This type of trust is called a "self-settled trust" and the person who creates the trust and transfers property to the trust is called the "settlor." The concept that you cannot create a trust to defeat your creditors is codified in Arizona Revised Statutes Section 14-10505(A)1 that states, "During the lifetime of the settlor, the property of a revocable trust is subject to claims of the settlor's creditors." Arizona Revised Statutes Section 14-10505(A)2 states, ". . . with respect to an irrevocable trust, a creditor or assignee of the settlor may reach the maximum amount that can be distributed to or for the settlor's benefit."

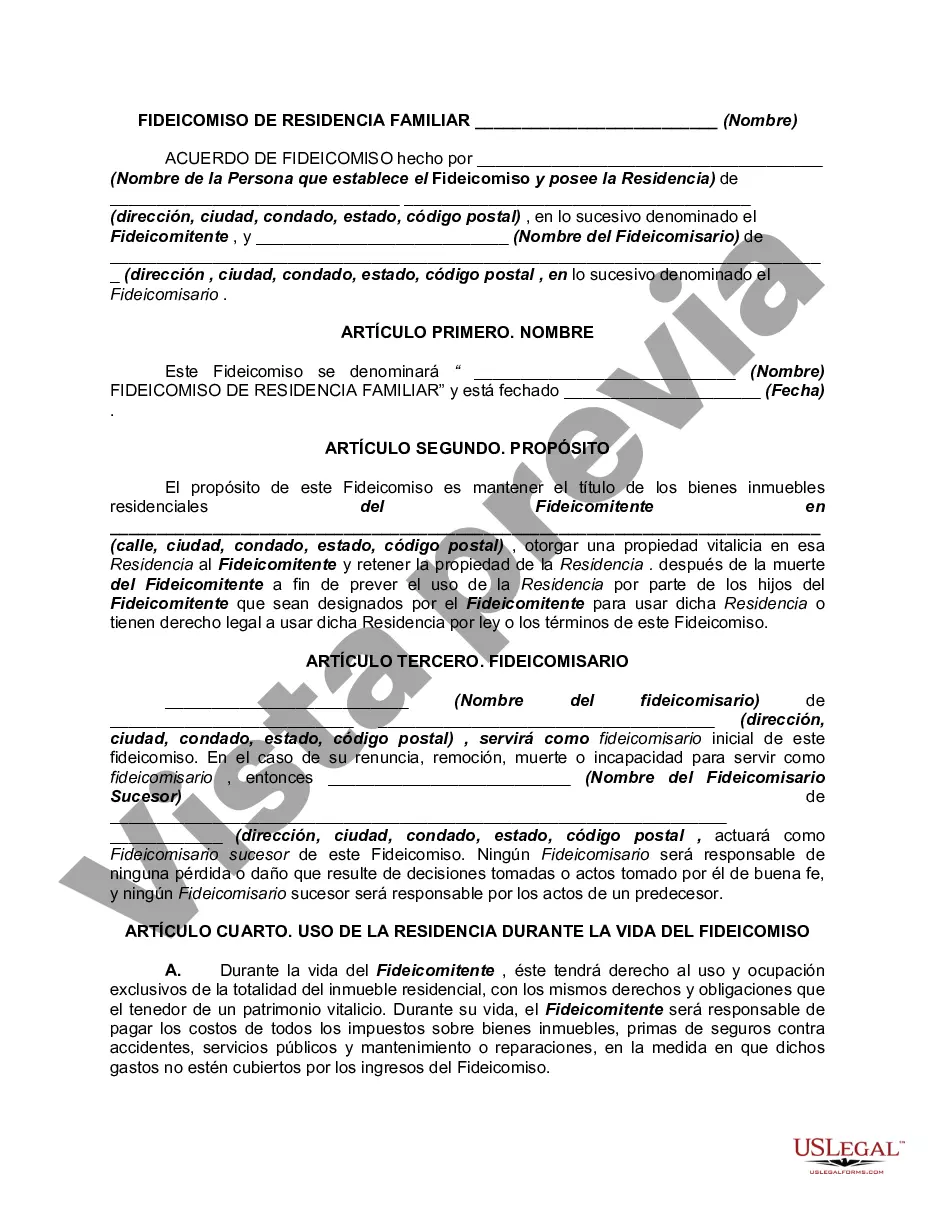

The Phoenix Arizona Irrevocable Trust for Lifetime Benefit of Trust or Covering Family Residence is a legal arrangement that involves the transfer of ownership of a family residence to a trust, overseen by a trustee, for the lifetime benefit of the trust or (the person creating the trust). This type of trust offers a range of benefits and protections for the trust or and their family, ensuring the smooth transfer and management of the family residence while allowing for tax advantages. One key aspect of this trust is its irrevocable nature, meaning that once the trust is established, it cannot be altered or revoked without the consent of all parties involved. This ensures the continuity and stability of the trust arrangement, providing peace of mind to the trust or and their family. The primary purpose of this trust is to preserve the value of the family residence while enabling the trust or to enjoy its benefits during their lifetime. It provides a means for the trust or to retain control over the property, access any income generated by it, and reside in the family home without fear of eviction or forced sale. There are different types of Phoenix Arizona Irrevocable Trusts for Lifetime Benefit of Trust or Covering Family Residence, each tailored to meet specific needs: 1. Qualified Personnel Residence Trusts (Parts): These trusts allow the trust or to transfer their residence to the trust, taking advantage of gift tax exemptions while remaining in the home for a specified period. After that period, the residence is transferred to the beneficiaries, typically family members. 2. Charitable Remainder Trusts (CRTs): This type of trust enables the trust or to donate their residence to charity, thus enjoying immediate tax benefits while retaining the right to occupy the residence for a set period or lifetime. Upon termination, the charity receives the property to use or sell. 3. Dynasty Trusts: These trusts are created to pass on the family residence from one generation to another, effectively preserving the property's value and protecting it from estate taxes and potential creditors. Regardless of the type of trust, the Phoenix Arizona Irrevocable Trust for Lifetime Benefit of Trust or Covering Family Residence safeguards the trust or's