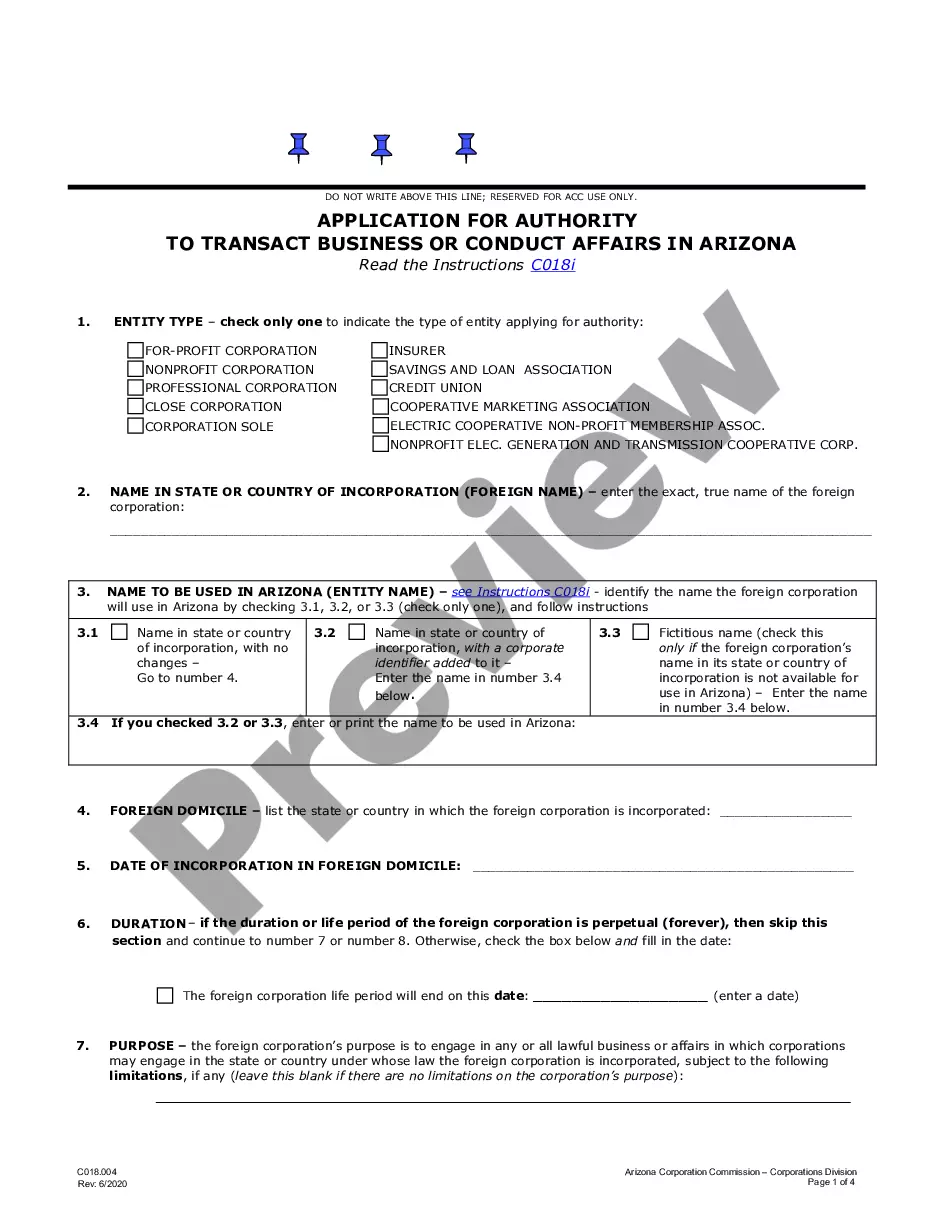

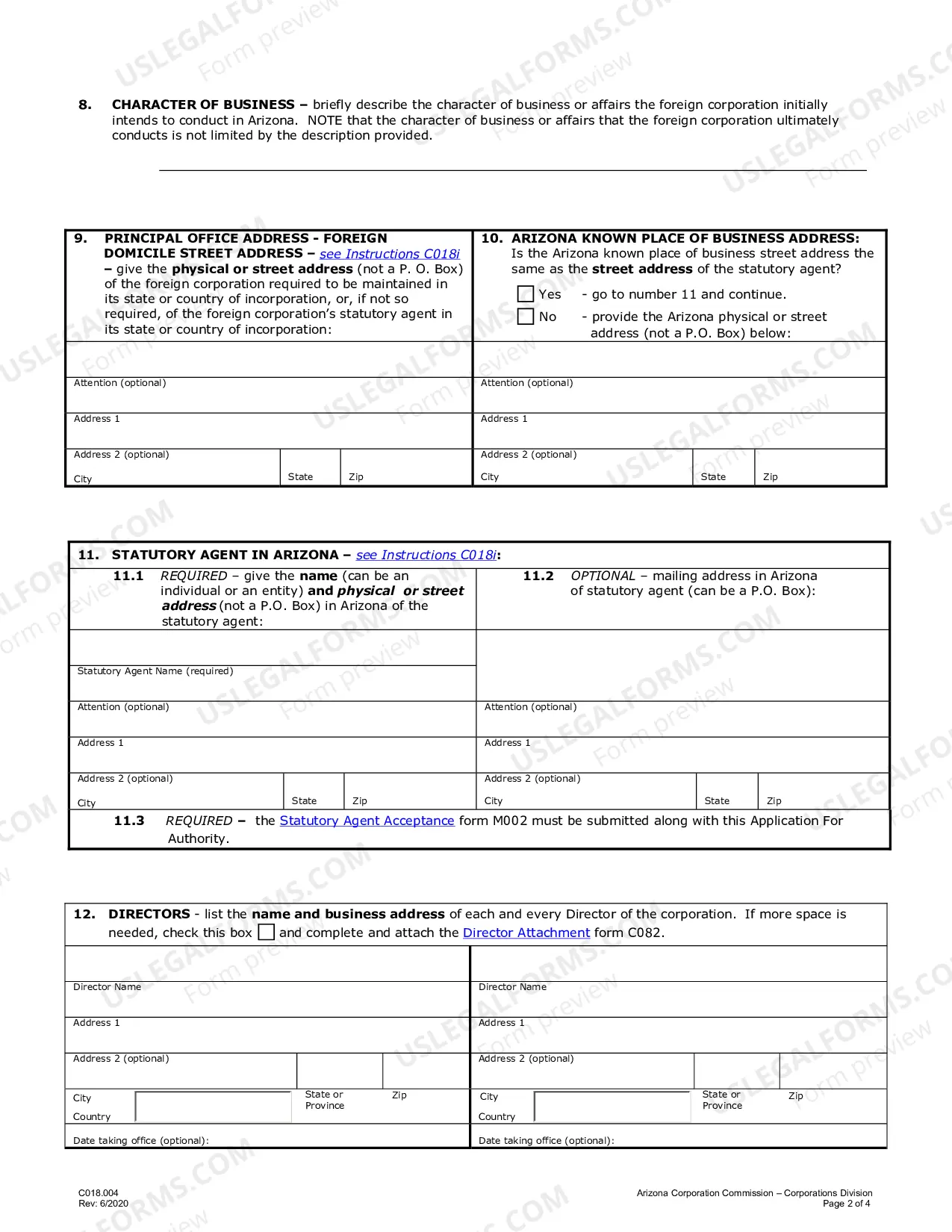

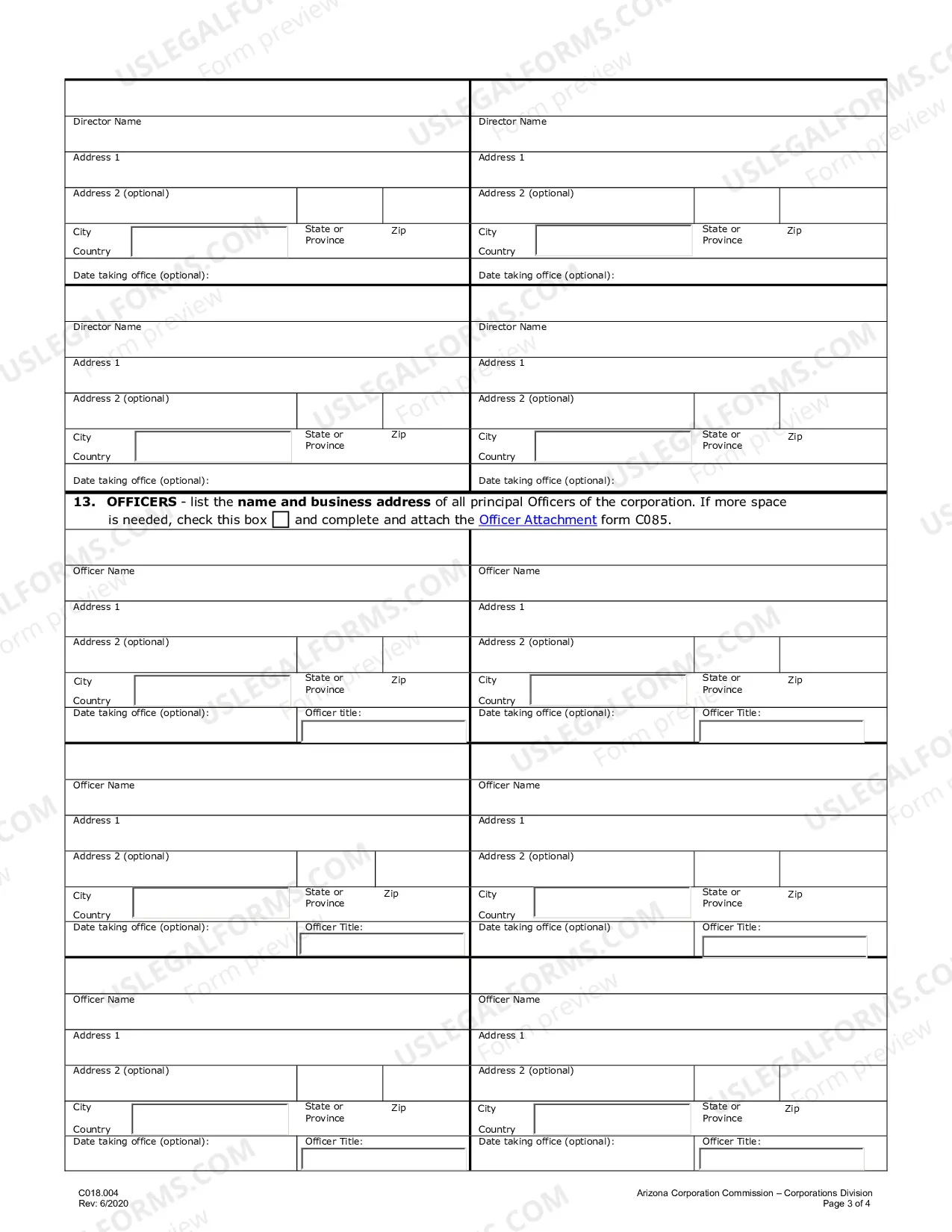

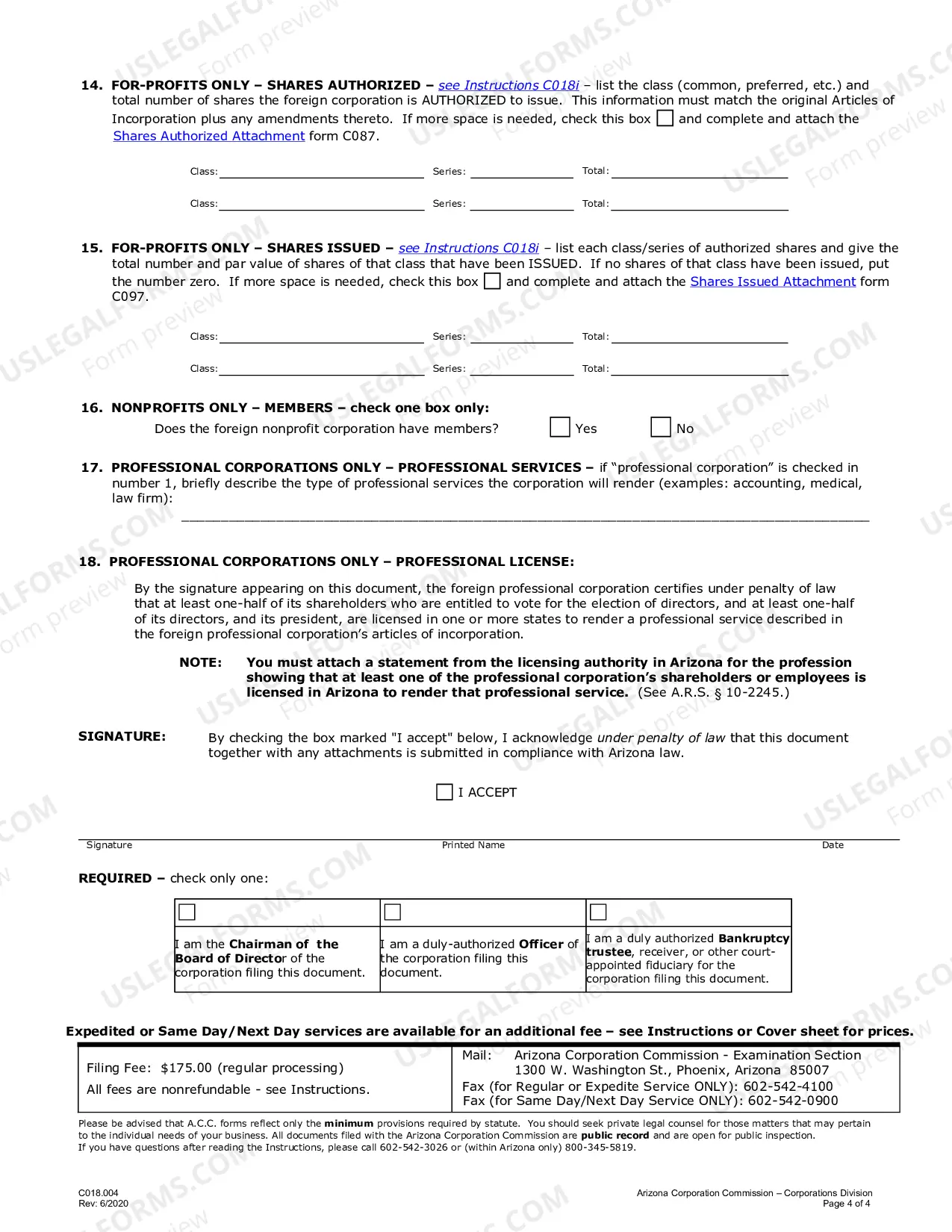

The Phoenix Arizona Registration of Foreign Corporation is a legal process by which corporations formed outside the state of Arizona can obtain permission to conduct business within the state. It is mandatory for any foreign corporation seeking to establish a presence or engage in business activities in Phoenix, Arizona. This registration process ensures that foreign corporations comply with local laws, regulations, and tax requirements. It also provides a level of transparency and protection for shareholders, stakeholders, and the public. To complete the registration, foreign corporations must submit certain documents to the Arizona Corporation Commission (ACC), the governing body responsible for overseeing