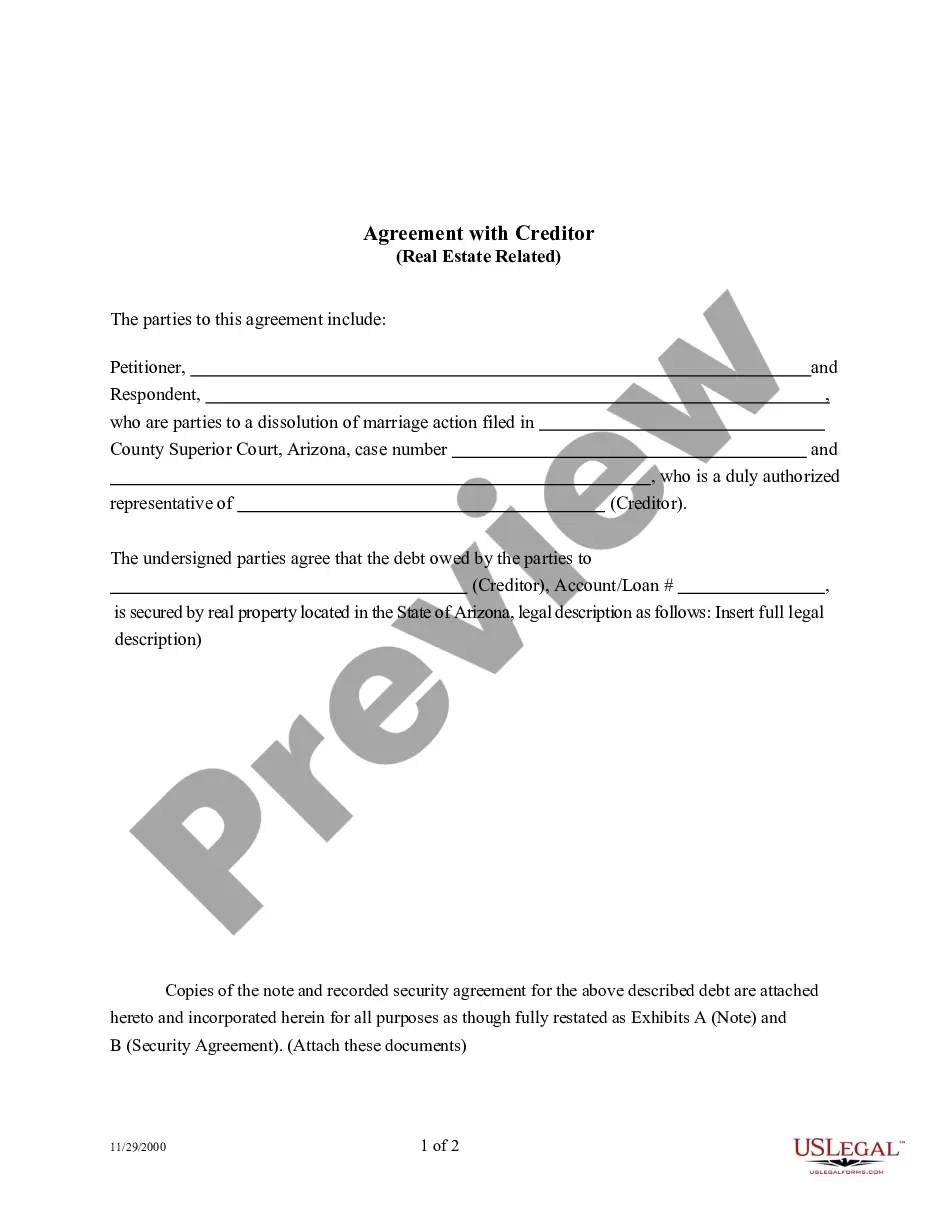

An Agreement with Creditor for Real Estate is a form used by parties to a dissolution of marriage action. It seeks to modify or reaffirm all real estate related to any of the couple's debts attained during the marriage.

