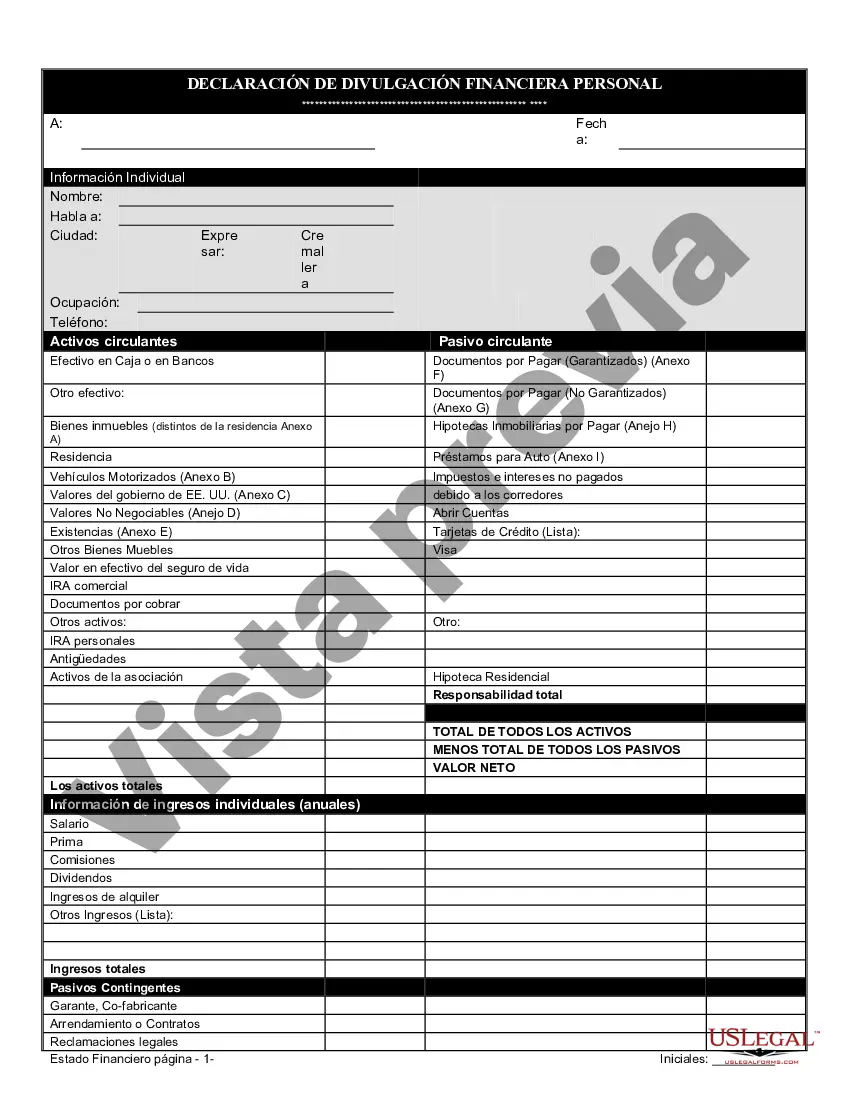

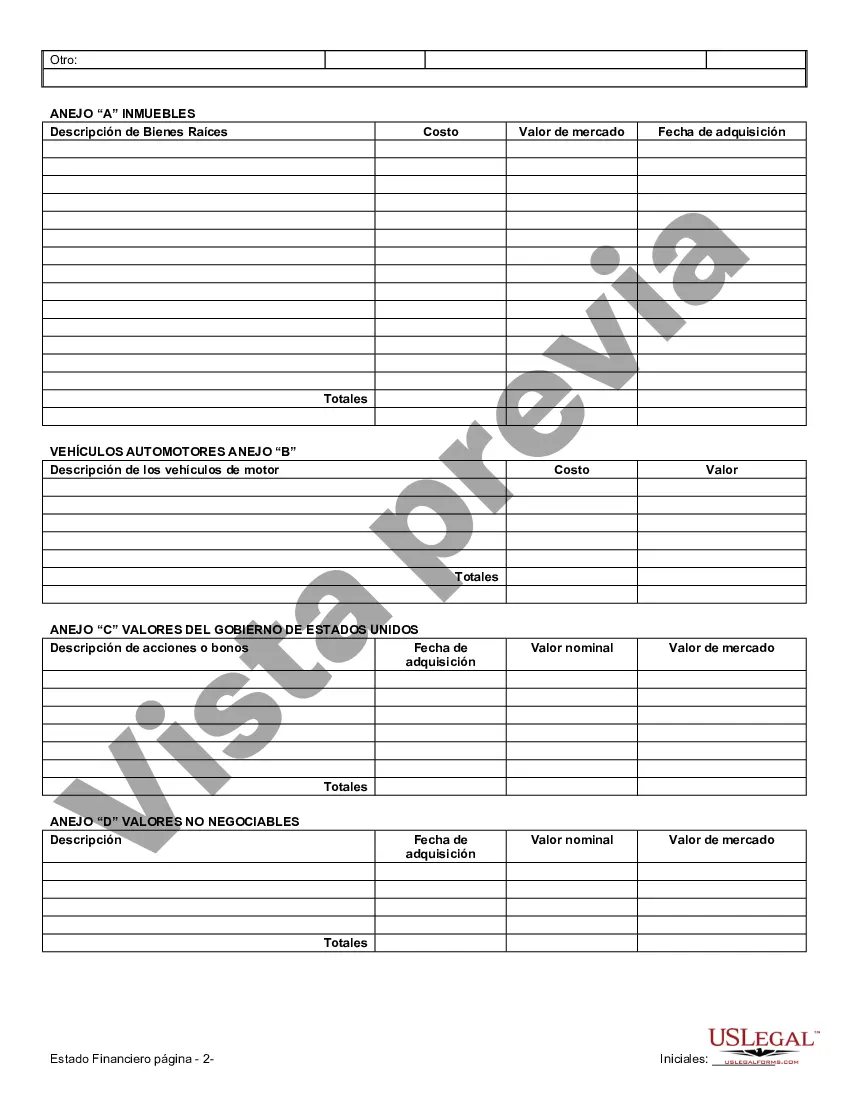

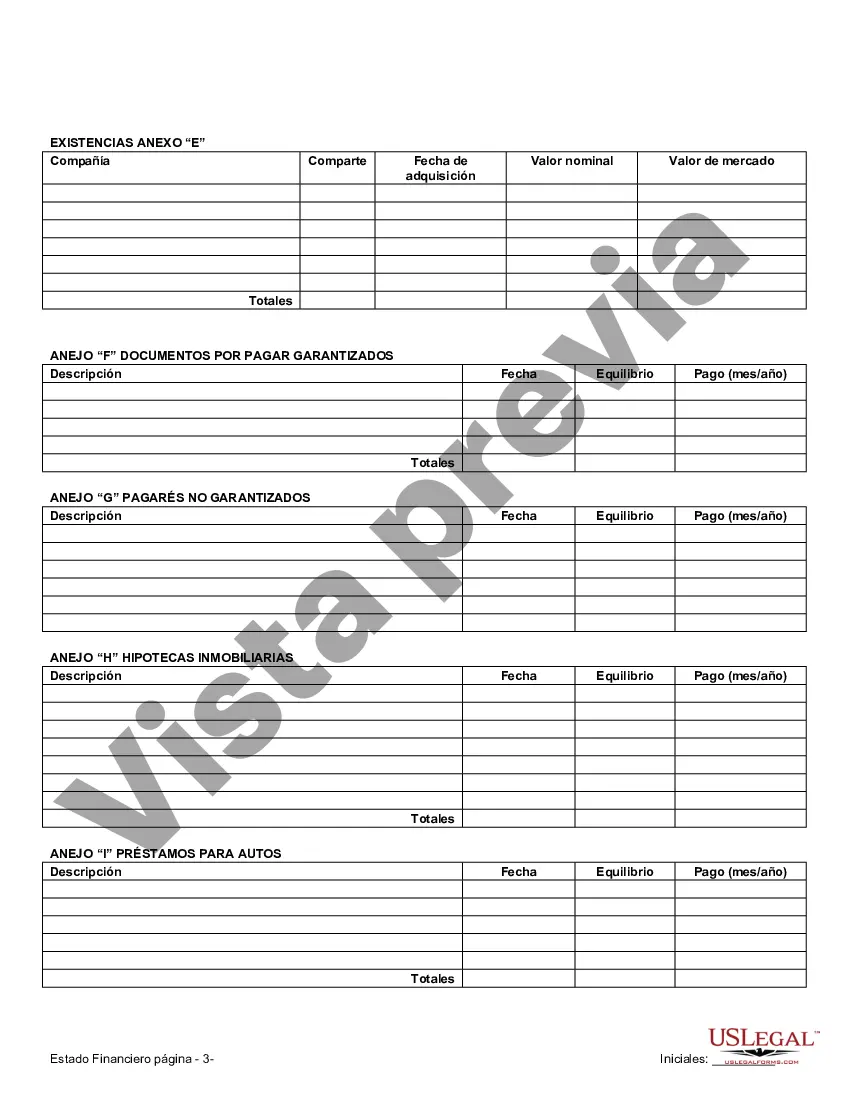

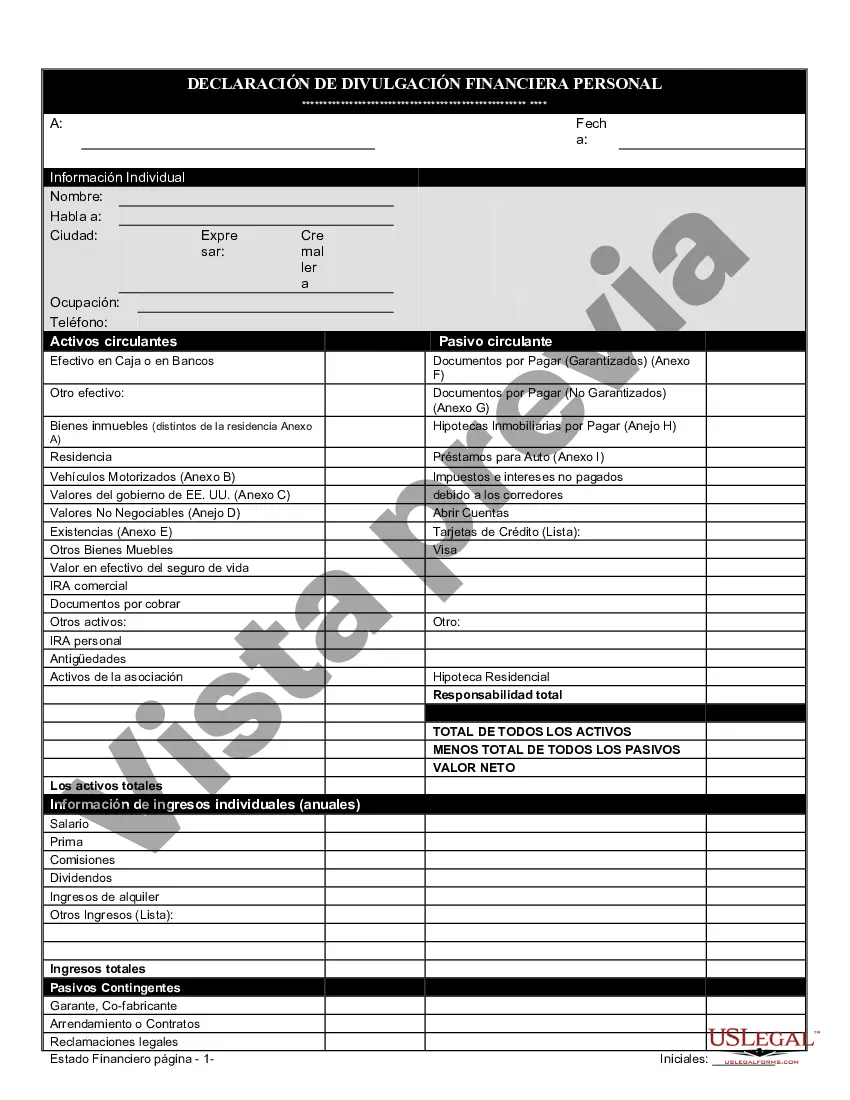

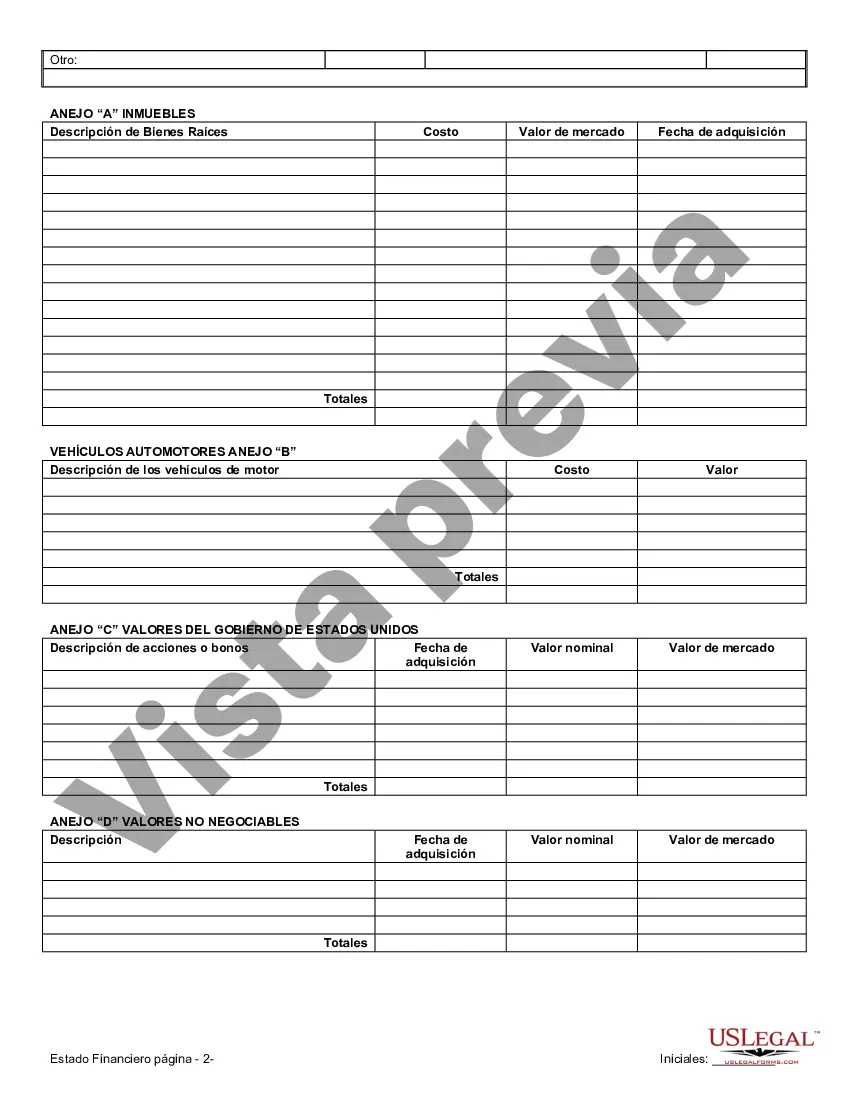

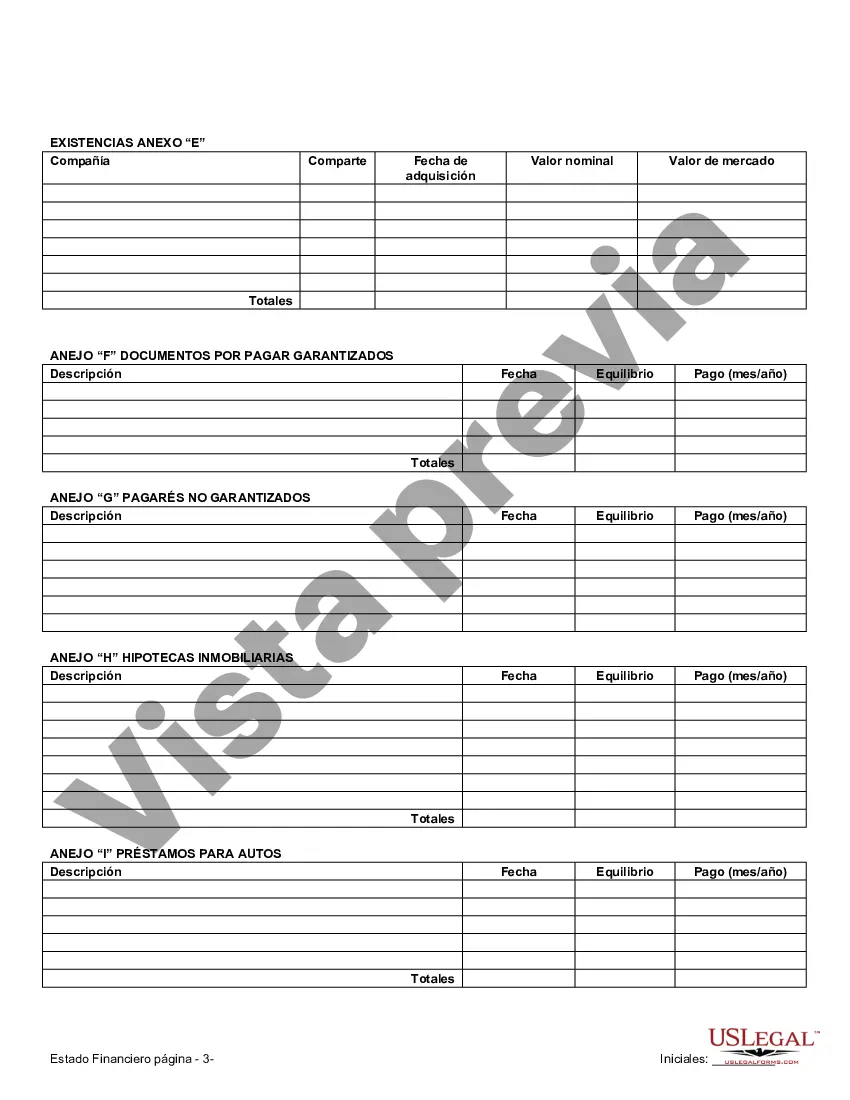

In Tucson, Arizona, financial statements play a crucial role in prenuptial or premarital agreements. These legal documents outline the financial rights and obligations of individuals entering into a marriage, ensuring transparency and protection of assets in case of divorce or separation. When it comes to financial statements specifically related to prenuptial or premarital