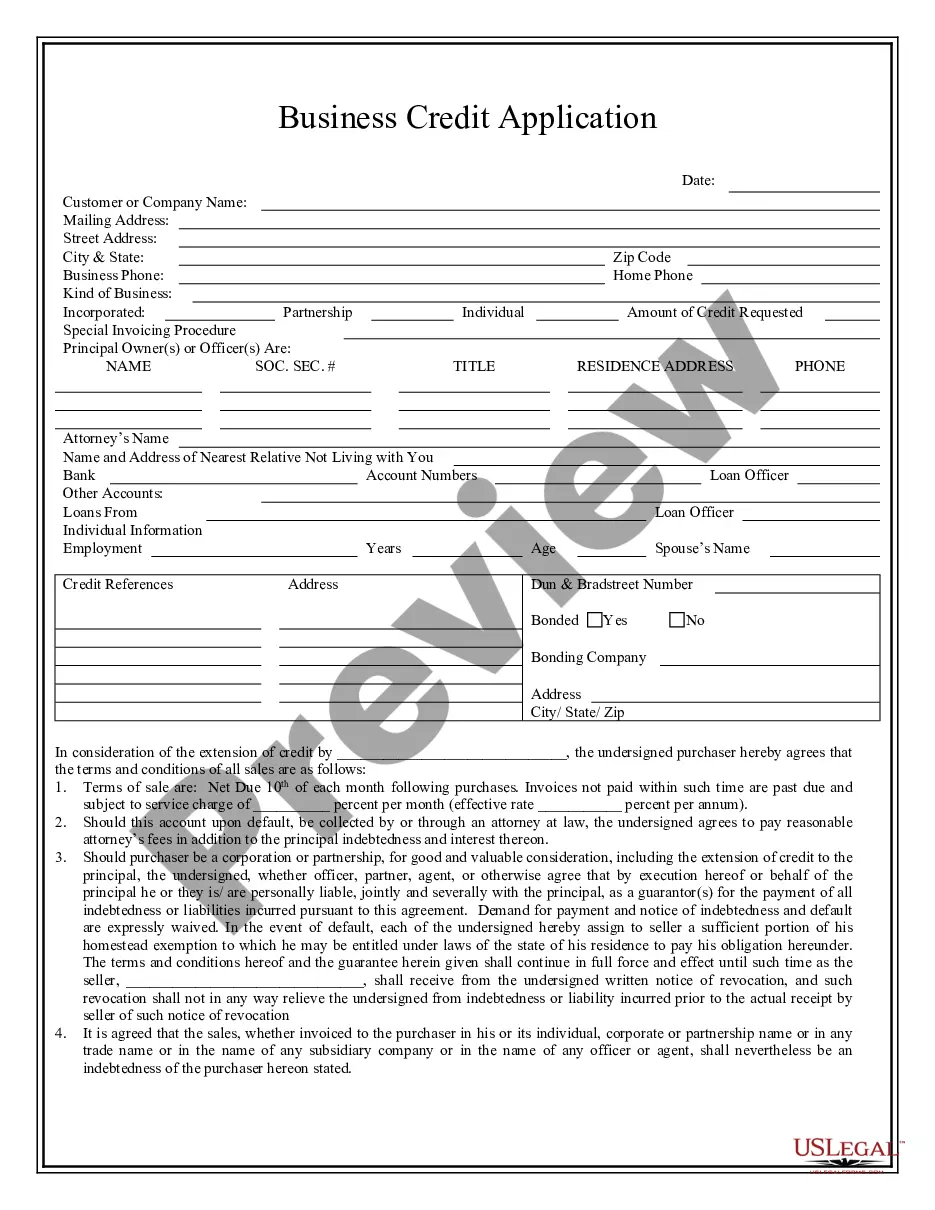

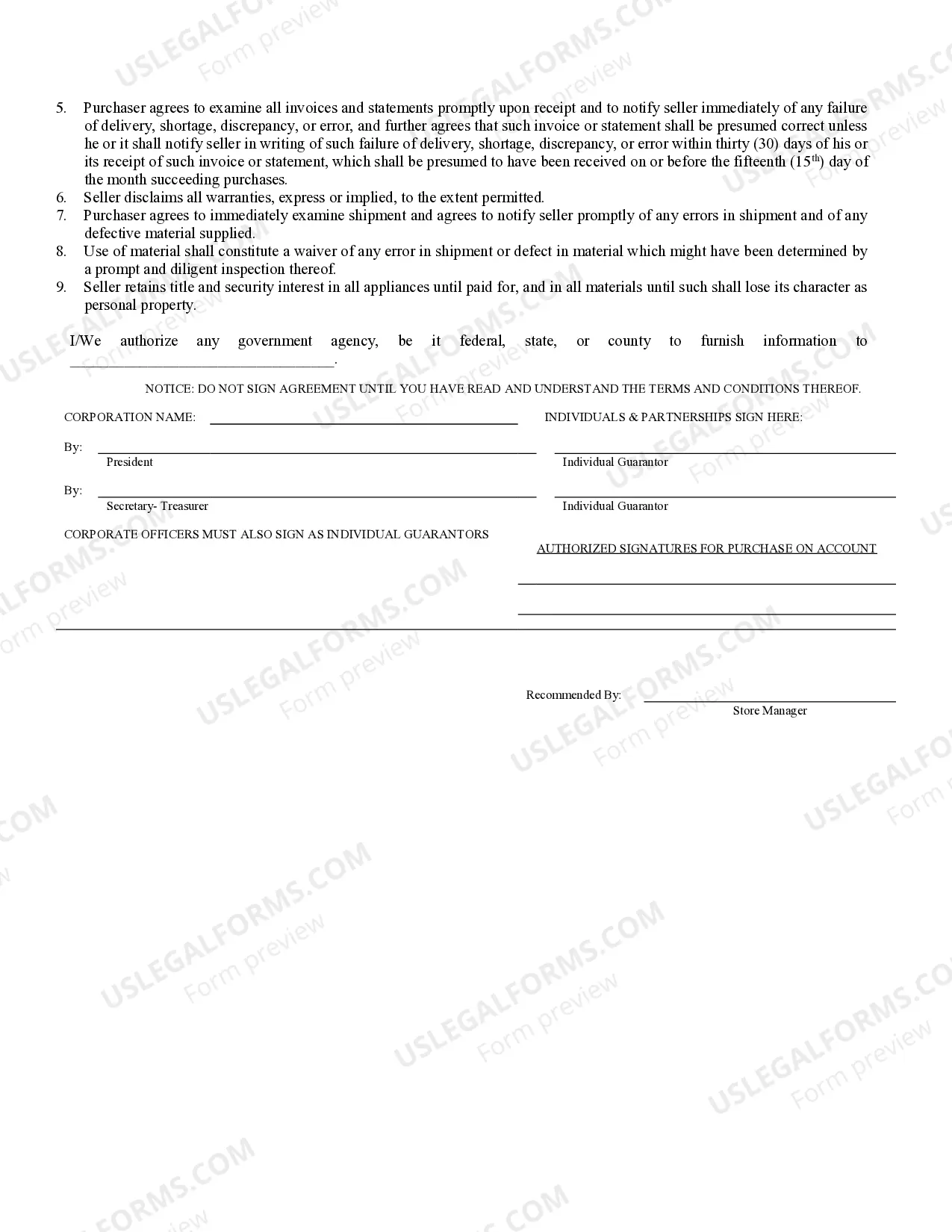

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Little Rock Arkansas Business Credit Application is a standardized form used by businesses in Little Rock, Arkansas, to apply for credit from financial institutions or suppliers. This application is crucial for businesses seeking to establish or expand their credit lines, acquire essential financing for their operations, or negotiate better terms with suppliers. By filling out this application, businesses provide the required information for lenders or vendors to assess their creditworthiness and make informed decisions regarding extending credit. Keywords: Little Rock Arkansas, Business Credit Application, credit, financial institutions, suppliers, credit lines, financing, operations, terms, lenders, creditworthiness, decisions, extending credit. There are several types of Little Rock Arkansas Business Credit Applications available, designed for various purposes or industries: 1. Small Business Credit Application: Tailored specifically for small businesses, this type of application focuses on the unique financial needs and challenges faced by these enterprises. It considers factors such as annual revenue, number of employees, years in operation, and the purpose of the credit requested. 2. Corporate Credit Application: Geared towards larger corporations or companies with complex financial structures, this application requires more detailed information about the business's financial history, assets, liabilities, and shareholder structure. Additional information about the business's industry, market share, and competition may also be included. 3. Supplier Credit Application: This type of application is used when a business wants to establish a credit line with a specific supplier. The application highlights the potential benefits of granting credit to the supplier, such as increased sales volumes, long-term partnership opportunities, and any existing vendor relationships. 4. Line of Credit Application: Businesses looking for a revolving credit facility or a predetermined credit limit can use this type of application. It outlines the maximum credit amount requested and may require businesses to provide details about their current financial obligations, collateral, and repayment plans. 