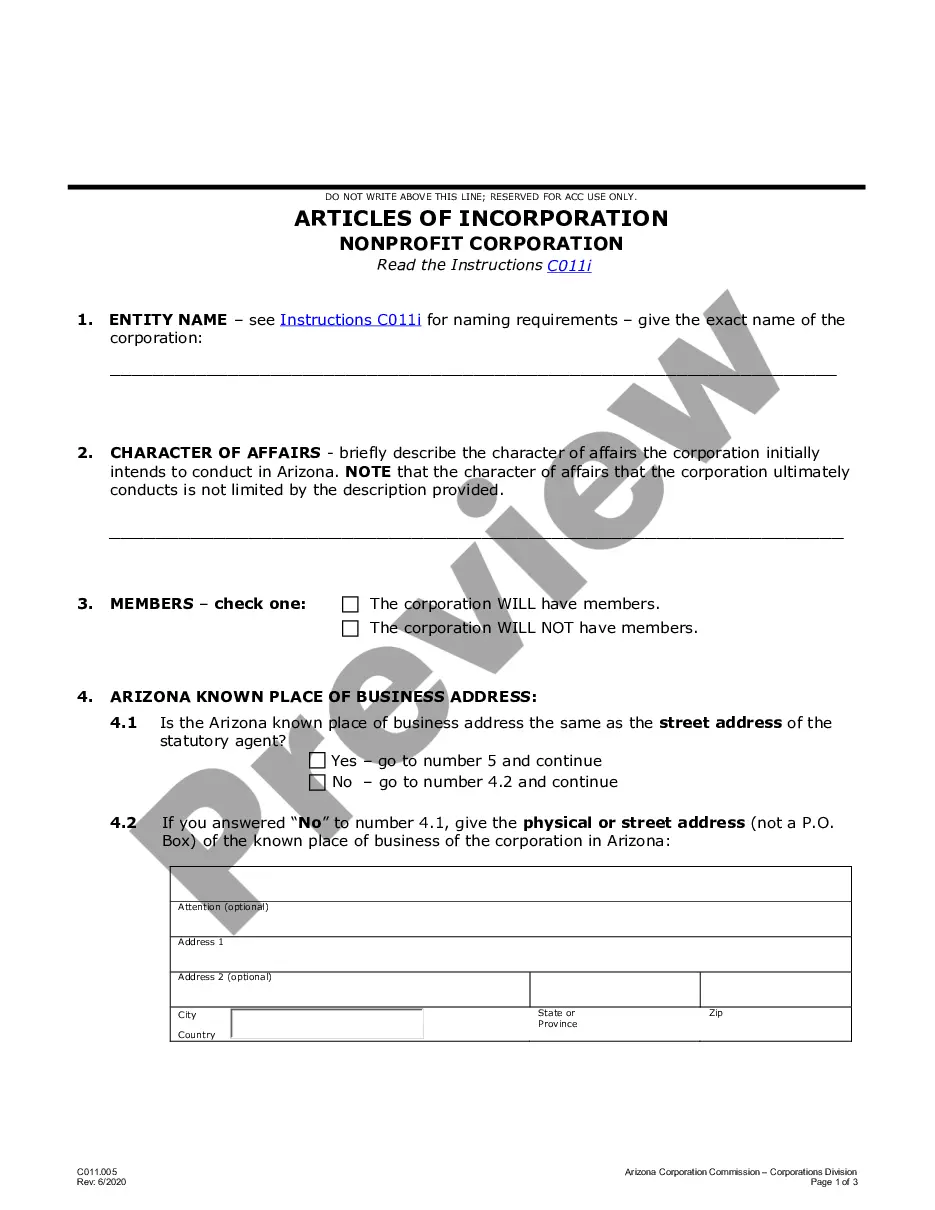

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

The Gilbert Arizona Articles of Incorporation for Domestic Nonprofit Corporation serve as a crucial legal document when establishing a nonprofit organization within Gilbert, Arizona. These articles are filed with the Arizona Corporation Commission and outline various essential details about the nonprofit's purpose, structure, and governing structure. The key components covered in the Gilbert Arizona Articles of Incorporation for Domestic Nonprofit Corporation include: 1. Name: The articles specify the chosen name of the nonprofit organization, ensuring uniqueness and compliance with Arizona state laws. Relevant keywords: Gilbert Arizona nonprofit organization, nonprofit corporation, incorporation. 2. Purpose: This section outlines the organization's mission, goals, and objectives, highlighting its charitable or educational purposes. Relevant keywords: nonprofit mission, nonprofit purpose, community service. 3. Registered Agent: The articles identify the registered agent, an individual or entity responsible for receiving legal documents and official communications on behalf of the nonprofit. Relevant keywords: registered agent, legal representation. 4. Duration: This section specifies whether the nonprofit is established for a specific period or perpetuity. Relevant keywords: nonprofit duration, continuous operation. 5. Members: If the nonprofit has members, this section describes the qualifications for membership and the rights and responsibilities of members. Relevant keywords: nonprofit membership, membership qualifications, nonprofit governance. 6. Directors: The articles mention the names and addresses of the initial directors of the nonprofit corporation. It may also include guidelines for the election and removal of directors. Relevant keywords: nonprofit board of directors, initial directors. 7. Bylaws: The articles may reference the nonprofit's bylaws, which provide detailed rules and regulations for its internal governance. Relevant keywords: nonprofit bylaws, internal regulations. 8. Dissolution: If the nonprofit corporation ever dissolves or ceases operations, this section outlines the procedures for asset distribution among qualified tax-exempt organizations. Relevant keywords: nonprofit dissolution, asset distribution. It is important to note that there are no specific variations or types of Gilbert Arizona Articles of Incorporation for Domestic Nonprofit Corporation. However, nonprofit organizations may have customized articles based on their specific needs while ensuring compliance with state laws. Establishing a nonprofit corporation with the Gilbert Arizona Articles of Incorporation for Domestic Nonprofit Corporation offers many benefits, such as tax-exempt status, limited liability protection, and the ability to solicit tax-deductible donations. It is recommended to consult an experienced attorney or legal professional specialized in nonprofit law to ensure the accuracy and conformity