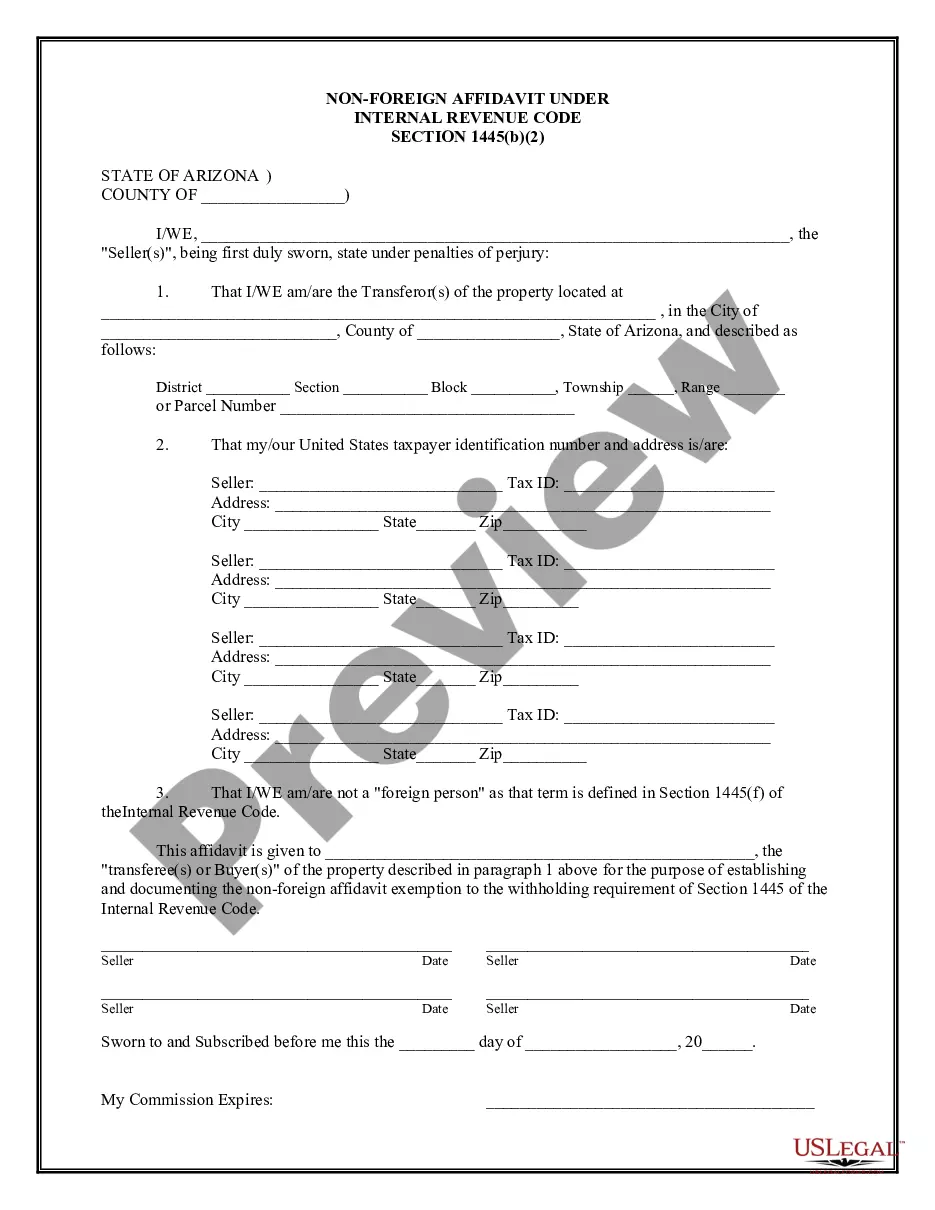

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Tempe, Arizona Non-Foreign Affidavit Under IRC 1445: A Comprehensive Overview In Tempe, Arizona, the Non-Foreign Affidavit under IRC 1445 plays a crucial role in real estate transactions involving non-U.S. residents. This affidavit serves as a declaration of the seller's or granter's legal status as a non-foreign person, ensuring compliance with the Internal Revenue Code (IRC) regulations. Under IRC 1445, certain tax withholding requirements are imposed on the transfer of U.S. real property interests (US RPI) by foreign persons. However, when the seller qualifies as a non-foreign person, this withholding requirement may not apply. The Tempe, Arizona Non-Foreign Affidavit under IRC 1445 helps determine the seller's eligibility for exemption from these withholding obligations. The affidavit typically includes important information such as the seller's full legal name, contact details, the property address, and the buyer's details. It also requires the seller to confirm their status as a non-foreign person, stating that they are either a U.S. citizen, U.S. resident alien, or a domestic corporation or partnership. Different types or variations of the Tempe, Arizona Non-Foreign Affidavit under IRC 1445 may include: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when the seller is an individual who is either a U.S. citizen or a U.S. resident alien. It involves the seller providing their taxpayer identification number (TIN) or Social Security number (SSN) to establish their non-foreign status. 2. Corporate Non-Foreign Affidavit: When the seller is a domestic corporation, this affidavit variant is utilized. It requires the corporation to provide its employer identification number (EIN) and other relevant details, establishing its non-foreign status. 3. Partnership Non-Foreign Affidavit: For situations where the seller is a domestic partnership, the partnership non-foreign affidavit is employed. It requires the partnership to furnish its EIN and other necessary information to demonstrate non-foreign status. It is important to note that the specific requirements and documentation for the Tempe, Arizona Non-Foreign Affidavit under IRC 1445 may vary depending on the transaction and the parties involved. Furthermore, it is advisable to consult with a qualified professional, such as a real estate attorney or tax advisor, to ensure compliance with all applicable regulations and to accurately complete the affidavit based on the individual circumstances. By properly executing the Tempe, Arizona Non-Foreign Affidavit under IRC 1445, both buyers and sellers can fulfill their obligations under the Internal Revenue Code, facilitating a smooth and legally