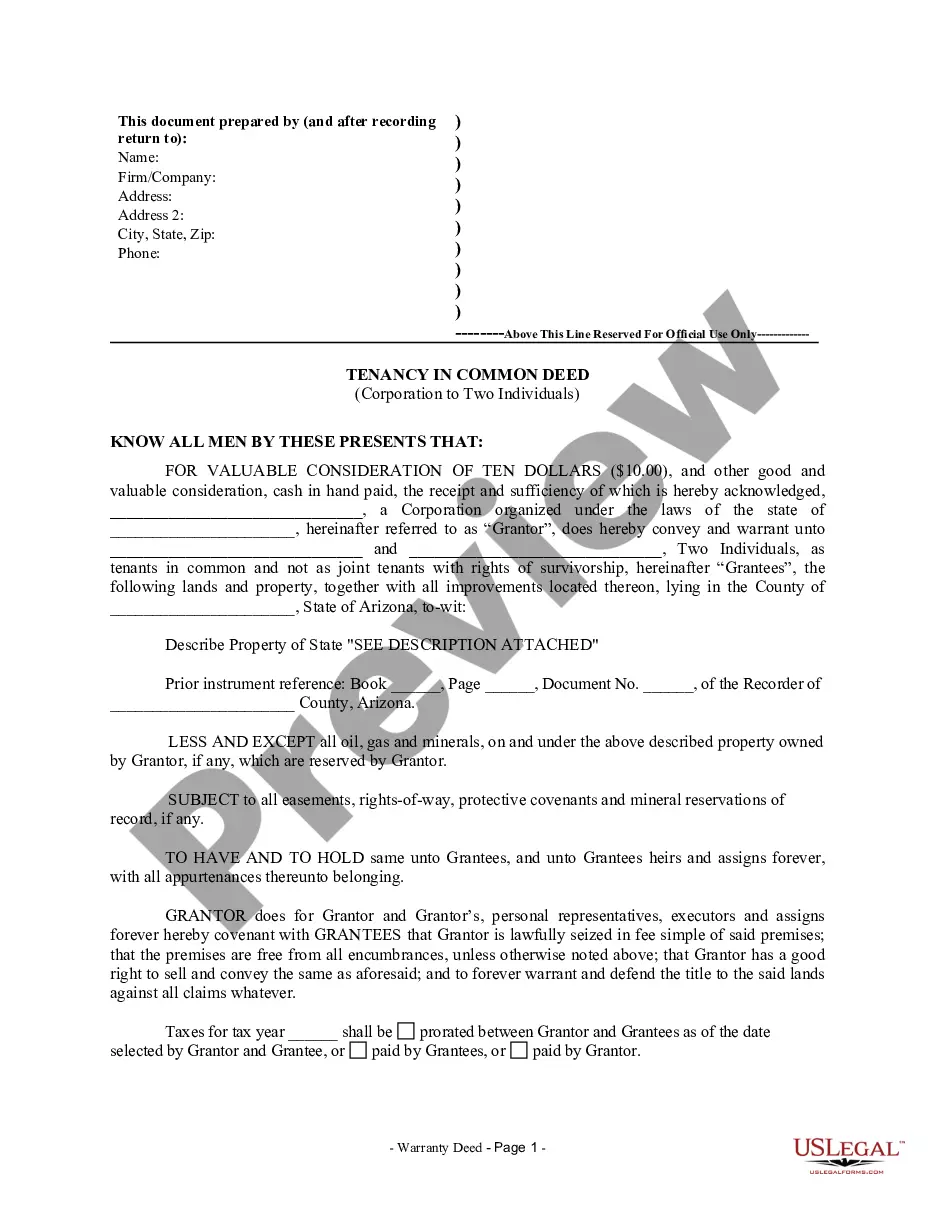

This form is a Joint Tenancy Deed where the grantor is a corporation and the grantees are two individuals.

A Surprise Arizona Tenancy in Common Deed from Corporation to Two Individuals is a legal document that transfers the ownership of a property from a corporation to two individuals, creating a tenancy in common arrangement. This type of deed is commonly used when a corporation intends to sell or transfer a property to two individual buyers. The Surprise Arizona Tenancy in Common Deed offers a unique ownership structure where the property is owned by two individuals with undivided interests but without the right of survivorship. This means that each individual owns a specific share of the property, typically expressed as a percentage, and upon the death of one owner, their share does not automatically transfer to the surviving owner, but instead passes according to their estate plan or applicable laws. There are a few variations of Surprise Arizona Tenancy in Common Deed from Corporation to Two Individuals: 1. Equal Shares Deed: This type of tenancy in common deed grants equal ownership shares to both individuals. For example, if two people purchase a property through a corporation, each will have a 50% ownership interest in the property. 2. Unequal Shares Deed: In some cases, the individuals may choose to have different ownership percentages. This can be based on the contributions made by each party, financial agreements, or other factors agreed upon during the purchase. For instance, one individual may own a 70% share, while the other owns a 30% share. 3. Sole Management Deed: This variation allows one individual to have sole management control over the property, despite the equal or unequal ownership shares. The decision-making authority is given to one owner, who can make decisions regarding maintenance, improvements, and leasing without the consent of the co-owner. 4. Sale or Partition Deed: This type of deed caters to situations where the co-owners want to sell the property or divide it into separate portions. In such cases, the sale or partition of the property can be executed with the agreement and consent of all parties involved. Understanding the specific type of Surprise Arizona Tenancy in Common Deed from Corporation to Two Individuals is essential as it determines the rights and responsibilities of each co-owner. It is highly recommended seeking legal guidance from a qualified attorney or a real estate professional to draft and review the deed to ensure that it accurately reflects the intentions and desired arrangements of all parties involved.A Surprise Arizona Tenancy in Common Deed from Corporation to Two Individuals is a legal document that transfers the ownership of a property from a corporation to two individuals, creating a tenancy in common arrangement. This type of deed is commonly used when a corporation intends to sell or transfer a property to two individual buyers. The Surprise Arizona Tenancy in Common Deed offers a unique ownership structure where the property is owned by two individuals with undivided interests but without the right of survivorship. This means that each individual owns a specific share of the property, typically expressed as a percentage, and upon the death of one owner, their share does not automatically transfer to the surviving owner, but instead passes according to their estate plan or applicable laws. There are a few variations of Surprise Arizona Tenancy in Common Deed from Corporation to Two Individuals: 1. Equal Shares Deed: This type of tenancy in common deed grants equal ownership shares to both individuals. For example, if two people purchase a property through a corporation, each will have a 50% ownership interest in the property. 2. Unequal Shares Deed: In some cases, the individuals may choose to have different ownership percentages. This can be based on the contributions made by each party, financial agreements, or other factors agreed upon during the purchase. For instance, one individual may own a 70% share, while the other owns a 30% share. 3. Sole Management Deed: This variation allows one individual to have sole management control over the property, despite the equal or unequal ownership shares. The decision-making authority is given to one owner, who can make decisions regarding maintenance, improvements, and leasing without the consent of the co-owner. 4. Sale or Partition Deed: This type of deed caters to situations where the co-owners want to sell the property or divide it into separate portions. In such cases, the sale or partition of the property can be executed with the agreement and consent of all parties involved. Understanding the specific type of Surprise Arizona Tenancy in Common Deed from Corporation to Two Individuals is essential as it determines the rights and responsibilities of each co-owner. It is highly recommended seeking legal guidance from a qualified attorney or a real estate professional to draft and review the deed to ensure that it accurately reflects the intentions and desired arrangements of all parties involved.