of the articles with the Arizona state laws.The Gilbert Arizona Articles of Incorporation for Domestic Nonprofit Corporation serve as a crucial legal document when establishing a nonprofit organization within Gilbert, Arizona. These articles are filed with the Arizona Corporation Commission and outline various essential details about the nonprofit's purpose, structure, and governing structure. The key components covered in the Gilbert Arizona Articles of Incorporation for Domestic Nonprofit Corporation include: 1. Name: The articles specify the chosen name of the nonprofit organization, ensuring uniqueness and compliance with Arizona state laws. Relevant keywords: Gilbert Arizona nonprofit organization, nonprofit corporation, incorporation. 2. Purpose: This section outlines the organization's mission, goals, and objectives, highlighting its charitable or educational purposes. Relevant keywords: nonprofit mission, nonprofit purpose, community service. 3. Registered Agent: The articles identify the registered agent, an individual or entity responsible for receiving legal documents and official communications on behalf of the nonprofit. Relevant keywords: registered agent, legal representation. 4. Duration: This section specifies whether the nonprofit is established for a specific period or perpetuity. Relevant keywords: nonprofit duration, continuous operation. 5. Members: If the nonprofit has members, this section describes the qualifications for membership and the rights and responsibilities of members. Relevant keywords: nonprofit membership, membership qualifications, nonprofit governance. 6. Directors: The articles mention the names and addresses of the initial directors of the nonprofit corporation. It may also include guidelines for the election and removal of directors. Relevant keywords: nonprofit board of directors, initial directors. 7. Bylaws: The articles may reference the nonprofit's bylaws, which provide detailed rules and regulations for its internal governance. Relevant keywords: nonprofit bylaws, internal regulations. 8. Dissolution: If the nonprofit corporation ever dissolves or ceases operations, this section outlines the procedures for asset distribution among qualified tax-exempt organizations. Relevant keywords: nonprofit dissolution, asset distribution. It is important to note that there are no specific variations or types of Gilbert Arizona Articles of Incorporation for Domestic Nonprofit Corporation. However, nonprofit organizations may have customized articles based on their specific needs while ensuring compliance with state laws. Establishing a nonprofit corporation with the Gilbert Arizona Articles of Incorporation for Domestic Nonprofit Corporation offers many benefits, such as tax-exempt status, limited liability protection, and the ability to solicit tax-deductible donations. It is recommended to consult an experienced attorney or legal professional specialized in nonprofit law to ensure the accuracy and conformity of the articles with the Arizona state laws.