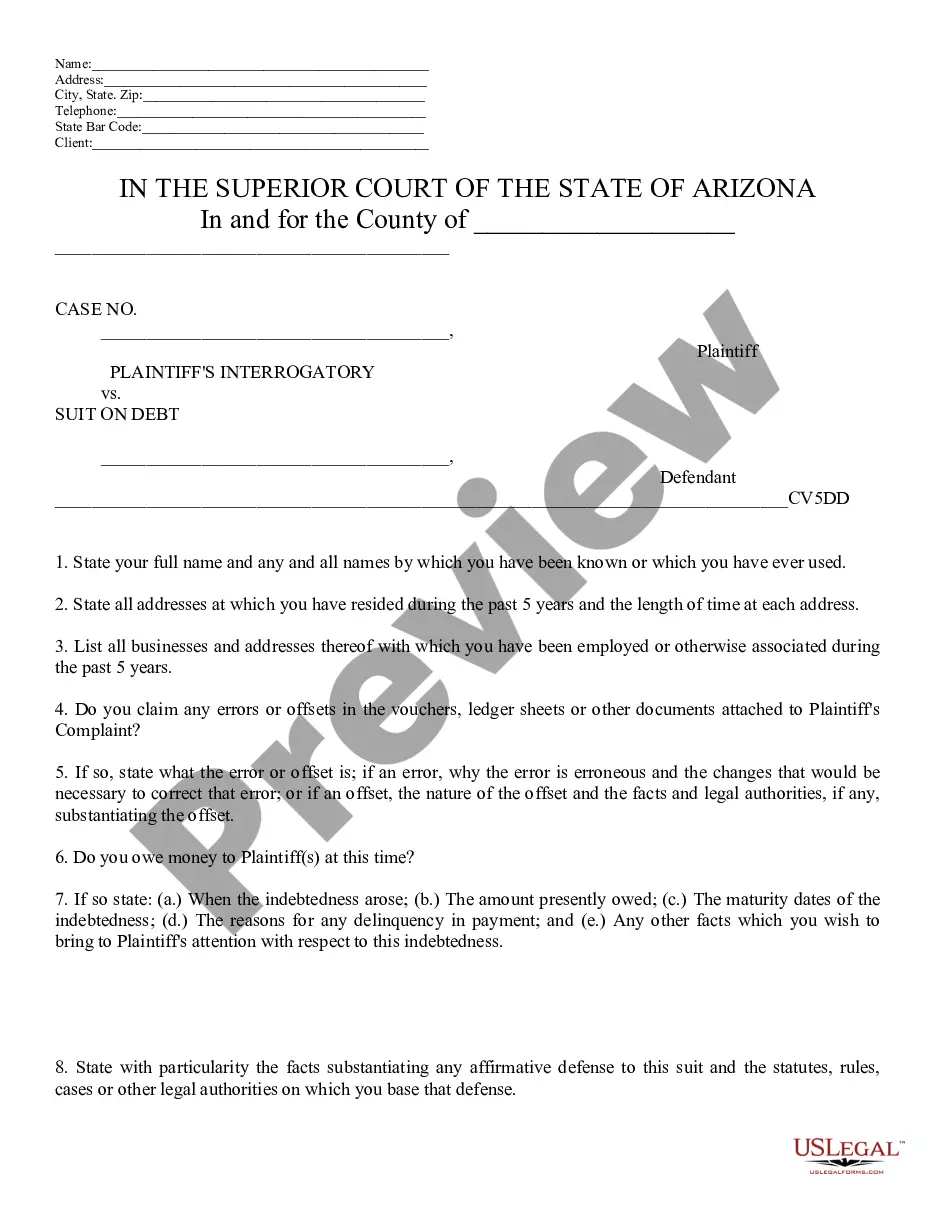

Plaintiffs Interrogatory Suit on Debt: These are sample questions to ask opposing counsel in a suit dealing with an unpaid debt. You should use these as a starting point only, and add or subtract other questions, as would benefit your lawsuit. This form is offered in both Word and Rich Text formats.

The Scottsdale Arizona Plaintiffs Interrogatory Suit on Debt is a legal proceeding that involves a plaintiff filing a lawsuit against a debtor in Scottsdale, Arizona. This lawsuit aims to recover outstanding debt by utilizing a specific type of discovery tool called interrogatories. Interrogatories are a set of written questions that the plaintiff serves to the debtor, who is then required to provide sworn written answers under oath. These questions are designed to gather crucial information regarding the debtor's financial situation, assets, income sources, expenses, and any other relevant details related to the debt owed. The plaintiff's legal team uses these answers to build a strong case and formulate appropriate strategies for debt recovery. This type of legal intervention is typically pursued when other attempts to collect the debt, such as negotiation or demand letters, have been unsuccessful. Filing a Scottsdale Arizona Plaintiffs Interrogatory Suit on Debt can provide a structured legal process for the plaintiff to obtain necessary information and increase their chances of successfully recovering what is owed. There may be different types of Scottsdale Arizona Plaintiffs Interrogatory Suit on Debt, including: 1. Consumer Debt Suit: This involves a plaintiff seeking to collect outstanding debts owed by individuals for personal expenses, such as credit card bills, medical bills, or loans. 2. Business Debt Suit: This type of suit applies to unpaid debts owed by businesses, including outstanding payments for goods or services provided. 3. Mortgage Debt Suit: In this scenario, a plaintiff initiates a suit to recover unpaid mortgage payments from a debtor, often as a result of foreclosure proceedings. 4. Auto Loan Debt Suit: This type of suit pertains to unpaid debts related to auto loans, where the plaintiff seeks to recover the remaining balance owed after repossession or default. In conclusion, the Scottsdale Arizona Plaintiffs Interrogatory Suit on Debt is a legal process that enables plaintiffs to recover outstanding debts by using interrogatories to gather essential information from debtors. This method can be applied to various types of debts, including consumer debt, business debt, mortgage debt, and auto loan debt.