corporate activities within the state. These documents typically include a completed application form, a certificate of good standing from the home state, and a filing fee. There are different types of Phoenix Arizona Registration of Foreign Corporation, categorized based on the corporation's legal structure and business activities. These may include: 1. Business Corporation: This type of foreign corporation registration applies to corporations that engage in for-profit business activities. They may include multinational companies, retail chains, or service-based organizations. 2. Nonprofit Corporation: Foreign nonprofit organizations seeking to establish a presence in Phoenix, Arizona, must register as a foreign nonprofit corporation. These organizations typically operate for religious, charitable, educational, or philanthropic purposes. 3. Professional Corporation: Certain professions, such as doctors, lawyers, and accountants, require business entities formed by individuals practicing these professions to register as professional corporations. Foreign professional corporations must obtain registration in order to provide their services in Phoenix, Arizona. 4. Close Corporation: A close corporation is a type of corporation in which shares are held by a limited number of individuals, often family members or close associates. Foreign close corporations must register before engaging in business activities in Phoenix, Arizona. By completing the Phoenix Arizona Registration of Foreign Corporation, these foreign entities gain official recognition in the state and are authorized to operate and transact business legally. This process allows them to establish a local presence, open bank accounts, enter into contracts, and avail themselves of the various benefits and protections afforded to domestic corporations in Phoenix, Arizona.

Foreign Qualification Arizona

Description

How to fill out Phoenix Arizona Registration Of Foreign Corporation?

We always strive to minimize or avoid legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney services that, as a rule, are extremely expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to legal counsel. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Phoenix Arizona Registration of Foreign Corporation or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally effortless if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Phoenix Arizona Registration of Foreign Corporation adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Phoenix Arizona Registration of Foreign Corporation would work for your case, you can pick the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!