associated with Birmingham Alabama Financial Account Transfer to Living Trust.

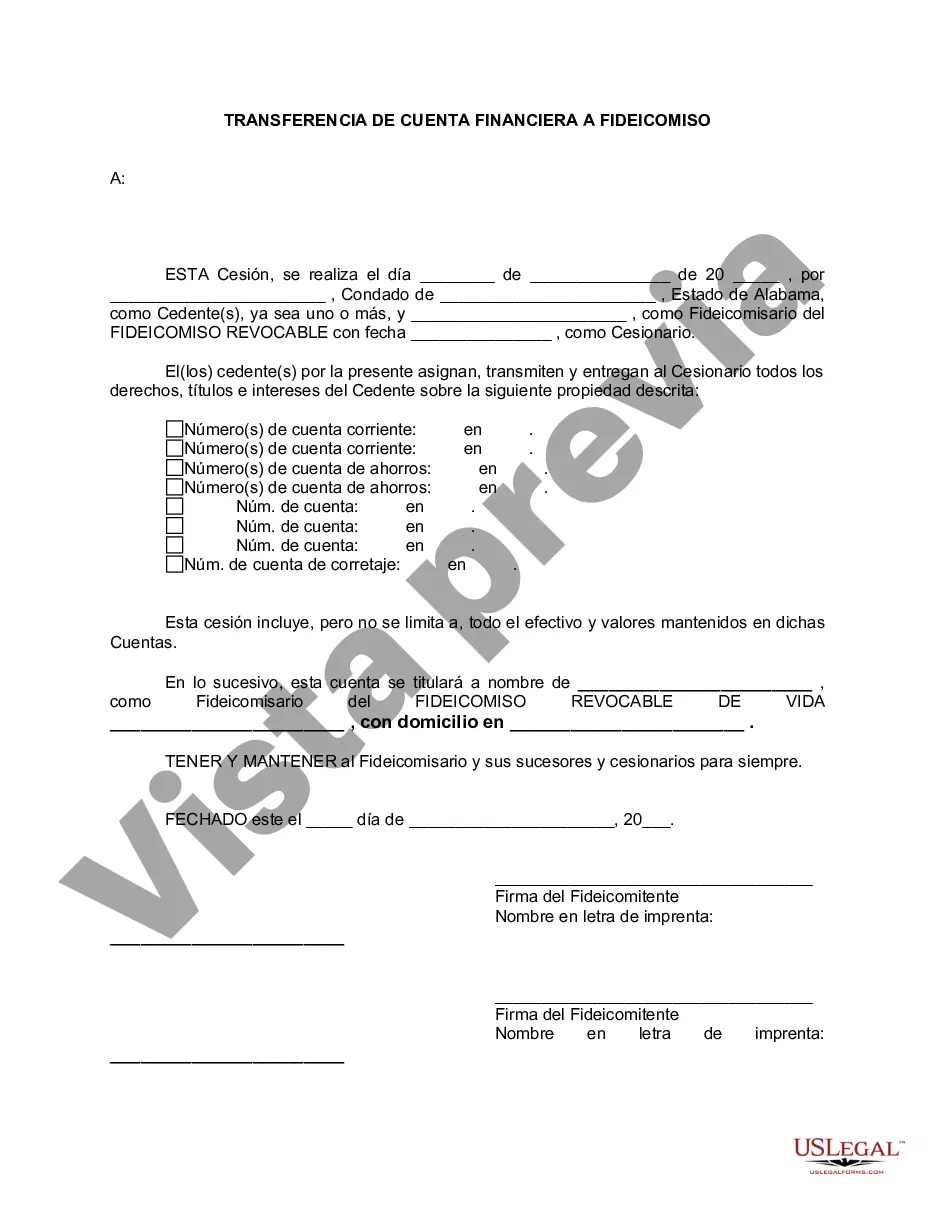

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Birmingham Alabama Transferencia de cuenta financiera a fideicomiso en vida - Alabama Financial Account Transfer to Living Trust

State:

Alabama

City:

Birmingham

Control #:

AL-E0178C

Format:

Word

Instant download

Description

Formulario para transferir cuentas financieras a un fideicomiso en vida.

Free preview

How to fill out Birmingham Alabama Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Regardless of social or professional standing, completing legal documentation is an unfortunate requirement in today's society.

Frequently, it’s almost unattainable for individuals without legal training to create such documents from scratch, primarily due to the intricate language and legal nuances involved.

This is where US Legal Forms proves to be beneficial.

Ensure the document you have selected is appropriate for your area since the laws of one state or region do not apply to another.

Review the document and read through a brief overview (if available) of scenarios the document can be utilized for.

- Our platform provides an extensive array of over 85,000 ready-to-use state-specific documents suitable for nearly any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors who wish to conserve time by utilizing our DIY documents.

- Regardless of whether you need the Birmingham Alabama Financial Account Transfer to Living Trust or any other documentation relevant to your state or region, everything is accessible with US Legal Forms.