5. Trade Credit Application: Trade credit refers to credit extended by one business to another to facilitate ongoing transactions. This application focuses on the credit history, payment terms, and trade references of the applicant business, as well as the intended trade relationship with the creditor. 6. Construction Credit Application: Aimed specifically at construction-related businesses, this application takes into account the unique nature of the construction industry. It may require information on projects completed, outstanding contracts, subcontractor relationships, and bonding capacity. 7. Startup Business Credit Application: Geared towards newly established businesses or startups, this application acknowledges the challenges faced by businesses with limited financial history. It may place more emphasis on the business plan, projected financials, industry potential, and the entrepreneur's background and experience. Using these various Little Rock Arkansas Business Credit Application types allows businesses to customize their approach based on their specific needs, ensuring that they present a comprehensive and tailored request for credit to potential lenders or suppliers.Little Rock Arkansas Business Credit Application is a standardized form used by businesses in Little Rock, Arkansas, to apply for credit from financial institutions or suppliers. This application is crucial for businesses seeking to establish or expand their credit lines, acquire essential financing for their operations, or negotiate better terms with suppliers. By filling out this application, businesses provide the required information for lenders or vendors to assess their creditworthiness and make informed decisions regarding extending credit. Keywords: Little Rock Arkansas, Business Credit Application, credit, financial institutions, suppliers, credit lines, financing, operations, terms, lenders, creditworthiness, decisions, extending credit. There are several types of Little Rock Arkansas Business Credit Applications available, designed for various purposes or industries: 1. Small Business Credit Application: Tailored specifically for small businesses, this type of application focuses on the unique financial needs and challenges faced by these enterprises. It considers factors such as annual revenue, number of employees, years in operation, and the purpose of the credit requested. 