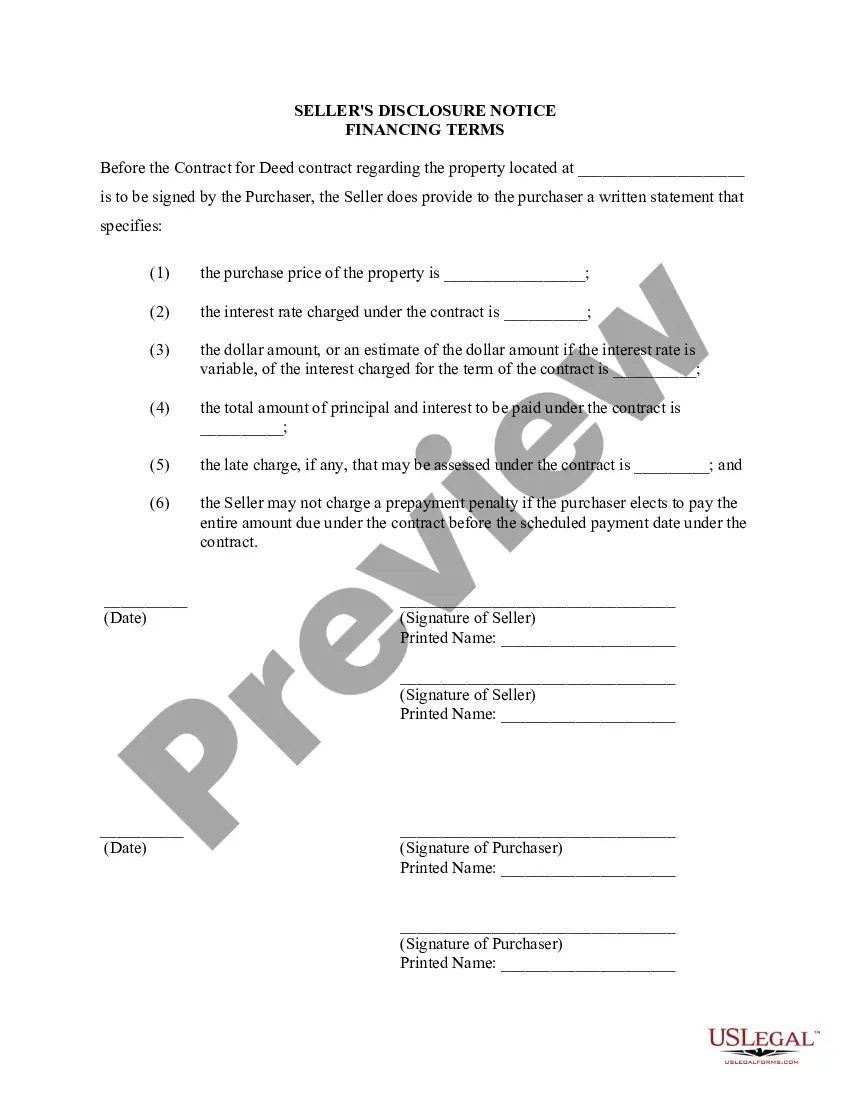

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

In Tempe, Arizona, when entering into a contract or agreement for deed, also known as a land contract, it is essential for sellers to provide a detailed Seller's Disclosure of Financing Terms for Residential Property. This disclosure serves to inform buyers about the various financing terms and conditions associated with the property, ensuring transparency and helping both parties make informed decisions. The Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed encompasses various key aspects that buyers should be aware of. These can include, but are not limited to: 1. Purchase Price: This term discloses the agreed-upon amount the buyer is required to pay for the property. 2. Down Payment: It specifies the initial payment amount required from the buyer at the time of closing the contract. 3. Interest Rate: The disclosed interest rate represents the percentage at which interest will accumulate on the outstanding balance of the property's purchase price. 4. Loan Term: This term states the duration of the loan, during which the buyer is expected to repay the remaining balance in full. 5. Amortization Schedule: The amortization schedule provides a breakdown of the monthly payments, including the portion allocated towards the principal and interest. It helps buyers understand how their payments will be applied. 6. Balloon Payment: In certain cases, the agreement might include a balloon payment clause, which means that a lump sum amount is due at the end of a specific period. 7. Prepayment Penalties: If applicable, this term indicates whether there are any penalties imposed on the buyer for paying off the loan balance before the specified loan term ends. 8. Default and Foreclosure Procedures: The disclosure outlines the consequences and procedures that will be implemented if the buyer defaults on the agreement, providing clarity on potential repercussions. 9. Insurance and Property Taxes: It may include information on the buyer's responsibilities for property insurance, as well as property tax payments. 10. Inspection and Refund Policy: In some agreements, there might be provisions regarding the buyer's right to inspect the property and obtain a refund if the property does not meet certain conditions. It is important to note that there might be different variations or modifications of the Tempe Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed. These variations can depend on factors such as the specific property, the preferences of the buyer and seller, and any additional conditions negotiated between the parties. Ultimately, this disclosure is designed to protect both the buyer and seller by providing comprehensive information and ensuring transparency regarding the financing terms associated with the property in Tempe, Arizona. Buyers are encouraged to thoroughly review and understand these disclosures before entering into any contracts to make informed decisions.In Tempe, Arizona, when entering into a contract or agreement for deed, also known as a land contract, it is essential for sellers to provide a detailed Seller's Disclosure of Financing Terms for Residential Property. This disclosure serves to inform buyers about the various financing terms and conditions associated with the property, ensuring transparency and helping both parties make informed decisions. The Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed encompasses various key aspects that buyers should be aware of. These can include, but are not limited to: 1. Purchase Price: This term discloses the agreed-upon amount the buyer is required to pay for the property. 2. Down Payment: It specifies the initial payment amount required from the buyer at the time of closing the contract. 3. Interest Rate: The disclosed interest rate represents the percentage at which interest will accumulate on the outstanding balance of the property's purchase price. 4. Loan Term: This term states the duration of the loan, during which the buyer is expected to repay the remaining balance in full. 5. Amortization Schedule: The amortization schedule provides a breakdown of the monthly payments, including the portion allocated towards the principal and interest. It helps buyers understand how their payments will be applied. 6. Balloon Payment: In certain cases, the agreement might include a balloon payment clause, which means that a lump sum amount is due at the end of a specific period. 7. Prepayment Penalties: If applicable, this term indicates whether there are any penalties imposed on the buyer for paying off the loan balance before the specified loan term ends. 8. Default and Foreclosure Procedures: The disclosure outlines the consequences and procedures that will be implemented if the buyer defaults on the agreement, providing clarity on potential repercussions. 9. Insurance and Property Taxes: It may include information on the buyer's responsibilities for property insurance, as well as property tax payments. 10. Inspection and Refund Policy: In some agreements, there might be provisions regarding the buyer's right to inspect the property and obtain a refund if the property does not meet certain conditions. It is important to note that there might be different variations or modifications of the Tempe Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed. These variations can depend on factors such as the specific property, the preferences of the buyer and seller, and any additional conditions negotiated between the parties. Ultimately, this disclosure is designed to protect both the buyer and seller by providing comprehensive information and ensuring transparency regarding the financing terms associated with the property in Tempe, Arizona. Buyers are encouraged to thoroughly review and understand these disclosures before entering into any contracts to make informed decisions.