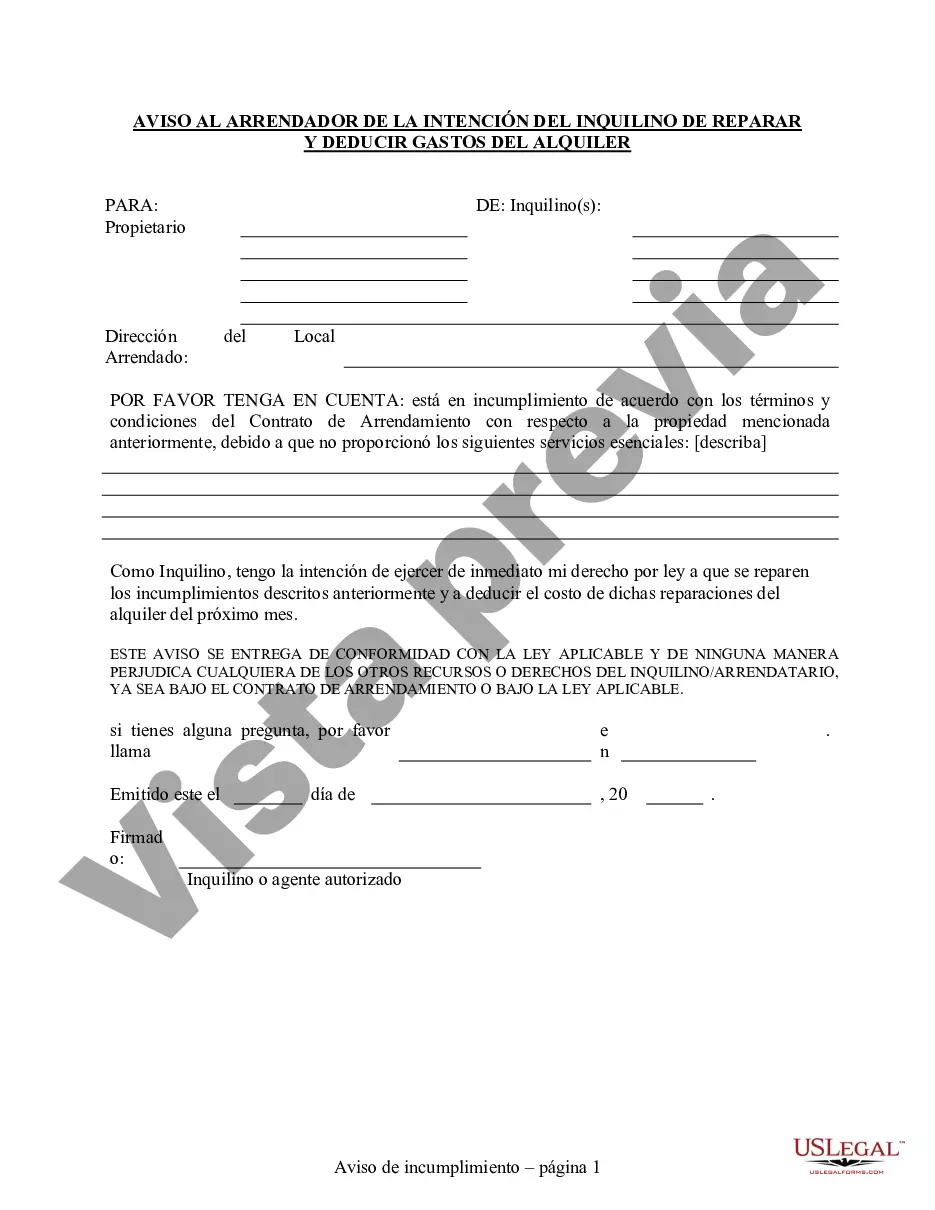

This form is for use by Tenant to notify Landlord of Tenant's intent to use the "repair and deduct" provisions of the Landlord-Tenant Laws (Tenant pays for repairs and deducts the costs from next month's rent) due to Landlords failure to fix problems on the premises.

