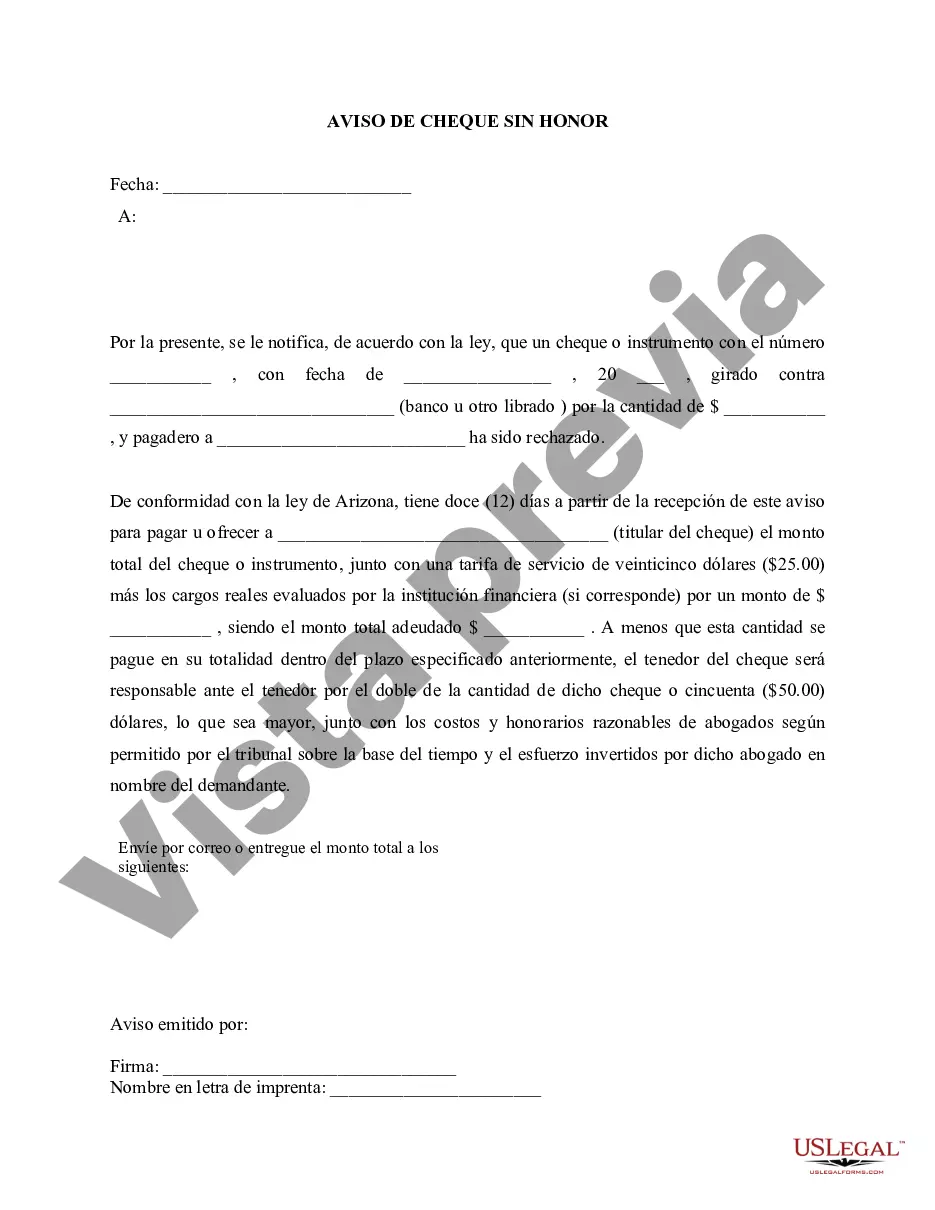

Tucson Arizona Notice of Dishonored Check — Civil: Understanding Bad Checks and Bounced Checks In Tucson, Arizona, if you have issued a check that has been returned due to insufficient funds or any other reason, it is crucial to be aware of the legal implications and procedures associated with such scenarios. This detailed description aims to provide you with comprehensive information regarding the Tucson Arizona Notice of Dishonored Check — Civil, emphasizing keywords such as bad check and bounced check. A bad check, also known as a bounced check or dishonored check, refers to a check that is not paid by the issuing bank due to insufficient funds, a closed account, forgery, or any other reason that renders the check invalid. When someone receives a bad check, they have the right to take certain legal actions to retrieve the owed funds and potentially pursue additional penalties for the inconvenience caused. In Tucson, Arizona, the Tucson Arizona Notice of Dishonored Check — Civil serves as an official document to inform the check issuer about the dishonored check and the subsequent legal actions that may be pursued. This notice is typically sent by the recipient of the bad check or their legal representative to the check issuer, notifying them of the dishonor and demanding repayment of the original check amount, along with any associated fees. There are different types of Tucson Arizona Notice of Dishonored Check — Civil notices that can be issued based on the circumstances of the bounced check: 1. Notice of Dishonored Check — Insufficient Funds: This notice is sent when a check bounces due to insufficient funds in the issuer's account. It alerts the check issuer about the failed payment and requests immediate repayment within a specified timeframe. The notice may outline the consequences of non-compliance, such as potential legal action or additional penalties. 2. Notice of Dishonored Check — Closed Account: If the bank informs the check recipient that the issuer's account has been closed, a Notice of Dishonored Check — Closed Account is sent. This notice informs the check issuer about the closure and their responsibility to make alternative payment arrangements promptly. Similarly, it highlights possible legal consequences if the issue is not resolved in a specified timeframe. 3. Notice of Dishonored Check — Forgery or Fraud: In cases of suspected forgery or fraud, where the check is not honored due to illegitimate or unauthorized activity, a Notice of Dishonored Check — Forgery or Fraud is issued. This notice informs the check issuer about the suspicious nature of the transaction, potential legal implications, and the need for immediate resolution. It is crucial for the recipient of a bad check to ensure that each Notice of Dishonored Check — Civil complies with the relevant legal requirements, including