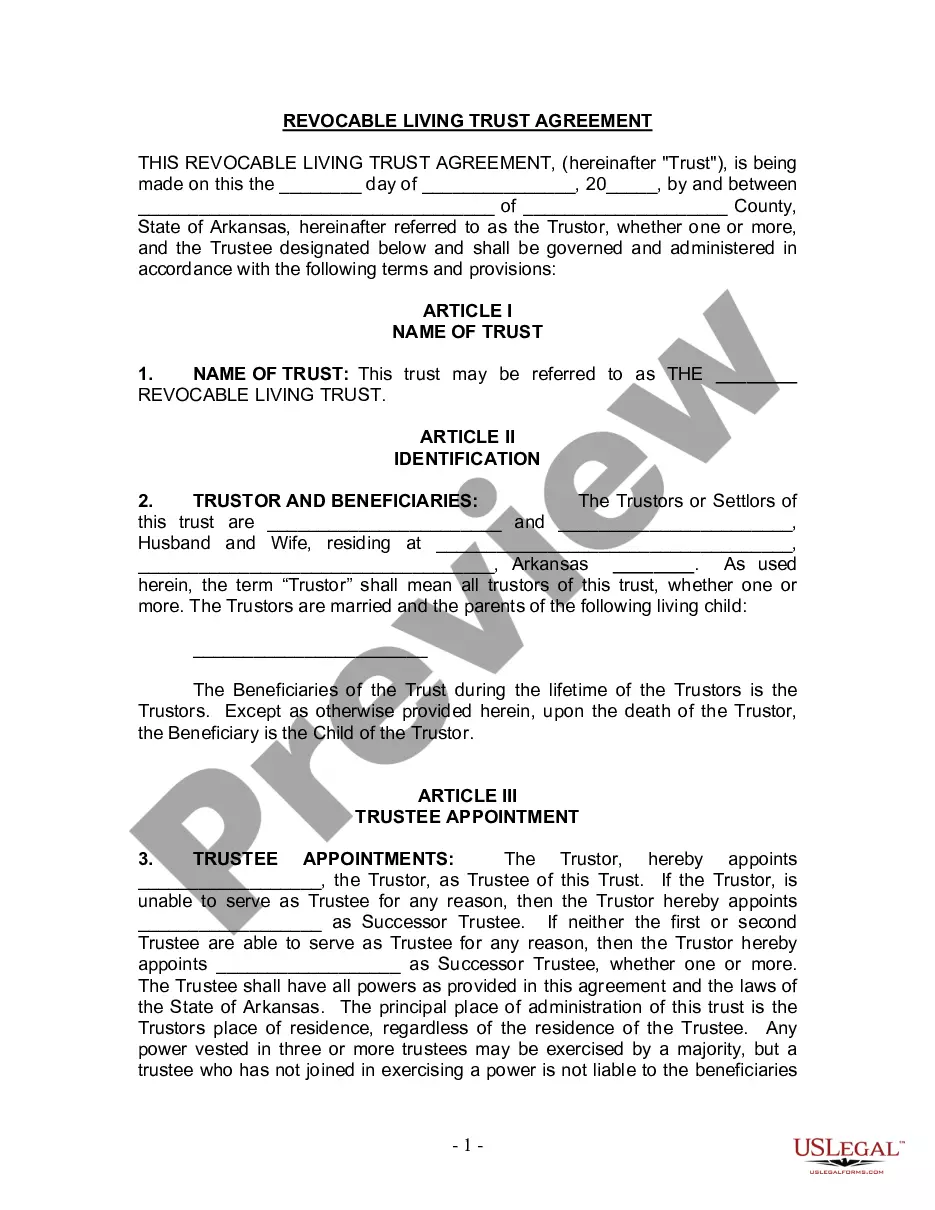

This is a living trust form prepared for your sState. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Little Rock Arkansas Living Trust for Husband and Wife with One Child

Description

How to fill out Arkansas Living Trust For Husband And Wife With One Child?

