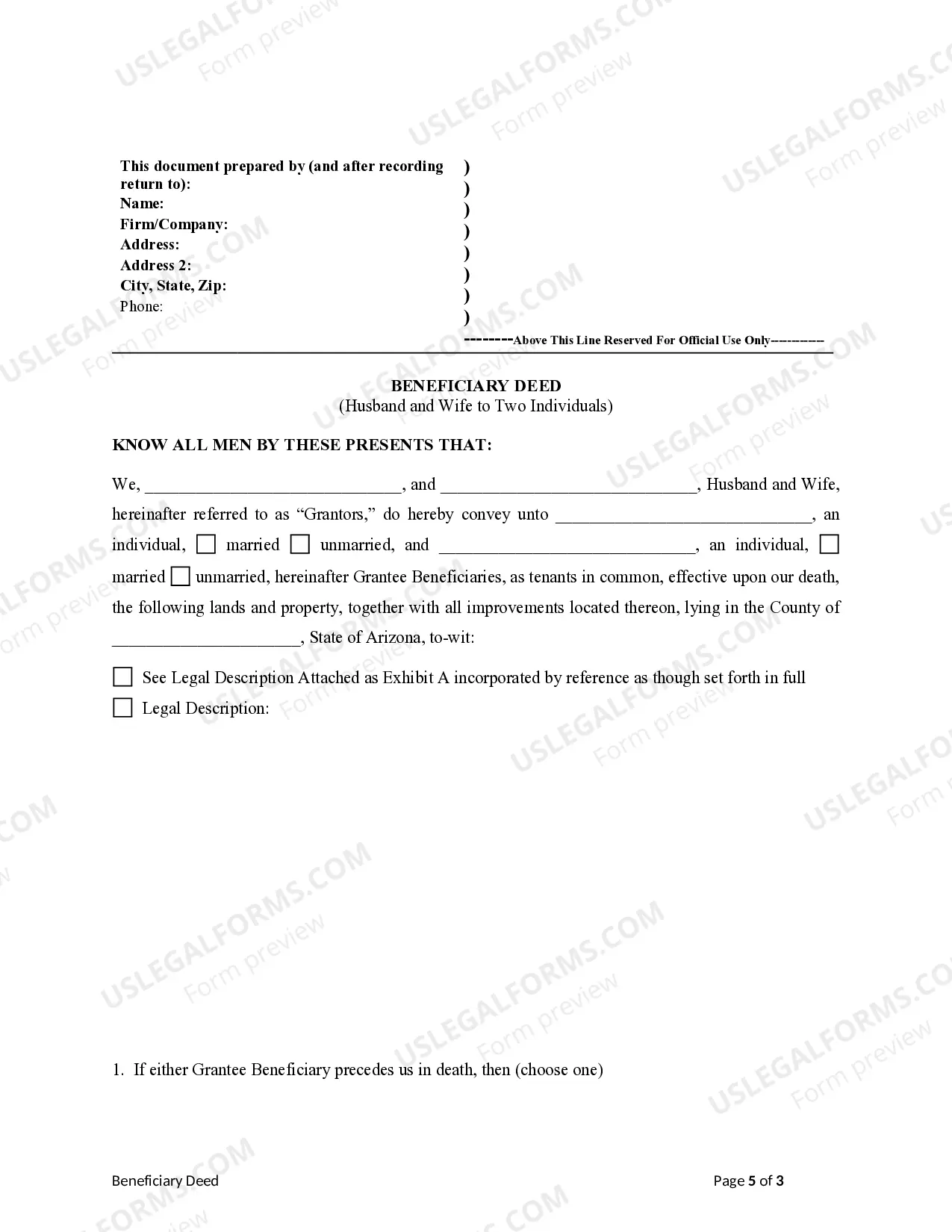

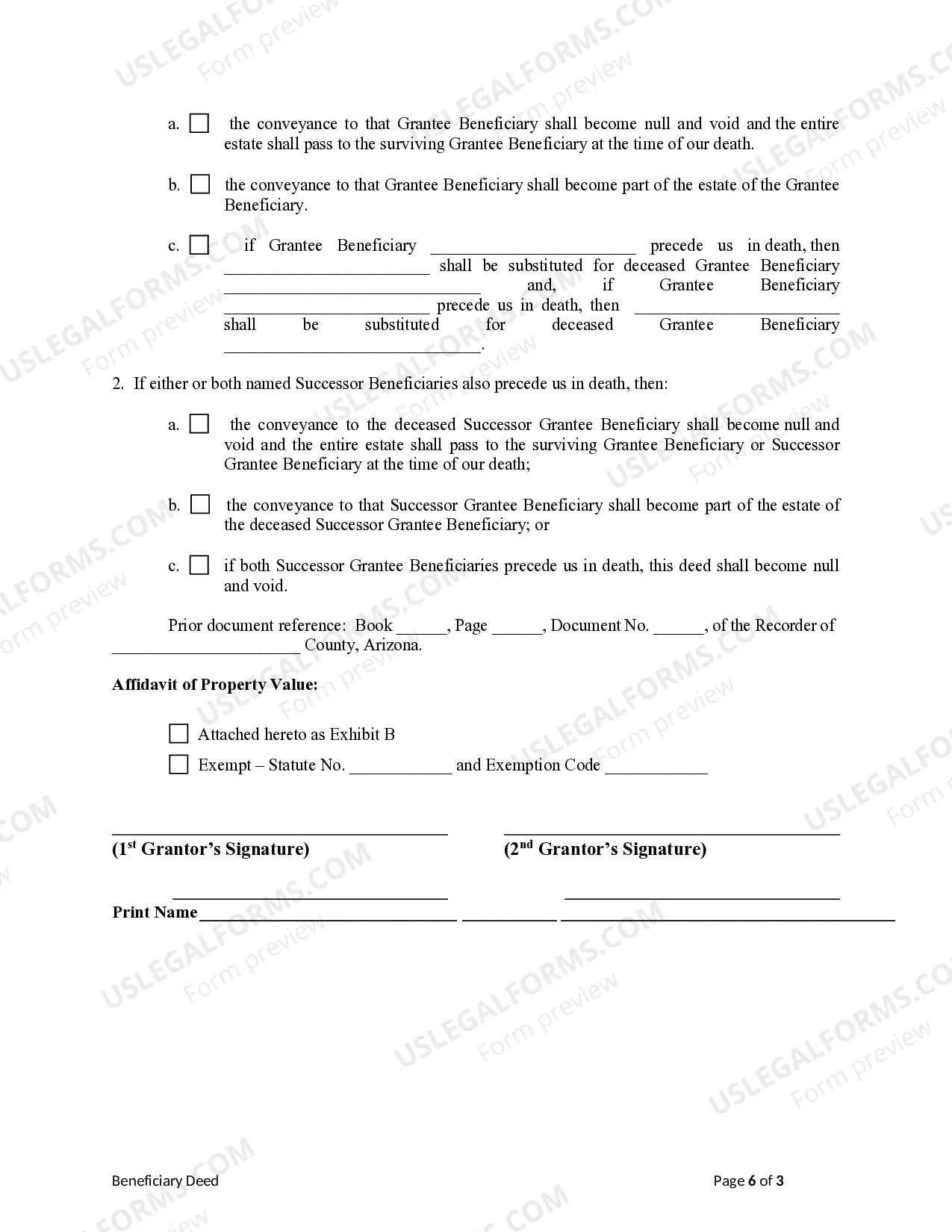

Transfer on Death Deed - Arizona - Husband and Wife to Two Individuals: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantors to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

A transfer on death deed, also known as a TOD — beneficiary deed, is a legal arrangement that allows a property owner in Chandler, Arizona, to designate specific individuals as beneficiaries who will inherit the property automatically upon the owner's death. This type of deed is particularly beneficial for married couples who wish to transfer their property seamlessly to two individuals, potentially their children, with successor beneficiaries named to ensure a smooth transfer in case of unforeseen events. In Chandler, Arizona, there are different types of transfer on death deeds or TOD — beneficiary deeds available for husband and wife to two individuals with successor beneficiaries. These different types include: 1. Joint Tenants with Rights of Survivorship (TWOS) TOD — Beneficiary Deed: This type of deed allows the married couple to transfer their property to two individuals, often their children, as joint tenants. In this arrangement, if one spouse passes away, the surviving spouse becomes the sole owner. However, if both spouses pass away simultaneously, the property transfers directly to the named beneficiaries, avoiding probate. 2. Tenants in Common TOD — Beneficiary Deed: With this type of deed, the married couple can designate two individuals as tenants in common, who will each inherit a specific share or percentage of the property. Unlike joint tenants with rights of survivorship, upon the death of one spouse, their share does not automatically transfer to the other spouse. Instead, it goes to the beneficiary named