Glendale Arizona Payoff Deed: Comprehensive Overview In Glendale, Arizona, a payoff deed refers to a legal document that serves as evidence of the full repayment of a mortgage or loan for a property. It is an essential document as it represents the transfer of ownership from the lender or creditor back to the borrower. The payoff deed ensures that the property is free from any lien or encumbrances, allowing the borrower to have complete ownership. Different Types of Glendale Arizona Payoff Deed: 1. Warranty Deed: The most common type of payoff deed in Glendale, Arizona, is the warranty deed. This deed guarantees that the property is clear of any liens, claims, or encumbrances, both apparent and hidden. It provides the highest level of protection for the new homeowner, assuring them that they will not face any legal issues related to the title. 2. Trustee's Deed: In situations where a foreclosure has occurred, a trustee's deed is used. When a borrower fails to make mortgage payments and the property goes through a foreclosure process, the trustee's deed transfers ownership from the trustee (acting on behalf of the lender) to the successful bidder or the lender. 3. Quitclaim Deed: Another type of payoff deed seen in Glendale, Arizona, is a quitclaim deed. Unlike a warranty deed, a quitclaim deed doesn't offer any guarantees regarding the property's title. It simply transfers the interest of the granter to the grantee without warranty or representation of ownership. These deeds are often used in situations such as gifting property between family members or correcting minor title issues. 4. Grant Deed: A grant deed is similar to a warranty deed but imprecise in guaranteeing the title against any previous ownership claims. However, it is a commonly used form of transfer in Glendale, Arizona. It conveys the granter's interest in the property to the grantee, ensuring that the granter has not previously transferred the property to anyone else. In conclusion, Glendale, Arizona, utilizes various types of payoff deeds to facilitate the transfer of property ownership. Whether it's a warranty deed offering comprehensive protection, a trustee's deed through a foreclosure process, a quitclaim deed for gifting purposes, or a grant deed for a straightforward transfer, understanding these different types of payoff deeds can help individuals navigate the process of buying or selling property in Glendale.

Glendale Arizona Payoff Deed

Category:

State:

Arizona

City:

Glendale

Control #:

AZ-00470-23

Format:

Word;