If you are looking for a pertinent form template, it’s hard to select a more user-friendly service than the US Legal Forms website – one of the most comprehensive libraries online.

Here you can obtain a substantial number of document samples for business and personal purposes by categories and regions, or keywords.

With the excellent search feature, locating the most recent Little Rock Arkansas Living Trust for Husband and Wife with One Child is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finish the registration process.

Acquire the template. Specify the file format and save it to your device.

- Moreover, the validity of each document is verified by a team of experienced lawyers who routinely review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our system and possess an account, all you need to do to acquire the Little Rock Arkansas Living Trust for Husband and Wife with One Child is to Log In to your user account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions provided below.

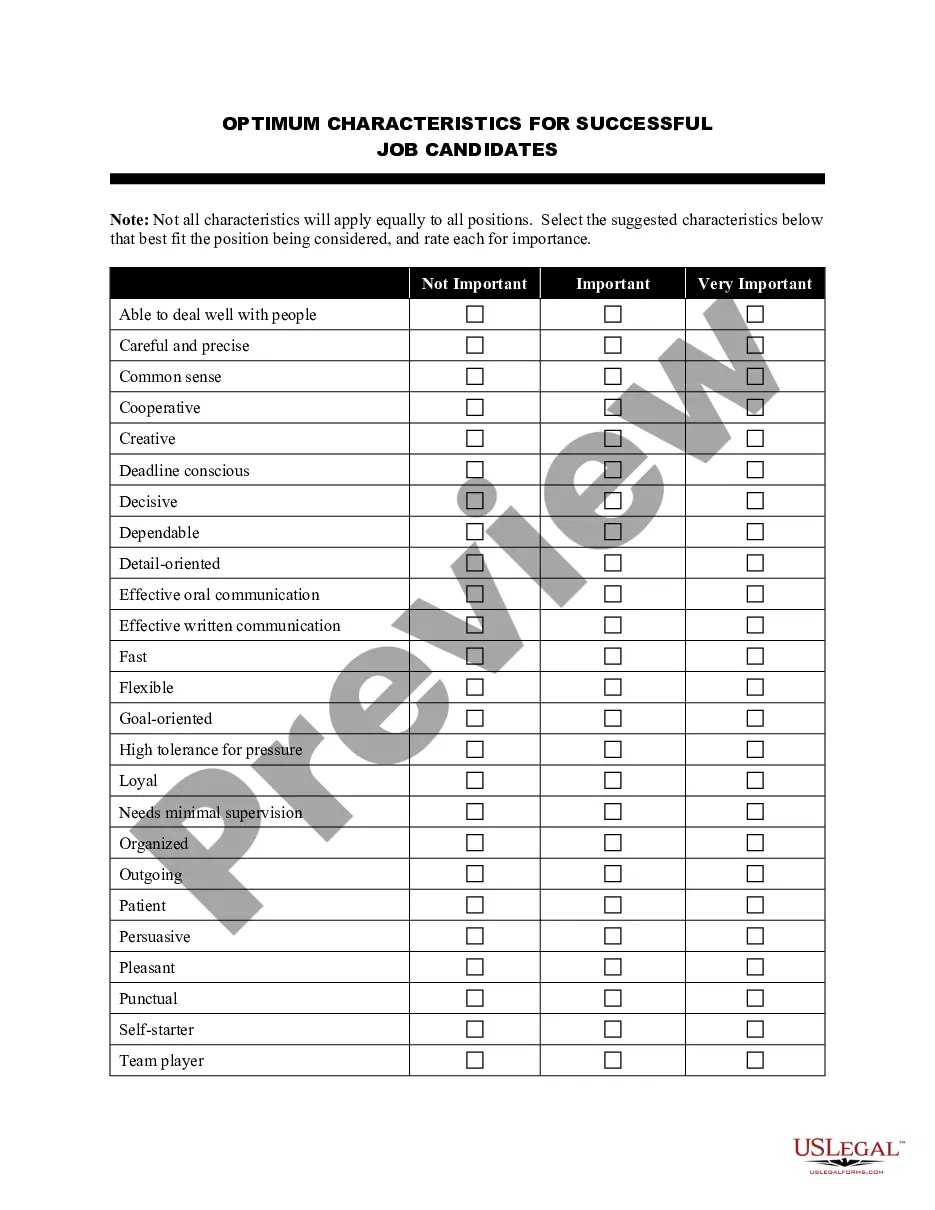

- Ensure you have accessed the sample you need. Review its description and use the Preview feature to examine its content. If it doesn’t meet your requirements, use the Search box at the top of the page to find the correct document.