2. Corporate Credit Application: Geared towards larger corporations or companies with complex financial structures, this application requires more detailed information about the business's financial history, assets, liabilities, and shareholder structure. Additional information about the business's industry, market share, and competition may also be included. 3. Supplier Credit Application: This type of application is used when a business wants to establish a credit line with a specific supplier. The application highlights the potential benefits of granting credit to the supplier, such as increased sales volumes, long-term partnership opportunities, and any existing vendor relationships. 4. Line of Credit Application: Businesses looking for a revolving credit facility or a predetermined credit limit can use this type of application. It outlines the maximum credit amount requested and may require businesses to provide details about their current financial obligations, collateral, and repayment plans. 5. Trade Credit Application: Trade credit refers to credit extended by one business to another to facilitate ongoing transactions. This application focuses on the credit history, payment terms, and trade references of the applicant business, as well as the intended trade relationship with the creditor. 6. Construction Credit Application: Aimed specifically at construction-related businesses, this application takes into account the unique nature of the construction industry. It may require information on projects completed, outstanding contracts, subcontractor relationships, and bonding capacity. 7. Startup Business Credit Application: Geared towards newly established businesses or startups, this application acknowledges the challenges faced by businesses with limited financial history. It may place more emphasis on the business plan, projected financials, industry potential, and the entrepreneur's background and experience. Using these various Little Rock Arkansas Business Credit Application types allows businesses to customize their approach based on their specific needs, ensuring that they present a comprehensive and tailored request for credit to potential lenders or suppliers.