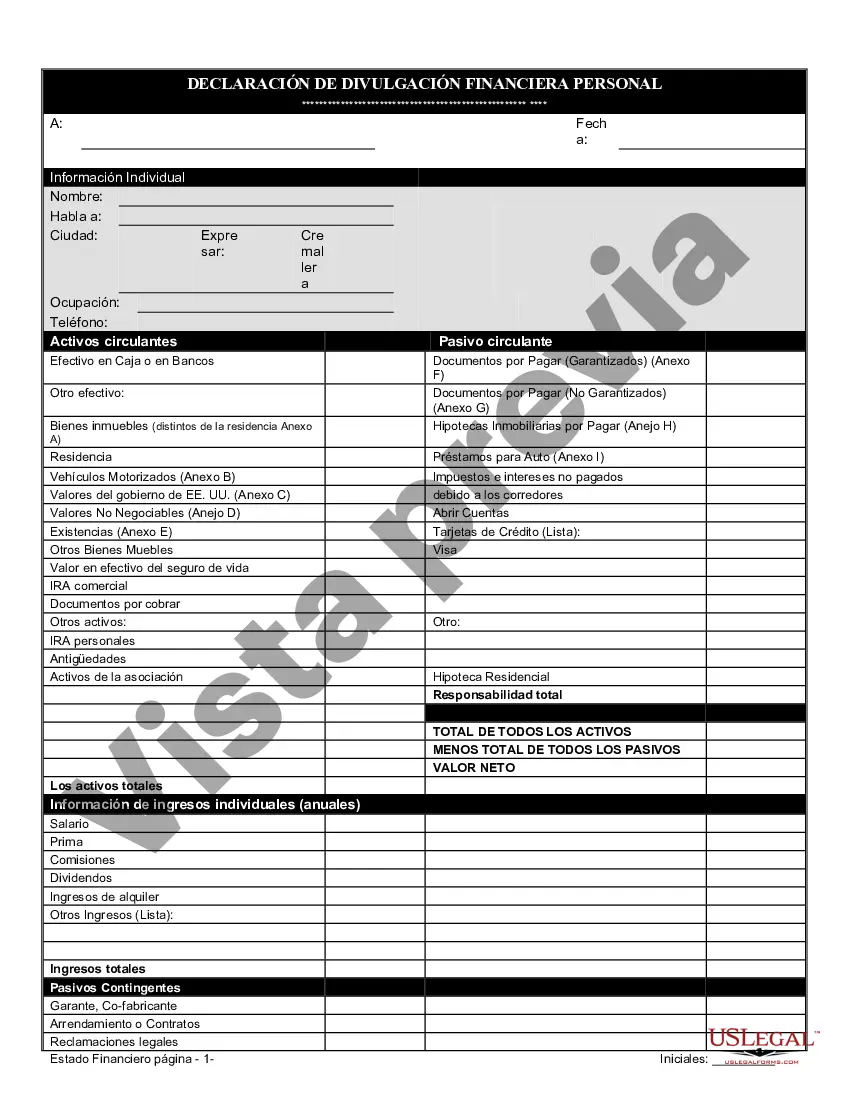

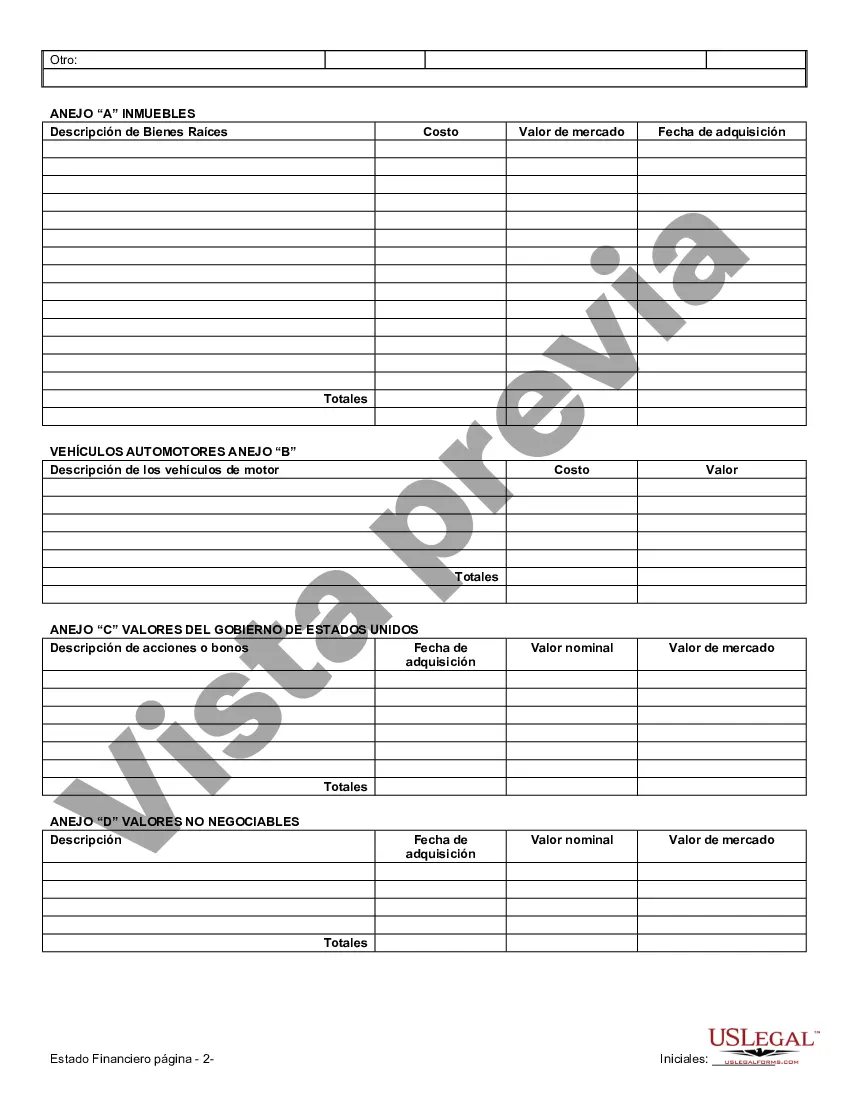

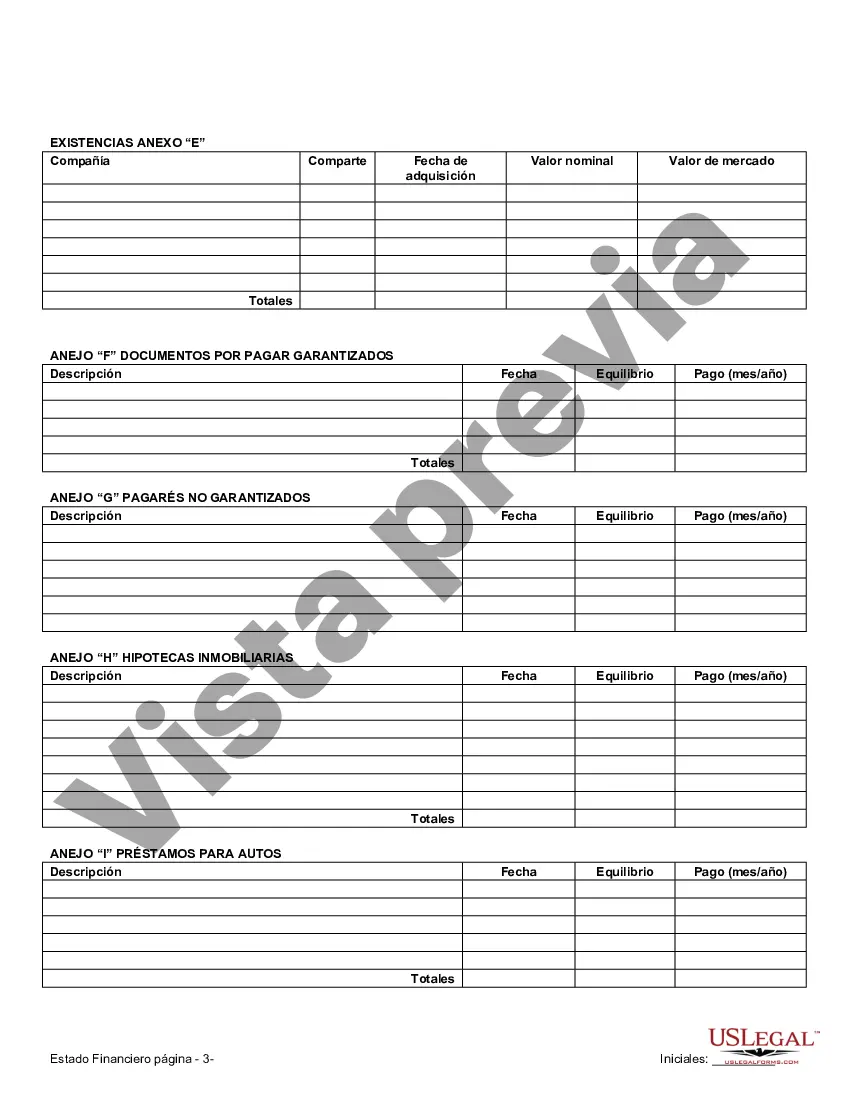

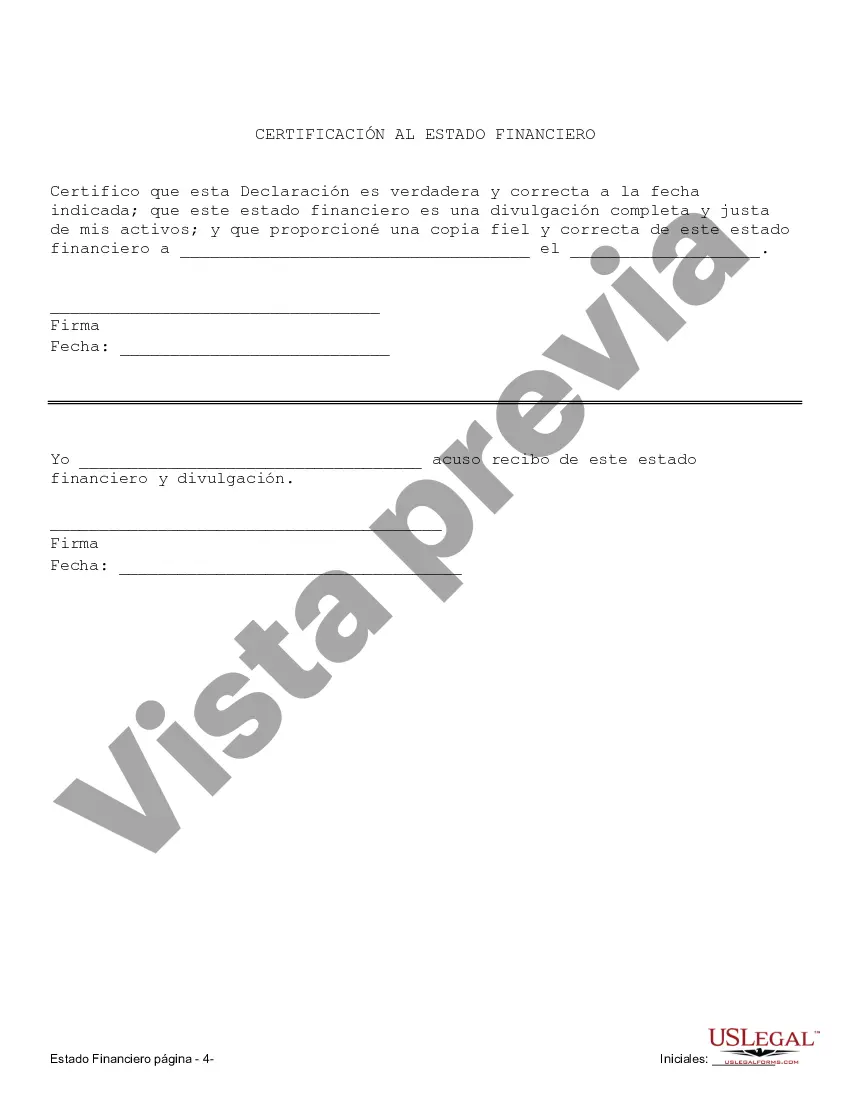

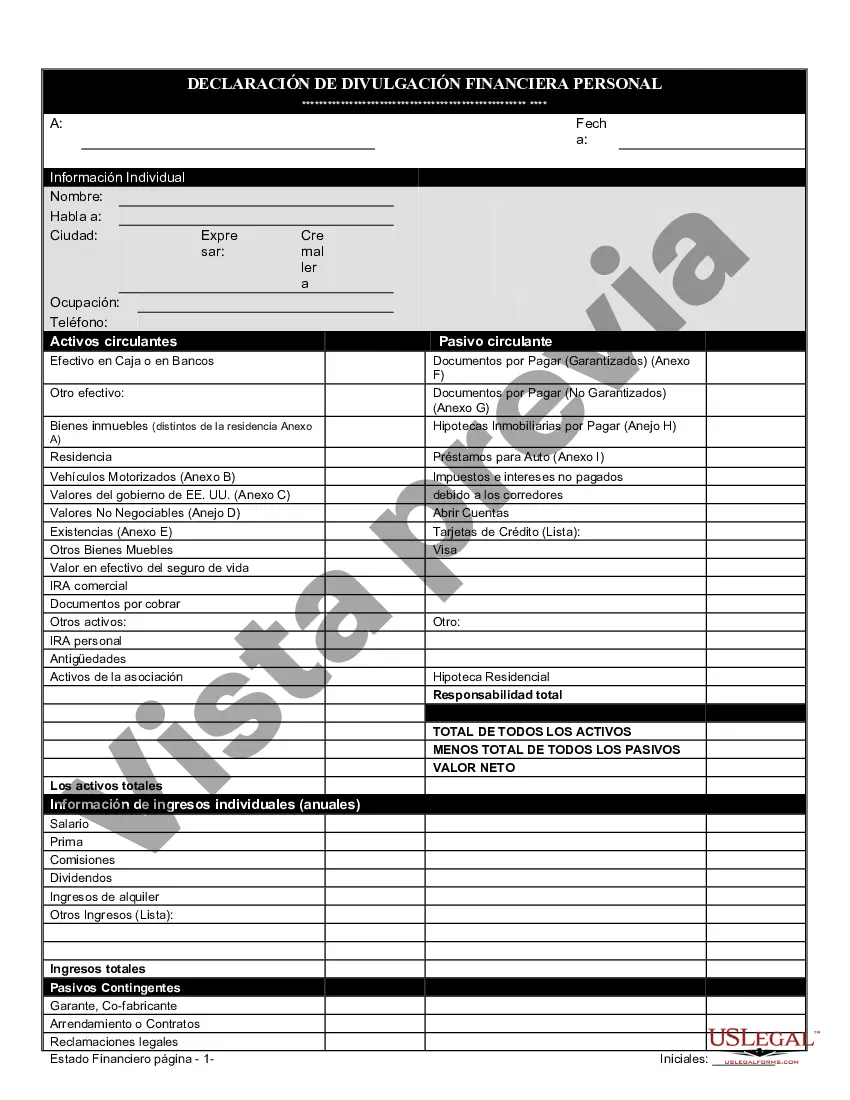

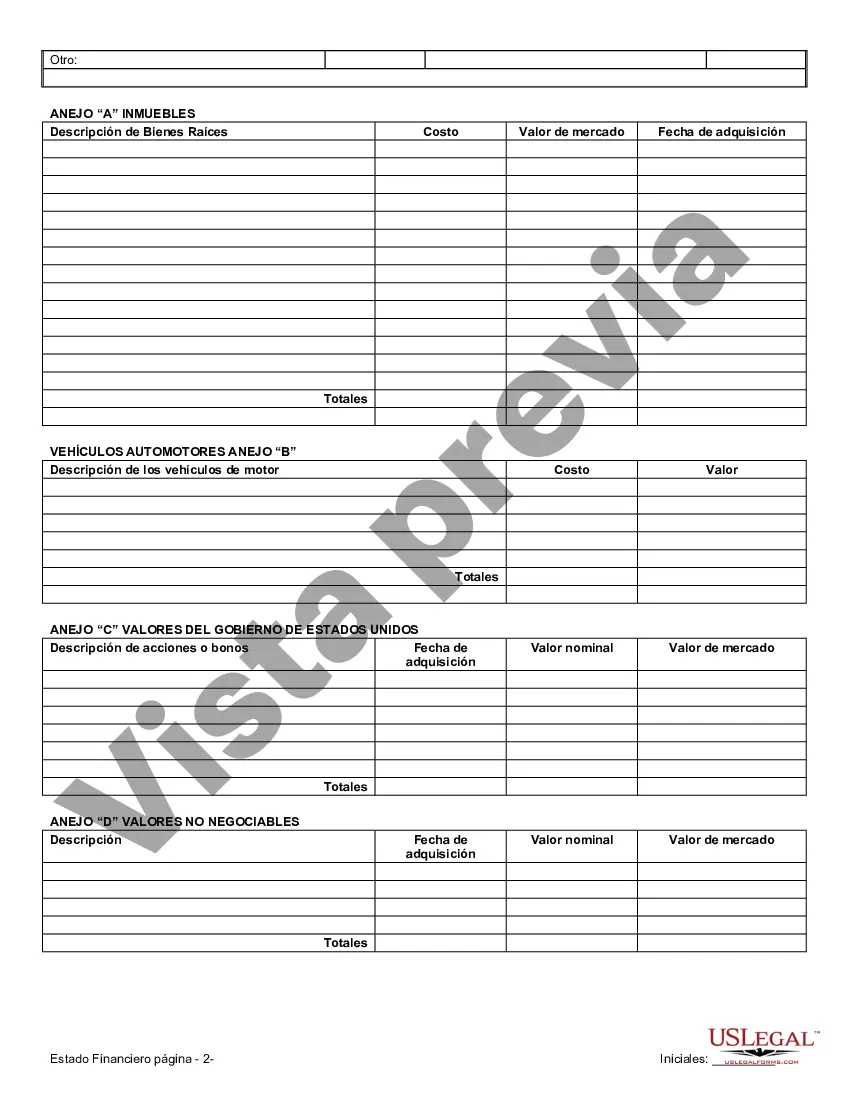

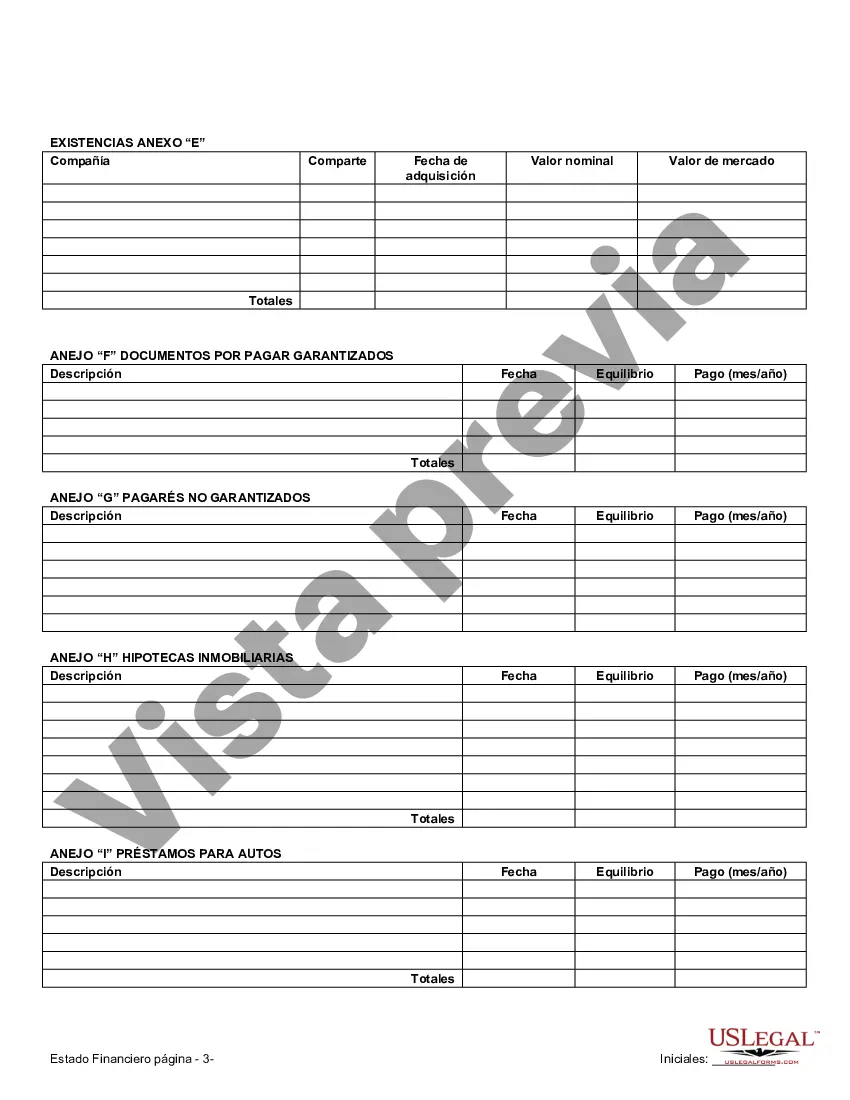

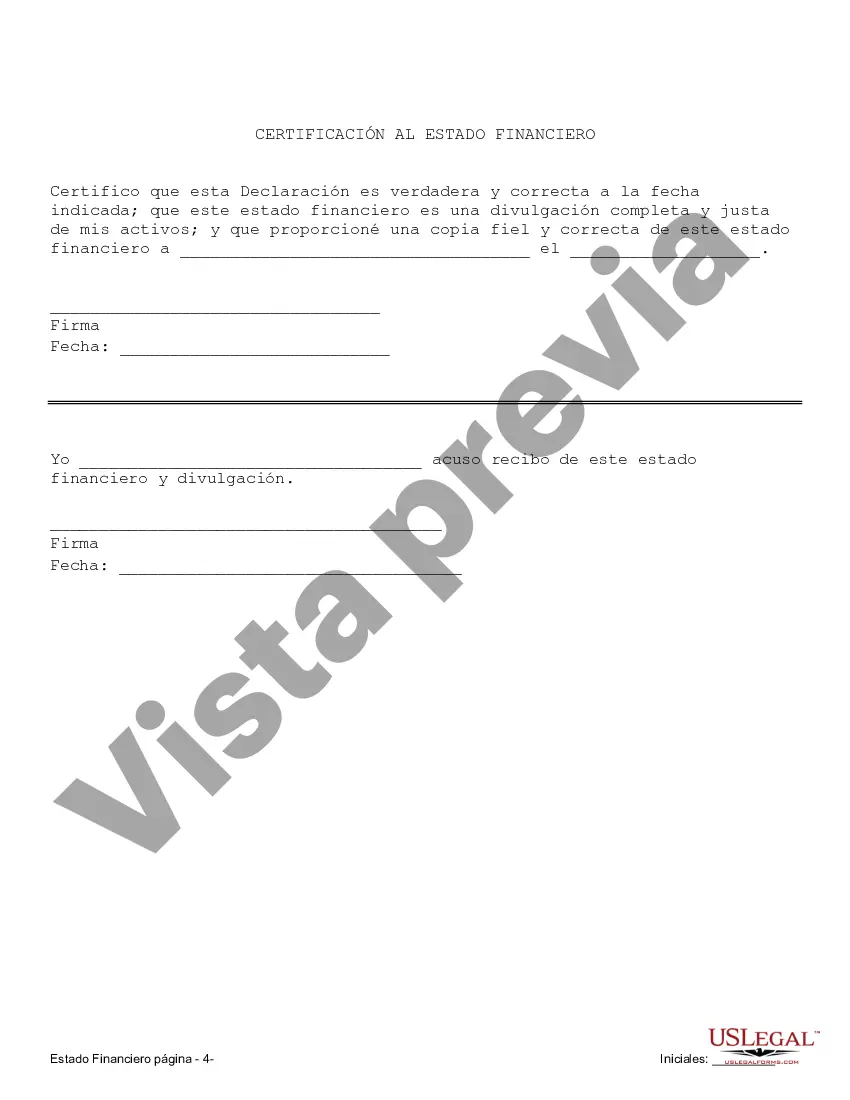

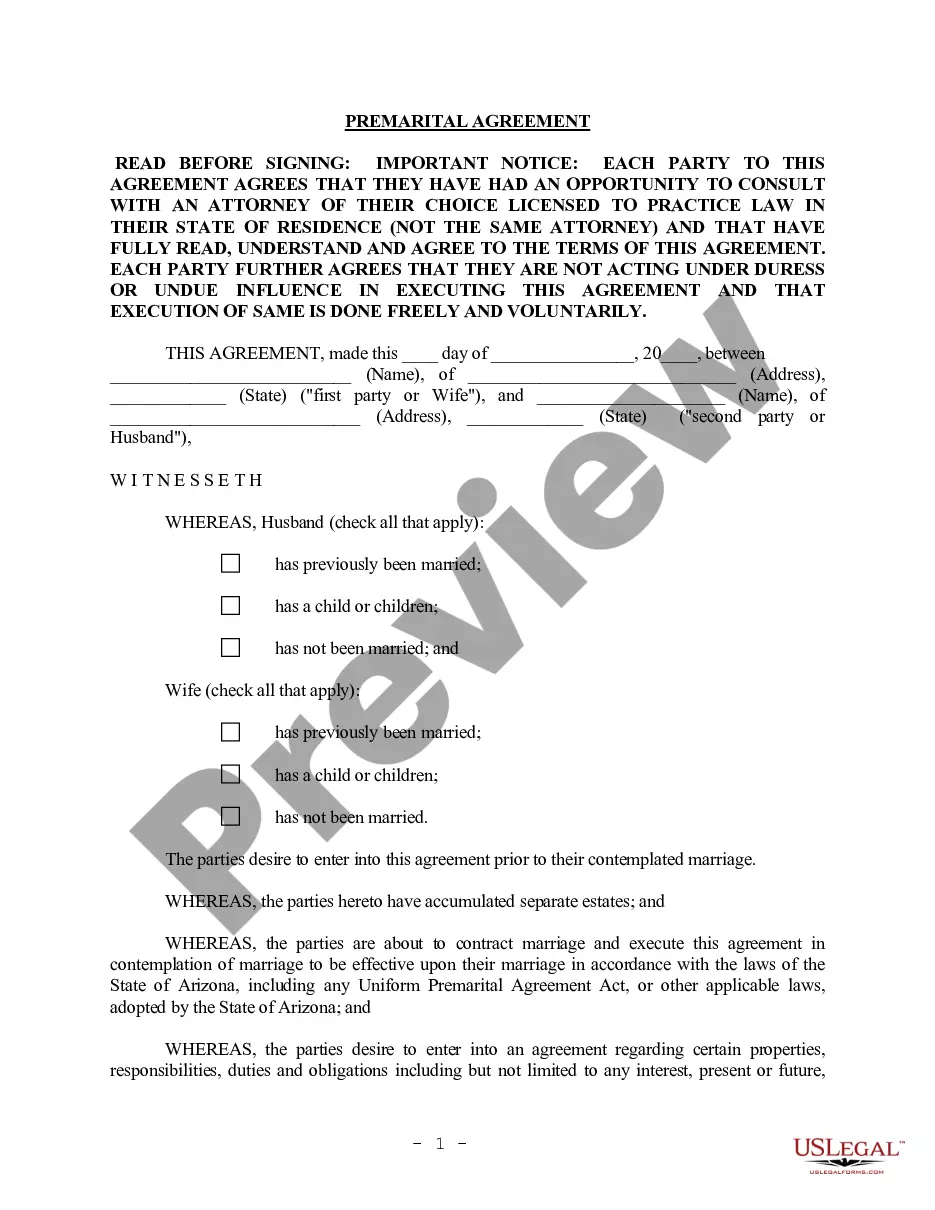

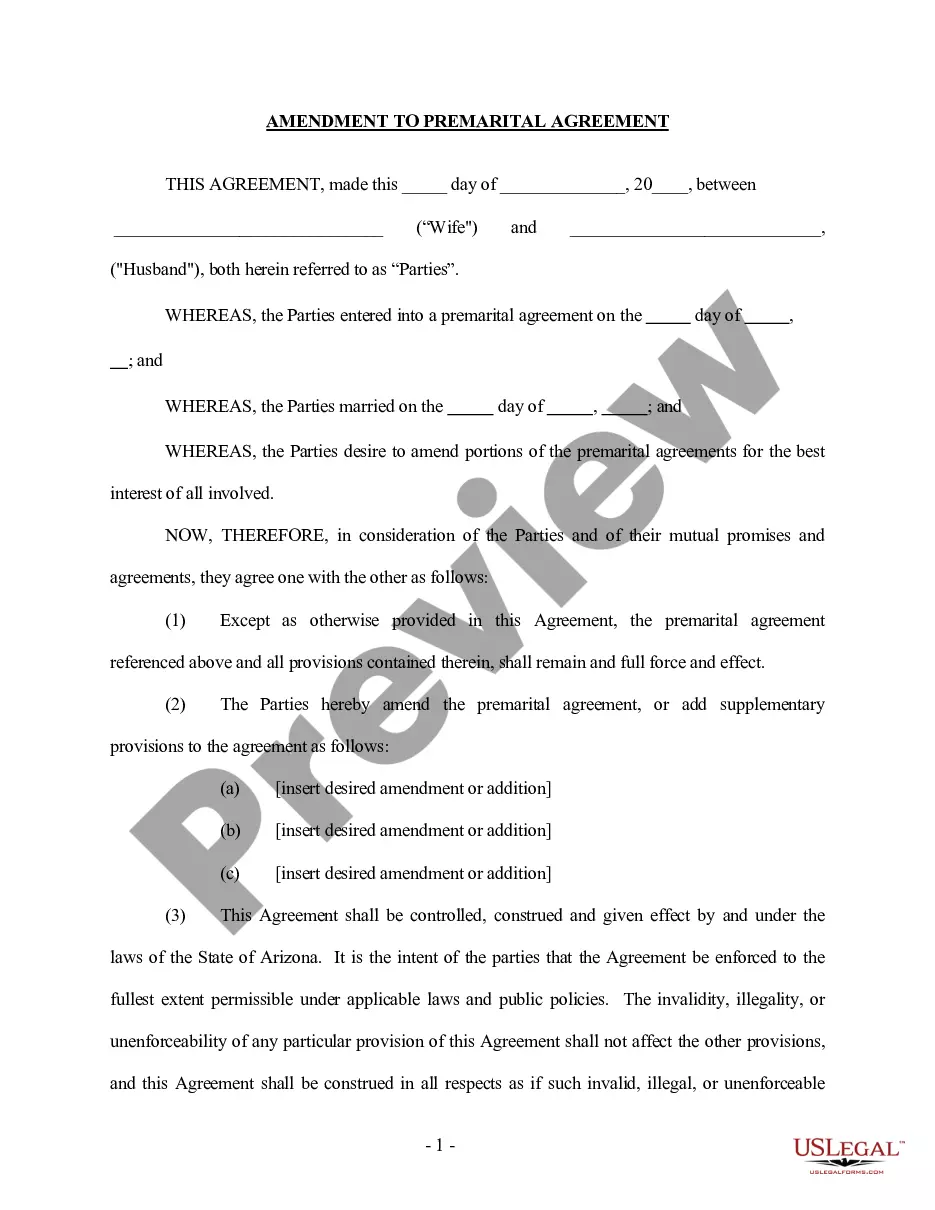

Chandler, Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement When couples in Chandler, Arizona decide to enter into a prenuptial or premarital agreement, it is common for each party to provide detailed financial statements. These statements aim to disclose the financial standing and assets of both individuals before they