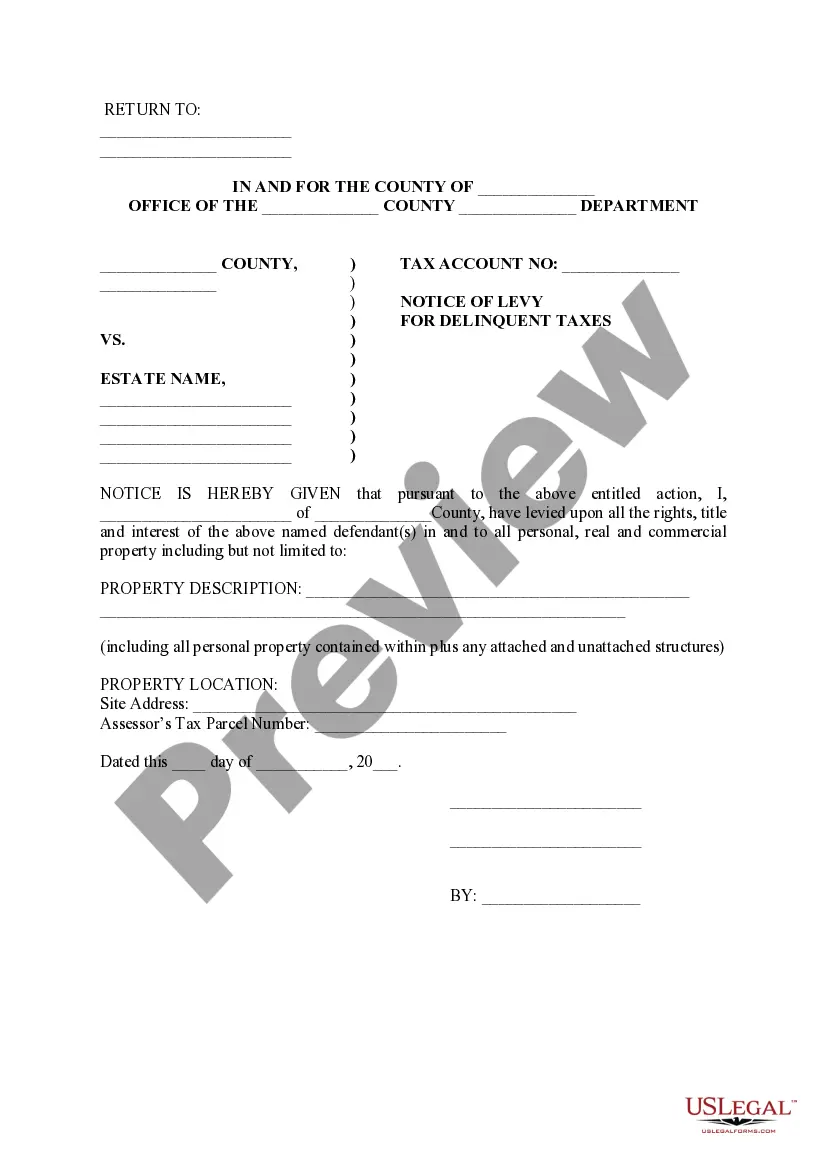

Chandler Arizona Notice of Levy for Delinquent Taxes is a legal notice issued by the Chandler Department of Revenue to individuals or businesses who have failed to pay their taxes on time. It serves as a warning and an enforcement action to collect the outstanding tax debt. The Chandler Department of Revenue takes tax delinquency seriously and uses the Notice of Levy as a tool to recoup the owed taxes. This notice is typically sent after multiple attempts to communicate with the taxpayer about the unpaid taxes have been made. The Notice of Levy informs the recipient that the department has seized or intends to seize their assets to satisfy the tax debt. Assets that can be subject to levy include bank accounts, wages, commissions, rents, or any other sources of income. It aims to recover the owed taxes by selling or liquidating the seized assets. There are different types of Chandler Arizona Notice of Levy for Delinquent Taxes, depending on the specific circumstances of the taxpayer. Some common types include: 1. Bank Levy: This Notice of Levy allows the Chandler Department of Revenue to freeze and seize funds from the taxpayer's bank accounts to settle the outstanding tax debt. 2. Wage Levy: This notice authorizes the department to garnish a percentage of the taxpayer's wages or salary directly from their employer until the tax liability is paid in full. 3. Property Levy: If the taxpayer owns real estate, the Notice of Levy may allow the department to place a lien on the property. If the tax debt remains unpaid, the property may be seized and sold to recover the owed taxes. 4. Accounts Receivable Levy: This type of notice empowers the department to seize funds owed to the taxpayer by their customers or clients, such as accounts receivable or pending payments, to satisfy the tax debt. It is essential to take the Chandler Arizona Notice of Levy for Delinquent Taxes seriously and act promptly to resolve the tax issue. Ignoring the notice or failing to address the outstanding tax debt can result in severe consequences, including additional penalties, interest, and legal action. To resolve a Chandler Arizona Notice of Levy for Delinquent Taxes, it is advisable to seek professional assistance from a tax attorney or a qualified tax professional. They can guide individuals or businesses through the necessary steps to negotiate a payment plan, settle the debt, or explore other options to resolve the tax issue amicably. In conclusion, receiving a Chandler Arizona Notice of Levy for Delinquent Taxes is a serious matter that requires immediate attention. Understanding the different types of levies and seeking professional help can greatly assist individuals or businesses in resolving their tax delinquency and avoiding further complications.