specific timeframes for repayment and potential penalties. These notices serve as an initial step to inform the check issuer about the dishonored payment, provide them an opportunity to rectify the issue, and allow them to avoid further legal actions or potential damage to their reputation. Remember, each case may have unique circumstances, and seeking legal advice or guidance from professionals well-versed in Tucson, Arizona's laws regarding dishonored checks is highly recommended.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tucson Arizona Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Arizona Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Tucson Arizona Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

If you are searching for a valid form template, it’s extremely hard to choose a better service than the US Legal Forms site – one of the most considerable online libraries. Here you can get a large number of templates for company and personal purposes by categories and regions, or keywords. Using our advanced search feature, finding the most recent Tucson Arizona Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is as easy as 1-2-3. Moreover, the relevance of each document is verified by a team of expert lawyers that on a regular basis review the templates on our platform and update them based on the most recent state and county requirements.

If you already know about our system and have a registered account, all you need to receive the Tucson Arizona Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is to log in to your user profile and click the Download option.

If you use US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have chosen the sample you need. Check its information and use the Preview function to check its content. If it doesn’t meet your needs, use the Search option near the top of the screen to get the appropriate document.

- Affirm your selection. Select the Buy now option. After that, choose your preferred pricing plan and provide credentials to register an account.

- Make the transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Get the form. Select the format and save it on your device.

- Make changes. Fill out, edit, print, and sign the received Tucson Arizona Notice of Dishonored Check - Civil - Keywords: bad check, bounced check.

Every single form you save in your user profile has no expiry date and is yours forever. You can easily access them via the My Forms menu, so if you want to have an additional version for enhancing or creating a hard copy, you may come back and download it once more whenever you want.

Make use of the US Legal Forms professional collection to gain access to the Tucson Arizona Notice of Dishonored Check - Civil - Keywords: bad check, bounced check you were looking for and a large number of other professional and state-specific samples in a single place!