marry, ensuring transparency and clarity in the agreement. Chandler, Arizona financial statements only in connection with prenuptial or premarital agreements hold great importance as they form the basis of the agreement and protect the interests of both parties involved. 1. Personal Financial Statement: This type of financial statement provides a comprehensive overview of an individual's personal assets, including real estate, investments, retirement accounts, bank accounts, and any other relevant financial information. It also includes liabilities such as outstanding debts, loans, and mortgages. 2. Income Statement: This statement outlines the individual's income sources, including salary, bonuses, investments, rental income, or any other earnings. It provides a clear picture of their financial inflow. 3. Balance Sheet: The balance sheet provides an overview of an individual's assets, liabilities, and equity as of a specific date. It includes details about real estate properties, vehicles, investments, cash, credit card debts, loans, and other financial obligations. This statement helps determine an individual's net worth. 4. Tax Returns: Providing recent tax returns as a financial statement is also essential. They offer evidence of the individual's income, deductions, credits, and taxable transactions. Tax returns help establish a precise financial picture and verify the accuracy of the provided statements. 5. Retirement Account Statements: If either party holds retirement accounts like a 401(k), IRA, or pension plans, providing accurate statements for these accounts is crucial. This ensures that the value of the retirement assets is accurately represented in the agreement. 6. Bank Account Statements: Providing bank account statements for both personal and joint accounts is critical. These statements show the individual's liquidity, saving patterns, and cash transactions, leaving no room for ambiguity during the agreement process. In Chandler, Arizona, financial statements are often required to be up-to-date, accurate, and reflective of the individual's true financial position. These statements act as a foundation for establishing the division of assets, property, and potential spousal support in case of a