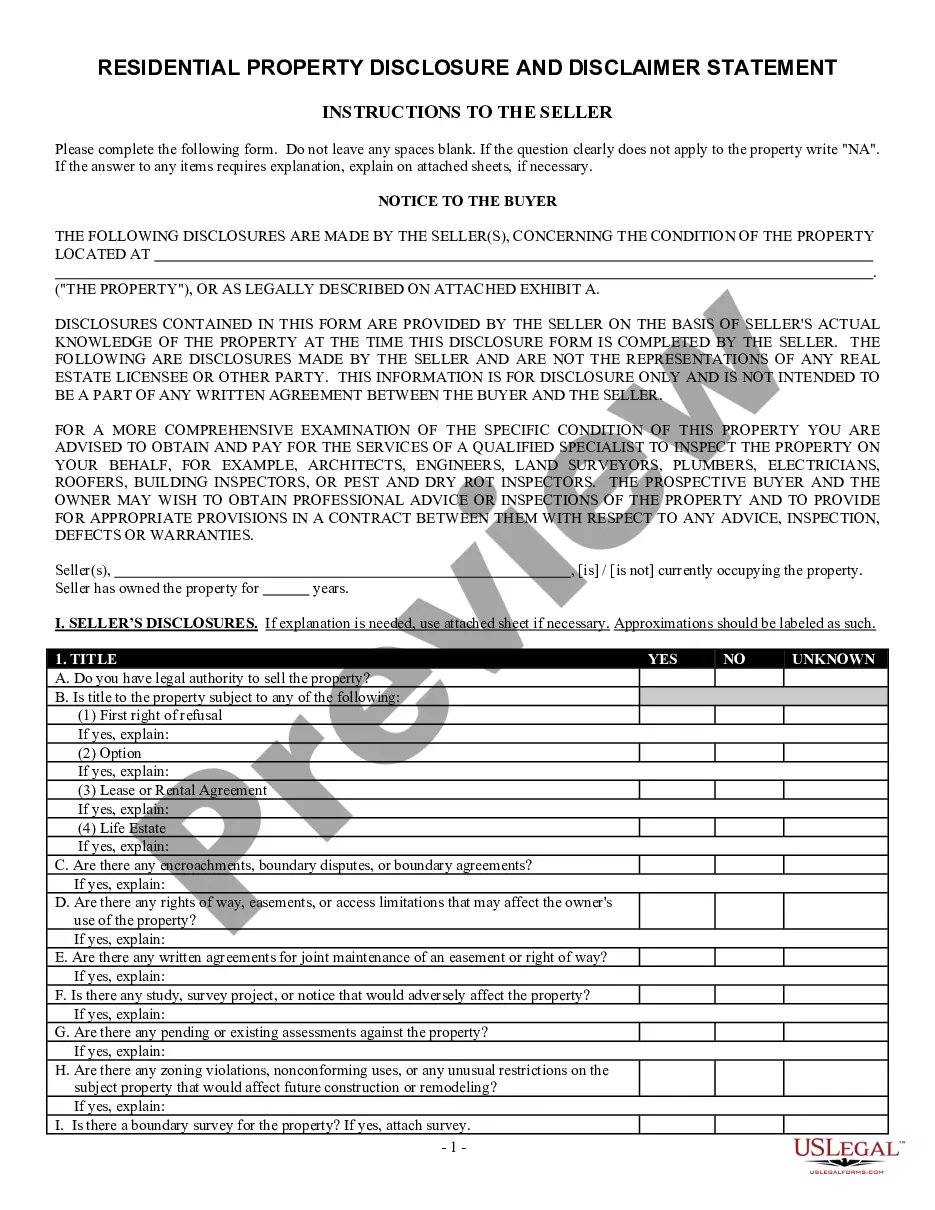

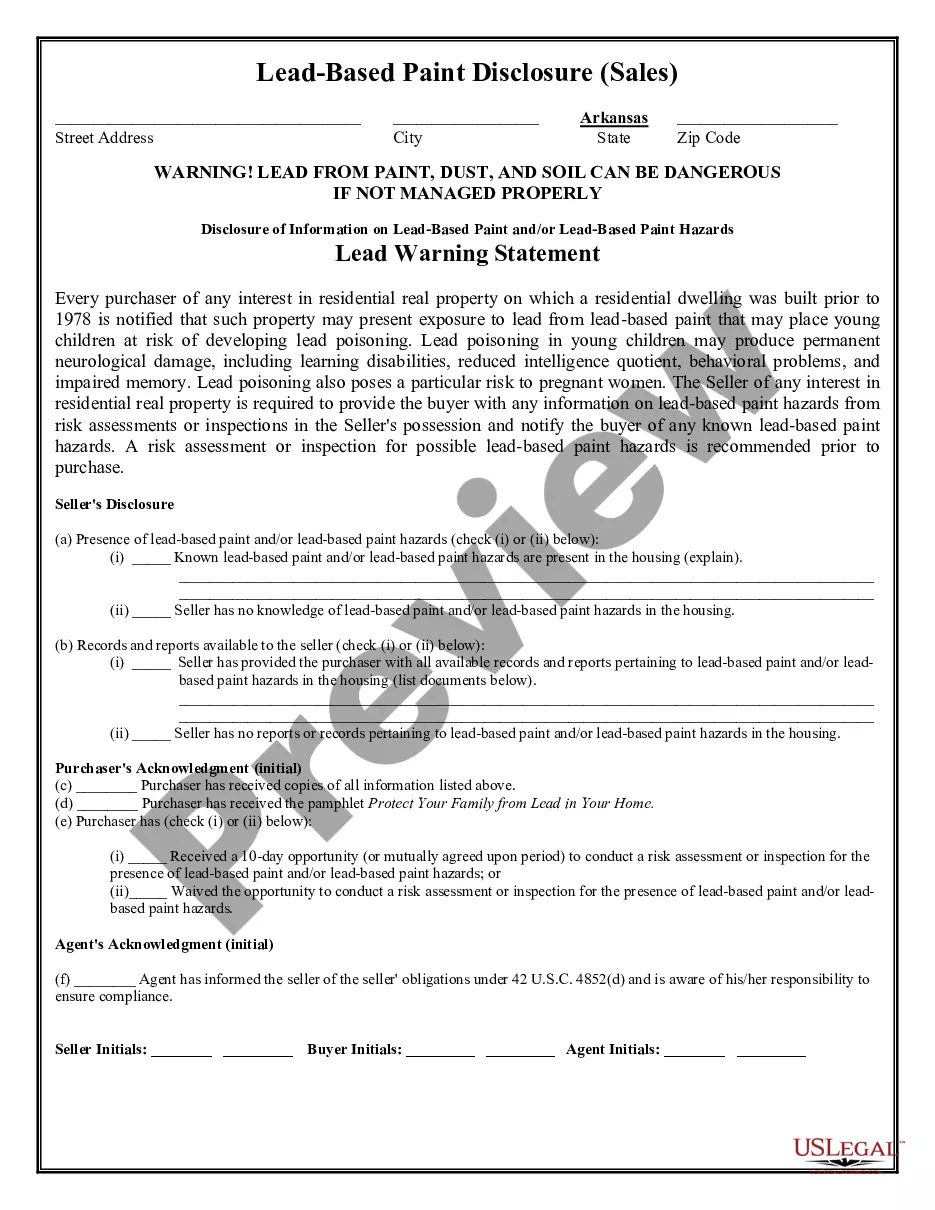

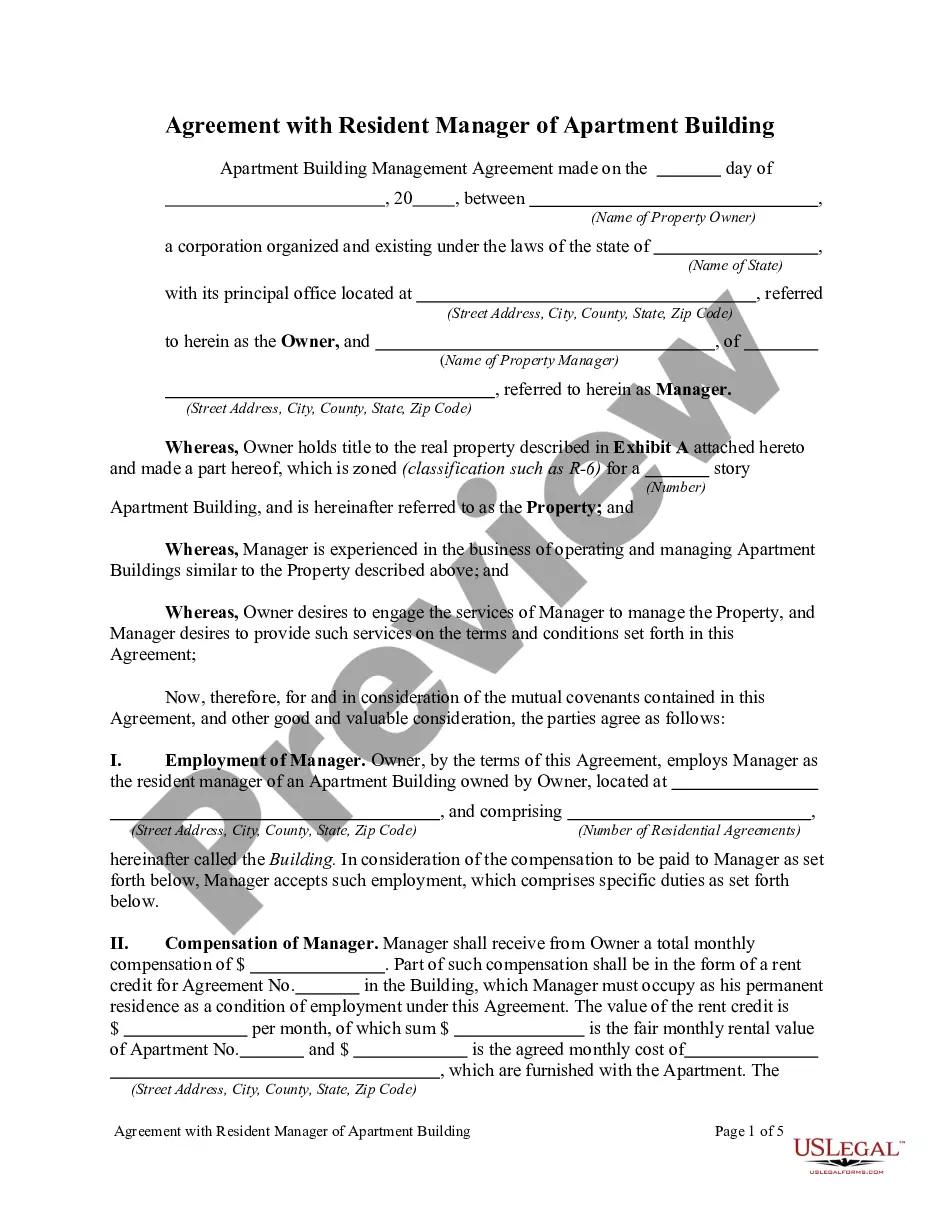

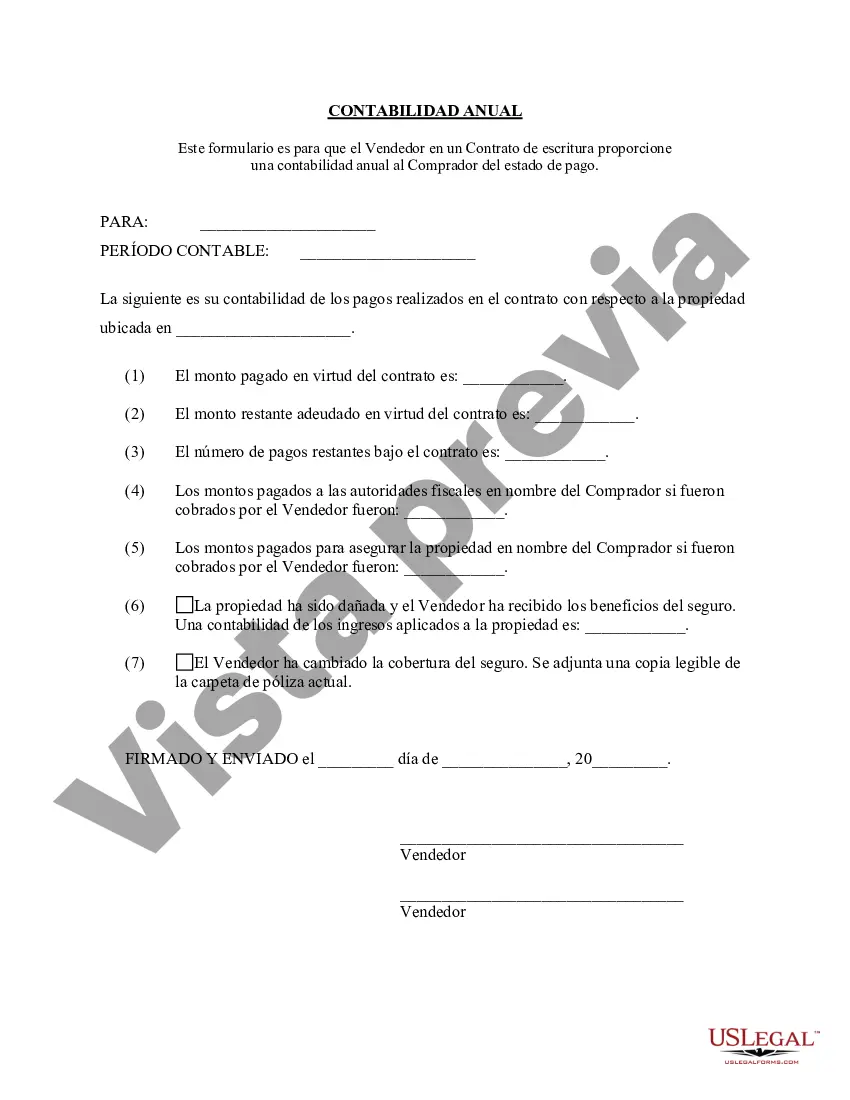

Little Rock Arkansas Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document provided by the seller in a contract for deed transaction in Little Rock, Arkansas. This statement outlines the financial transactions, income, and expenses related to the property being sold through this type of agreement. It offers a transparent view of the financial status of the contract for deed agreement and helps both parties track and analyze the financial aspects of the transaction. Keywords: Little Rock Arkansas, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, income, expenses, property, agreement, transparent, financial status, parties, track, analyze. Different types of Little Rock Arkansas Contract for Deed Seller's Annual Accounting Statement may include: 1. Property-specific