- Confirm your selection. Choose the Buy now button. Then, select the desired pricing plan and provide details to create an account.

Form popularity

FAQ

The purpose of a spousal trust is to secure assets for the benefit of a surviving partner while protecting the interests of any children. In a Little Rock Arkansas Living Trust for Husband and Wife with One Child, this trust ensures that assets are managed according to the couple's wishes after one spouse passes. It can provide financial support for the surviving spouse, while also ensuring that their child benefits in the long term. This structure allows for thoughtful planning and peace of mind.

A spousal trust can create complexities and potential limitations. In the case of a Little Rock Arkansas Living Trust for Husband and Wife with One Child, both spouses must agree on asset management decisions, which can lead to disputes. Additionally, setting up and maintaining a trust may involve time and costs that some couples find burdensome. It is vital to weigh these factors against the benefits of protection and control.

Choosing between a trust and a will in Arkansas depends on your specific circumstances. A Little Rock Arkansas Living Trust for Husband and Wife with One Child offers benefits such as avoiding probate and maintaining privacy, while a will may be simpler and less expensive initially. However, trusts provide more control over asset distribution and can streamline the process for your heirs. Evaluating your needs and goals is essential; many choose a living trust for these advantages.

A joint trust is a legal arrangement that allows a husband and wife to manage their assets together. In the context of a Little Rock Arkansas Living Trust for Husband and Wife with One Child, both spouses contribute to the trust, retaining control during their lifetimes. Upon the passing of one spouse, the trust usually becomes irrevocable, and assets transfer seamlessly to the surviving spouse and, eventually, to their child. This arrangement helps avoid probate and provides financial security for the family.

One disadvantage of a family trust is that it may complicate financial situations. Establishing a trust requires careful planning and could incur costs that some families may find burdensome. For those engaged in creating a Little Rock Arkansas Living Trust for Husband and Wife with One Child, understanding these complexities is crucial for effective long-term planning.

Yes, you can create your own living trust in Arkansas, but it's important to proceed with caution. While templates are available, a Little Rock Arkansas Living Trust for Husband and Wife with One Child requires careful consideration of legal language and local laws to ensure validity. It may be beneficial to seek assistance from professionals like USLegalForms to avoid potential pitfalls.

Parents often make the mistake of not specifying detailed instructions for how and when funds should be distributed. This oversight can lead to confusion or misuse of the trust assets by beneficiaries. When creating a Little Rock Arkansas Living Trust for Husband and Wife with One Child, it’s essential to clearly outline your intentions to ensure that your child’s needs are met as they grow.

No, a trust does not have to go through probate in Arkansas, making it a valuable option for estate planning. A properly established Little Rock Arkansas Living Trust for Husband and Wife with One Child can bypass the lengthy and costly probate process. This feature offers quicker asset distribution, providing peace of mind to families and ensuring that your loved ones receive their inheritance without delays.

One significant mistake parents often make when setting up a trust fund is not involving all relevant family members in the decision-making process. This can lead to misunderstandings or even disputes later on. For those considering a comparable strategy, understanding the importance of clear communication is crucial when creating a Little Rock Arkansas Living Trust for Husband and Wife with One Child.

While trusts offer many benefits, there are negative aspects to consider. For instance, the initial setup can be costly and require legal services, which may deter some couples. Furthermore, trusts sometimes lack the flexibility needed for changing family circumstances, which can be particularly challenging for a Little Rock Arkansas Living Trust for Husband and Wife with One Child as your situation evolves.