divorce or dissolution of the marriage. Therefore, due diligence and transparency in disclosing all financial details are crucial to ensure the integrity and enforceability of the prenuptial or premarital agreement. In conclusion, Chandler, Arizona financial statements only in connection with prenuptial or premarital agreements play a vital role in protecting the interests of both parties. They provide a clear picture of the financial assets and liabilities of each individual, ensuring transparency and fairness in the agreement. Properly prepared financial statements, including personal financial statements, income statements, balance sheets, tax returns, retirement account statements, and bank account statements, are essential components in creating a comprehensive prenuptial or premarital agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chandler Arizona Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Chandler Arizona Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

If you are looking for a valid form template, it’s difficult to choose a better place than the US Legal Forms website – probably the most comprehensive libraries on the web. Here you can find thousands of document samples for business and personal purposes by types and states, or key phrases. With our high-quality search option, getting the most recent Chandler Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement is as elementary as 1-2-3. Furthermore, the relevance of each file is verified by a group of professional attorneys that regularly review the templates on our platform and update them according to the most recent state and county laws.

If you already know about our platform and have a registered account, all you need to get the Chandler Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement is to log in to your account and click the Download option.

If you use US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have opened the sample you need. Check its information and utilize the Preview option (if available) to check its content. If it doesn’t suit your needs, use the Search option at the top of the screen to discover the needed file.

- Affirm your choice. Select the Buy now option. Next, pick your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Receive the template. Select the file format and save it to your system.

- Make modifications. Fill out, edit, print, and sign the received Chandler Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement.

Each template you add to your account does not have an expiration date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you want to receive an additional duplicate for enhancing or creating a hard copy, you can come back and download it once more at any moment.

Make use of the US Legal Forms professional collection to get access to the Chandler Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement you were seeking and thousands of other professional and state-specific samples in one place!