in the deed. 3. Life Estate with Remainder Interest TOD — Beneficiary Deed: This type of deed allows the husband and wife to retain the right to live in and use the property for the remainder of their lives while designating two individuals as remainder beneficiaries. Upon the death of the surviving spouse, the property passes directly to the remainder beneficiaries without the need for probate. Naming successor beneficiaries is crucial in case the primary beneficiaries named in the TOD — beneficiary deed are unable to inherit the property due to unfortunate circumstances like their demise before the property owner's death. By naming successors, the property owner ensures that the property is efficiently passed on to the intended beneficiaries. It is important to consult with an experienced real estate attorney or legal professional in Chandler, Arizona, to determine the most suitable type of transfer on death deed or TOD — beneficiary deed for a husband and wife, considering their unique circumstances and estate planning goals.A transfer on death deed, also known as a TOD — beneficiary deed, is a legal arrangement that allows a property owner in Chandler, Arizona, to designate specific individuals as beneficiaries who will inherit the property automatically upon the owner's death. This type of deed is particularly beneficial for married couples who wish to transfer their property seamlessly to two individuals, potentially their children, with successor beneficiaries named to ensure a smooth transfer in case of unforeseen events. In Chandler, Arizona, there are different types of transfer on death deeds or TOD — beneficiary deeds available for husband and wife to two individuals with successor beneficiaries. These different types include: 1. Joint Tenants with Rights of Survivorship (TWOS) TOD — Beneficiary Deed: This type of deed allows the married couple to transfer their property to two individuals, often their children, as joint tenants. In this arrangement, if one spouse passes away, the surviving spouse becomes the sole owner. However, if both spouses pass away simultaneously, the property transfers directly to the named beneficiaries, avoiding probate. 2. Tenants in Common TOD — Beneficiary Deed: With this type of deed, the married couple can designate two individuals as tenants in common, who will each inherit a specific share or percentage of the property. Unlike joint tenants with rights of survivorship, upon the death of one spouse, their share does not automatically transfer to the other spouse. Instead, it goes to the beneficiary named in the deed. 3. Life Estate with Remainder Interest TOD — Beneficiary Deed: This type of deed allows the husband and wife to retain the right to live in and use the property for the remainder of their lives while designating two individuals as remainder beneficiaries. Upon the death of the surviving spouse, the property passes directly to the remainder beneficiaries without the need for probate. Naming successor beneficiaries is crucial in case the primary beneficiaries named in the TOD — beneficiary deed are unable to inherit the property due to unfortunate circumstances like their demise before the property owner's death. By naming successors, the property owner ensures that the property is efficiently passed on to the intended beneficiaries. It is important to consult with an experienced real estate attorney or legal professional in Chandler, Arizona, to determine the most suitable type of transfer on death deed or TOD — beneficiary deed for a husband and wife, considering their unique circumstances and estate planning goals.