Surprise Arizona Agreement with Creditor — Real Estate Related: A Surprise Arizona Agreement with Creditor in real estate typically refers to a legal contract entered into between a debtor and a creditor regarding a specific property in Surprise, Arizona. This agreement is designed to address and resolve financial issues or disputes related to the property, providing a clear understanding and arrangement between the parties involved. The agreement aims to outline the terms and conditions to be followed, ensuring a mutually acceptable resolution regarding the debtor's obligations towards the creditor. Here are some important aspects typically covered by Surprise Arizona Agreement with Creditor — Real Estate Related: 1. Debt settlement: The agreement can focus on a debtor's outstanding debts related to a real estate property, such as mortgage payments, liens, or unpaid fees. It may outline a plan for repayment, including negotiation of reduced amounts, revised interest rates, or extended payment terms. 2. Loan modification: In cases where the debtor is struggling to meet their mortgage obligations, the agreement may involve modifying the loan terms to make it more affordable. This can include adjusting interest rates, extending the loan period, or making other necessary changes to facilitate successful repayments. 3. Foreclosure avoidance: If the debtor is at risk of foreclosure due to financial difficulties, this agreement may be entered into as a measure to prevent the property from being seized by the creditor. It may involve restructuring the debt, implementing a forbearance plan, or other means to help the debtor catch up on their payments. 4. Short sale: In situations where the debtor owes more than the property's current market value, a short sale agreement may be considered. This allows the property to be sold at a reduced price to settle the debt, with the creditor agreeing to accept the proceeds as a full settlement. 5. Deed in lieu of foreclosure: This type of agreement involves the debtor voluntarily transferring ownership of the property to the creditor, effectively avoiding foreclosure proceedings. By accepting the property deed instead of foreclosure, the creditor can obtain the property without going through the time-consuming and costly foreclosure process. It is important to note that Surprise Arizona Agreement with Creditor — Real Estate Related can have various specific names or terms depending on the nature of the agreement, such as Debt Settlement Agreement, Loan Modification Agreement, Foreclosure Avoidance Agreement, Short Sale Agreement, or Deed in Lieu of Foreclosure Agreement. Overall, these agreements aim to establish a legal framework and negotiate terms that benefit both the debtor and creditor in resolving real estate-related financial issues.Surprise Arizona Agreement with Creditor — Real Estate Related: A Surprise Arizona Agreement with Creditor in real estate typically refers to a legal contract entered into between a debtor and a creditor regarding a specific property in Surprise, Arizona. This agreement is designed to address and resolve financial issues or disputes related to the property, providing a clear understanding and arrangement between the parties involved. The agreement aims to outline the terms and conditions to be followed, ensuring a mutually acceptable resolution regarding the debtor's obligations towards the creditor. Here are some important aspects typically covered by Surprise Arizona Agreement with Creditor — Real Estate Related: 1. Debt settlement: The agreement can focus on a debtor's outstanding debts related to a real estate property, such as mortgage payments, liens, or unpaid fees. It may outline a plan for repayment, including negotiation of reduced amounts, revised interest rates, or extended payment terms. 2. Loan modification: In cases where the debtor is struggling to meet their mortgage obligations, the agreement may involve modifying the loan terms to make it more affordable. This can include adjusting interest rates, extending the loan period, or making other necessary changes to facilitate successful repayments. 3. Foreclosure avoidance: If the debtor is at risk of foreclosure due to financial difficulties, this agreement may be entered into as a measure to prevent the property from being seized by the creditor. It may involve restructuring the debt, implementing a forbearance plan, or other means to help the debtor catch up on their payments. 4. Short sale: In situations where the debtor owes more than the property's current market value, a short sale agreement may be considered. This allows the property to be sold at a reduced price to settle the debt, with the creditor agreeing to accept the proceeds as a full settlement. 5. Deed in lieu of foreclosure: This type of agreement involves the debtor voluntarily transferring ownership of the property to the creditor, effectively avoiding foreclosure proceedings. By accepting the property deed instead of foreclosure, the creditor can obtain the property without going through the time-consuming and costly foreclosure process. It is important to note that Surprise Arizona Agreement with Creditor — Real Estate Related can have various specific names or terms depending on the nature of the agreement, such as Debt Settlement Agreement, Loan Modification Agreement, Foreclosure Avoidance Agreement, Short Sale Agreement, or Deed in Lieu of Foreclosure Agreement. Overall, these agreements aim to establish a legal framework and negotiate terms that benefit both the debtor and creditor in resolving real estate-related financial issues.