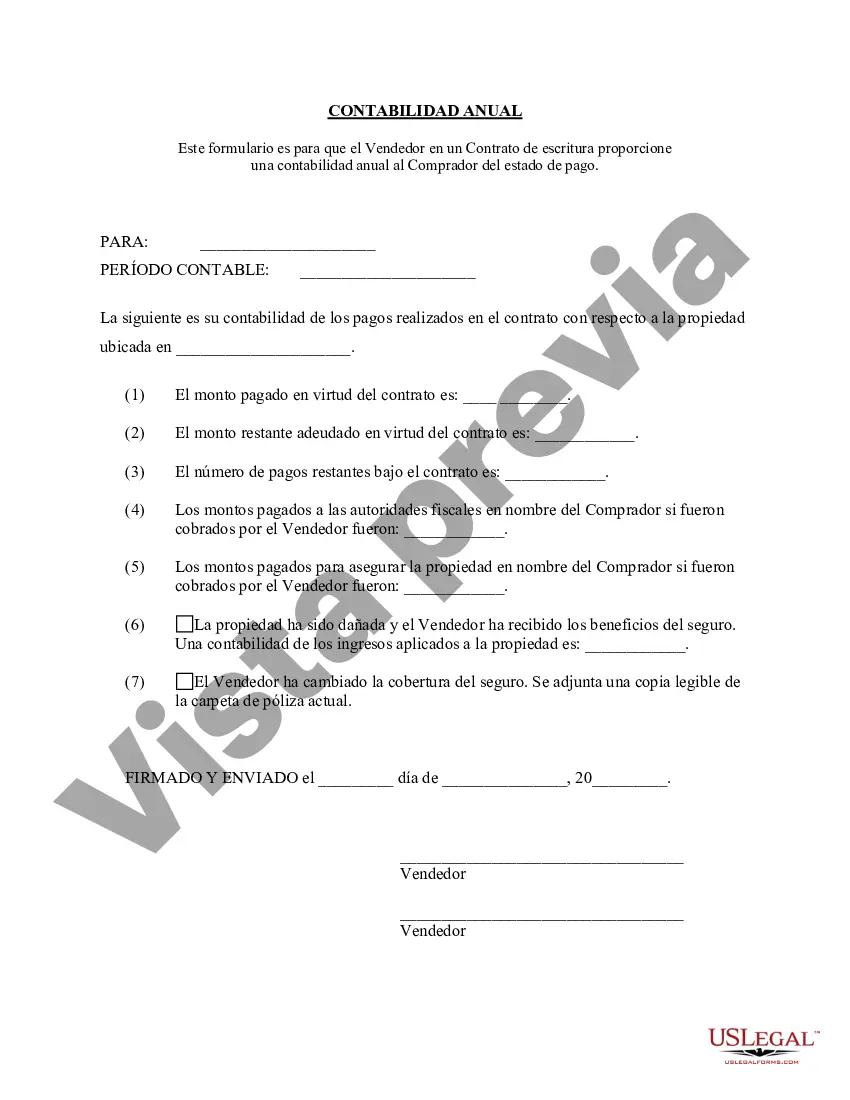

Maricopa Arizona Contract for Deed Seller's Annual Accounting Statement is a document that provides a comprehensive financial report to the seller of a property sold through a contract for deed arrangement in Maricopa, Arizona. This statement outlines the financial transactions and details regarding the property sale, ensuring transparency and accountability throughout the contract period. Key elements included in the Maricopa Arizona Contract for Deed Seller's Annual Accounting Statement may vary depending on the terms agreed upon by both parties. However, typically, the following information is presented: 1. Property Details: The statement begins with a complete description of the property, including its address, legal description, and any specific details regarding its location or features. 2. Buyer Information: The name and contact information of the buyer involved in the contract for deed agreement are mentioned, ensuring clear identification. 3. Transaction Summary: This section provides a comprehensive summary of all financial transactions related to the property sale. It outlines the initial down payment received from the buyer, the principal amount of the contract, any subsequent payments made by the buyer, and any interest charges or fees associated with the contract. 4. Payment Schedule: The statement details the payment schedule agreed upon between the buyer and the seller. It includes the due dates of the payments, the principal amount, and the interest charged, if applicable. 5. Payments Received: This section summarizes the payments received by the seller from the buyer throughout the year. It includes the payment date, payment amount, and any additional information relevant to each payment. 6. Outstanding Balance: The statement presents the remaining balance owed by the buyer at the end of the accounting period. It may also include any additional fees or charges that have accrued during the period. 7. Expenses: If there are any expenses incurred by the seller related to the property during the specified period, such as property taxes, insurance, repairs, or maintenance costs, they will be detailed in this section. 8. Closing Costs: This section outlines any closing costs associated with the property sale that the seller may have covered. It includes a breakdown of the costs and their corresponding amounts. 9. Net Income: The statement concludes with the calculation of the net income generated from the contract for deed arrangement. It deducts all expenses and outstanding balance from the total payments received during the year. Different variations or types of Maricopa Arizona Contract for Deed Seller's Annual Accounting Statement may exist based on specific contractual agreements or legal requirements. However, the general purpose remains the same, focusing on transparency and accountability in financial matters for sellers and buyers involved in contract for deed arrangements in Maricopa, Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Contrato de Escrituración Estado Contable Anual del Vendedor - Arizona Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Maricopa Arizona Contrato De Escrituración Estado Contable Anual Del Vendedor?

No matter the social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for a person with no law background to create this sort of papers cfrom the ground up, mainly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes in handy. Our service provides a massive collection with over 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you want the Maricopa Arizona Contract for Deed Seller's Annual Accounting Statement or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Maricopa Arizona Contract for Deed Seller's Annual Accounting Statement quickly using our trusted service. If you are already a subscriber, you can go ahead and log in to your account to get the appropriate form.

However, if you are new to our platform, ensure that you follow these steps before obtaining the Maricopa Arizona Contract for Deed Seller's Annual Accounting Statement:

- Ensure the template you have chosen is specific to your area since the regulations of one state or area do not work for another state or area.

- Preview the document and go through a brief outline (if provided) of scenarios the document can be used for.

- If the form you chosen doesn’t suit your needs, you can start over and search for the needed form.

- Click Buy now and choose the subscription option you prefer the best.

- utilizing your credentials or register for one from scratch.

- Choose the payment gateway and proceed to download the Maricopa Arizona Contract for Deed Seller's Annual Accounting Statement as soon as the payment is done.

You’re all set! Now you can go ahead and print the document or complete it online. Should you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.