Title: Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent for Residential: A Comprehensive Guide Introduction: In Surprise, Arizona, tenants have certain rights when it comes to repairing issues in their rented residential properties. When facing repair or maintenance problems, tenants may opt to provide their landlord with a Notice of Intent to Repair and Deduct from Rent. This document serves as a written notice to inform the landlord of the tenant's plan to deduct the cost of repairs from their monthly rent. Below, we delve into the essential details surrounding this notice, including its purpose, requirements, and variations. 1. Purpose of Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent: The Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent aims to acknowledge tenant rights and facilitate a fair and efficient resolution process for maintenance issues. This notice allows tenants to promptly address problems, ensuring a habitable living environment and protecting their health and safety. 2. Key Components of the Notice: A Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent should contain crucial details, such as: — Tenant's contacinformationio— - Landlord's contact information — Rental propertaddresses— - Description of the repair problem or maintenance issue — Approximate cost of necessary repair— - A request for written confirmation of receipt 3. Requirements and Legal Considerations: To ensure legal validity, the Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent must adhere to specific requirements, which may vary from state to state. Pay attention to these essential points: — Review your lease agreement: Ensure it doesn't prohibit or specify an alternative method for handling repairs. — Give reasonable notice: The tenant should provide the landlord with a reasonable period to address the repairs themselves before proceeding with the repair and deduct option. — Document the issue: Take photographs or videos of the maintenance problem to support your claim. — Provide receipts: Keep receipts for all repair expenses, including labor and materials. — Follow state-specific laws: Familiarize yourself with Arizona's landlord-tenant laws to ensure compliance when initiating the repair and deduct process. Types of Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent: 1. Urgent Repair Notice: Use this notice when facing urgent repairs that directly impact health, safety, or habitability, such as roof leaks, electrical issues, or plumbing failures. 2. Non-Urgent Repair Notice: Employ this notice for repair matters that are not immediately hazardous but still negatively affect the tenant's enjoyment of the property, such as cosmetic repairs, faulty appliances, or non-functional amenities. Conclusion: The Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent offers tenants a valuable tool to effectively communicate their intent to address necessary repairs promptly. By following the appropriate legal guidelines and utilizing the correct notice type, tenants can aim to resolve maintenance issues while ensuring their rights are protected. Consulting local legal resources or seeking professional advice can help tenants smoothly navigate this process and maintain a safe and habitable living environment.Title: Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent for Residential: A Comprehensive Guide Introduction: In Surprise, Arizona, tenants have certain rights when it comes to repairing issues in their rented residential properties. When facing repair or maintenance problems, tenants may opt to provide their landlord with a Notice of Intent to Repair and Deduct from Rent. This document serves as a written notice to inform the landlord of the tenant's plan to deduct the cost of repairs from their monthly rent. Below, we delve into the essential details surrounding this notice, including its purpose, requirements, and variations. 1. Purpose of Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent: The Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent aims to acknowledge tenant rights and facilitate a fair and efficient resolution process for maintenance issues. This notice allows tenants to promptly address problems, ensuring a habitable living environment and protecting their health and safety. 2. Key Components of the Notice: A Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent should contain crucial details, such as: — Tenant's contacinformationio— - Landlord's contact information — Rental propertaddresses— - Description of the repair problem or maintenance issue — Approximate cost of necessary repair— - A request for written confirmation of receipt 3. Requirements and Legal Considerations: To ensure legal validity, the Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent must adhere to specific requirements, which may vary from state to state. Pay attention to these essential points: — Review your lease agreement: Ensure it doesn't prohibit or specify an alternative method for handling repairs. — Give reasonable notice: The tenant should provide the landlord with a reasonable period to address the repairs themselves before proceeding with the repair and deduct option. — Document the issue: Take photographs or videos of the maintenance problem to support your claim. — Provide receipts: Keep receipts for all repair expenses, including labor and materials. — Follow state-specific laws: Familiarize yourself with Arizona's landlord-tenant laws to ensure compliance when initiating the repair and deduct process. Types of Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent: 1. Urgent Repair Notice: Use this notice when facing urgent repairs that directly impact health, safety, or habitability, such as roof leaks, electrical issues, or plumbing failures. 2. Non-Urgent Repair Notice: Employ this notice for repair matters that are not immediately hazardous but still negatively affect the tenant's enjoyment of the property, such as cosmetic repairs, faulty appliances, or non-functional amenities. Conclusion: The Surprise Arizona Notice to Landlord of Intent to Repair and Deduct from Rent offers tenants a valuable tool to effectively communicate their intent to address necessary repairs promptly. By following the appropriate legal guidelines and utilizing the correct notice type, tenants can aim to resolve maintenance issues while ensuring their rights are protected. Consulting local legal resources or seeking professional advice can help tenants smoothly navigate this process and maintain a safe and habitable living environment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.