agreements in Tucson, there are different types available to accommodate various financial situations and needs. 1. Basic Financial Statements: These statements provide a general overview of an individual's financial position, including income, expenses, assets, and liabilities. They help both parties gain a clear understanding of each other's financial standing before entering into a marriage and determine how assets should be divided in case of a divorce. 2. Business Financial Statements: If either or both parties own a business, it is vital to include business financial statements in the prenuptial agreement. These statements detail the business's financial health, including revenue, costs, debts, and assets, ensuring that the business remains protected in the event of a marital dissolution. 3. Real Estate Financial Statements: For couples who own properties or real estate assets, including real estate financial statements in the prenuptial agreement is essential. These statements provide information about the properties' value, mortgage details, and other crucial factors. By including these statements, it becomes easier to determine how real estate assets would be divided or managed following a divorce. 4. Retirement Account Statements: Retirement accounts are often substantial assets for individuals entering into a marriage. By documenting retirement account statements within the prenuptial agreement, couples can establish how these funds will be handled in the event of a divorce. This might include outlining whether these accounts should be divided equally, protected from division, or subject to specific income-sharing or property distribution rules. 5. Investment Portfolio Statements: If either party has an investment portfolio, such as stocks, bonds, or other financial assets, it is imperative to include investment portfolio statements in the prenuptial agreement. These statements offer insights into the value and composition of the portfolio, guiding decisions related to asset division or maintenance upon divorce. By incorporating these various types of financial statements into a prenuptial agreement, couples in Tucson, Arizona, can ensure transparency, safeguard their assets, and minimize potential disputes during a divorce or separation. Working with experienced family law attorneys or financial professionals can provide couples with invaluable guidance and expertise to create comprehensive and tailored financial statements suitable for their unique circumstances.

