Are you a married couple residing in Mesa, Arizona with no children? If so, establishing a Mesa Arizona Living Trust for Husband and Wife with No Children can offer numerous benefits and peace of mind for you and your spouse. A living trust is a legal document that allows you to outline your wishes for the management and distribution of your assets during your lifetime and after your passing. By setting up a living trust specifically tailored to your situation in Mesa, Arizona, you can protect your assets, minimize taxes, and ensure a seamless transfer of property. The key advantage of establishing a Living Trust for Husband and Wife with No Children in Mesa, Arizona is the ability to bypass probate. Probate is the legal process that validates a will and transfers assets after someone passes away. It can be time-consuming, costly, and often public. By opting for a living trust, you can avoid probate altogether, ensuring your estate is distributed efficiently and privately. Among the different types of living trusts for married couples with no children in Mesa, Arizona, two primary options are commonly considered: 1. Joint Living Trust: A joint living trust is a single trust document created by both spouses. It allows you and your spouse to combine your assets and manage them jointly, providing a simplified and unified approach to estate planning. With a joint living trust, both spouses act as co-trustees, maintaining control and flexibility over trust assets. In the event of the passing of one spouse, the surviving spouse retains complete control, allowing for uninterrupted management of assets without the need for probate. 2. Separate Living Trust: In some cases, spouses may opt for separate living trusts to maintain individual control over their assets while still benefiting from the advantages of a living trust. Each spouse can outline their own wishes for the management and distribution of their assets. This option allows for personalization while still offering the benefits of avoiding probate, reducing taxes, and ensuring a smooth transfer of assets. Regardless of which type of living trust you choose, it's essential to work with an experienced estate planning attorney who specializes in Mesa, Arizona Living Trusts for Husband and Wife with No Children. They can guide you through the process, help you understand the legal requirements, and assist in drafting a comprehensive and legally binding trust document that reflects your unique wishes and goals. In conclusion, establishing a Mesa Arizona Living Trust for Husband and Wife with No Children is a proactive step towards securing your financial future. By avoiding probate, minimizing taxes, and ensuring a seamless transfer of your assets, you can enjoy peace of mind and protect your loved ones. Consider consulting an estate planning attorney to explore the different types of living trusts available and create a personalized plan that best suits your needs and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mesa Arizona Fideicomiso en vida para esposo y esposa sin hijos - Arizona Living Trust for Husband and Wife with No Children

