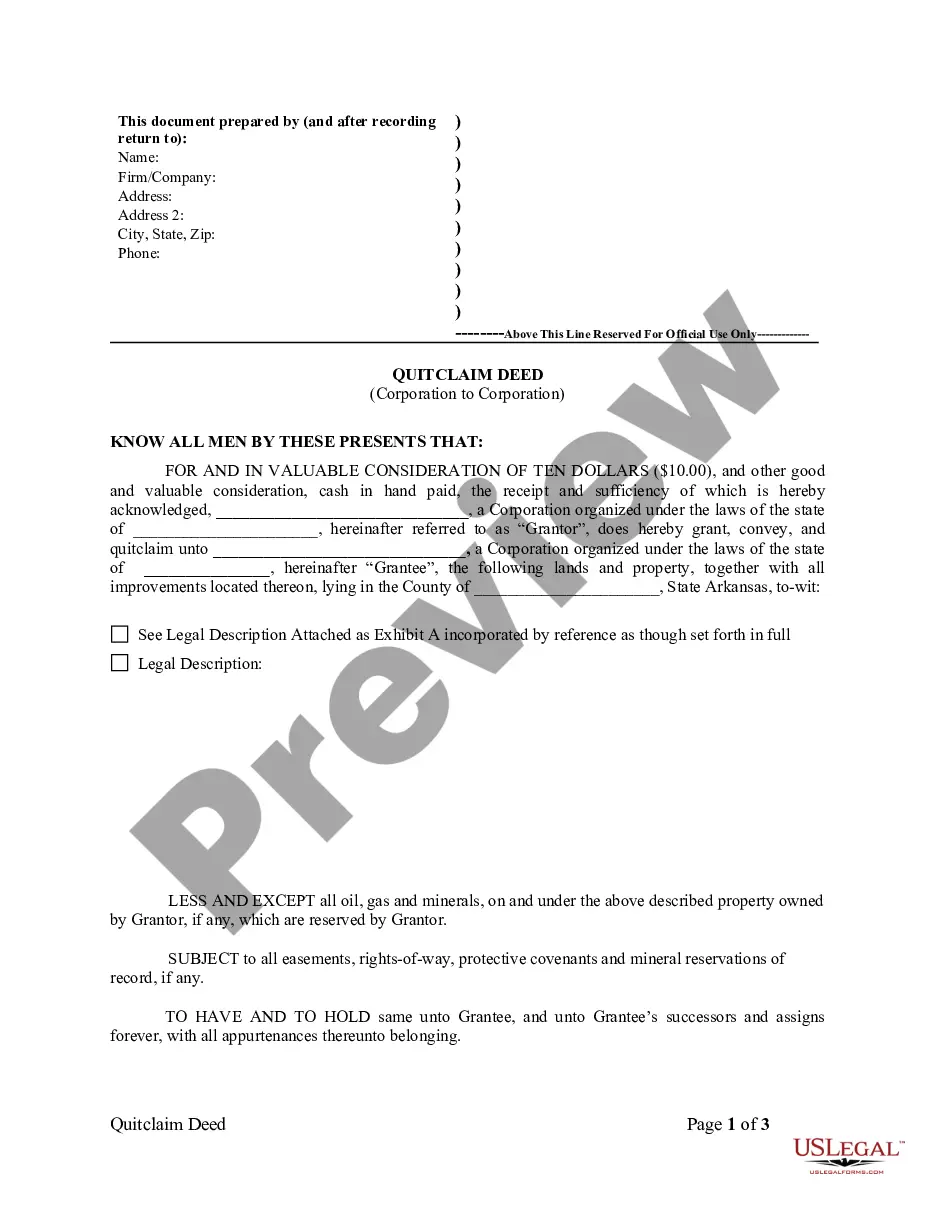

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Little Rock Arkansas Quitclaim Deed from Corporation to Corporation is a legal document that enables one corporation to transfer ownership rights of a property or real estate to another corporation without offering any warranties. In this type of transfer, the granter (the corporation transferring the property) is not guaranteeing that they own the property outright or guaranteeing the property's condition. Instead, it simply conveys whatever interest the granter has in the property to the grantee (the corporation receiving the property). It is important to note that a quitclaim deed does not provide any protection against potential claims or liens on the property. There are various types of Little Rock Arkansas Quitclaim Deeds from Corporation to Corporation, which may include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used in Little Rock, Arkansas. It transfers the property ownership from one corporation to another without any specific conditions or limitations. 2. Special Quitclaim Deed: This type of quitclaim deed includes specific conditions or limitations agreed upon by both the transferor and transferee corporations. These conditions might include restrictions on property usage or granting only a partial interest in the property. 3. Non-Warranty Quitclaim Deed: This type of quitclaim deed provides no warranties or guarantees related to the property's title, ownership, or condition. The granter corporation relinquishes any claims it may have on the property and transfers whatever interests it holds to the grantee corporation. 4. Assumed Name Quitclaim Deed: In certain cases, corporations may use an assumed name or "DBA" (which stands for "doing business as"). In such cases, a quitclaim deed may be used to transfer property from one corporation with an assumed name to another corporation with either the actual legal name or another assumed name. It is vital for both the granter and grantee corporations to consult with legal professionals while drafting and executing a quitclaim deed to ensure that the transaction is legally valid, and the transfer of property rights is correctly documented.A Little Rock Arkansas Quitclaim Deed from Corporation to Corporation is a legal document that enables one corporation to transfer ownership rights of a property or real estate to another corporation without offering any warranties. In this type of transfer, the granter (the corporation transferring the property) is not guaranteeing that they own the property outright or guaranteeing the property's condition. Instead, it simply conveys whatever interest the granter has in the property to the grantee (the corporation receiving the property). It is important to note that a quitclaim deed does not provide any protection against potential claims or liens on the property. There are various types of Little Rock Arkansas Quitclaim Deeds from Corporation to Corporation, which may include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used in Little Rock, Arkansas. It transfers the property ownership from one corporation to another without any specific conditions or limitations. 2. Special Quitclaim Deed: This type of quitclaim deed includes specific conditions or limitations agreed upon by both the transferor and transferee corporations. These conditions might include restrictions on property usage or granting only a partial interest in the property. 3. Non-Warranty Quitclaim Deed: This type of quitclaim deed provides no warranties or guarantees related to the property's title, ownership, or condition. The granter corporation relinquishes any claims it may have on the property and transfers whatever interests it holds to the grantee corporation. 4. Assumed Name Quitclaim Deed: In certain cases, corporations may use an assumed name or "DBA" (which stands for "doing business as"). In such cases, a quitclaim deed may be used to transfer property from one corporation with an assumed name to another corporation with either the actual legal name or another assumed name. It is vital for both the granter and grantee corporations to consult with legal professionals while drafting and executing a quitclaim deed to ensure that the transaction is legally valid, and the transfer of property rights is correctly documented.