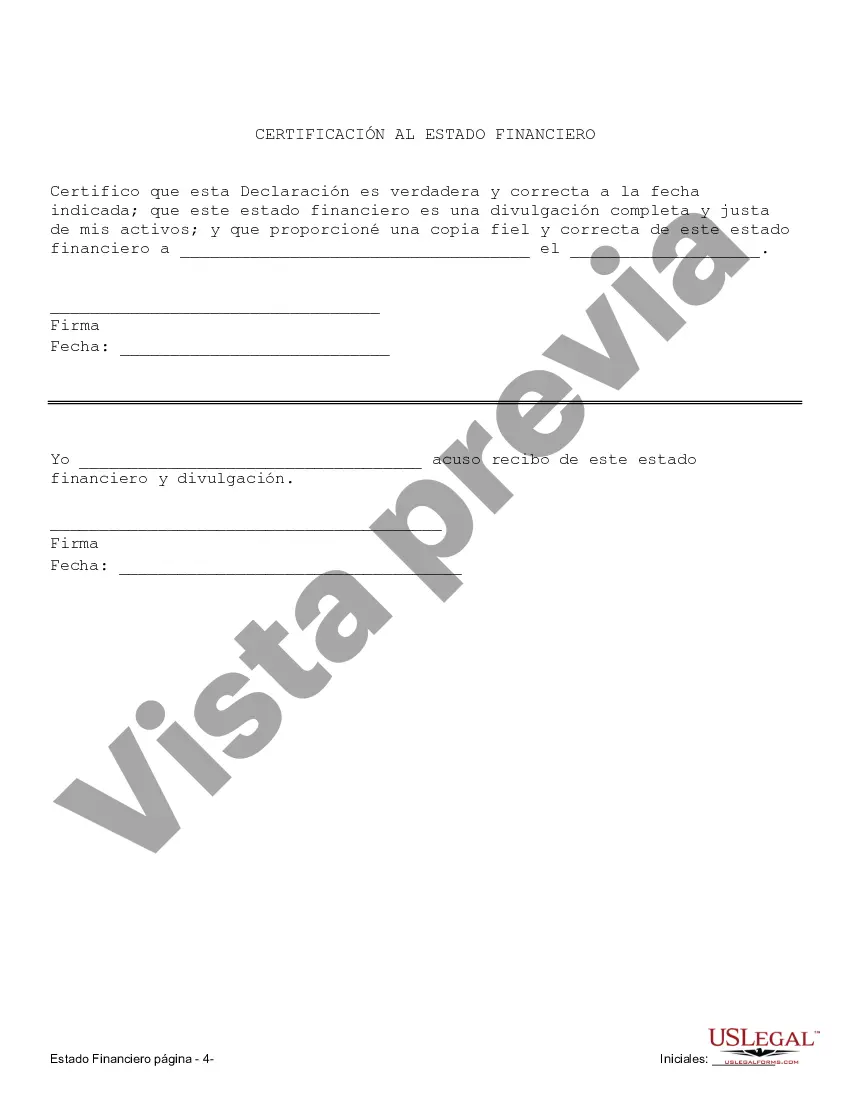

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tucson Arizona Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Arizona Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

If you’ve previously employed our service, Log Into your account and acquire the Tucson Arizona Financial Statements solely in Relation to Prenuptial Premarital Agreement on your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it according to your payment schedule.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have indefinite access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Ensure you’ve found a suitable document. Review the description and utilize the Preview option, if present, to verify if it fulfills your requirements. If it doesn’t meet your needs, make use of the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and complete the payment. Use your credit card information or the PayPal choice to finish the purchase.

- Obtain your Tucson Arizona Financial Statements solely in Relation to Prenuptial Premarital Agreement. Select the file format for your document and save it onto your device.

- Finalize your form. Print it or use professional online editors to complete and electronically sign it.