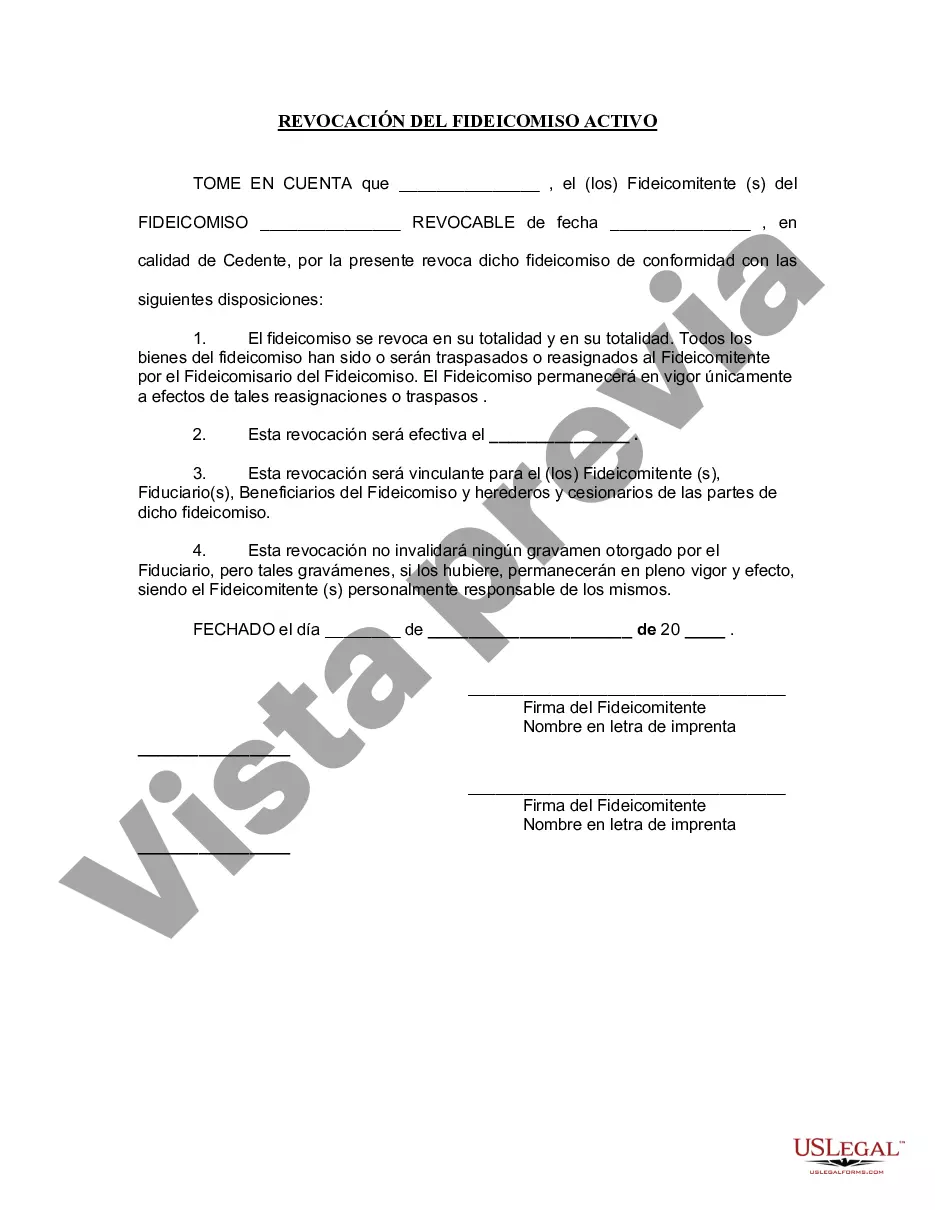

Little Rock Arkansas Revocation of Living Trust is a legal process that allows individuals in Little Rock, Arkansas, to terminate or abolish an existing living trust. A living trust is a legal document that enables individuals to transfer their assets to designated beneficiaries while avoiding probate. However, situations may arise where one needs to make amendments, modifications, or completely revoke their living trust. The revocation process for a Little Rock Arkansas Living Trust involves several important steps. Firstly, the granter, the person who established the trust, must draft a revocation document that clearly states their intention to terminate the trust. This document typically includes crucial information such as the date of the trust, the names of the granter and beneficiaries, and details regarding the trust's assets. Once the revocation document is completed, it must be notarized and signed by the granter. It is crucial to ensure that the revocation document complies with the legal requirements outlined by the state of Arkansas and any specific instructions stated in the original trust agreement. Additionally, copies of the revocation document should be kept in a safe place and distributed to any relevant parties, such as the trustee and beneficiaries. There are different types of Little Rock Arkansas Revocation of Living Trust based on the circumstances of the revocation. Some common types include: 1. Full Revocation: This type of revocation is selected when the granter wishes to completely terminate the living trust, discontinue its provisions, and distribute the assets directly to beneficiaries or make alternative estate planning arrangements. 2. Partial Revocation: If the granter wants to make changes to specific aspects of the living trust, such as amending the trustees or altering certain terms, a partial revocation is required. This allows for modifications without fully revoking the trust. 3. Specific Asset Revocation: In certain cases, the granter may choose to revoke the living trust for only specific assets. This can be relevant when the granter wants to transfer specific assets to a different entity or a newly created trust. It is crucial to consult with an experienced attorney specializing in estate planning and trust administration while executing a Little Rock Arkansas Revocation of Living Trust. They can provide personalized guidance, ensure compliance with legal requirements, and address any potential tax implications or consequences of the revocation. This professional assistance will help individuals navigate the complexities of revoking a living trust with confidence and accuracy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Little Rock Arkansas Revocación de fideicomiso en vida - Arkansas Revocation of Living Trust

Description

How to fill out Little Rock Arkansas Revocación De Fideicomiso En Vida?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Little Rock Arkansas Revocation of Living Trust gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Little Rock Arkansas Revocation of Living Trust takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve selected the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Little Rock Arkansas Revocation of Living Trust. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!