compliant real estate transaction in Tempe, Arizona.Tempe, Arizona Non-Foreign Affidavit Under IRC 1445: A Comprehensive Overview In Tempe, Arizona, the Non-Foreign Affidavit under IRC 1445 plays a crucial role in real estate transactions involving non-U.S. residents. This affidavit serves as a declaration of the seller's or granter's legal status as a non-foreign person, ensuring compliance with the Internal Revenue Code (IRC) regulations. Under IRC 1445, certain tax withholding requirements are imposed on the transfer of U.S. real property interests (US RPI) by foreign persons. However, when the seller qualifies as a non-foreign person, this withholding requirement may not apply. The Tempe, Arizona Non-Foreign Affidavit under IRC 1445 helps determine the seller's eligibility for exemption from these withholding obligations. The affidavit typically includes important information such as the seller's full legal name, contact details, the property address, and the buyer's details. It also requires the seller to confirm their status as a non-foreign person, stating that they are either a U.S. citizen, U.S. resident alien, or a domestic corporation or partnership. Different types or variations of the Tempe, Arizona Non-Foreign Affidavit under IRC 1445 may include: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when the seller is an individual who is either a U.S. citizen or a U.S. resident alien. It involves the seller providing their taxpayer identification number (TIN) or Social Security number (SSN) to establish their non-foreign status. 2. Corporate Non-Foreign Affidavit: When the seller is a domestic corporation, this affidavit variant is utilized. It requires the corporation to provide its employer identification number (EIN) and other relevant details, establishing its non-foreign status. 3. Partnership Non-Foreign Affidavit: For situations where the seller is a domestic partnership, the partnership non-foreign affidavit is employed. It requires the partnership to furnish its EIN and other necessary information to demonstrate non-foreign status. It is important to note that the specific requirements and documentation for the Tempe, Arizona Non-Foreign Affidavit under IRC 1445 may vary depending on the transaction and the parties involved. Furthermore, it is advisable to consult with a qualified professional, such as a real estate attorney or tax advisor, to ensure compliance with all applicable regulations and to accurately complete the affidavit based on the individual circumstances. By properly executing the Tempe, Arizona Non-Foreign Affidavit under IRC 1445, both buyers and sellers can fulfill their obligations under the Internal Revenue Code, facilitating a smooth and legally compliant real estate transaction in Tempe, Arizona.