Chandler Arizona Notice of Levy for Delinquent Taxes

Description

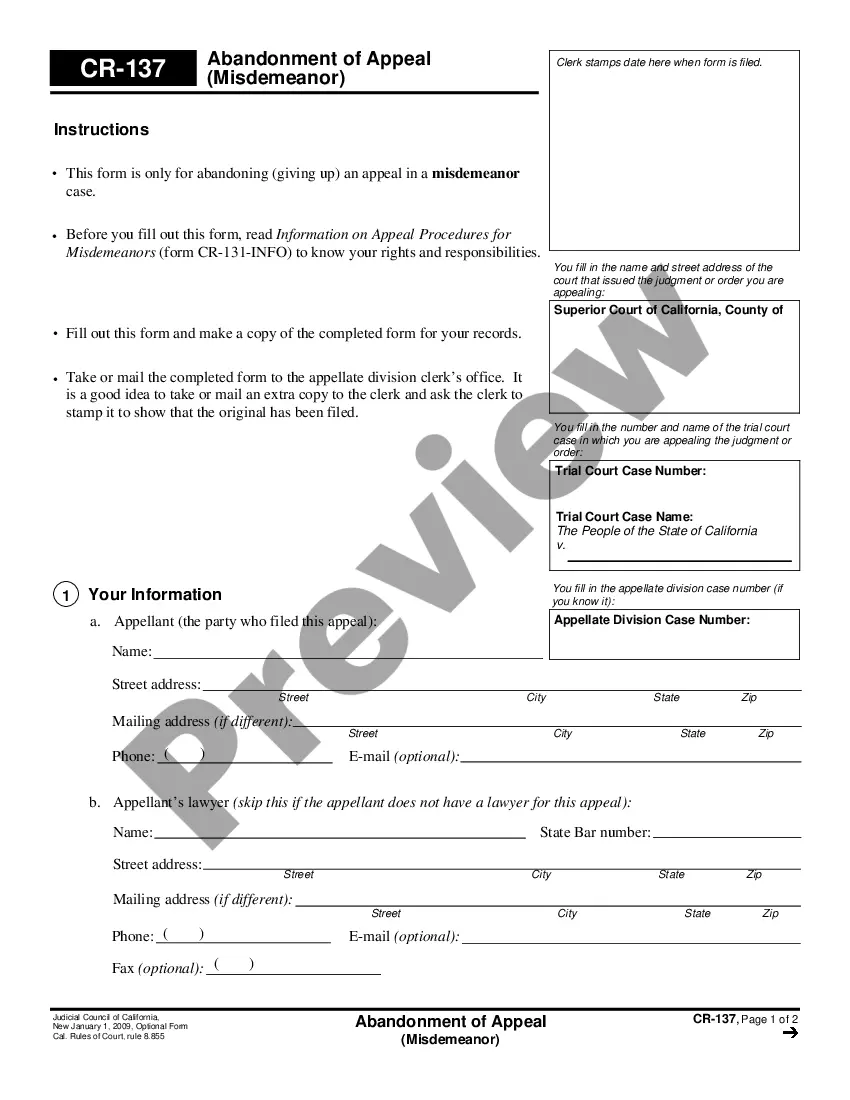

How to fill out Chandler Arizona Notice Of Levy For Delinquent Taxes?

Are you looking for a reliable and affordable legal forms supplier to get the Chandler Arizona Notice of Levy for Delinquent Taxes? US Legal Forms is your go-to option.

Whether you need a simple arrangement to set rules for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of particular state and county.

To download the form, you need to log in account, locate the required form, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Chandler Arizona Notice of Levy for Delinquent Taxes conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is good for.

- Restart the search in case the form isn’t good for your legal scenario.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Chandler Arizona Notice of Levy for Delinquent Taxes in any available file format. You can get back to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours learning about legal papers online for good.