Annual Accounting Statement: This type of statement provides a detailed breakdown of the financial activities related to a specific property within the Little Rock, Arkansas area. It includes information such as rental income, property expenses, repairs, and maintenance costs. 2. Portfolio-based Annual Accounting Statement: This statement is designed for sellers who have multiple properties under contract for deed agreements in Little Rock, Arkansas. It provides an overview of the overall financial performance of all properties, consolidating the income and expenses from each property into one comprehensive statement. 3. Tax-optimized Annual Accounting Statement: This type of statement focuses on highlighting the tax benefits and implications of the contract for deed agreement in Little Rock, Arkansas. It includes information on deductible expenses, depreciation, and other tax-related considerations to ensure sellers can maximize their tax advantages. 4. Performance-based Annual Accounting Statement: This statement evaluates the financial performance of the contract for deed agreement in Little Rock, Arkansas over a specific period. It includes key indicators such as return on investment, cash flow analysis, and profit margin to provide a thorough assessment of the agreement's overall success. 5. Compliance-based Annual Accounting Statement: This type of statement ensures adherence to legal and regulatory obligations associated with contract for deed transactions in Little Rock, Arkansas. It includes information on financial reporting requirements, tax compliance, and any other relevant legal obligations sellers must fulfill. Keywords: Little Rock, Arkansas, Contract for Deed, Seller's Annual Accounting Statement, property-specific, portfolio-based, tax-optimized, performance-based, compliance-based, financial activities, income, expenses, rental income, property expenses, repairs, maintenance costs, tax benefits, deductible expenses, tax implications, return on investment, cash flow analysis, profit margin, legal obligations, regulatory compliance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Little Rock Arkansas Contrato de Escrituración Estado Contable Anual del Vendedor - Arkansas Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Little Rock Arkansas Contrato De Escrituración Estado Contable Anual Del Vendedor?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Little Rock Arkansas Contract for Deed Seller's Annual Accounting Statement becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Little Rock Arkansas Contract for Deed Seller's Annual Accounting Statement takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve picked the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Little Rock Arkansas Contract for Deed Seller's Annual Accounting Statement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!