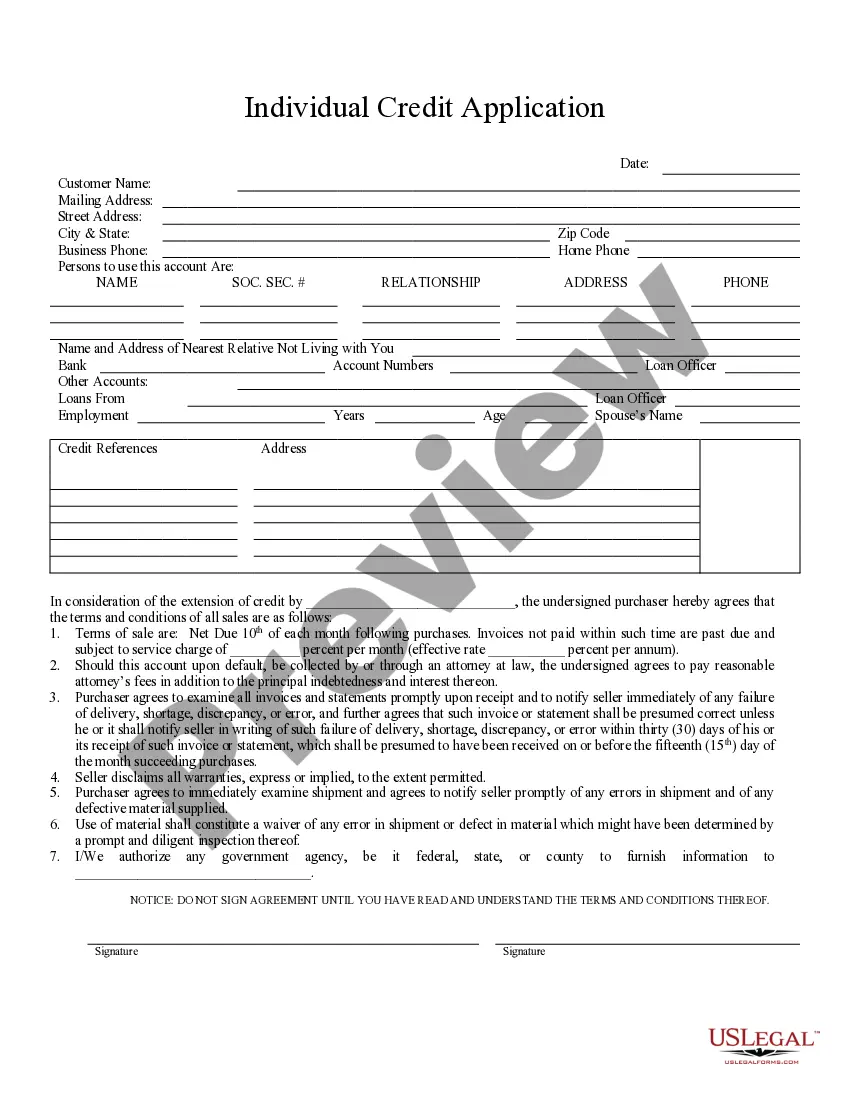

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Tempe Arizona Individual Credit Application is a formal document required by financial institutions, banking establishments, or other credit lending organizations in Tempe, Arizona. This application is used by individuals seeking credit or loans for various purposes, such as purchasing a home, car, or funding educational expenses. Keywords: Tempe Arizona, individual credit application, credit lending organizations, financial institutions, banking establishments, loans, credit, purchasing a home, purchasing a car, educational expenses. There are several types of Tempe Arizona Individual Credit Applications, each catering to specific needs and purposes. Some common types include: 1. Personal Loan Application: This type of credit application is used when individuals need financial assistance for personal expenses or consolidating debts. It typically requires to be detailed personal information, such as employment history, income proof, and credit history. 2. Mortgage Loan Application: Specifically designed for individuals looking to secure a loan for purchasing a home in Tempe, this application requires information regarding the property, payment preferences, employment details, and financial assets. 3. Auto Loan Application: Aimed at individuals wanting to purchase a car in Tempe, this application collects details about the vehicle, desired loan amount, employment stability, and other relevant factors. 4. Student Loan Application: For students pursuing higher education in Tempe, this application helps secure loans for tuition fees, books, and other related expenses. It typically requires information about the educational institution and the student's financial background. 5. Credit Card Application: This type of credit application allows individuals to apply for a Tempe Arizona credit card, enabling them to make purchases and payments on credit. It requires personal and financial information to assess eligibility and creditworthiness. 6. Business Loan Application: Suitable for individuals seeking loans to start or expand a business in Tempe, this application collects information related to the business plan, projected income, expenses, and collaterals. Each type of Tempe Arizona Individual Credit Application serves different purposes and may have varying requirements. It is important for applicants to carefully review the specific application form and provide accurate information to increase the chances of credit approval.Tempe Arizona Individual Credit Application is a formal document required by financial institutions, banking establishments, or other credit lending organizations in Tempe, Arizona. This application is used by individuals seeking credit or loans for various purposes, such as purchasing a home, car, or funding educational expenses. Keywords: Tempe Arizona, individual credit application, credit lending organizations, financial institutions, banking establishments, loans, credit, purchasing a home, purchasing a car, educational expenses. There are several types of Tempe Arizona Individual Credit Applications, each catering to specific needs and purposes. Some common types include: 1. Personal Loan Application: This type of credit application is used when individuals need financial assistance for personal expenses or consolidating debts. It typically requires to be detailed personal information, such as employment history, income proof, and credit history. 2. Mortgage Loan Application: Specifically designed for individuals looking to secure a loan for purchasing a home in Tempe, this application requires information regarding the property, payment preferences, employment details, and financial assets. 3. Auto Loan Application: Aimed at individuals wanting to purchase a car in Tempe, this application collects details about the vehicle, desired loan amount, employment stability, and other relevant factors. 4. Student Loan Application: For students pursuing higher education in Tempe, this application helps secure loans for tuition fees, books, and other related expenses. It typically requires information about the educational institution and the student's financial background. 5. Credit Card Application: This type of credit application allows individuals to apply for a Tempe Arizona credit card, enabling them to make purchases and payments on credit. It requires personal and financial information to assess eligibility and creditworthiness. 6. Business Loan Application: Suitable for individuals seeking loans to start or expand a business in Tempe, this application collects information related to the business plan, projected income, expenses, and collaterals. Each type of Tempe Arizona Individual Credit Application serves different purposes and may have varying requirements. It is important for applicants to carefully review the specific application form and provide accurate information to increase the chances of credit approval.