interests, provides for their family's housing needs, and offers various estate planning advantages. Expert legal guidance is crucial when setting up this trust to ensure compliance with state laws and regulations while tailoring its provisions to meet the unique circumstances of the trust or and their family.The Phoenix Arizona Irrevocable Trust for Lifetime Benefit of Trust or Covering Family Residence is a legal arrangement that involves the transfer of ownership of a family residence to a trust, overseen by a trustee, for the lifetime benefit of the trust or (the person creating the trust). This type of trust offers a range of benefits and protections for the trust or and their family, ensuring the smooth transfer and management of the family residence while allowing for tax advantages. One key aspect of this trust is its irrevocable nature, meaning that once the trust is established, it cannot be altered or revoked without the consent of all parties involved. This ensures the continuity and stability of the trust arrangement, providing peace of mind to the trust or and their family. The primary purpose of this trust is to preserve the value of the family residence while enabling the trust or to enjoy its benefits during their lifetime. It provides a means for the trust or to retain control over the property, access any income generated by it, and reside in the family home without fear of eviction or forced sale. There are different types of Phoenix Arizona Irrevocable Trusts for Lifetime Benefit of Trust or Covering Family Residence, each tailored to meet specific needs: 1. Qualified Personnel Residence Trusts (Parts): These trusts allow the trust or to transfer their residence to the trust, taking advantage of gift tax exemptions while remaining in the home for a specified period. After that period, the residence is transferred to the beneficiaries, typically family members. 2. Charitable Remainder Trusts (CRTs): This type of trust enables the trust or to donate their residence to charity, thus enjoying immediate tax benefits while retaining the right to occupy the residence for a set period or lifetime. Upon termination, the charity receives the property to use or sell. 3. Dynasty Trusts: These trusts are created to pass on the family residence from one generation to another, effectively preserving the property's value and protecting it from estate taxes and potential creditors. Regardless of the type of trust, the Phoenix Arizona Irrevocable Trust for Lifetime Benefit of Trust or Covering Family Residence safeguards the trust or's interests, provides for their family's housing needs, and offers various estate planning advantages. Expert legal guidance is crucial when setting up this trust to ensure compliance with state laws and regulations while tailoring its provisions to meet the unique circumstances of the trust or and their family.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.