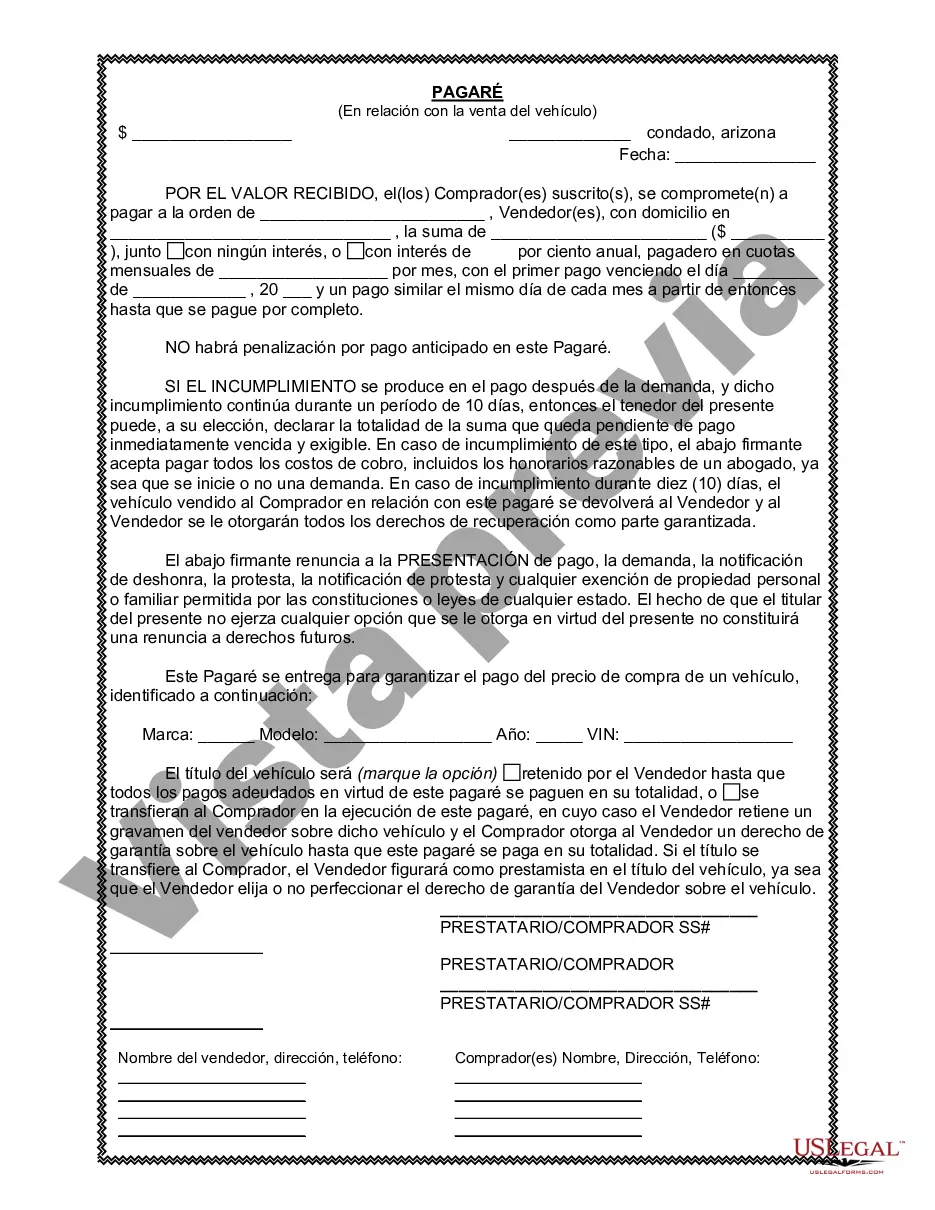

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

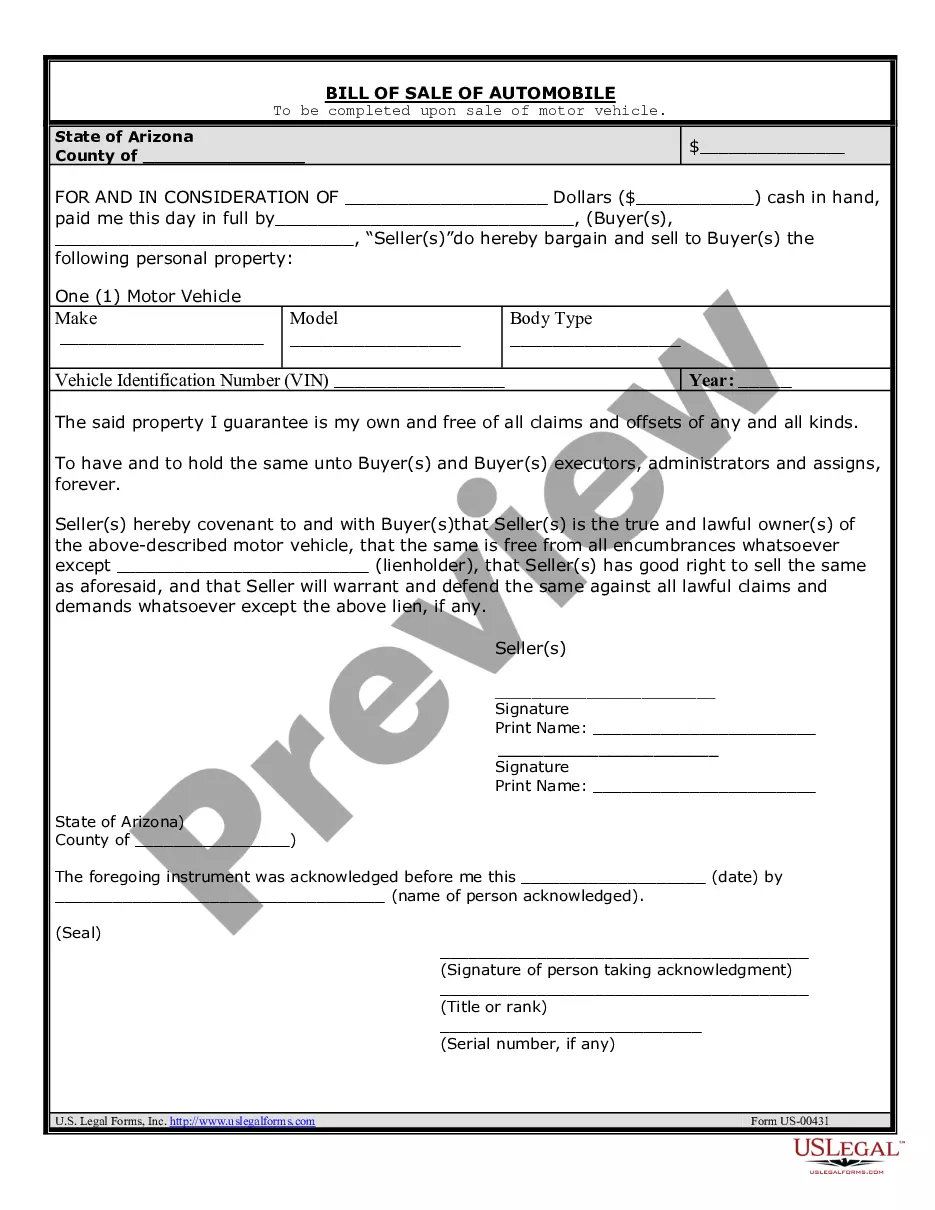

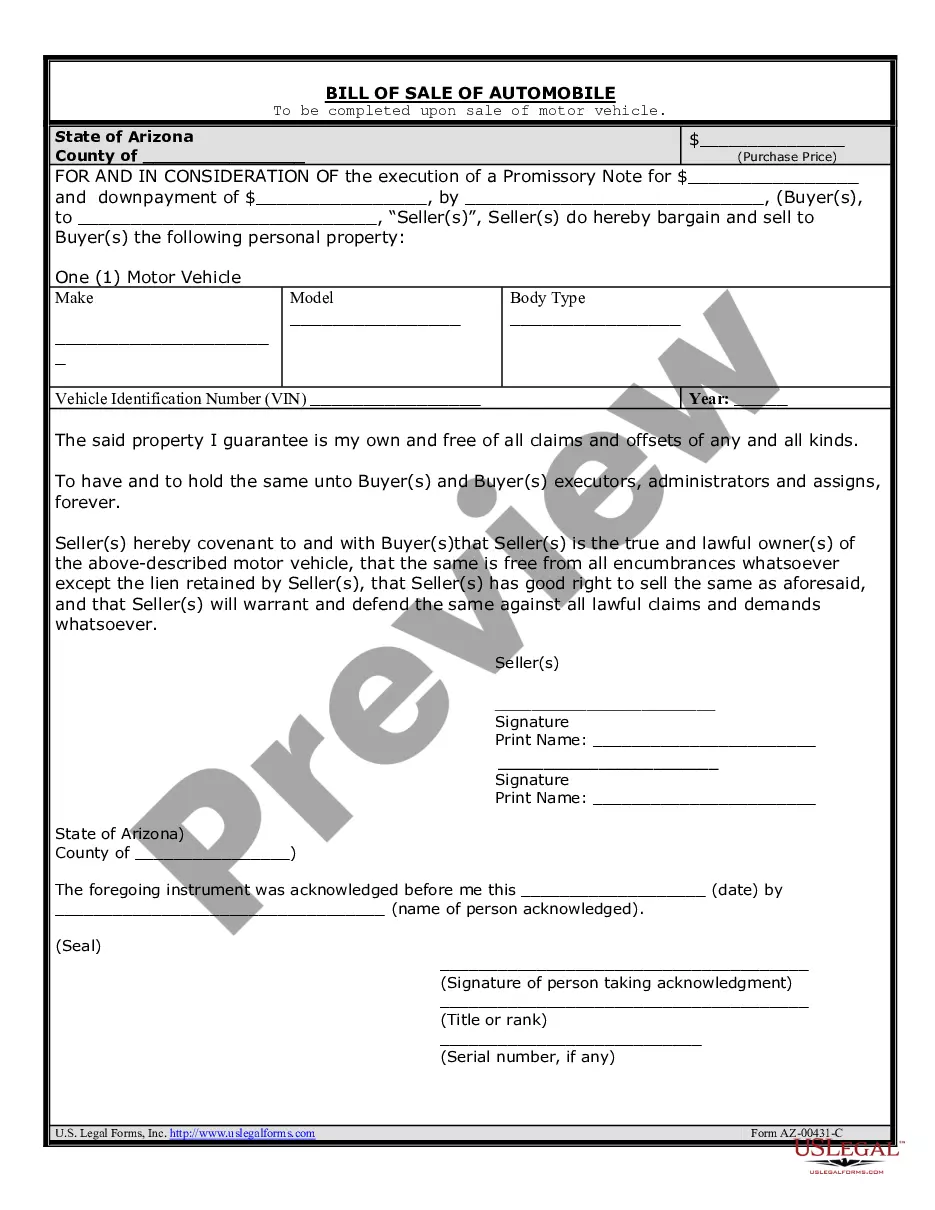

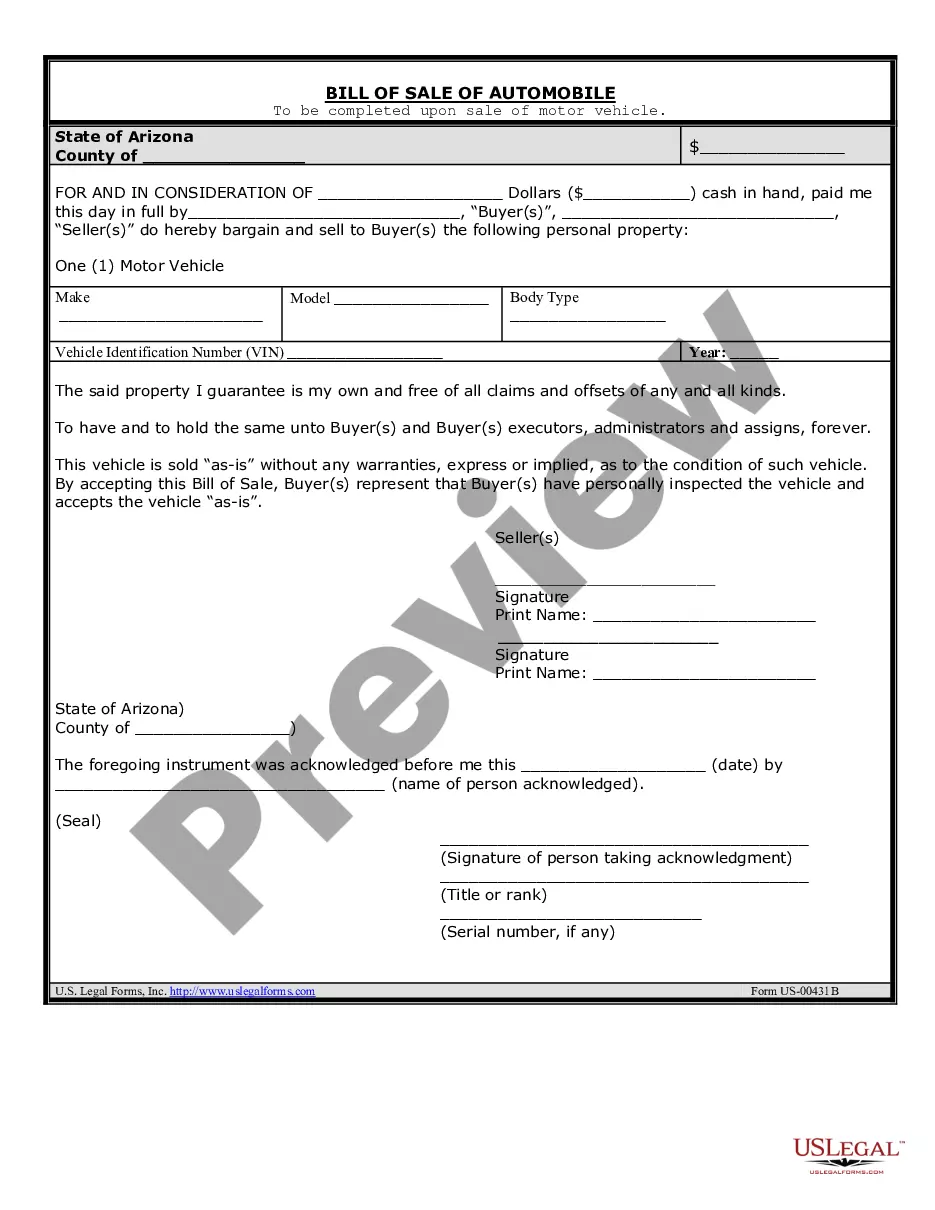

A Tempe Arizona Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement for the purchase of a vehicle. It serves as evidence of the borrower's promise to repay the lender a specific amount of money within a specified timeframe, typically with interest. Keywords: Tempe Arizona, Promissory Note, Sale of Vehicle, Automobile. There are two types of Tempe Arizona Promissory Notes commonly used in connection with the sale of a vehicle or automobile: 1. Secured Promissory Note: This type of promissory note is used when the buyer needs financing to purchase a vehicle. It includes specific details about the vehicle, such as make, model, year, and identification number (VIN). The note acts as collateral, with the vehicle serving as security for the loan. If the borrower defaults on payments, the lender has the right to repossess the vehicle. 2. Unsecured Promissory Note: This type of promissory note is used when the buyer and seller agree to a private loan arrangement without any collateral. In this case, the vehicle's ownership is transferred to the buyer, but the seller retains a legal interest in the vehicle