- Here’s how you can quickly obtain the Birmingham Alabama Financial Account Transfer to Living Trust using our reliable platform.

- If you are currently a subscriber, you can proceed to Log In to your account to acquire the required document.

- However, if you are new to our platform, make sure to follow these steps before securing the Birmingham Alabama Financial Account Transfer to Living Trust.

Form popularity

Interesting Questions

More info

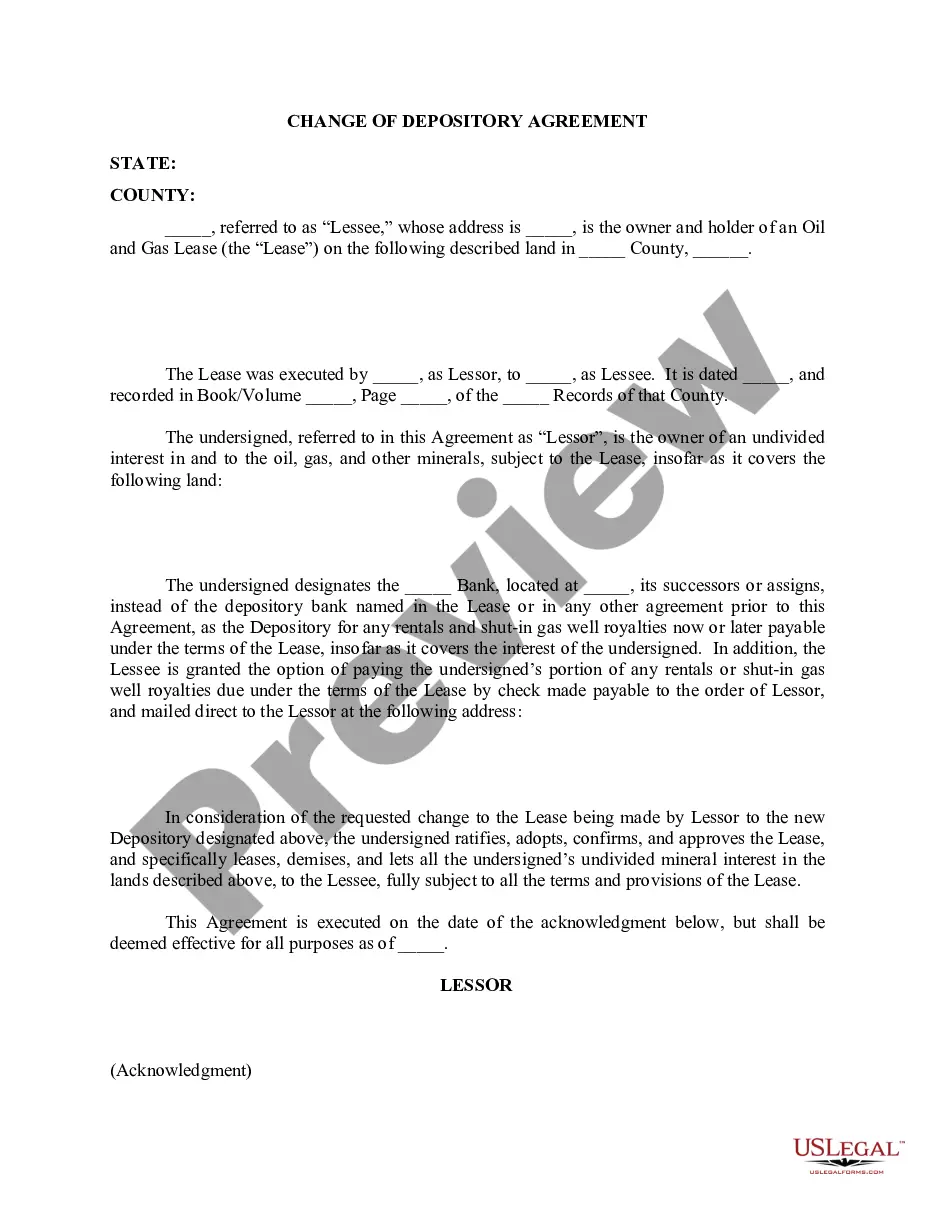

By establishing a living trust, you can list out the specific terms and conditions for how your beneficiaries are to receive your assets. Checking and savings accounts, credit cards, mortgages, investments, small business, and commercial banking.Looking to open a bank account in Alabama? Will Beckum is an experienced estate planning lawyer in Birmingham, Alabama. Hear from Michael Liersch, Head of Advice and Planning, about how starting and updating your estate plan can help loved ones make the most out of life. Discover how Northern Trust delivers financial services and technological expertise for corporations, institutions and private individuals around the world. Transform the way you manage your money with the UK's best bank. Enjoy personal and business banking online and at your fingertips, always. Tom Hammett with MavenCross Wealth Advisors in Birmingham, AL is here to help you with all of your financial planning needs. Credit cards, Mortgages, Savings, ISAs, Investments and Insurance – Our quest to make banking better starts here.