Rich Text

Instant download

Description

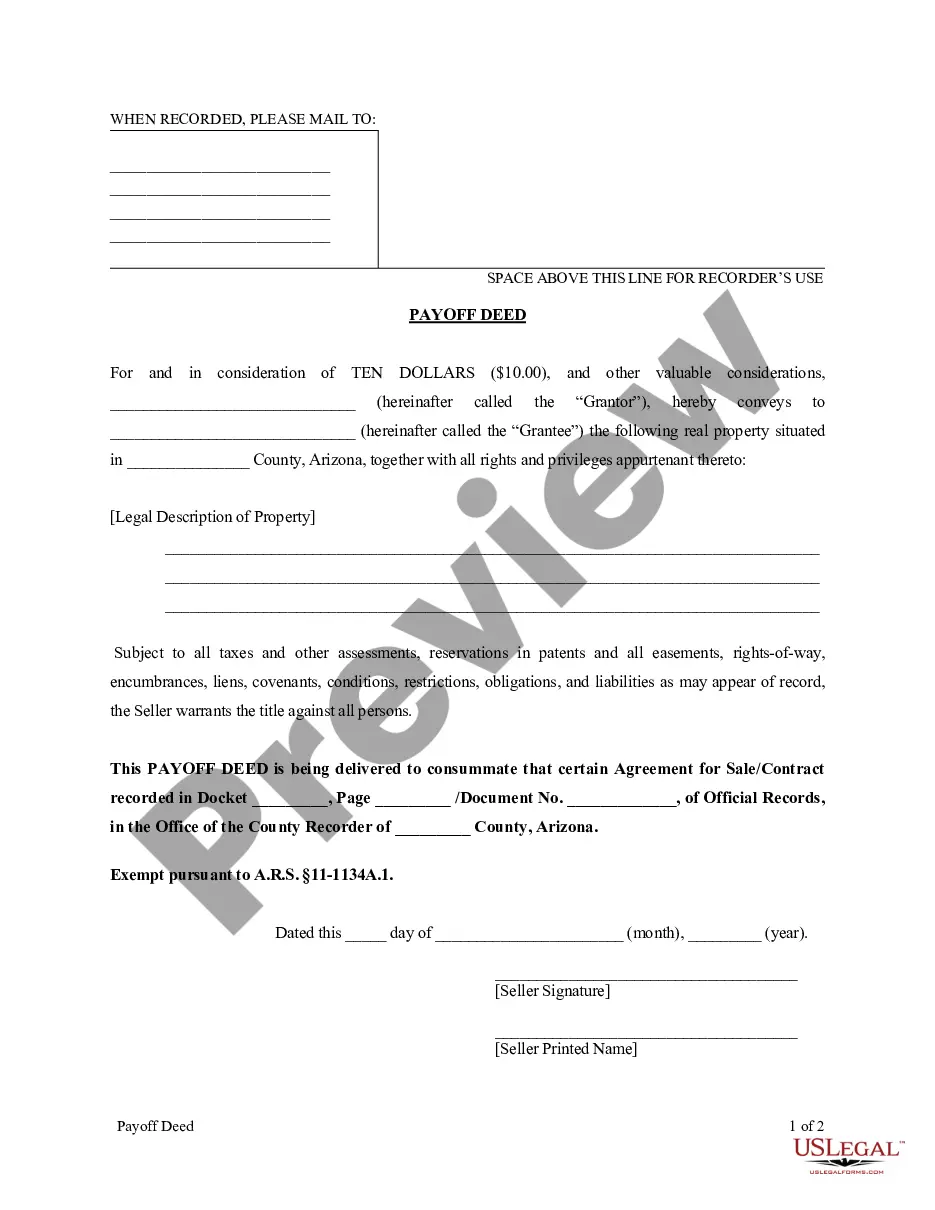

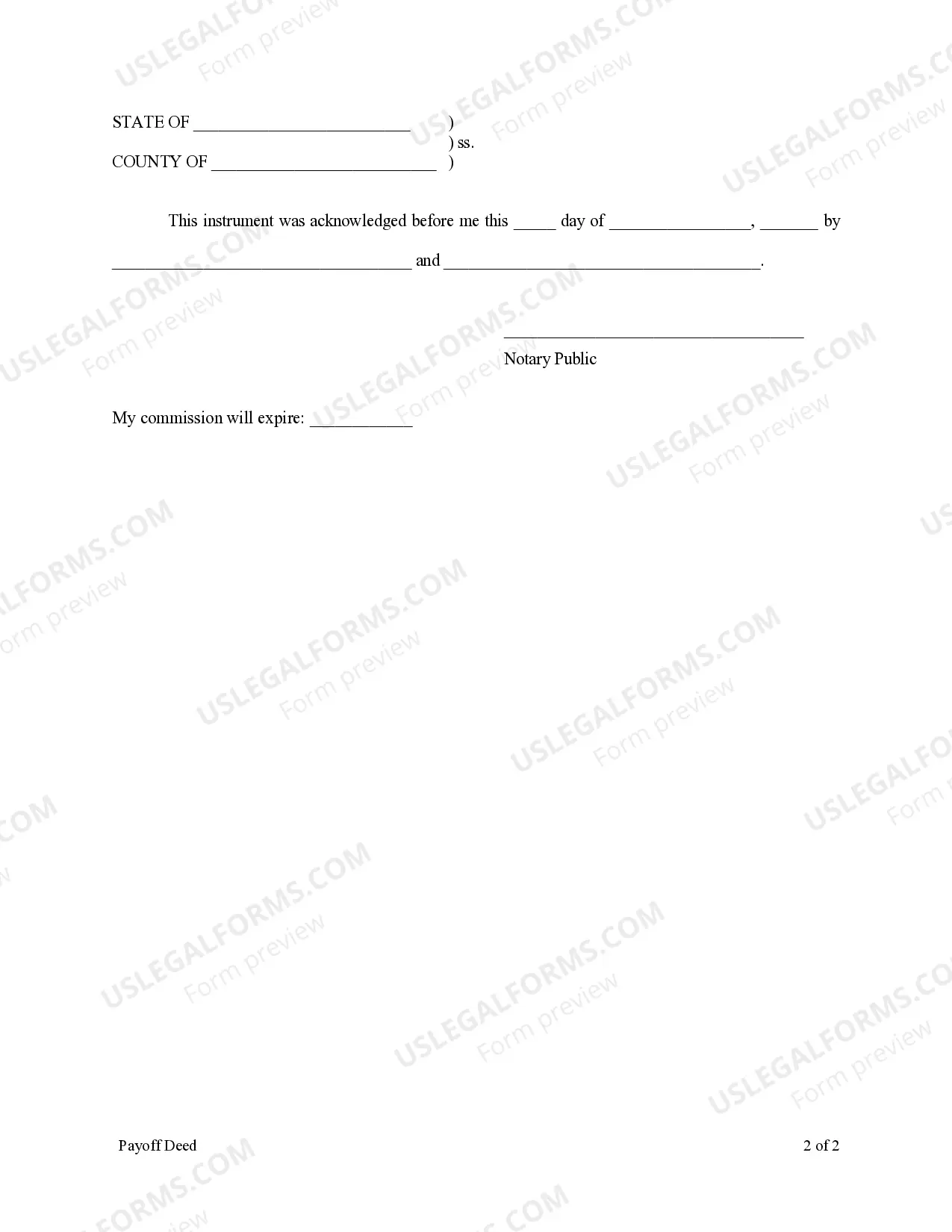

This document is provided by the Seller to the Purchaser after all payments and terms of the Contract for Deed have been successfully fulfilled. This document conveys ownership to the Purchaser.

Glendale Arizona Payoff Deed: Comprehensive Overview In Glendale, Arizona, a payoff deed refers to a legal document that serves as evidence of the full repayment of a mortgage or loan for a property. It is an essential document as it represents the transfer of ownership from the lender or creditor back to the borrower. The payoff deed ensures that the property is free from any lien or encumbrances, allowing the borrower to have complete ownership. Different Types of Glendale Arizona Payoff Deed: 1. Warranty Deed: The most common type of payoff deed in Glendale, Arizona, is the warranty deed. This deed guarantees that the property is clear of any liens, claims, or encumbrances, both apparent and hidden. It provides the highest level of protection for the new homeowner, assuring them that they will not face any legal issues related to the title. 2. Trustee's Deed: In situations where a foreclosure has occurred, a trustee's deed is used. When a borrower fails to make mortgage payments and the property goes through a foreclosure process, the trustee's deed transfers ownership from the trustee (acting on behalf of the lender) to the successful bidder or the lender. 3. Quitclaim Deed: Another type of payoff deed seen in Glendale, Arizona, is a quitclaim deed. Unlike a warranty deed, a quitclaim deed doesn't offer any guarantees regarding the property's title. It simply transfers the interest of the granter to the grantee without warranty or representation of ownership. These deeds are often used in situations such as gifting property between family members or correcting minor title issues. 4. Grant Deed: A grant deed is similar to a warranty deed but imprecise in guaranteeing the title against any previous ownership claims. However, it is a commonly used form of transfer in Glendale, Arizona. It conveys the granter's interest in the property to the grantee, ensuring that the granter has not previously transferred the property to anyone else. In conclusion, Glendale, Arizona, utilizes various types of payoff deeds to facilitate the transfer of property ownership. Whether it's a warranty deed offering comprehensive protection, a trustee's deed through a foreclosure process, a quitclaim deed for gifting purposes, or a grant deed for a straightforward transfer, understanding these different types of payoff deeds can help individuals navigate the process of buying or selling property in Glendale.

Free preview

How to fill out Glendale Arizona Payoff Deed?

If you’ve already used our service before, log in to your account and save the Glendale Arizona Payoff Deed on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make certain you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Glendale Arizona Payoff Deed. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!