until the debt is fully repaid. If the borrower defaults, the seller may take legal action to reclaim the vehicle. Regardless of the type, a Tempe Arizona Promissory Note in connection with the sale of a vehicle or automobile typically includes the following details: 1. Parties involved: Names, addresses, and contact information of both the borrower (buyer) and lender (seller). 2. Vehicle information: Make, model, year, and VIN of the vehicle being sold. 3. Loan amount: The total amount of money being borrowed by the buyer. 4. Repayment terms: The agreed-upon repayment schedule, including the frequency of payments (monthly, bi-monthly, etc.), the due date for each payment, and the number of installments. 5. Interest rate: The interest rate charged on the loan, if applicable. 6. Late payment penalties: Any additional charges for late or missed payments. 7. Default consequences: The actions that can be taken by the lender in case of default, such as repossession, legal action, or collection fees. 8. Governing law: The note should specify that it is subject to the laws of Tempe, Arizona. 9. Signatures: Both parties must sign and date the agreement to make it legally binding. It is essential to consult with a legal professional or seek expert advice while drafting or entering into a Tempe Arizona Promissory Note in connection with the sale of a vehicle or automobile, ensuring compliance with Arizona laws and regulations.A Tempe Arizona Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement for the purchase of a vehicle. It serves as evidence of the borrower's promise to repay the lender a specific amount of money within a specified timeframe, typically with interest. Keywords: Tempe Arizona, Promissory Note, Sale of Vehicle, Automobile. There are two types of Tempe Arizona Promissory Notes commonly used in connection with the sale of a vehicle or automobile: 1. Secured Promissory Note: This type of promissory note is used when the buyer needs financing to purchase a vehicle. It includes specific details about the vehicle, such as make, model, year, and identification number (VIN). The note acts as collateral, with the vehicle serving as security for the loan. If the borrower defaults on payments, the lender has the right to repossess the vehicle. 2. Unsecured Promissory Note: This type of promissory note is used when the buyer and seller agree to a private loan arrangement without any collateral. In this case, the vehicle's ownership is transferred to the buyer, but the seller retains a legal interest in the vehicle until the debt is fully repaid. If the borrower defaults, the seller may take legal action to reclaim the vehicle. Regardless of the type, a Tempe Arizona Promissory Note in connection with the sale of a vehicle or automobile typically includes the following details: 1. Parties involved: Names, addresses, and contact information of both the borrower (buyer) and lender (seller). 2. Vehicle information: Make, model, year, and VIN of the vehicle being sold. 3. Loan amount: The total amount of money being borrowed by the buyer. 4. Repayment terms: The agreed-upon repayment schedule, including the frequency of payments (monthly, bi-monthly, etc.), the due date for each payment, and the number of installments. 5. Interest rate: The interest rate charged on the loan, if applicable. 6. Late payment penalties: Any additional charges for late or missed payments. 7. Default consequences: The actions that can be taken by the lender in case of default, such as repossession, legal action, or collection fees. 8. Governing law: The note should specify that it is subject to the laws of Tempe, Arizona. 9. Signatures: Both parties must sign and date the agreement to make it legally binding. It is essential to consult with a legal professional or seek expert advice while drafting or entering into a Tempe Arizona Promissory Note in connection with the sale of a vehicle or automobile, ensuring compliance with Arizona laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.