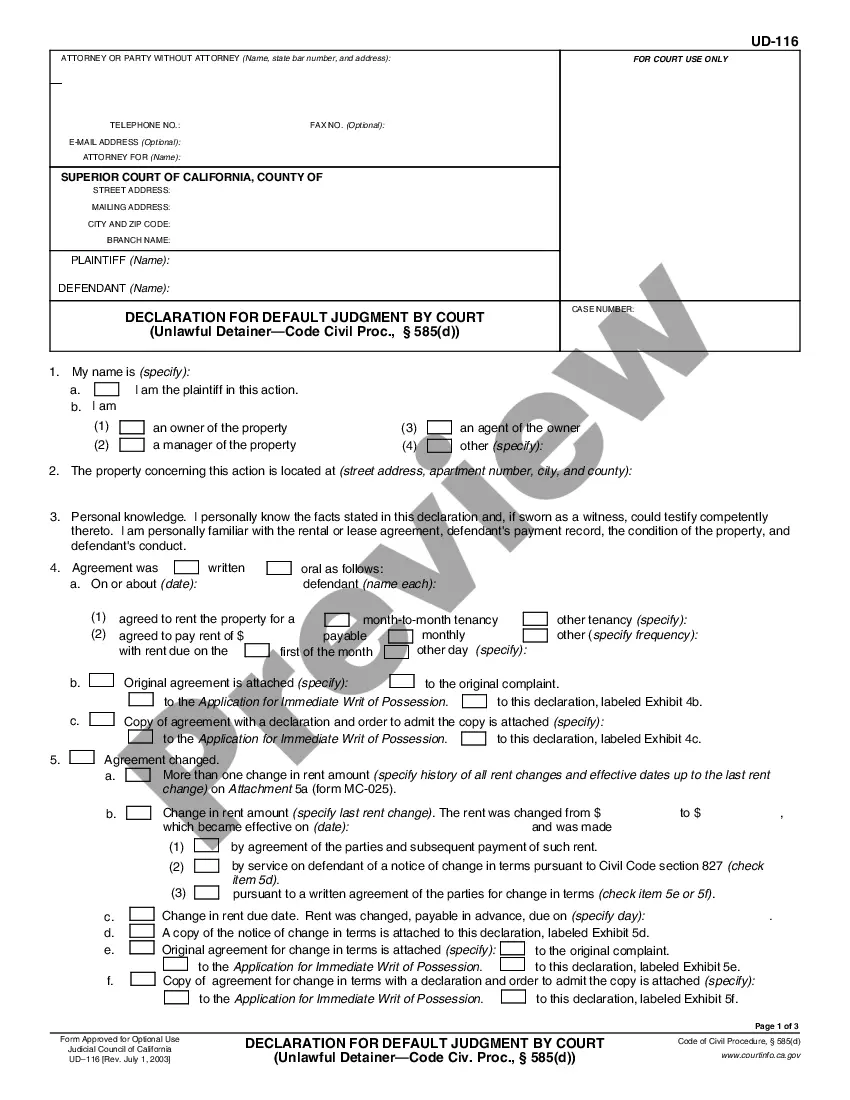

Description

How to fill out Mesa Arizona Fideicomiso En Vida Para Esposo Y Esposa Sin Hijos?

Regardless of social or career status, completing legal documents is a regrettable requirement in today’s workplace.

Frequently, it’s almost unfeasible for someone lacking legal education to create this type of paperwork from beginning due to the intricate language and legal nuances involved.

This is where US Legal Forms can be a lifesaver.

Ensure the template you’ve found is appropriate for your area since the laws of one state or locality do not apply to another.

Preview the document and read a brief description (if available) of the contexts for which the form may be utilized.

- Our service provides a vast inventory with over 85,000 ready-to-use state-specific forms suitable for nearly any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors aiming to enhance their efficiency using our DIY forms.

- Regardless of whether you need the Mesa Arizona Living Trust for Husband and Wife with No Children or any other document that will be accepted in your state or locality, US Legal Forms has it all available.

- Here’s how you can quickly obtain the Mesa Arizona Living Trust for Husband and Wife with No Children utilizing our dependable service.

- If you are an existing customer, simply Log In to your account to download the necessary form.

- If you are new to our library, be sure to follow these steps prior to downloading the Mesa Arizona Living Trust for Husband and Wife with No Children.

Form popularity

FAQ

In Arizona, the average cost for a living trust is around $1,500. However, this price may vary depending on the location and size of the trust. For example, trusts in major metropolitan areas may be more expensive than those in rural areas. Smaller trusts may also cost less than larger ones.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

The Joint Trust. Typically, when a married couple utilizes a Revocable Living Trust-based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

Joint trusts are easier to manage during a couple's lifetime. Since all assets are held in one trust, ownership mimics how many couples hold their assets - jointly. Both spouses having equal control of the management of joint assets held by the trust.

Under Hindu law, a wife gets an equal share of the assets of the deceased husband divided between other Class I heirs, the children and mother. This applies only if the man dies intestate. If there are no children and other claimants, the wife is entitled to the total property.

If someone dies without a will, their estate assets will pass by intestate succession. Intestate succession means that any part of the estate not covered by the decedent's will goes to the decedent's spouse and/or other heirs under Arizona law.

In Arizona, your surviving spouse will automatically inherit your half of the community property if you have no descendants or if you have descendants -- children, grandchildren, or great grandchildren ? resulting only from your relationship with your surviving spouse.

Upon the death of one spouse, every asset that is community property is divided in half. One half of the property is retained by the surviving spouse and the other half is passed down to the heirs of the deceased spouse, either by will or trust or by intestacy.

In Arizona, your surviving spouse will automatically inherit your half of the community property if you have no descendants or if you have descendants -- children, grandchildren, or great grandchildren ? resulting only from your relationship with your surviving spouse.

Generally, no. An inheritance remains separate property of the spouse that inherits it. However, it is possible that an inheritance or other separate assets becomes mixed or ?comingled? with community property.